U.S. Short-term Vacation Rental Market Size, Share & Trends Analysis Report By Accommodation Type (Homes, Apartments, Condominium), By Booking Mode (Online/Platform Based, Offline), And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-503-7

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

Market Size & Trends

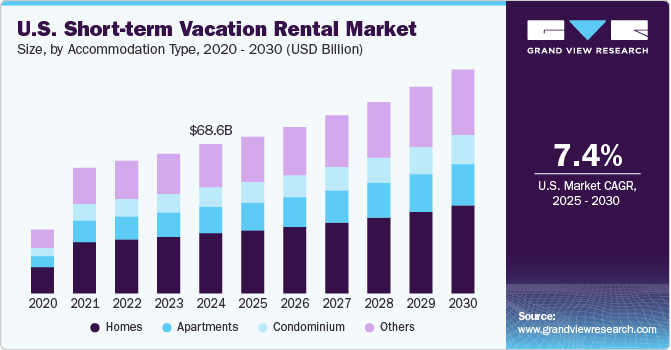

The U.S. short-term vacation rental market size was estimated at USD 68.64 billion in 2024 and is projected to grow at a CAGR of 7.4% from 2025 to 2030. The growing desire among travelers for unique and personalized experiences drives the demand for short-term vacation rentals. Unlike traditional hotels, short-term rentals offer diverse accommodation options, such as private homes, apartments, cabins, and even luxury villas, which allow travelers to immerse themselves in local cultures and lifestyles. This variety appeals to modern tourists who seek more authentic and customizable travel experiences.

Short-term vacation rentals have become a significant contributor to the U.S. economy. The revenue generated from rental bookings supports local economies by creating jobs, fostering tourism, and contributing to the hospitality sector. For property owners, hosting short-term rentals offers an attractive income opportunity, with many generating substantial earnings through these platforms. This economic boost is not limited to hosts; it extends to local businesses that cater to tourists, such as restaurants, shops, and transportation services. Moreover, many hosts use rental income to offset mortgage payments and housing costs or supplement retirement savings, contributing to financial well-being.

As the market continues to expand, local governments have increasingly implemented regulations to address concerns such as the impact on housing affordability, neighborhood disruptions, and safety standards. Many cities have enacted rules requiring hosts to register their properties, pay taxes, or limit the number of days a property can be rented out each year. These regulations aim to strike a balance between the benefits of short-term rentals and maintaining affordable housing availability for residents. On the other hand, there are opportunities for investors and property managers to navigate these regulations by staying informed and adapting their business models to comply with local laws.

Furthermore, the rise of remote work and the blending of work and leisure, often referred to as "bleisure" travel, has further fueled the demand for short-term rentals. As more companies adopt flexible work policies, professionals can now work from virtually anywhere. Short-term rentals provide the comfort and convenience of a home, with many offering work-friendly environments, such as high-speed internet and dedicated workspaces. This shift has expanded the target audience for short-term rentals beyond traditional vacationers to include digital nomads and remote workers.

Additionally, technology has played a crucial role in driving demand. Platforms like Airbnb, Vrbo, and Booking.com have made it easier than ever to browse, compare, and book vacation rentals. These platforms offer user-friendly interfaces, detailed reviews, and seamless booking processes, increasing consumer confidence and accessibility. The integration of features such as flexible cancellation policies and instant booking has also encouraged more travelers to explore short-term rentals.

Consumer Insights

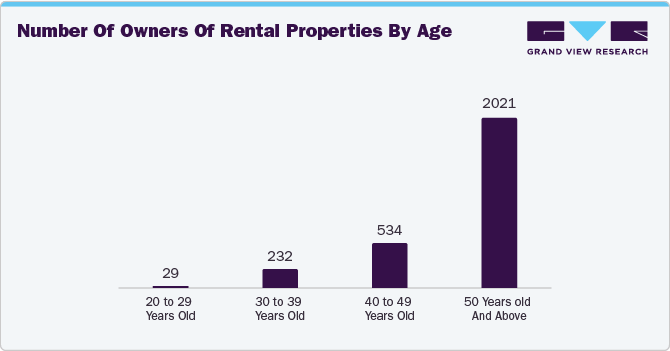

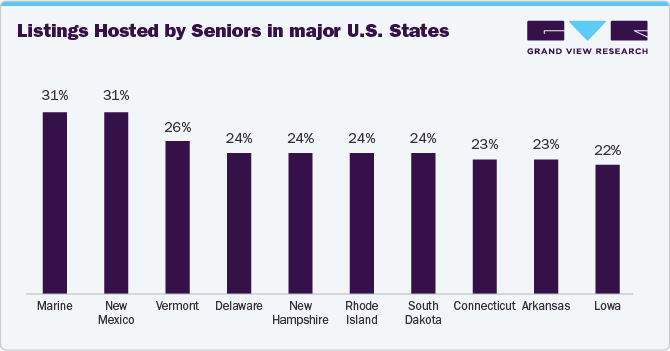

A substantial portion of short-term rental property owners are middle-aged individuals, typically ranging from 35 to 55 years old. This age group is often well-established in their careers and financially secure enough to invest in real estate. Many in this demographic view short-term rental properties as a lucrative means of generating passive income or as a strategy for diversifying their investment portfolios. For some, owning vacation rental properties aligns with long-term goals of preparing for retirement, as these homes can be both income-generating assets and personal vacation retreats.

Younger adults, particularly those in their late 20s to early 30s, are also entering the short-term rental market, albeit at a slower pace. This age group tends to be tech-savvy and attracted to the flexibility and entrepreneurial opportunities associated with short-term rental platforms. However, younger investors often face challenges such as limited capital and stricter lending requirements, which may hinder their ability to purchase and manage rental properties. Despite these barriers, many millennials are drawn to the idea of financial independence through property ownership, especially in urban areas or popular tourist destinations.

Cities like New York City, San Francisco, Chicago, and Miami have a strong demand for short-term rentals, particularly apartments and condos. These accommodations are highly preferred by consumers visiting cities for business, cultural events, or tourism. Travelers in urban areas often prioritize proximity to landmarks, public transportation, and dining options, making centrally located rentals especially desirable.

From an owner’s perspective, urban properties are appealing because of their year-round demand, ensuring steady bookings. However, high property costs and strict regulations in cities like New York (e.g., Local Law 18) limit the pool of eligible STR properties. Urban rentals are often marketed as luxurious, modern, or boutique-style accommodations to attract higher-paying guests. Amenities such as high-speed Wi-Fi, fully equipped kitchens, and concierge services are prioritized to meet the expectations of business travelers and affluent tourists.

Locations like the Hamptons, Malibu, and Myrtle Beach offer properties tailored for relaxation and luxury. Popular accommodations in these locations include beach houses, cottages, and waterfront condos, often marketed for their scenic views and tranquil surroundings. Consumers highly sought-after features such as private docks, beachfront access, and outdoor decks.

Travelers in these locations often prioritize privacy, exclusivity, and access to water-based activities like boating, fishing, or paddleboarding. For an owner, these properties are appealing as investments due to their capability to generate high nightly rates, particularly during peak summer months. However, maintaining these homes can be costly due to weather-related wear and tear. Owners often enhance their properties with upscale amenities like hot tubs, fire pits, and outdoor kitchens to justify higher rental prices and attract affluent clientele.

Accommodation Type Insights

short-term vacation rental homes accounted for 40.4% of the overall industry in 2024. These rentals cater to diverse traveler preferences by providing unique stays, from cozy cabins to spacious family homes, often equipped with full kitchens and private amenities like pools or patios. Additionally, the rise of remote work has allowed more people to travel while maintaining their routines, making rental homes an attractive option for long-term stays or work-friendly environments.

The industry for Others (Cabins and Cottages, Themed Properties, etc.) short-term vacation rental is expected to expand at a CAGR of 8.1% from 2025 to 2030. These properties allow guests to escape traditional lodging and immerse themselves in settings that reflect local culture, natural beauty, or creative themes. Cabins and cottages, for instance, appeal to those seeking a tranquil nature retreat, while themed properties cater to families, couples, or groups looking for novelty and fun. The shift toward experiential travel, combined with social media's influence in showcasing these unique stays, has further fueled their popularity. Additionally, these accommodations often offer privacy and personalized amenities, making them ideal for both leisure and work-focused travelers seeking alternatives to conventional rentals.

Booking Mode Insights

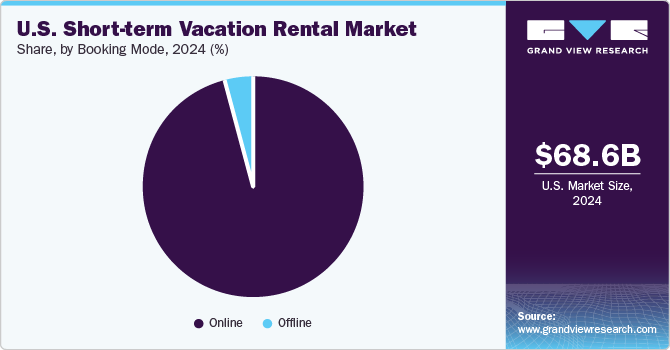

The online/platform-based booking mode accounted for a market share of 95.8% in 2024. Online platforms enable travelers to search, compare, and book accommodations from anywhere, offering detailed property descriptions, reviews, and real-time availability. This seamless process appeals to modern consumers who prioritize efficiency and transparency in travel planning. Additionally, features like secure payment options, flexible cancellation policies, and 24/7 customer support enhance trust and confidence in online booking. The growing use of mobile devices and apps has further amplified this trend, making it easier for travelers to plan and book trips on the go, driving the popularity of online booking.

The offline booking mode for short-term vacation rental in the U.S. is expected to grow at a CAGR of 1.4% from 2025 to 2030. Offline mode allows for customized recommendations, negotiation of terms, and tailored travel arrangements that may not always be available through online platforms. Additionally, offline bookings can be more appealing in niche markets or remote destinations where internet connectivity and digital literacy may be limited. As some travelers seek a more hands-on approach to planning their stays, offline booking remains a valuable and reliable option in the evolving vacation rental market.

Key U.S. Short-term Vacation Rental Company Insights

The U.S. short-term vacation rental market is fragmented and characterized by a diverse array of players, from large multinational corporations to smaller regional/local manufacturers. Some of the leading players in the market are Extended Stay America, AvantStay, Inc., Airbnb, Inc., Booking Holdings Inc., Expedia, Inc., and more.

Key U.S. Short-term Vacation Rental Companies:

- Extended Stay America

- AvantStay, Inc.

- Airbnb, Inc.

- Booking Holdings Inc.

- Expedia, Inc.

- Evolve Vacation Rental.

- Vacasa LLC

- Sonder Holdings Inc.

- Wyndham Destinations, Inc.

- NOVASOL A/S

View a comprehensive list of companies in the U.S. Short-term Vacation Rental Market

Recent Developments

-

In August 2022, Extended Stay America announced the addition of over 100 WoodSpring Suites properties to its portfolio, bringing the company’s total to 762 hotels with nearly 85,000 rooms across 45 states. This expansion strengthens the company's position as a leader in the extended-stay segment.

-

In February 2022, AvantStay announced a USD 500 million fund to invest in residential properties, supported by real estate advisory firm Saluda Grade. The fund aims to acquire luxury homes for rental purposes, highlighting the growing institutional interest in vacation rentals as a mainstream investment asset. AvantStay will manage the properties while Saluda Grade owns them, reflecting a trend of institutional investors diversifying beyond traditional hotels into short-term rental markets.

U.S. Short-term Vacation Rental Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 72.00 billion |

|

Revenue forecast in 2030 |

USD 102.86 billion |

|

Growth rate |

CAGR of 7.4% from 2025 to 2030 |

|

Historical data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Accommodation type, booking mode |

|

Country scope |

U.S. |

|

Key companies profiled |

Extended Stay America; AvantStay Inc.; Airbnb, Inc.; Booking Holdings Inc.; Expedia, Inc.; Evolve Vacation Rental.; Vacasa LLC; Sonder Holdings Inc.; Wyndham Destinations, Inc.; NOVASOL A/S |

|

Customization |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

U.S. Short-term Vacation Rental Market Report Segmentation

This report forecasts revenue growth at the country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. short-term vacation rental market report based on accommodation type, and booking mode.

-

Accommodation Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Homes

-

Apartments

-

Condominium

-

Others (Cabins & Cottages, Themed Properties, etc.)

-

-

Booking Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

Online/ Platform Based

-

Offline

-

Frequently Asked Questions About This Report

b. The U.S. short-term vacation rental market was estimated at USD 68.64 billion in 2024 and is expected to reach USD 72.0 billion in 2025.

b. The U.S. short-term vacation rental market is expected to grow at a compound annual growth rate of 7.4% from 2025 to 2030, reaching USD 102.86 billion by 2030.

b. Short-term vacation rental homes accounted for 40.35% of the market share in 2024 due to their spacious accommodations, family-friendly appeal, and strong demand in popular tourist destinations.

b. Some key players operating in the U.S. short-term vacation rental market include Extended Stay America, AvantStay, Inc., Airbnb, Inc., Booking Holdings Inc., Expedia, Inc., Evolve Vacation Rental., Vacasa LLC, Sonder Holdings Inc., Wyndham Destinations, Inc., NOVASOL A/S

b. Key factors driving the U.S. short-term vacation rental increased travel demand, the rise of remote work, platform-based accessibility, and preferences for unique, private accommodations.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."