- Home

- »

- Electronic Devices

- »

-

U.S. Semiconductor Devices Market, Industry Report, 2030GVR Report cover

![U.S. Semiconductor Devices Market Size, Share & Trends Report]()

U.S. Semiconductor Devices Market (2025 - 2030) Size, Share & Trends Analysis Report, By Compound (GaN, GaAs, GaP, GaSb, SiC), By Product(LED, Optoelectronics, RF Devices, Power Electronics, Others), By Application, And Segment Forecasts

- Report ID: GVR-4-68040-492-3

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Semiconductor Devices Market Trends

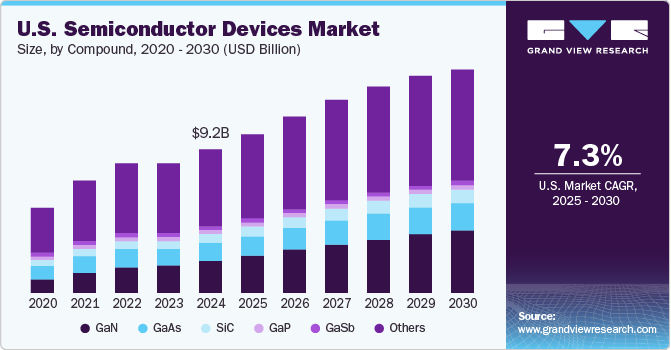

The U.S. semiconductor devices market size was estimated at USD 9.17 billion in 2024 and is projected to grow at a CAGR of 7.3% from 2025 to 2030. The U.S. semiconductor devices market is poised for significant growth driven by its rising demand in applications such as wired communication, consumer electronics, industrial electronics, automotive electronics, wireless communication, and computing & data storage, among others. The widespread application of semiconductor devices, coupled with advancements in areas such as 5G and Artificial Intelligence, is expected to fuel market growth in the coming years.

In the U.S. semiconductor devices industry, technological trends center around integrating advanced materials such as GaN (Gallium Nitride) and SiC (Silicon Carbide). These materials, with their wider bandgaps, offer higher voltage resistance, faster switching speeds, and greater thermal efficiency, making them ideal for applications demanding robust performance under stringent conditions. This shift is driving innovations in power electronics and high-frequency devices, enhancing the efficiency and durability of semiconductor components.

The U.S. semiconductor devices industry is witnessing a surge in the adoption of Artificial Intelligence (AI) and Internet-of-Things (IoT)-driven chip designs. Startups are developing multifunctional chipsets that incorporate microcontrollers and analytics directly into IoT devices, moving computing to the edge to reduce latency and vulnerability. AI's integration into semiconductor manufacturing processes is also optimizing design and production workflows, enabling predictive maintenance and improving product quality. This convergence of AI and IoT is fostering the development of smarter, more efficient semiconductor devices that can handle complex computational tasks and enhance industrial applications.

In 2024, The U.S. Department of Energy's Office of Electricity initiated the American-Made Silicon Carbide (SiC) Packaging Prize, a USD 2.25 million contest aimed at encouraging participants to propose, develop, construct, and evaluate cutting-edge SiC semiconductor packaging designs. The competition aims to enhance the performance of these devices in high-voltage settings, particularly in applications such as energy storage. This initiative promotes collaboration among entrepreneurs, innovators, the private sector, and the DOE's National Labs.

Numerous players across the U.S. are expanding and investing in advanced manufacturing processes, stringent quality control systems, and thorough testing procedures to offer efficient semiconductors for end use applications. For instance, in January 2024, Wolfspeed, Inc., a leading global manufacturer of silicon carbide wafers, announced the expansion of a long-term silicon carbide wafer supply agreement with Infineon Technologies AG, a global semiconductor company valued at approximately USD 275 million. This supply agreement would focus on facilitating silicon carbide applications in renewable energy, electric vehicles, charging infrastructure, industrial power supplies, and variable speed drives, driving advancements in electrification, thereby fueling the growth of the U.S. semiconductor devices industry.

Furthermore, the widespread adoption of 5G is expected to catalyze innovation across various industries, from healthcare and transportation to entertainment and manufacturing, by enabling new applications and services that were previously impossible with older wireless technologies. As these industries evolve and adapt to the capabilities of 5G, the demand for specialized semiconductor devices tailored to specific use cases is likely to further increase. The ongoing advancements in 5G technology also encourage greater collaboration between semiconductor companies and other tech sectors, fostering an ecosystem of innovation that drives continuous improvement and adaptation. Consequently, the synergy between 5G deployment and semiconductor development is anticipated to propel the growth of the U.S. semiconductor devices industry.

Compound Insights

The GaN (Gallium Nitride) segment accounted for a revenue share of 24.1% in 2024. The growth of the segment can be attributed to the superior performance GaN-based semiconductor devices can deliver over conventional silicon-based devices. High efficiency, wide bandwidth, and ability to handle higher voltages are some of the advantages that make GaN-based semiconductor devices ideal for a variety of applications.

The SiC (Silicon Carbide) segment is expected to witness significant growth during the forecast period. High efficiency, improved thermal performance, and a smaller physical footprint are some of the advantages offered by SiC-based semiconductors over conventional silicon-based semiconductors. As such, SiC-based semiconductors can play a crucial role in enabling next-generation Electric Vehicles (EVs).

In January 2024, Mitsubishi Electric Corporation announced the forthcoming release of six new J3-Series semiconductor modules for various EVs, featuring either an RD-IGBT (Si) or SiC-MOSFET, with compact designs and scalability for use in the inverters of Plug-in Hybrid Electric Vehicles (PHEVs) or EVs. The SiC segment is poised for significant growth over the forecast period as the EV industry continues to evolve.

Product Insights

The power electronics segment dominates the U.S. semiconductor devices market in 2024 and is expected to remain dominant during the forecast period. Industries such as electric vehicles, renewable energy, and industrial automation all rely heavily on power electronics for efficient power conversion and control. This translates to a continuous demand for these specialized chips, driving the segment growth. Moreover, the growing emphasis on energy efficiency accelerates the development of advanced power electronics with minimized energy waste, prompting even more innovative and powerful semiconductors.

The LED segment is expected to witness the highest CAGR during the forecast period. The growth of the market is driven by the increasing demand for energy-efficient lighting and advanced display technologies. LEDs are integral to a variety of applications, from residential and commercial lighting to automotive and consumer electronics. The push toward sustainable energy solutions has accelerated the adoption of LEDs due to their superior energy efficiency, longer lifespans, and lower environmental impact compared to traditional lighting technologies. Innovations in LED technology, such as improved brightness and color rendering, are further driving market growth. Government regulations aimed at promoting energy efficiency and substantial investments in smart lighting solutions also contribute to the expansion of the LED segment.

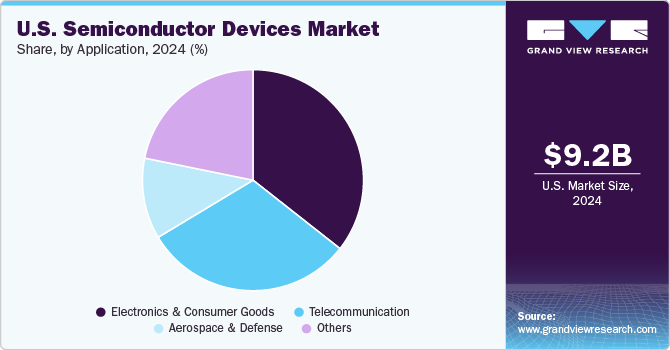

Application Insights

The electronics & consumer goods segment holds a major U.S. semiconductor devices market share in 2024. The growth of the segment is driven by the widespread adoption of consumer electronics such as smartphones, TVs, and smart appliances, which is boosting the demand for the chips that power them. As these products become more sophisticated, the need for even more advanced semiconductors increases, thus driving the segment growth.

The telecommunication segment is expected to witness significant growth during the forecast period. The growth of the telecommunication segment can be attributed to the aggressive rollout of 5G networks underway in different parts of the world, which is driving the demand for advanced RF chips and processors capable of handling high-bandwidth data transmission. The proliferation of connected devices, fueled by the advances in the Internet of Things (IoT), is also driving the demand for low-power, high-efficiency semiconductors for mobile devices and base stations. The confluence of such factors is expected to drive the growth of the telecommunications segment over the forecast period.

Key U.S. Semiconductor Devices Company Insights

Some of the key companies in the U.S. semiconductor devices industry include Samsung Semiconductor, Inc., Qorvo, Inc., Skyworks Solutions, Inc., Intel Corporation, Texas Instruments Incorporated, Broadcom Inc., WOLFSPEED, INC., Analog Devices, Inc., and others. Companies are pursuing strategic initiatives, such as regional expansion and strategic acquisitions, mergers, partnerships, and collaborations, to strengthen their position in the market.

-

Samsung Semiconductor, Inc. is a manufacturer of semiconductor products, including SSD, DRAM, LEDs, display ICs, energy storage devices, image sensors, processors, and power ICs. It is a subsidiary of Samsung Electronics, Ltd, a global manufacturer of smartphones, TVs, tablets, wearable devices, network systems, home appliances, foundry solutions, and LED solutions.

-

Intel Corporation is the manufacturer of central processing units, semiconductors, and related devices. It manages its business through operating segments, including Data Center and AI, Client Computing Group, Network and Edge, Intel Foundry Services, and Mobileye. The company provides products including processors, systems and devices, AI accelerators, FPGAs and programmable devices, and software solutions.

Key U.S. Semiconductor Devices Companies:

- Samsung Semiconductor, Inc.

- Qorvo, Inc.

- Skyworks Solutions, Inc.

- Intel Corporation

- Texas Instruments Incorporated

- Broadcom Inc.

- WOLFSPEED, INC.

- Analog Devices, Inc.

- Microchip Technology Inc.

- MACOM Technology Solutions Holdings, Inc.

- GlobalFoundries Inc.

- GPD Optoelectronics Corp.

- NTE Electronics, Inc.

Recent Developments

-

In February 2024, Qorvo, Inc. introduced four 1200V SiC modules - two full-bridge and two half-bridges-in a compact E1B package with RDS (on) starting at 9.4mΩ. These SiC modules are ideal for energy storage, electric vehicle charging stations, industrial power supplies, and solar power applications.

-

In February 2024, Analog Devices, Inc. announced a collaboration with TSMC, a global semiconductor foundry, to provide long-term wafer capacity via Japan Advanced Semiconductor Manufacturing, Inc. (JASM), a majority-owned manufacturing subsidiary of TSMC located in Kumamoto Prefecture, Japan.

-

In March 2024, Intel Corporation and the U.S. Department of Commerce announced a non-binding memorandum of terms for around USD 8.5 billion in funding under the CHIPS and Science Act. This funding is intended to support multiple semiconductor manufacturing and research and development projects at its sites in New Mexico, Arizona, Oregon, and Ohio and aims to enhance research and development and semiconductor manufacturing capabilities in the U.S.

U.S. Semiconductor Devices Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 10.18 billion

Revenue forecast in 2030

USD 14.48 billion

Growth rate

CAGR of 7.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Country scope

U.S.

Segments covered

Compound, product, application

Key companies profiled

Samsung Semiconductor, Inc.; Qorvo, Inc.; Skyworks Solutions, Inc.; Intel Corporation; Texas Instruments Incorporated; Broadcom Inc.; WOLFSPEED, INC.; Analog Devices, Inc.; Microchip Technology Inc.; MACOM Technology Solutions Holdings, Inc.; GlobalFoundries Inc.; GPD Optoelectronics Corp.; NTE Electronics, Inc.

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

15% free customization scope (equivalent to up to 5 analysts working days)

If you need specific market information, which is not currently within the scope of the report, we will provide it to you as a part of the customization

U.S. Semiconductor Devices Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. semiconductor devices market report by compound, product, and application:

-

Compound Outlook (Revenue, USD Million, 2018 - 2030)

-

GaN

-

GaAs

-

GaP

-

GaSb

-

Sic

-

Others

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

LED

-

Optoelectronics

-

RF Devices

-

Power Electronics

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Electronics & Consumer Goods

-

Aerospace & Defense

-

Telecommunication

-

Others

-

Frequently Asked Questions About This Report

b. .The U.S. semiconductor devices market size was estimated at USD 9.17 billion in 2024 and is expected to reach USD 10.18 million in 2025.

b. .The U.S. semiconductor devices market is expected to grow at a compound annual growth rate of 7.3% from 2025 to 2030 to reach USD 14.48 bllion by 2030.

b. .The GaN (Gallium Nitride) segment accounted for a revenue share of 24.1% in 2024. The growth of the segment can be attributed to the superior performance GaN-based semiconductor devices can deliver over conventional silicon-based devices.

b. .Some key players operating in the U.S. semiconductor devices market include Samsung Semiconductor, Inc.; Qorvo, Inc.; Skyworks Solutions, Inc.; Intel Corporation; Texas Instruments Incorporated; Broadcom Inc.; WOLFSPEED, INC.; Analog Devices, Inc.; Microchip Technology Inc.; MACOM Technology Solutions Holdings, Inc.; GlobalFoundries Inc.; GPD Optoelectronics Corp.; NTE Electronics, Inc.

b. .The U.S. semiconductor devices market is poised for significant growth driven by its rising demand in applications such as wired communication, consumer electronics, industrial electronics, automotive electronics, wireless communication, and computing & data storage, among others.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.