U.S. Shower Heads Market Size, Share & Trends Analysis Report By Type (Handheld, Fixed, Dual-Purpose), By Application (Residential, Commercial), By Distribution Channel (Online, Offline), And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-543-7

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

U.S. Shower Heads Market Size & Trends

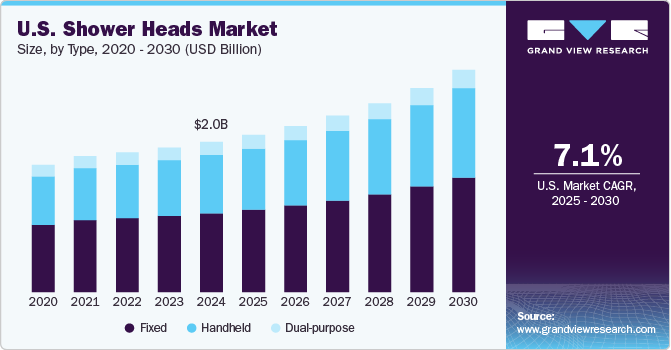

The U.S. shower heads market size was estimated at USD 2.00 billion in 2024 and is projected to grow at a CAGR of 7.1% from 2025 to 2030. The U.S. market growth is attributed to the increased consumer demand for water-efficient and technologically advanced shower heads, fueled by growing environmental awareness, which plays a significant role. The rising adoption of smart home solutions has also increased the popularity of features such as temperature control, customizable spray patterns, and energy-saving designs.

The increased surge in home remodeling and renovation projects, improved living standards, and enhanced aesthetic preferences are boosting market expansion. Furthermore, favorable government regulations and incentives promoting water conservation encourage the uptake of innovative shower head products. In addition, the rapid expansion of the hospitality sector is likely to contribute to the demand for shower head applications.

For instance, according to Lodging Econometrics' (LE) Q4 2022 U.S. Construction Pipeline Trend Report, the U.S. construction pipeline was expected to have 5,465 hotels and 650,626 rooms at the end of the fourth quarter of 2022, up 14% in terms of projects and 12% in terms of rooms year-over-year. Such trends in the hotel industry are anticipated to boost the demand for high-end shower heads over the coming years.

According to the Census Bureau’s latest Survey of Construction (SOC) in 2022, 4.4% of new single-family homes started had one full bathroom or less, 62.3% had two full bathrooms, 25.8% had three full bathrooms, and 7.5% had four or more full bathrooms. Moreover, Companies are focusing on unique designs and smart technology in shower heads. Hansgrohe and Delta, leading companies in the U.S., focus on smart technology such as multi-functional designs, filtration, H2Okinetic technology, and MagnaTite docking.

The 2024 U.S. Houzz Bathroom Trends Study highlights the growing emphasis on functionality in remodeling, with accommodating designs rising from 23% in 2023 to 27% in 2024. Meanwhile, resale value considerations declined from 31% to 26%. Median spending on bathroom remodels increased by 11% overall, with minor remodel costs rising across bathroom sizes.

Consumer Survey & Insights

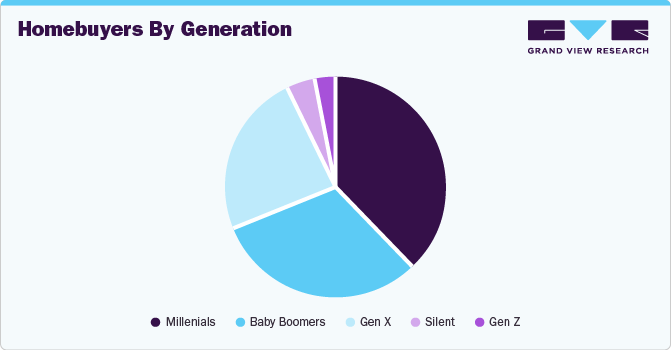

Millennial homeownership reached a milestone, with 52% of millennials owning homes as of 2022, in the U.S., up from 49% in 2021, according to a blog by Motley Fool Money published in 2024. This generational shift influences demand for home fixtures like shower heads. Millennials accounted for 38% of home buyers in 2023, becoming the largest home-buying generation. However, their delayed homeownership, only 42% owned homes by age 30 compared to 48% of Gen X and 51% of Baby Boomers-indicates unique challenges such as economic hurdles and high mortgage rates. As millennials embrace homeownership later in life, they prioritize energy-efficient and sustainable fixtures, driving demand for modern shower head designs.

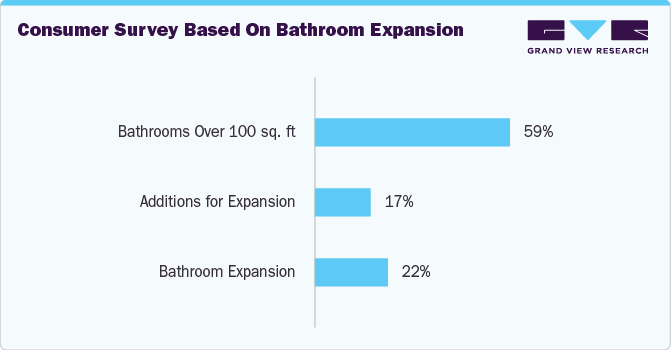

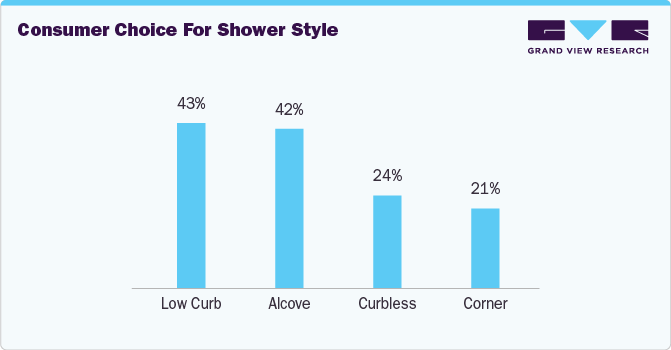

The 2023 U.S. Houzz Bathroom Trends Study highlighted key remodeling behaviors among homeowners. Notably, 22% of homeowners expanded their primary bathrooms, often drawing square footage from closets (44%), bedrooms (24%), or hallways (7%). Bathroom enlargements through additions accounted for 17%, with 59% of renovated bathrooms exceeding 100 square feet. Shower size was increased by 61% of homeowners, with 20% opting for significant expansions. Popular shower styles include low curb (43%), alcove (42%), curbless (24%), and corner (21%). Premium features like rainfall shower heads, dual showers, and thermostatic mixers were incorporated by 67%.

Median spending on primary bathroom remodels jumped 50% to USD 13,500, with major renovations reaching USD 20,000 and larger bathrooms at USD 25,000. The majority (86%) hired professionals, with general contractors seeing notable increases. Sustainability remained a priority, with 87% selecting options like LED lightbulbs and water-efficient fixtures, emphasizing long-term cost savings and eco-friendliness as driving factors.

Type Insights

Based on type, the fixed shower heads segment led the market with the largest revenue share of 52.5% in 2024. The rising demand for luxury bath products has made fixed shower heads increasingly popular among consumers with their customizable features like adjustable spray patterns and water pressure settings. In addition, their sleek and elegant designs, particularly rainfall models, align with modern aesthetic trends, making them a preferred choice in bathroom renovations. Their durability and low maintenance requirements further appeal to cost-conscious buyers. Technological advancements, such as water-saving technologies and smart IoT-enabled features, have attracted environmentally conscious and tech-savvy individuals.

The handheld shower heads segment is expected to grow at the fastest CAGR of 7.8% from 2025 to 2030. Handheld showerheads are often equipped with advanced water-saving technologies such as flow restrictors and EcoSmart functions, which reduce water consumption without compromising the user experience. For example, Moen’s Magnetix handheld showerhead allows users to effortlessly dock the showerhead while maintaining a flow rate of just 1.75 GPM, adhering to water conservation regulations. In addition, the rise in eco-conscious consumers drives the demand for products that combine luxury with resource efficiency. This trend is particularly evident in urban regions with water scarcity concerns.

Application Insights

Based on application, the residential segment led the market with the largest revenue share of 70% in 2024, driven by the increasing rate of home construction and renovation activities in the country. According to the U.S. Census Bureau, the U.S. homeownership rate, which stood at 65.7% in the fourth quarter of 2023, reflects a stable market where homeowners are more likely to personalize and enhance their bathrooms.

Home renovation trends are another major growth driver for the residential shower heads market, as homeowners upgrade their bathrooms to reflect contemporary styles and improve energy efficiency. In the U.S., home improvement spending reached over USD 400 billion in 2022, driven by both first-time homebuyers and long-term homeowners looking to enhance comfort.

The commercial segment is expected to grow at the fastest CAGR of 8.7% from 2025 to 2030. The demand for the product in commercial applications, such as hotels, resorts, gyms, and institutions, is driven by increased construction activities across the country. For instance, the U.S. construction industry continues to grow, with non-residential construction activity projected to rise by 5.7% in 2024, according to the American Institute of Architects (AIA).

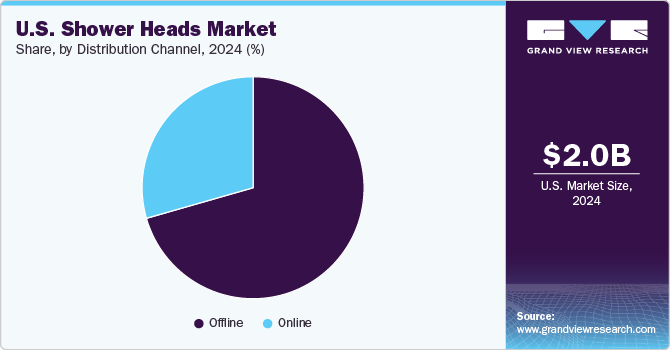

Distribution Channel Insights

Based on distribution channel, the offline segment led the market with the largest revenue share of 70.6% in 2024. The preference for offline purchasing is particularly strong in markets where customers like to physically examine products before buying. Major home improvement stores such as The Home Depot, Lowe's, Walmart, and Menards in the U.S. make up a significant portion of shower head sales. There is a rise in renovation projects in the country's residential and commercial sectors. As homeowners and property managers seek bathroom upgrades, they often visit physical stores to visualize fixtures in real time, ensuring compatibility with their design needs.

For example, the U.S. remodeling market hit more than USD 420 billion in 2022, according to Harvard's Joint Center for Housing Studies, with bathroom renovations being one of the top projects undertaken. Knowledgeable sales staff bolster this demand for in-store purchases by guiding customers through options, such as energy-saving or water-efficient shower heads that comply with WaterSense certifications.

The online segment is expected to grow at the fastest CAGR of 8.0% from 2025 to 2030 in the overall U.S. shower heads industry. The convenience of online shopping, where customers can browse various products, compare prices, and read reviews, has led to a surge in sales. Platforms such as Amazon, Home Depot, and specialized bathroom fixture websites have made purchasing shower heads easier for homeowners, renovators, and contractors without visiting physical stores. Moreover, the convenience of doorstep delivery and the rise of omnichannel strategies adopted by major retailers are key growth drivers. Many brands and retailers now offer fast shipping, easy returns, and integration of offline and online services, enhancing customer experience.

Key U.S. Shower Heads Company Insights

The U.S. shower heads industry is fragmented primarily due to the presence of several globally recognized players as well as regional players. Some prominent companies in the U.S. shower heads industry are Kohler Co., Masco Corporation, Moen, Inc., Fortune Brands Innovations Inc., Delta Faucet, and others.

-

Kohler Co. manufactures kitchen and bath appliances, engines & power generation systems, furniture & decorative products, and home interiors & tiles. Under the kitchen and bath segment, the company offers sinks & faucets, toilet seating, bathing products, mirrors & vanities, kitchen faucets, shower doors, and lighting products. Its product portfolio comprises furniture and decorative items, including ceramics, wood tiles, beds, tables, and other accessories.

-

Masco Corporation is engaged in designing, manufacturing, and distributing home improvement and building products. The company sells its products to plumbers, building contractors, remodelers, smaller retailers, and to consumers. The company operated in four segments: Plumbing Products, Decorative Architectural Products, Cabinetry Products, Windows, and Other Specialty Products.

Key U.S. Shower Heads Companies:

- Kohler Co.

- Masco Corporation

- Moen, Inc.

- Fortune Brands Innovations Inc.

- Delta Faucet

- American Standard

- Grohe

- Hansgrohe USA

- Jacuzzi Brands LLC

- TOTO

View a comprehensive list of companies in the U.S. Shower Heads Market

Recent Developments

-

In May 2024, Marcone, the parent company of Speakman, unveiled the Speakman Neo Exhilaration filtered handheld showerhead. This innovative product removes bacteria and chemicals from shower water, promoting healthier skin, hair, and air quality. Featuring advanced filtration technology, four spray functions, pause control and a corrosion-resistant finish, it comes in polished chrome with flow rates of 1.75 and 2.0 GPM. Speakman continues to pioneer plumbing innovation with a commitment to performance, sustainability, and well-being across residential and commercial markets.

U.S. Shower Heads Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 2.10 billion |

|

Revenue forecast in 2030 |

USD 2.96 billion |

|

Growth rate |

CAGR of 7.1% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, distribution channel, application, country |

|

Country scope |

U.S. |

|

Key companies profiled |

Kohler Co.; Masco Corporation; Moen, Inc.; Fortune Brands Innovations Inc.; Delta Faucet; American Standard; Grohe; Hansgrohe USA; Jacuzzi Brands LLC; TOTO |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

U.S. Shower Heads Market Report Segmentation

This report forecasts revenue growth at the country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. shower heads market report based on type, application, and distribution channel:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Fixed

-

Handheld

-

Dual-purpose

-

-

Application Outlook (USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

-

Distribution Channel Outlook (USD Million, 2018 - 2030)

-

Offline

-

Online

-

Frequently Asked Questions About This Report

b. The U.S. shower heads market was estimated at USD 2.00 billion in 2024 and is expected to reach USD 2.10 billion in 2025.

b. The U.S. shower heads market is expected to grow at a compound annual growth rate of 6.7% from 2025 to 2030 to reach USD 2.96 billion by 2030.

b. The U.S. shower heads market accounted for a share of about 78.4% in the overall North America shower heads market. This is due to the increased consumer demand for water-efficient and technologically advanced shower heads, fueled by growing environmental awareness, which plays a significant role.

b. Key players in the U.S. shower heads market are Kohler Co.; Masco Corporation; Moen, Inc.; Fortune Brands Innovations Inc.; Delta Faucet; American Standard; Grohe; Hansgrohe USA; Jacuzzi Brands LLC; TOTO.

b. Key factors that are driving the U.S. shower heads market growth include favorable government regulations and incentives promoting water conservation encourage the uptake of innovative shower head products.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."