- Home

- »

- Medical Devices

- »

-

U.S. Sexual And Reproductive Health Clinics Market Report 2030GVR Report cover

![U.S. Sexual And Reproductive Health Clinics Market Size, Share & Trends Report]()

U.S. Sexual And Reproductive Health Clinics Market Size, Share & Trends Analysis Report By Service (Birth Control, Pregnancy-related Services), By Age Group, By Ownership And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-169-3

- Number of Report Pages: 101

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

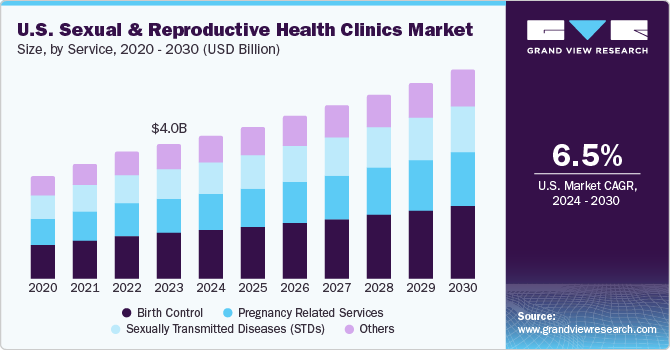

The U.S. sexual and reproductive health clinics market size was estimated at USD 4.03 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 6.53% from 2024 to 2030. Market growth can be attributed to the increasing adoption of newly developed contraceptive methods, rising prevalence of sexually transmitted infections, and an increasing demand for healthcare services and technology, which is driving the development of safe and effective healthcare products. Increasing awareness about family planning has also been a major growth-driving factor for the market. Improved access to family planning and reproductive health services can prevent maternal deaths and unintended pregnancies, with almost one-third of maternal deaths being preventable through effective healthcare services.

In 2021, 1,205 women died from complications during childbirth and pregnancy in low- and middle-income regions in the country. In addition, in the United States, 74% of married and 9% of cohabiting women have an unmet demand for modern contraception. For unmarried, sexually active women, they were 85%, and 11% respectively. In addition, the U.S. government has been a major supporter of global FP/RH efforts for over 50 years. As the largest donor and one of the biggest purchasers and distributors of contraceptives internationally, the U.S. plays a crucial role in promoting access to family planning and reproductive health services.

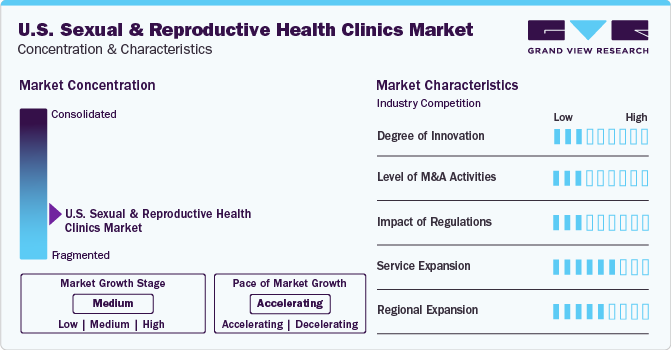

Market Concentration & Characteristics

The market is characterized by a medium degree of innovation. Innovation in women’s health space is currently an underserved area, with R&D funding lagging behind the significant impact it has on society. The Bill & Melinda Gates Foundation (BMGF) and the U.S. National Institutes of Health (NIH) have been the primary sources of funding for sexual and reproductive health R&D, accounting for almost 60% of the funding as in 2020. This highlights the need for more investment in women's health innovation to address the imbalance.

Market players, such as Maven Clinic and Ro, are involved in merger and acquisition activities. Through M&A activity, these companies can expand their geographic reach and enter new territories. The Supreme Court's decision in Dobbs v Jackson Women's Health Organization has significantly altered the legal landscape around access to reproductive health care services. This has led to a substantial decline in access to abortion and other reproductive health services in some states, resulting in over 66 clinics across 15 states ceasing to offer abortion services.

Increased access to information related to sexual wellness through internet, social media, and educational campaigns has resulted in increased awareness about sexual and reproductive health.

Telemedicine/telehealth is a widely used substitute for sexual and reproductive health in the country. Telemedicine can improve access to reproductive health care services for underserved populations by providing remote care and overcoming geographical & logistical barriers. It offers a variety of reproductive health care services, such as hormonal contraception, medication abortions, and sexually transmitted infections (STIs) care. While some services can replace the need for in-person care, most telemedicine services still operate as adjuncts to the existing healthcare system.

Florida, California, New Jersey, Louisiana, Tennessee, South Carolina, and Virginia implemented laws to enhance reproductive health care for those who are incarcerated, particularly by developing pregnancy-related healthcare. For instance, the new Tennessee and California laws require expanded access and postpartum and prenatal care for incarcerated individuals (including abortion care in California).

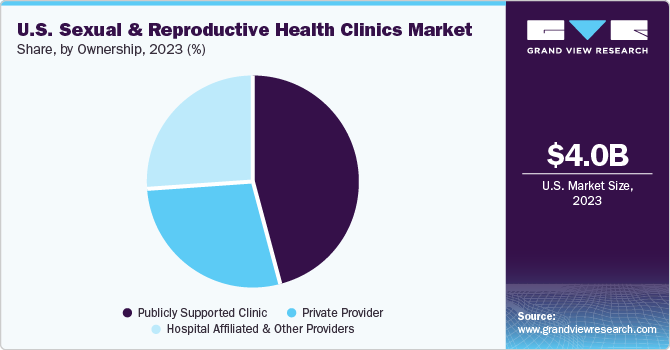

Ownership Insights

Based on ownership, the market has been segmented into private providers, publicly supported clinics, hospital-affiliated, and other providers. The publicly supported clinic segment accounted for the largest share in 2023 due to the presence of a majority of government-operated clinics. The Affordable Care Act (ACA) and the expansion of Medicaid have increased access to sexual and reproductive health services for many individuals. This has led to more people utilizing publicly supported clinics due to the coverage provided by these programs. Publicly supported clinics contribute to community health initiatives, particularly for underserved populations.

These clinics offer a wide range of sexual and reproductive health services, as well as education and resources to those who may not have access. Thus, publicly funded clinics continue to play a crucial role in providing sexual and reproductive health care to many women. This is particularly for those who are in lower income brackets, foreign-born women, women with Medicaid coverage, and those who are uninsured. In addition, among women who seek care at clinics for their SRH needs, two-thirds confirm that the clinic is their usual source of medical care. The private provider segment is expected to witness the fastest CAGR from 2024 to 2030.

Individuals are seeking private providers for a variety of reasons, including desire for more personalized care, discretion, and convenience. In addition, many private clinics specialize in fertility services, providing comprehensive assessments, consultations, and treatments for individuals or couples experiencing challenges with conception. This includes diagnostic tests, fertility medications, intrauterine insemination (IUI), in vitro fertilization (IVF), and other assisted reproductive technologies. These factors are expected to drive segment growth.

Age Group Insights

Based on age group, the market has been segmented into 15 to 25 years, 26 to 35 years, and 36 to 44 years. The 15 to 25-years age group segment accounted for the largest share of 40.7% in 2023 and is expected to register the fastest growth rate from 2024 to 2030. This can be attributed to increased sexual activity and awareness about the importance of STI testing. Younger individuals, particularly those in the age group of 15 to 25 years, have higher rates of STIs due to various factors, such as higher levels of sexual activity, multiple partners, and inconsistent use of protection. For instance, according to the CDC, approximately 46% of new STIs occur in individuals between the ages of 15 and 24 years.

Moreover, about 21% of new HIV diagnoses were reported among people aged 13 to 24 years in the United States in 2021. The 26 to 35 years age group segment is expected to have significant growth over the projected period. Women aged between 26 to 35 years are of reproductive age, and women’s health issues associated with this age group are related to fertility, such as hormonal infertility, endometriosis, and Polycystic Ovary Syndrome (PCOS). Furthermore, this age range is also a significant contributor to market growth due to the demand for educational programs, contraceptive counseling, and STI/STD testing and treatment.

Service Insights

Based on services, the market is segmented into birth control, pregnancy-related procedures, sexually transmitted diseases (STDs), and others. The birth control segment accounted for the largest share in 2023 and is expected to register the fastest CAGR from 2024 to 2030. This can be attributed to factors, such as increasing demand for a variety of birth control methods, and technological advancement in contraceptive technology. In addition, recent emphasis on abortion ban in various states of the U.S. has also proportionally increased the demand for the use of different contraceptive methods in this country. Moreover, the developmentof new, more effective, and long-acting reversible contraceptive methods are expected to drive industry growth.

For instance, pharmaceutical company Agile Therapeutics launched Twirla, a hormonal patch, in the U.S. in the fourth quarter of 2020. Due to a rise in the availability of generic and low-cost drugs and devices, there has been an increase in demand for contraceptives among teenagers. The pregnancy-related services segment is expected to witness significant growth during the forecast period owing to the increasing demand for infertility treatments and services, pregnancy-related care in the market is becoming more prevalent. According to the CDC, approximately 10% of women in the U.S. aged 15-44 years have difficulty getting pregnant or staying pregnant. This is anticipated to increase the need for infertility treatment services in clinics.

Key Companies & Market Share Insights

The market is fragmented and includes a diverse range of healthcare providers, such as private clinics, public health clinics, non-profit organizations, hospitals, and specialized healthcare providers that offer sexual and reproductive health services.

RAMSEY COUNTY, Public Health Solutions, and Planned Parenthood Federation of America Inc. are some of the dominant players operating in this market.

-

Ramsey County has more than 4,000 positions in a variety of fields related to Health and Wellness, Safety and Justice, Information and Public Records, Economic Growth and Community Investment, and more

-

Public Health Solutions (PHS) is NYC's largest public health nonprofit. They address key public health issues, such as nutrition, health insurance, maternal and child health, reproductive health, tobacco control, and HIV/AIDS prevention

-

Planned Parenthood is a 501 nonprofit organization that operates globally, providing reproductive and sexual healthcare, as well as sexual education. The organization is a member of the International Planned Parenthood Federation

Pacific Reproductive Center and Bloom Women’s Health are some of the emerging market players in this market

-

Bloom Women’s Health provides women's health care services to women and adolescents in Jackson, Mississippi, and the surrounding areas. The services they offer include primary care, menopause therapy, family planning, pregnancy testing, ultrasounds, prenatal care, and related services

-

Pacific Reproductive Center operates a board-certified fertility clinic, catering to individuals and couples who face challenges with pregnancy. Their services specialize in reproductive endocrinology, in vitro fertilization, egg donation, male infertility, genetic testing, diagnosis, and infertility care

Key U.S. Sexual And Reproductive Health Clinics Companies:

- Public Health Solutions

- Teton County, WY

- Ramsey County

- Bloom Women’s Health

- Planned Parenthood Federation of America Inc.

- Pacific Reproductive Center

- Male Sexual & Reproductive Health Center

- University of Rochester Medical Center Rochester, NY (Golisano Children's Hospital)

Recent Developments

-

In February 2023, Nebraska Family Planning recently launched a new campaign called "In Control" that aims to help people access virtual and affordable healthcare. The organization is dedicated to providing access to reproductive health care services and education to the community

-

In October 2022, The U.S. Department of Health and Human Services (HHS) announced it has allocated more than USD 6 million towards Teenage Pregnancy Prevention Evaluation and Research grants, Research-to-Practice Center grants, and Title X Family Planning Research grants. These are aimed at maintaining and expanding access to reproductive health care, which is an essential aspect of overall wellness

U.S. Sexual And Reproductive Health Clinics Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 6.27 billion

Growth rate

CAGR of 6.53% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, age group, ownership

Key companies profiled

Public Health Solutions; Teton County, WY; Ramsey County; Bloom Women’s Health; Planned Parenthood Federation of America Inc.; Pacific Reproductive Center; Male Sexual & Reproductive Health Center; University of Rochester Medical Center Rochester, NY (Golisano Children's Hospital)

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Sexual And Reproductive Health Clinics Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. sexual and reproductive health clinics market report based on service, age group, and ownership:

-

Age Group Outlook (Revenue, USD Million, 2018 - 2030)

-

15 to 25 Years

-

26 to 35 Years

-

36 to 44 Years

-

-

Service (Revenue, USD Million, 2018 - 2030)

-

Birth control

-

Pregnancy Related Services

-

Sexually Transmitted Diseases (STDs)

-

Others

-

-

Ownership Outlook (Revenue, USD Million, 2018 - 2030)

-

Private Provider

-

Publicly Supported Clinic

-

Hospital Affiliated and Other Providers

-

Frequently Asked Questions About This Report

b. The U.S. sexual and reproductive health clinics market size was estimated at USD 4.03 billion in 2023 and is expected to reach USD 4.29 billion in 2024.

b. The U.S. sexual and reproductive health clinics market is expected to grow at a compound annual growth rate of 5.57% from 2024 to 2030 to reach USD 6.27 billion by 2030.

b. The birth control segment accounted for the largest market share of 34.3% in 2023 and is expected to register the fastest growth rate over the forecast period. This can be attributed to factors such as increasing demand for a variety of birth control methods. Ongoing advancements in contraceptive technology drive the development of more effective and user-friendly birth control methods.

b. Some key players operating in the U.S. sexual and reproductive health clinics market include Public Health Solutions; Teton County, WY; RAMSEY COUNTY; Bloom Women Health; Planned Parenthood Federation of America Inc.; Pacific Reproductive Center; Male Sexual & Reproductive Health Center; University of Rochester Medical Center Rochester, NY (Golisano Children's Hospital).

b. Key factors that are driving the U.S. sexual and reproductive health clinics market growth include increasing adoption of newly developed contraceptive methods, rising prevalence of sexually transmitted infections and increasing demand for healthcare services and technology which driving the development of safe and effective healthcare products.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."