- Home

- »

- Medical Devices

- »

-

U.S. Senior Living Market Size, Share, Industry Report, 2033GVR Report cover

![U.S. Senior Living Market Size, Share & Trends Report]()

U.S. Senior Living Market (2025 - 2033) Size, Share & Trends Analysis Report By Facility (Assisted Living Residences, Adult Care Facilities, Nursing Facilities, Memory Care, Active Adults 55+ Community), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-360-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Senior Living Market Summary

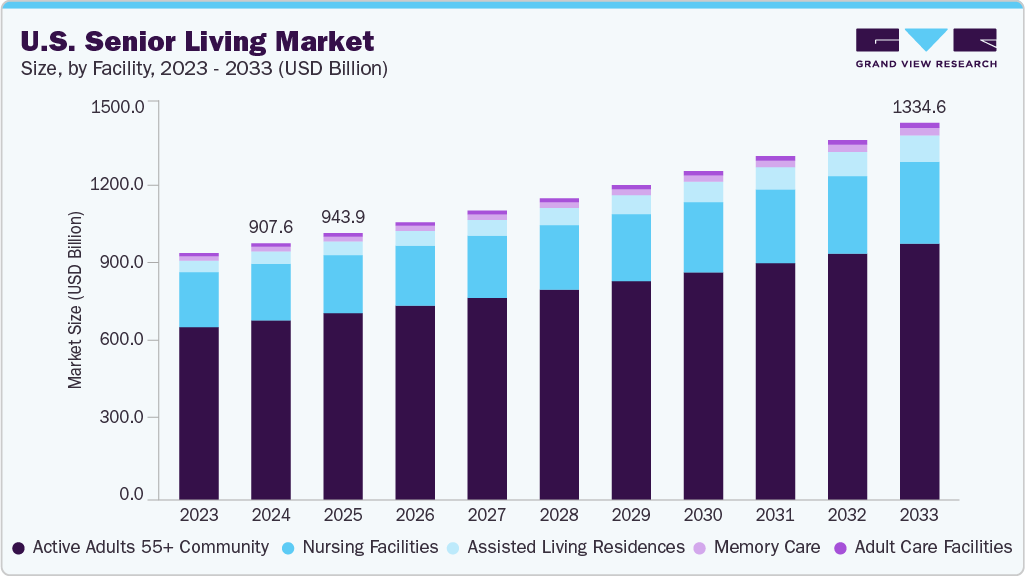

The U.S. senior living market size was estimated at USD 907.59 billion in 2024 and is expected to reach USD 1.33 trillion by 2033, growing at a CAGR of 4.42% from 2025 to 2033. As the senior population grows, the demand for senior living facilities increases. According to the National Investment Center, a nonprofit organization in Annapolis, Maryland, the U.S. needs about 156,000 by 2025, 549,000 by 2028, and 806,000 by 2030 to fulfill the demand of residents. Moreover, according to the Consumers Unified, LLC, a consumer news and advocacy organization, the U.S. needs about 1 million new senior living units by 2040. Monitoring projections and trends in the assisted living industry is necessary for operators and owners to predict and meet the growing demand for senior living services. By understanding demographic shifts and future needs, organizations strategically position their facilities to provide high-quality care and accommodations for the ever-increasing aging population.

Senior living facilities provide housing for elderly residents with varying degrees of independence. Some individuals require personal hygiene support while nurses manage their medication. Several residents need assistance with daily activities and more comprehensive medical care. Moreover, Alzheimer’s and dementia, and prevalent health issues among those in assisted living, include high blood pressure, arthritis, and heart disease. These facilities provide memory care for patients. In addition, the senior living services also include nursing facilities, which provide trained staff such as licensed nurses coordinated by doctors, with the seniors 24/7.

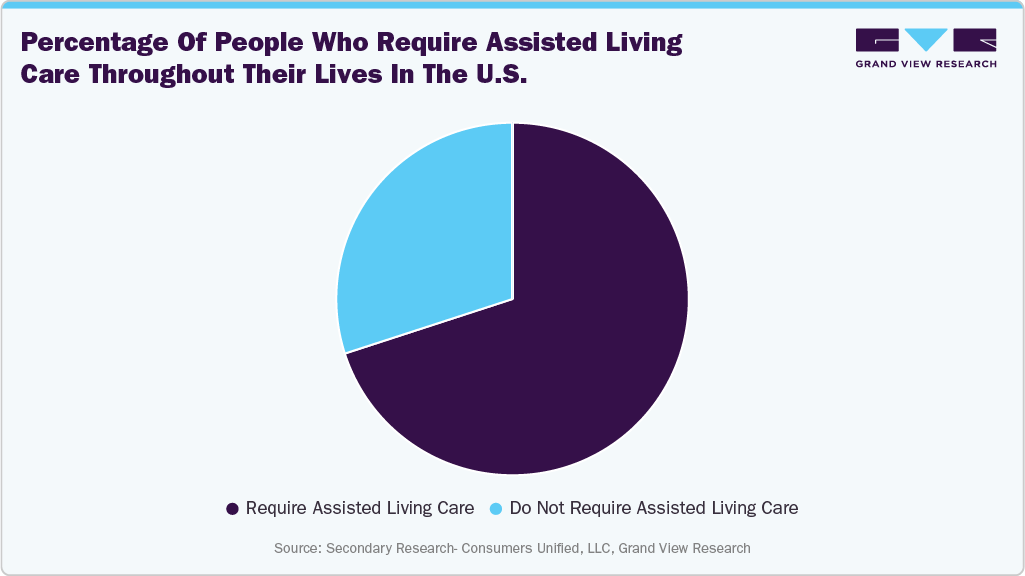

According to Consumers Unified, LLC, seven out of ten individuals in the U.S. require assisted living care in their lifetime.

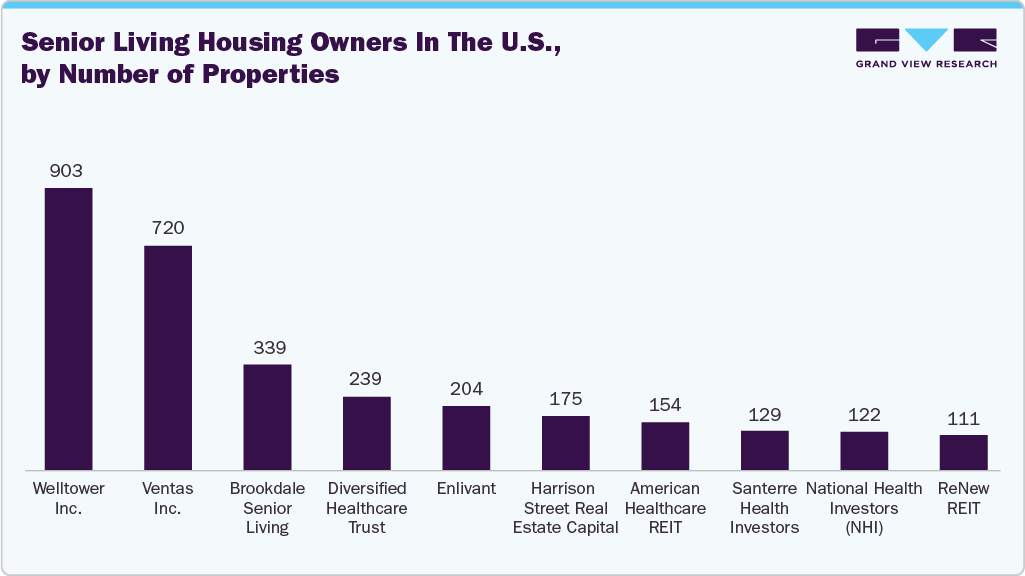

The U.S. senior living industry is witnessing a surge in investments and franchising of assisted living facilities, propelled by a growing demand for quality senior care. Real estate investment trusts (REITs), private equity firms, and institutional investors are investing capital into the sector, recognizing the long-term growth potential of senior housing. As the industry evolves, established operators expand their footprint through partnerships, acquisitions, and franchise models. The rise of franchised assisted living facilities and adult care facilities has provided investors with scalable business opportunities, allowing for brand consistency, standardized care protocols, and operational efficiencies. For instance, in September 2020, Elder-Well, a non-medical social model for adult day care in Massachusetts, began offering entrepreneurs the chance to franchise its services. This franchising initiative illustrates the growing popularity of adult daycare models across the U.S.

The following figure provides an overview of the number of properties owned by key senior living housing operators in the U.S. market:

The rise in investment is fueling advancements in facility design, amenities, and care services. New developments incorporate smart technologies, wellness initiatives, and personalized care solutions to improve the resident experience. Investors are increasingly focusing on mixed-use senior living communities that offer a combination of independent living, assisted living, and memory care, ensuring a seamless continuum of care. Merging smaller, independent facilities into larger networks enhances operational efficiency and elevates service quality.

For instance, since 2018, KKR, a private equity firm, has closed two real estate funds focusing on senior living housing. The first fund, announced in early 2018, was valued at USD 2 billion and aimed to acquire various properties, including those in the senior housing sector. At the time of the announcement, the fund had already been allocated or committed to USD 250 million. Then, in October 2021, KKR closed another real estate fund worth USD 4.3 billion, which had already committed over USD 1 billion before the announcement. In addition, in 2019, KKR made a notable move by acquiring Benchmark, a senior living provider, purchasing its 48 properties from the real estate investment trust Welltower for USD 1.8 billion.

Assisted living and adult care facilities incorporate innovative features and amenities to meet residents' evolving needs and preferences. These enhancements aim to provide older adults with a comfortable and engaging living environment. Thus, such technological advancements in the facilities boost the number of residents in those facilities. Several innovative features and amenities include:

-

Smart Home Technology: Assisted living facilities are integrating smart home technology to improve safety and convenience for residents. This includes smart thermostats, automated lighting, and voice-activated assistants, which empower residents to control their living environment.

-

Wellness Programs: Many assisted living facilities focus on enabling residents' overall well-being by offering comprehensive wellness programs. These programs include mental health support, nutritional counseling, and fitness classes, promoting a holistic approach to care.

Market Concentration & Characteristics

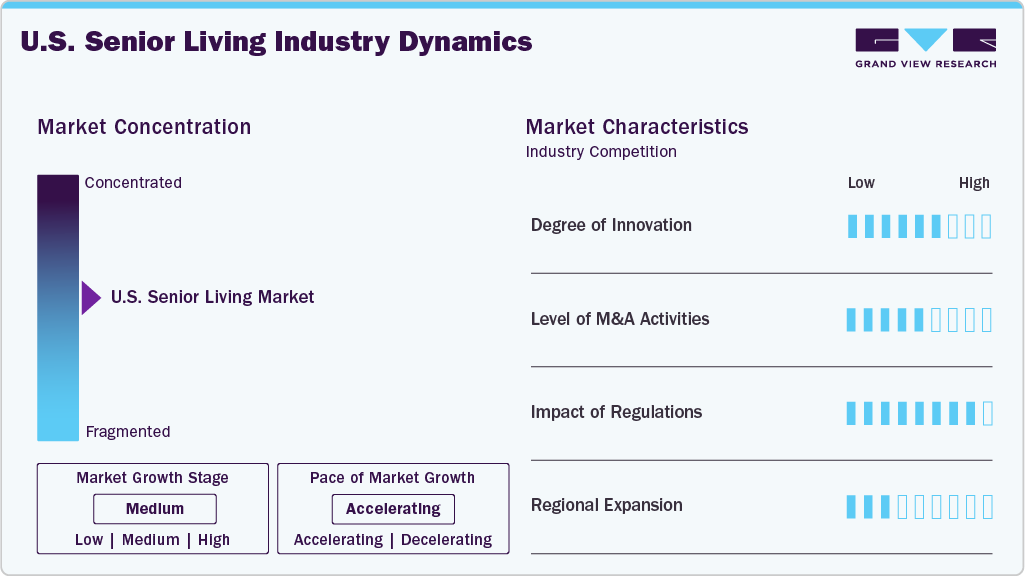

The U.S. senior living market is fragmented, with many small players entering the space. The degree of innovation is medium, and the level of acquisition and mergeractivities is medium. The impact of regulations on the market is high, and the service expansion of players is medium.

The degree of innovation in the U.S. senior living industry is advancing steadily, driven by technology adoption and evolving care models. Providers are integrating wearables, fall detection sensors, and telehealth platforms to enhance safety and enable remote health monitoring. Increasing use of AI and predictive analytics is allowing for personalized care planning and proactive chronic disease management. Innovative models such as continuing care retirement communities (CCRCs) and hybrid living arrangements are gaining traction, offering flexibility across independent and assisted living.

The market players are leveraging strategies such as acquisitions and mergers to promote the reach of their offerings and increase their service capabilities. In February 2025, Ensign Group, Inc. announced the acquisition of five senior living and care properties in Texas through Standard Bearer Healthcare REIT, which is its captive real estate company.

The industry is regulated primarily at the state level, resulting in variations in standards for staffing, safety protocols, and quality of care across the country. The federal government influences the sector indirectly through Medicare and Medicaid policies, particularly for reimbursement of specialized services such as dementia or chronic disease care.

The level of regional expansion is significant in the U.S. senior living market due to various government programs and initiatives. For instance, in October 2024, Life Care Services began construction on Orchard Terrace, a 109-unit expansion of its Ashby Ponds senior living community in Ashburn, VA.

Facility Insights

The active adults 55+ community segment dominated the U.S. senior living industry with a revenue share of 70.02% in 2024. As the Baby Boomer generation ages, many individuals are looking for housing options that reduce the burdens associated with traditional homeownership, such as yard work and home repairs. They are also seeking environments that promote community and social engagement. According to the U.S. Census Bureau, more than 55 million Americans were age 65 or older as of 2020, with a substantial portion residing in Midwest states such as Illinois, Michigan, and Ohio. In addition, in 2023, the 55+ population in Illinois was 3,746,769. This demographic shift highlights the growing necessity for housing solutions tailored to the preferences of older adults.

The assisted living residences segment is anticipated to grow at the fastest CAGR during the forecast period, due to the increasing prevalence of target diseases. The prevalence of chronic diseases such as cancer, Parkinson's disease, diabetes, heart problems, dementia, multiple sclerosis, Alzheimer’s disease, mental stress, and cerebral palsy is growing in the country, and the elderly population is especially affected.Parkinson's disease is becoming more prevalent in the U.S. According to the Parkinson's Foundation indicates that 1 million Americans have Parkinson's condition, with a projected 1.2 million expected to be diagnosed by 2030. Furthermore, 90,000 new cases are diagnosed annually. Parkinson's disease is the second most common neurodegenerative disorder after Alzheimer's disease, and its increasing prevalence is expected to further increase the demand for assisted living facilities.

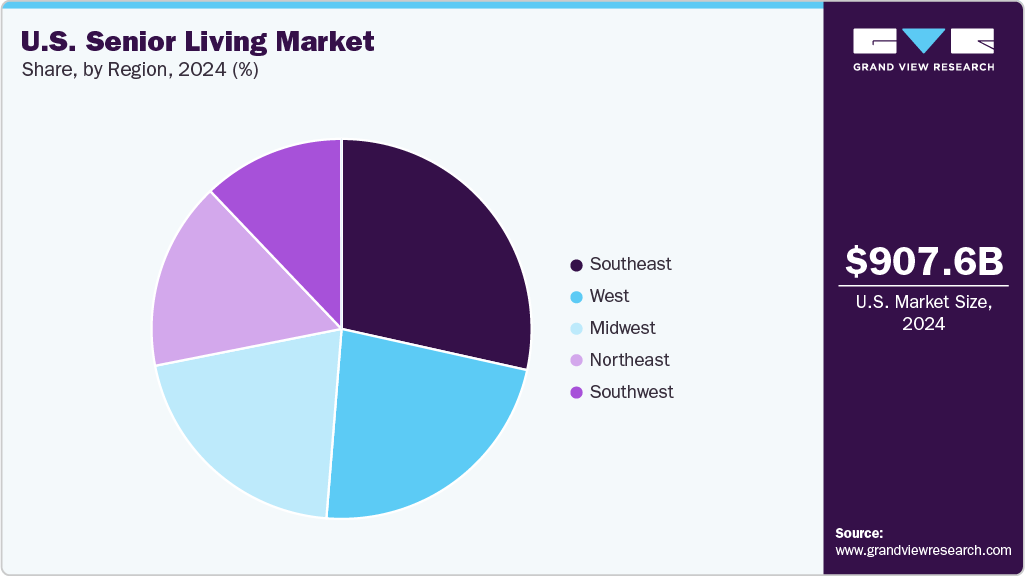

Regional Insights

Southeast led the U.S. senior living market with the largest revenue share of 28.48% in 2024. The industry is expected to grow owing to the lower cost of living and tax-friendly policies that attract retirees. States such as Florida, Georgia, North Carolina, and South Carolina are experiencing rapid growth in senior housing developments, with new communities catering to assisted living and memory care needs. For instance, in August 2024, Thrive Senior Living, a provider of senior living space, announced the opening of its operations in about three new senior living communities in Georgia.

The Southwest U.S. senior living market is expected to grow at the fastest CAGR during the forecast period. Assisted living facilities in the South are small, medium, and large facilities. The region has several senior care organizations, such as Sunrise Senior Living, Inc. and Brookdale Senior Living, Inc. Texas is one of the fastest-growing states in terms of improved living conditions and the number of facilities for senior residents. According to the information published by the Texas Health Care Association, the HHSC 2024 data suggested that there were 1,183 nursing facilities and 2,008 assisted living facilities in Texas.

Key U.S. Senior Living Company Insights

The U.S. senior living market presents a competitive landscape marked by consolidation among large operators and the continued presence of regional and independent providers. Major national chains are expanding through acquisitions and new developments, seeking economies of scale in staffing, technology adoption, and resident services.

Key U.S. Senior Living Companies:

- Genesis Healthcare

- Brookdale Senior Living Solutions

- The Ensign Group, Inc.

- Sunrise Senior Living

- Brightview Senior Living.

- Life Care Centers of America.

- Kindred Healthcare

- Atria Senior Living, Inc.

- Five Star Senior Living (AlerisLife)

- Sonida Senior Living

- Merrill Gardens

- Belmont Village, L.P.

- Holding Company of The Villages, Inc.

- LCS. (Life Care Services)

- Erickson Senior Living

- Kensington Park Senior Living

- Masonicare.org

- Azura Memory Care

- Robson Senior Living

- Kisco Senior Living

- Discovery Senior Living

- Americare Senior Living

- Gardant Management Solutions

- Asbury Communities, Inc.

- Covenant Living

- Vetter Senior Living

- Eden Senior Care

- Stellar Living Communities.

- Phoenix Senior Living

- Trilogy Health Services, LLC (American Healthcare REIT)

Recent Developments

-

In January 2025, Masonicare.org merged with United Methodist Homes and acquired Atria Greenridge Place, expanding its senior residency and care services.

-

In January 2025, Azura Memory Care and Assisted Living announced the opening of its new Verona facility this month, expanding its specialized care services.

-

In December 2024, Stellar Living Communities introduced Stellar Equity Promote JV I, a USD 25 million joint venture investment platform to develop and acquire senior living properties and related assets.

-

In December 2024, Morgan Stanley Investment Management, through MSREI, partnered with Brightview Senior Living to acquire eight premium senior housing communities from Harrison Street.

U.S. Senior Living Market Report Scope

Report Attribute

Details

Revenue forecast in 2033

USD 1.33 trillion

Growth rate

CAGR of 4.42% from 2025 to 2033

Actual data

2021 - 2024

Forecast data

2025 - 2033

Quantitative units

Revenue in USD billion/trillion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Facility, region

Country scope

U.S.

Key companies profiled

Genesis Healthcare, Brookdale Senior Living Solutions, The Ensign Group, Inc., Sunrise Senior Living, Brightview Senior Living, Life Care Centers of America, Kindred Healthcare, Atria Senior Living, Inc., Five Star Senior Living (AlerisLife), Sonida Senior Living, Merrill Gardens, Belmont Village, L.P., Holding Company of The Villages, Inc., LCS. (Life Care Services), Erickson Senior Living, Kensington Park Senior Living, Masonicare.org, Azura Memory Care, Robson Senior Living, Kisco Senior Living, Discovery Senior Living, Americare Senior Living, Gardant Management Solutions, Asbury Communities, Inc., Covenant Living, Vetter Senior Living, Eden Senior Care, Stellar Living Communities, Phoenix Senior Living, Trilogy Health Services, LLC (American Healthcare REIT)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Senior Living Market Report Segmentation

This report forecasts revenue growth at the country and regional levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033 For this study, Grand View Research has segmented the U.S. senior living market report based on facility, and region:

-

Facility Outlook (Revenue, USD Billion, 2021 - 2033)

-

Assisted Living Residences

-

Adult Care Facilities

-

Nursing Facilities

-

Memory Care

-

Active Adults 55+ Community

-

-

Region Outlook (Revenue, USD Billion, 2021 - 2033)

-

West

-

Southeast

-

Southwest

-

Midwest

-

Northeast

-

Frequently Asked Questions About This Report

b. The U.S. senior living market size was estimated at USD 907.59 billion in 2024 and is expected to reach USD 943.90 billion in 2025.

b. The U.S. senior living market is expected to grow at a compound annual growth rate of 4.42% from 2025 to 2033 to reach USD 1.33 trillion by 2033.

b. The active adult (55+) communities/independent living segment held the largest share of 70.02% in 2024. This expansion is driven by the increasing number of baby boomers seeking vibrant, maintenance-free lifestyles in age-restricted communities. Key drivers include the desire for social engagement, access to recreational amenities, and the appeal of downsizing to more manageable living spaces.

b. Some key players operating in the U.S. senior living market include Genesis Healthcare, Brookdale Senior Living Solutions, The Ensign Group, Inc., Sunrise Senior Living, Brightview Senior Living, Life Care Centers of America, Kindred Healthcare, Atria Senior Living, Inc., Five Star Senior Living (AlerisLife), Sonida Senior Living, Merrill Gardens, Belmont Village, L.P., Holding Company of The Villages, Inc., LCS. (Life Care Services), Erickson Senior Living, Kensington Park Senior Living, Masonicare.org, Azura Memory Care, Robson Senior Living, Kisco Senior Living, Discovery Senior Living, Americare Senior Living, Gardant Management Solutions, Asbury Communities, Inc., Covenant Living, Vetter Senior Living, Eden Senior Care, Stellar Living Communities, Phoenix Senior Living, Trilogy Health Services, LLC (American Healthcare REIT)

b. Key factors driving the U.S. senior living market growth include greater demand for various types of senior housing, ranging from independent living to assisted living and memory care facilities.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.