- Home

- »

- Clothing, Footwear & Accessories

- »

-

U.S. Shoe Insoles Market Size, Share, Industry Report, 2030GVR Report cover

![U.S. Shoe Insoles Market Size, Share & Trends Report]()

U.S. Shoe Insoles Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (Casual, Athletic, Orthotics), By Material (Foam, Gel, Rubber, Plastic, Carbon Fiber), By End-use, By Type, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-226-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Shoe Insoles Market Size & Trends

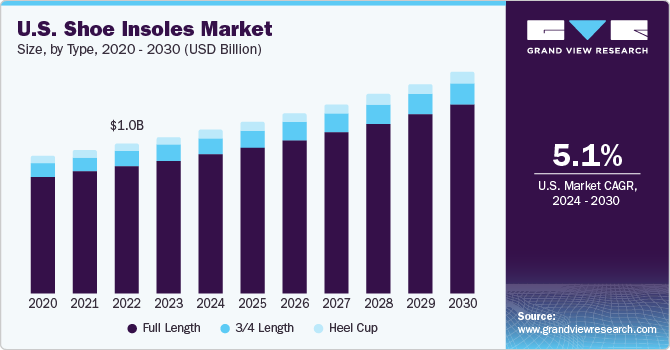

The U.S. shoe insoles market size was estimated at USD 1.06 billion in 2023 and is projected to grow at a CAGR of 5.1% from 2024 to 2030. The rise in sports and physical activities has had a significant effect on the market for shoe insoles by driving up customer demand for personalized insoles that boost comfort and performance while lowering injury risk. Over the past few decades, sports and physical activity have seen a sharp rise in popularity and engagement.

The U.S. market accounted for a share of 17.8% of the global shoe insoles market in 2023. There is currently a greater need for shoe insoles in the nation due to growing consumer awareness of the value of good foot health and the negative effects of wearing inappropriate footwear on general wellbeing. There is a growing need for supportive and comfortable shoe insoles due to the rise in foot-related issues, such as plantar fasciitis, flat feet, and numerous orthopedic ailments. For example, two new insoles from Spenco's newest performance series—Propel and Propel + Carbon—were revealed in November 2021. Spenco is a trailblazing healthcare firm that aims to improve foot health and raise athletic performance for people worldwide. Using cutting-edge running technology, these custom-made insoles are made to maximize running shoes. According to Spenco, both insoles will be available for purchase on Spenco.com and at a number of national retailers.

The Ferndale, California-based business Superfeet announced in October 2022 that it would be releasing two different kinds of detachable insoles designed with skiers and snowboarders in mind. Superfeet is known for its cushioning and foot stability, and these qualities are reportedly present in both the Winter Comfort and Winter Comfort Thin insoles. These insoles also have features that work with different kinds of footwear, like moisture-wicking qualities and a thermal top cover for warmth.Many people in the U.S. participate in sports, fitness regimens, and outdoor excursions. Athletes and fitness enthusiasts in order to improve performance, avoid injuries, and lessen foot fatigue frequently seek after specialized insoles. For example, Dr. Scholl's teamed up with American gold medallist Allyson Felix in November 2020 to promote their Performance Sized to Fit Running Shoes. Allyson Felix will assist runners in comprehending how these shoes' ideal performance characteristics and pain management work. Initiatives of this nature have the potential to raise awareness of and demand for shoe insoles, which would fuel market expansion throughout the course of the projection period.

Market Concentration & Characteristics

With so many brands and possibilities, the shoe insole industry can be quite competitive. A firm may set itself apart from competitors by emphasizing the special qualities and advantages of its insoles through a well-executed product launch.

A number of mergers and acquisitions (M&A) have taken place in the shoe insole sector in an effort to increase market share, improve product offerings, and achieve strategic growth.

The shoe insole sector is heavily influenced by regulations, which have an effect on quality standards, market rivalry, technical innovation, and product safety. Regulatory agencies frequently establish guidelines for the material composition, strength, and safety of insoles for shoes. In order to safeguard consumers and maintain consumer confidence in the market, compliance with these criteria guarantees that insoles meet the minimal safety requirements.Depending on their unique requirements, tastes, and use cases, customers in the shoe insole market may take into consideration a number of product alternatives. Sometimes customers choose to replace the complete shoe instead of just the insoles, especially if the current shoe is too old or no longer offers enough support.

Type Insights

The full-length insoles category held a revenue share of 84.8% in 2023. These insoles for shoes are becoming more and more popular as a means of improving arch support. Stress on the feet, ankles, knees, and back is lessened with the use of insoles, which support and stabilize the foot.

To increase comfort, customers are choosing long length shoe insoles more and more. In addition, women have begun to choose insoles for their feet in order to provide additional comfort and cushioning as many of them spend a lot of time in stylish footwear and high heels.

Application Insights

The orthotic insoles market accounted for a revenue share of 58.8% in 2023. The expansion of this market is being driven by rising consumer awareness of the advantages of custom orthotics. Particularly helpful for people with arthritis or those who stand for long amounts of time at work, custom orthotics provide additional cushioning, support, and pressure redistribution. Additionally common uses of orthotics insoles include the prevention of diabetic foot deformities and pressure sores, which over time has led to continuous segment growth.

The casual insoles market is projected to grow at a CAGR of 5.6% from 2024 to 2030, as customers are looking for comfort, proper fit, and arch support from casual shoes. For improved arch support, more and more people are choosing to use shoe insoles. Stress on the feet, ankles, knees, and back is lessened with the use of insoles, which support and stabilize the foot. Because of this, people are choosing more and more casual shoe insoles for more comfort. In addition, ladies have begun to choose insoles for their feet to provide additional comfort and cushioning as many of them spend a lot of time in stylish footwear and high heels.

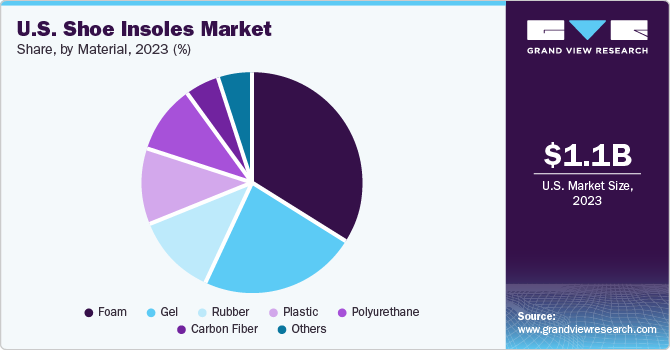

Material Insights

The foam-based shoe insoles category accounted for a revenue share of 34.3% in 2023. Foam insoles made of high-density polyurethane are preferred by many because of their remarkable capacity to offer support and alleviate pressure. Moreover, the foam's chemical composition may have therapeutic advantages for the comfort of the feet. Furthermore, the footwear has bounce and comfort because to the density of the foam.

Given that foam insoles are lightweight, they are a desirable option for people looking for breathable and light-weight shoe insoles. People who spend a lot of time on their feet, athletes, and fitness fanatics should pay particular attention to this.

The carbon fiber-based shoe insoles category is expected to grow at a CAGR of 6.2% from 2024 to 2030, owing to its superior arch support and stability, which helps to relieve foot strain and discomfort.

End-user Insights

Women’s shoe insoles category accounted for a revenue share of nearly 51% in 2023 because women prioritize comfort and foot health and have a wide range of shoe preferences. Their fashion-conscious decisions, active lifestyles, and increasing desire for customizing possibilities contributed to their increasing notoriety. Women's notable presence in the industry was also influenced by wellness trends, the ease of online buying, and customized insole solutions.

The men’s shoe insoles segment is projected to grow at a CAGR of 5.6% from 2024 to 2030. Men are choosing more and more specialist shoe insoles that can offer targeted support and comfort for particular foot disorders as a result of the growing prevalence of foot issues like plantar fasciitis, flat feet, and various forms of foot pain.

Key U.S. Shoe Insoles Company Insights

The U.S. shoe insoles market is characterized by intense competition among major players with great brand recognition, significant geographic presence, and extensive distribution networks. In order to expand their product offerings and acquire a competitive edge, market players are focusing on product innovation through enhanced R&D activities. Technological innovations, sustainability initiatives, mergers, and acquisitions are expected to rise over the forecast period as companies look to expand their consumer reach. Product price, sustainability, and distribution channels are among the key strategic areas to gain a competitive advantage.

Key U.S. Shoe Insoles Companies:

- Bauerfeind AG

- Foot Science International

- Superfeet Worldwide, Inc.

- Texon International Group

- FootBalance System Ltd.

- Sidas

- ENERTOR

- YONEX Co., Ltd.

- Asics Corporation

- New Balance Athletics, Inc.

Recent Developments

-

In March 2023, Dr. Scholl's unveiled a new range of products that included insoles, a foot file, and a foot mask. The insoles aid in preventing pain from a variety of sources, including weight gain, poor posture, uneven pressure, flat feet, and running on hard terrain.

-

In January 2023, Dr. Scholl's formed alliance with entrepreneur and sports journalist Erin Andrews to declare the introduction of two new kinds of insoles: Prevent Pain Protective Insoles and Revitalize Recovery Insoles. These insoles are claimed to be medically proven to avoid lower body pain, strain, and stiffness and aid in post-game recovery by reducing fatigue.

-

In July 2021, Asics, a well-known sportswear brand, announced an investment in healthcare startup Japan HealthCare Co., Ltd. The startup is working toward developing preventative systems targeted at musculoskeletal disorders such as low back and knee pain. Japan HealthCare specializes in creating custom insoles using photos of feet taken by smartphones. The investment was made through Asics Ventures, which is the brand's investment subsidiary.

U.S. Shoe Insoles Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.11 billion

Revenue forecast in 2030

USD 1.49 billion

Growth rate

CAGR of 5.1% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in million Units, Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue & volume forecasts, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, material, end-user, type

Country scope

U.S.

Key companies profiled

Bauerfeind AG; Foot Science International; Superfeet Worldwide, Inc.; Texon International Group; FootBalance System Ltd.; Sidas; ENERTOR; YONEX Co., Ltd.; Asics Corporation; New Balance Athletics, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Shoe Insoles Market Report Segmentation

This report forecasts revenue & volume growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the U.S. shoe insoles market report based on application, material, end-user, and type:

-

Application Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

Casual

-

Athletic

-

Orthotics

-

-

Material Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

Foam

-

Gel

-

Rubber

-

Plastic

-

Carbon Fiber

-

Polyurethane

-

Others

-

-

End-user Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

Men

-

Women

-

-

Type Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

Full Length

-

3⁄4 Length

-

Heel Cup

-

Frequently Asked Questions About This Report

b. The U.S. shoe insoles market size was estimated at USD 1.06 billion in 2023 and is expected to reach USD 1.11 billion in 2024.

b. The U.S. shoe insoles market is expected to grow at a compound annual growth rate of 5.1% from 2024 to 2030 to reach USD 1.49 billion by 2030.

b. Foam insoles dominated the U.S. shoe insoles market with a share of 34.3% in 2023. This is attributable to the comfort and bounce offered by these insoles, coupled with the therapeutic properties.

b. Some key players operating in the U.S. shoe insoles market include Bauerfeind AG, Foot Science International, Superfeet Worldwide, Inc., Texon International Group, FootBalance System Ltd., Sidas, ENERTOR, YONEX Co., Ltd., Asics Corporation, and New Balance Athletics, Inc.

b. Key factors that are driving the market growth include growing awareness among consumers about the importance of foot health and the impact of improper footwear on overall well-being.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.