U.S. Single-use Bioprocessing Market Size, Share & Trends Analysis Report By Product (Simple & Peripheral Elements, Apparatus & Plants), By Workflow (Upstream, Fermentation, Downstream), By End Use, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-288-7

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

U.S. Single-use Bioprocessing Market Trends

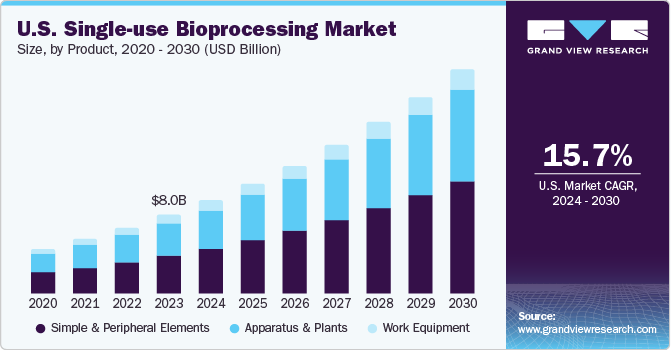

The U.S. single-use bioprocessing market size was estimated at USD 9.34 billion in 2024 and is projected to grow at a CAGR of 15.04% from 2025 to 2030. Due to the high demand for biopharmaceuticals, suppliers have made their disposable product offerings more robust and inclusive. Single-use equipment suppliers are trying to fulfill end users' growing and ever-changing expectations. Furthermore, significant technological advancements in bioreactor designs, mixing systems, fluid assemblies, and liner technologies are anticipated to drive the implementation of single-use technology for biopharmaceutical developments & advancements.

The U.S. single-use bioprocessing industry experienced a positive impact from the COVID-19 pandemic, particularly due to the increased demand for single-use products driven by the heightened need for vaccines, treatments, and assays. These products played an important role in facilitating the rapid scaling up of production by biopharmaceutical companies to meet the unprecedented global demand for vaccines. The pandemic underscored the importance of maintaining sterility and minimizing contamination risks in pharmaceutical and biologics production, highlighting the significance of single-use products in such scenarios.

Furthermore, the benefits of using SUT, such as significant cost reduction in capital, decreased time in operation & construction of a facility, and environmental sustainability, have supported the implementation of single-use systems in the bioprocessing market. The current industry trend of perfusion and continuous cell culture in bioprocessing has greatly enabled the use of single-use equipment. Single-use technologies offer enhanced mobility, ease of sampling, higher productivity, and faster product changeovers, further boosting their implementation in the biopharmaceutical industry. The following figure represents the usage of single-use disposables in biopharmaceutical manufacturing.

In addition, membrane adsorbers and columns for downstream chromatography have provided faster product output with decreased processing time and are now the single-use alternative to resins. For instance, drug product-filling operations can be carried out in single-use systems. For instance, in August 2023, Trelleborg Healthcare and Medical launched the BioPharmaPro family of advanced products and services for fluid path single-use equipment to boost the development of advanced therapies. Similarly, in February 2021, Cytiva acquired Varnx Pharmasystems, a Canadian aseptic filling innovator, and brought single-use flow paths for drug product filling. Due to the growth in single-use trends, the single-use workstation for filling and sterile operations will pose a great opportunity for the players in this market.

With the continued demand for biopharmaceuticals, CMOs have adopted these single-use systems for highly dynamic and frequent changes in product portfolios. Some of the major factors for the adoption of this technology by the CMOs are ease of use, flexibility, energy & capital cost reduction features, and decreased turnaround time for product changeover. Due to the benefits above and process advantages like performance efficiency, SUS has allowed CMOs to transition between product campaigns quickly. The adoption of SUS has resulted in CMOs building multiproduct facilities and providing enhanced services for faster market penetration of commercial products. For instance, in October 2024, Lonza acquired Roche’s Genentech facility in Vacaville for USD 1.2 billion. This strategic move significantly expanded its large-scale biological manufacturing capacity, catering to the growing demand for mammalian therapies.

Product Insights

The simple & peripheral elements segment held the largest market share of 48.54% in 2024 due to continuous innovations in these products and the increasing prominence of bioprocessing operations in manufacturing. The segment is further anticipated to grow at the fastest CAGR over the forecast period. Tubing, filters, connectors, and transfer systems held a majority share within simple & peripheral elements, as most single-use suppliers provide tubing elements and connectors compatible with single-use bags, bioreactors, or other single-use bioprocessing apparatuses. For instance, Thermo Fisher Scientific, Inc. offers customization options to add tubing and connectors to its bioprocessing container bags and other bioprocessing equipment. These factors are expected to drive the segment growth.

The apparatus & plants segment is anticipated to grow at a significant CAGR of 14.75% from 2025 to 2030. The apparatus and plants segment observed significant penetration in the bioprocessing market due to the variety of single-use bioreactors available. Over the years, following the single-use industry trend, a substantial number of single-use bioprocessing products have been introduced in the market. Single-use bioreactors and fermenters have seen significant adoption in the bioprocessing market. Benefits such as reduced facility construction cost, flexibility of multiproduct handling, and elimination of cleaning requirements have assisted bioprocess manufacturers in implementing this technology. Thus propelling the growth of the segment over the forecast period.

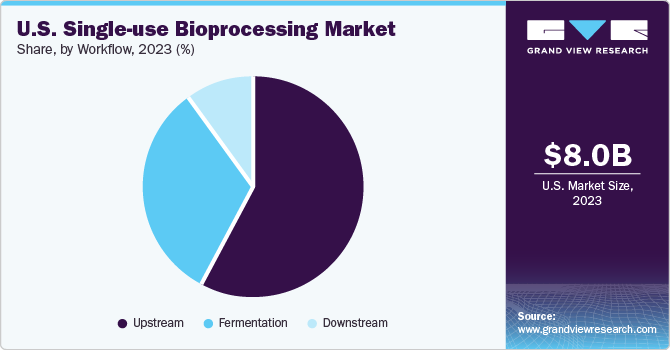

Workflow Insights

The upstream segment dominated the U.S. market with a share of 57.80% in 2024 and is anticipated to grow at the fastest CAGR over the forecast period. This can be attributed to the increasing adoption of single-use media bags and bioreactors by manufacturers involved in the upstream manufacturing process. Furthermore, single-use bioreactors (SUBs) are widely implemented in bioprocessing and thus are anticipated to propel the demand. Other disposable systems, such as single-use bags, mixing systems, and sensors, are also used in this segment, further boosting the market growth.

The fermentation segment is anticipated to witness a significant CAGR during the forecast period. The primary need for any fermentation bioprocess manufacturing is to maintain optimum manufacturing conditions such as oxygen, temperature, and pH, among other variables, in the fermenter. Advancement in technology has optimized & engineered Single-use Fermenters (SUFs) and has, therefore, resulted in the growth of this segment.

End Use Insights

In 2023, biopharmaceutical manufacturers held the largest market share in the end use segment and are anticipated to grow at the fastest CAGR over the forecast period. Consistent new product developments in the market are boosting segment growth. Moreover, an increase in the adoption of disposable products among in-house biopharmaceutical manufacturers is driving segment growth to meet the rising demand for biopharmaceuticals.

The academic & clinical research institutes are expected to grow significantly from 2025 to 2030. The use of single-use systems has seen a rapid surge due to advanced research being undertaken in the U.S. in institutes for the development of safe & efficient medicines and life-saving therapies. In addition, their research activities increasingly involve bioprocessing and cell culture applications. Probes & sensors can help streamline experimental setups and reduce overhead costs.

Key U.S. Single-use Bioprocessing Company Insights

The market players operating in the U.S. single-use bioprocessing industry are undertaking product approvals to expand their product presence and enhance accessibility across various geographical regions. Expansion serves as a strategy to bolster production and research purposes. Moreover, numerous market entities are acquiring smaller firms to improve their market position. This approach enables companies to enhance capabilities, broaden product offerings, and develop new competencies.

Key U.S. Single-use Bioprocessing Companies:

- Sartorius AG

- Danaher

- Thermo Fisher Scientific, Inc.

- Merck KGaA

- Avantor, Inc.

- Eppendorf SE

- Corning Incorporated

- Meissner Filtration Products, Inc.

- Lonza

- PBS Biotech, Inc.

Recent Development

-

In August 2024, Freudenberg Medical expanded its biopharma portfolio with custom single-use assemblies, including Y-connector manifolds, tubing, and bottle cap assemblies, for critical fluid transfer in labs and CGMP bioprocesses.

-

In July 2024, Qosina partnered with Polestar Technologies, experts in monitoring O2, CO2, and pH, and added Polestar's iDOT Single-Use Sensor Bag Ports to its product portfolio.

-

In June 2023, Sartorius AG partnered with Waters Corporation to create integrated analytical solutions for downstream biomanufacturing, expanding their existing agreement.

U.S. Single-use Bioprocessing Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 10.62 billion |

|

Revenue forecast in 2030 |

USD 21.41 billion |

|

Growth rate |

CAGR of 15.04% from 2025 to 2030 |

|

Actual data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, workflow, end use |

|

Country scope |

U.S. |

|

Key companies profiled |

Sartorius AG; Danaher; Thermo Fisher Scientific, Inc.; Merck KGaA; Avantor, Inc.; Eppendorf SE; Corning Incorporated; Meissner Filtration Products, Inc.; Lonza; PBS Biotech, Inc. |

|

Customization scope |

Free report customization (equivalent to 8 analyst's working days) with purchase. Addition or alteration to country, regional & segment scope. |

U.S. Single-use Bioprocessing Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the U.S. Single-use bioprocessing market report based on product, workflow, and end use.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Simple & Peripheral Elements

-

Tubing, Filters, Connectors, & Transfer Systems

-

Bags

-

Sampling Systems

-

Probes, Sensors, & Flow Meters

-

pH Sensor

-

Oxygen Sensor

-

Pressure Sensors

-

Temperature Sensors

-

Conductivity Sensors

-

Flow Meters & Sensors

-

Others

-

-

Others

-

-

Apparatus & Plants

-

Bioreactors

-

Upto 1000L

-

Above 1000L to 2000L

-

Above 2000L

-

-

Mixing, Storage, & Filling Systems

-

Filtration System

-

Chromatography Systems

-

Pumps

-

Others

-

-

Work Equipment

-

Cell Culture System

-

Syringes

-

Others

-

-

-

Workflow Outlook (Revenue, USD Million, 2018 - 2030)

-

Upstream

-

Fermentation

-

Downstream

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Biopharmaceutical Manufacturer

-

CMOs & CROs

-

In-house Manufacturer

-

-

Academic & Clinical Research Institutes

-

Frequently Asked Questions About This Report

b. The U.S. single-use bioprocessing market size was estimated at USD 9.34 billion in 2024 and is expected to reach USD 10.62 billion in 2025.

b. The U.S. single-use bioprocessing market is expected to witness a compound annual growth rate of 15.04% from 2025 to 2030 to reach USD 21.41 million by 2030.

b. The simple and peripheral elements segment, which includes filters, tubing, transfer systems, and connectors, dominated the market for single-use bioprocessing and accounted for the largest revenue share of 48.54% in 2024.

b. Some key participants in the U.S. Single-use Bioprocessing market include Sartorius AG; Danaher; Thermo Fisher Scientific, Inc.; Merck KGaA; Avantor, Inc.; Eppendorf SE; Corning Incorporated; Lonza; PBS Biotech, Inc.; Meissner Filtration Products, Inc.

b. Commercial advantages of single-use technology within the bioprocessing industry with respect to operating & production costs and new product development timelines have driven the revenue of the U.S. single-use bioprocessing market.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."