- Home

- »

- Biotechnology

- »

-

U.S. Scaffold Technology Market Size, Industry Report, 2030GVR Report cover

![U.S. Scaffold Technology Market Size, Share & Trends Report]()

U.S. Scaffold Technology Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Hydrogels, Polymeric Scaffolds), By Disease Type (Skin & Integumentary, Dental, Cardiology & Vascular), By Application, By End-use, And Segment Forecasts

- Report ID: GVR-4-68040-287-9

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Scaffold Technology Market Trends

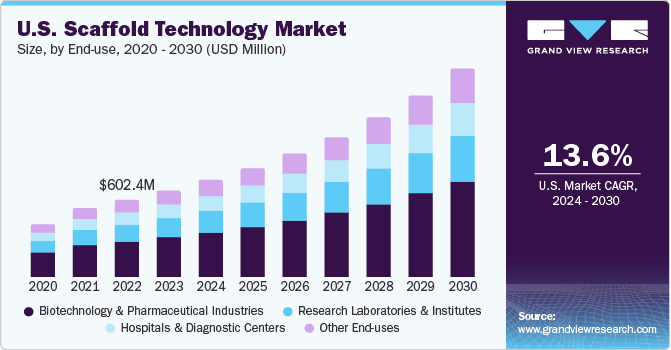

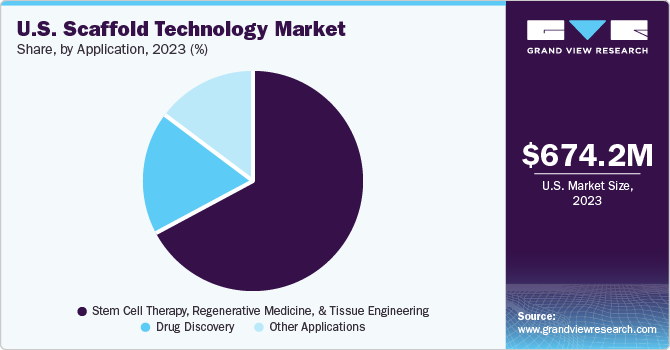

The U.S. scaffold technology market size was estimated at USD 674.21 million in 2023 and is expected to register a CAGR of 13.57% from 2024 to 2030, driven by increased demand for 3D cellular models, body reconstruction procedures, and advancements in nanofiber-based scaffold technologies. This growth is fueled by the replacement of animal models in drug testing and rising need for medical solutions.

The U.S. scaffold technology market dominated the global scaffold technology market in 2023, generating over 30% of the total revenue share. One major driving factor is the increasing demand for 3D cellular models in translational research. These models offer a more accurate representation of biological systems compared to traditional 2D cell cultures, eliminating the need for animal models in drug testing. This growing demand for scaffold technology that supports proper cell growth during 3D cell culturing is propelling market expansion.

Another factor contributing to market growth is the increasing demand for body reconstruction procedures and tissue engineering. Scaffold technology plays a crucial role in enabling biomimetic tissue constructs, which find applications in 3D organotypic structures, organ transplantation, and other medical procedures. As the need for advanced medical solutions continues to rise, the revenue generated from scaffold technology applications in these areas is expected to increase.

Moreover, advancements in scaffold technology are a significant catalyst for market growth. Ongoing technological progress in tissue engineering leads to the development of innovative scaffold technologies, which in turn, boosts the market’s overall potential. These advancements not only improve the effectiveness of existing scaffold-based solutions but also pave the way for new applications and opportunities in the U.S. scaffold technology market.

The emergence of technologically advanced nanofiber-based scaffold technologies has become a major driving force for market growth. Integrating 3D printing with rapid development has significantly increased the popularity of these products. As a result, the scaffold technology market continues to expand, driven by continuous innovation and strategic partnerships within the industry. These developments not only enhance the effectiveness of scaffold applications but also contribute to the overall growth and competitiveness of the market.

Market Concentration & Characteristics

Scaffold technology has emerged as one of the key technologies used in various clinical applications such as drug development procedures, oncology, stem cell research, and more. Industry entities are engaged in introducing different fabrication technologies for scaffolds to enhance their capabilities. For instance, development of a selective vacuum manufacturing rapid prototyping technique for scaffold fabrication to enhance scaffold properties is expected to boost the industry.

Numerous industry players are undergoing mergers and acquisitions, aiding industry expansion and growth. Recent examples include acquisitions like BrandSafway‘s acquisition of AGF Access Group Inc. This strategic move aim to strengthen industry positions, expand product portfolios, and enhance service offerings through synergies and increased industry presence.

Compliance with safety standards set by OSHA (Occupational Safety and Health Administration) is crucial for manufacturers to ensure the safety of workers using scaffolding systems. National funding programs significantly contribute to the progress of scaffold technology applications, particularly in 3D cell cultures. Regulatory bodies’ increased approvals of scaffold technology products further stimulate industry growth. Government agencies actively support the development of new scaffolds through research projects, fostering technological advancements. Collaborations between manufacturers and distributors positively impact industry penetration, expanding the reach of scaffold-based solutions.

In the scaffold technology industry, a significant trend is the emphasis on product development to adapt to changing demands and maintain competitiveness. Companies are diversifying their offerings by introducing innovative scaffold solutions tailored to specific applications. For example, in November 2023, Thermo Fisher Scientific and Flagship Pioneering expanded their strategic partnership to jointly create new platform companies with first-in-class enabling technologies for life sciences. The collaboration aims to develop and commercially scale multiproduct platforms at an accelerated pace.

The industry is witnessing an expansion of companies into different regions to capitalize on local opportunities, cater to specific demands, and broaden their industry presence. For instance, in July 2023, Merck announced the expansion of its Lenexa, Kansas, U.S. facility, adding 9,100 sq m2 of lab space and production capability to manufacture cell culture media. This investment in the region reflects Merck’s strategy to expand and diversify its supply chain, ensuring a consistent and high-quality supply of cell culture media.

Type Insights

Hydrogels dominated the market in 2023, accounting for 41.85% of the total revenue generated. Their wide-ranging potential in medical fields and increased adoption in tissue engineering drove this growth. Hydrogels’ applications as cell transplantation carriers, drug depots, and restenosis barriers are expected to further propel the segment. Hydrogels’ significance in 3D cell cultivation and tissue engineering has been a key factor in their market leadership. The ongoing advancements in hydrogel microfabrication technology are anticipated to fuel the segment’s growth in the coming years.

Nanofiber based scaffolds are projected to experience the fastest growth during the forecast period due to the increasing awareness and popularity among researchers about the integration of nanoscience and nanotechnology. The use of biomatrix incorporating nanoparticles for drug delivery and tissue repair is expected to have a high success rate in the near future. Nanoscience and nanotechnology approaches for scaffold design are expanding the markets for tissue engineering and drug delivery. Consequently, nanoscience-driven scaffold design is considered the foundation for a highly commercial niche segment within the scaffold market.

Disease Type Insights

The orthopedics, musculoskeletal, & spine segment led the segment in 2023 with over 50% of the total revenue share. Estimates suggest that nearly 60% to 67% of all annual unintentional injuries in the U.S. occur in the musculoskeletal system. Moreover, nearly 34 million surgeries on the musculoskeletal system are performed annually in the U.S. alone. According to the U.S. Medicare and Medicaid facility, there are around 900,000 surgeries every year that require bone reconstruction or replacement. These therapies involve use of autografts, where bone is isolated and grafted to damaged bone.

The neurology segment is anticipated to witness the highest CAGR over the forecast period. Approximately 65,000 individuals are diagnosed with Parkinson’s disease annually in the U.S., while the number of people living with Alzheimer’s reached around 6.2 million in 2021. The field of stem cell therapy and regenerative medicine has significantly transformed the outlook for previously considered incurable or irreversible neurodegenerative disorders.

Regenerative medicines utilize biomaterial scaffolds, neural injections, and drug-induced stimulation to promote tissue regeneration. Furthermore, recent research breakthroughs have led to the development of sophisticated biodegradable scaffolds capable of mimicking natural tissues. These advanced scaffolds offer a promising approach for facilitating stem cell transplantation and drug delivery, targeting the treatment of Parkinson’s, Alzheimer’s, spinal cord injuries, aging brain degeneration, and traumatic brain injuries.

Application Insights

The stem cell therapy, regenerative medicine, & tissue engineering segment held the largest share in the market in 2023 at over 65% of the revenue earned. Moreover, the segment is anticipated to witness the fastest CAGR over the forecast period, as the implementation of scaffold technology in tissue engineering and other clinical applications is expected to increase in the near future owing to high usage of scaffolds in wound healing as well as in aesthetic surgeries, soft tissue tumor repair, abdominal wall repair, periodontology, and colorectal surgeries.

The application of scaffold technology in drug discovery is expected to experience lucrative demand from 2024 to 2030. The growing necessity for efficient and portable tools in the biomedical science domain, particularly for drug discovery and therapeutic development, has stimulated the demand for scaffold technology in this segment. The benefits of cultivating cells in a 3D environment using scaffolds are evident and are expected to contribute positively to the growth of the scaffold technology market in the upcoming years.

The 3D cellular models’ unique ability to replicate the microenvironment for pathway elucidation and etiology studies offers a significant advantage over traditional methods, such as monolayer cell cultivation. This advantage is expected to accelerate the adoption of scaffold-based technology. Moreover, the increasing demand for scaffold-based reagents and products to assess pharmacokinetic and pharmacodynamic properties of potential drug candidates is anticipated to drive segment growth in the coming years.

End-use Insights

Biotechnology and pharmaceutical organizations led the segment in 2023 with over 45% of the total revenue share, primarily due to their high adoption during toxicity screening in drug development processes. In pharmaceutical companies, scaffolds function as implants for delivering drugs, cells, and genes into the body, facilitating drug discovery and cellular assay quantification. Their high drug-loading capacity and efficiency make scaffold matrices essential for targeted drug delivery. Moreover, scaffolds are utilized in joint pain inflammation, osteo chondrogenesis, diabetes management, heart disease treatment, and wound dressing. This versatile technology continues to expand its presence in diverse medical applications, highlighting its significance in the biotechnology and pharmaceutical industries.

Hospitals and Diagnostic Centers are anticipated to be the fastest-growing segment from 2024 to 2030, driven by the rising number of grafting procedures and increased cases of road accidents and related injuries. This growth leads to heightened demand for biological scaffolds. Numerous hospitals incorporate scaffold-based treatments in cardiovascular and dental surgeries, contributing to their revenue. For instance, Apollo Hospitals offers the Bioresorbable Vascular Scaffold (BVS) procedure for coronary artery disease treatment. The hospital also organized a live workshop on BVS, allowing healthcare entities to gain insights into scaffold technology’s utility and raising awareness among hospitals and patients.

Key U.S. Scaffold Technology Company Insights

The market is fairly fragmented, with various players operating in different segments. This fragmentation allows for diverse offerings and competition within the market. Thermo Fisher Scientific, Inc.; Merck KGaA; Tecan Trading AG; REPROCELL Inc.; 3D Biotek LLC; Becton, Dickinson, and Company; and Medtronic are some important companies in the U.S. scaffold technology market.

Companies are focusing on specific niches or technologies, contributing to a decentralized landscape where innovation and specialization thrive. Thus, strategic initiatives undertaken by key companies in the country to reinforce their market presence drives the usage of scaffold technology across a wide range of applications. For instance, in November 2022, Gelomics and Rousselot announced a cobranding collaboration that involves the use of Rousselot Biomedical’s X-Pure GelMA (gelatin methacryloyl) extracellular matrix in combination with Gelomics’ LunaGel 3D Tissue Culture System.

Key U.S. Scaffold Technology Companies:

- Thermo Fisher Scientific, Inc.

- Merck KGaA

- Tecan Trading AG

- REPROCELL Inc.

- 3D Biotek LLC

- Becton, Dickinson, and Company

- Medtronic

- Xanofi

- Molecular Matrix, Inc.

- Matricel GmbH

- Pelobiotech

- 4titude

- Corning Incorporated

- Akron Biotech

- Avacta Life Sciences Limited.

- Vericel Corporation

- NuVasive, Inc.

- Allergan

Recent Developments

-

In December 2023, Thermo Fisher Scientific Inc., a leading science-serving company, launched CorEvidence, a cloud-based data lake platform for optimizing pharmacovigilance case processing and safety data management. This platform enhanced CorEvitas clinical research registries, which are part of Thermo Fisher’s PPD clinical research business.

-

In August 2023, Nurami Medical received FDA 510(k) clearance for its electrospun, nanofiber-based ArtiFascia dura substitute, a resorbable dural repair graft for neurosurgery.

-

In July 2021, BD, a leading global medical technology company, acquired Tepha, Inc., a developer and manufacturer of resorbable polymer technology. This acquisition enhanced BD’s surgical mesh portfolio and expanded potential applications in soft tissue repair, reconstruction, and regeneration.

U.S. Scaffold Technology Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 757.06 million

Revenue forecast in 2030

USD 1.62 billion

Growth rate

CAGR of 13.57% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Type, disease type, application, end-use

Country scope

U.S.

Key companies profiled

Thermo Fisher Scientific, Inc.; Merck KGaA; Tecan Trading AG; REPROCELL Inc.; 3D Biotek LLC; Becton, Dickinson, and Company; Medtronic; Xanofi; Molecular Matrix, Inc.; Pelobiotech; 4titude; Corning Incorporated; Akron Biotech; Avacta Life Sciences Limited.; Vericel Corporation; NuVasive, Inc.; Allergan

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Scaffold Technology Market Report Segmentation

This report forecasts revenue growth at the country level and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. scaffold technology market report based on type, disease type, application, and end-use.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Hydrogels

-

Wound Healing

-

3D Bioprinting

-

Immunomodulation

-

-

Polymeric Scaffolds

-

Micropatterned Surface Microplates

-

Nanofiber Based Scaffolds

-

-

Disease Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Orthopedics, Musculoskeletal, & Spine

-

Cancer

-

Skin & Integumentary

-

Dental

-

Cardiology & Vascular

-

Neurology

-

Urology

-

GI, Gynecology

-

Other Diseases

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Stem Cell Therapy, Regenerative Medicine, & Tissue Engineering

-

Drug Discovery

-

Other Applications

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Biotechnology and Pharmaceutical Industries

-

Research Laboratories and Institutes

-

Hospitals and Diagnostic Centers

-

Other End-uses

-

Frequently Asked Questions About This Report

b. The U.S. scaffold technology market size was estimated at USD 674.21 million in 2023 and is expected to reach USD 757.06 million in 2024.

b. The U.S. scaffold technology market is expected to grow at a compound annual growth rate of 13.57% from 2024 to 2030 to reach USD 1.62 billion by 2030.

b. The hydrogel segment dominated the scaffold technology market with a share of 41.85% in 2023. This is attributable to the properties associated with the use of hydrogels, such as the ease of loading cells and drugs for controlled drug delivery.

b. Some key players operating in the U.S. scaffold technology market include Thermo Fisher Scientific, Inc.; Merck KGaA; Tecan Trading AG; REPROCELL Inc.; 3D Biotek LLC; Becton, Dickinson, and Company; Medtronic; Xanofi; Molecular Matrix, Inc.; Matricel GmbH; Pelobiotech; 4titude; Corning Incorporated; Akron Biotech; Avacta Life Sciences Limited.; Vericel Corporation; NuVasive, Inc.; Allergan

b. Key factors that are driving the U.S. scaffold technology market growth include rising demand for 3D cellular models in translational research, increasing demand for body reconstruction procedures and tissue engineering, and technological advancement of scaffold technology.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.