- Home

- »

- Alcohol & Tobacco

- »

-

U.S. Roll-your-own Tobacco Products Market, Industry Report, 2030GVR Report cover

![U.S. Roll-your-own Tobacco Products Market Size, Share & Trends Report]()

U.S. Roll-your-own Tobacco Products Market Size, Share & Trends Analysis Report By Product (RYO Tobacco, Rolling Paper & Cigarette Tubes, Injector, Filter & Paper Tip), By Distribution Channel (Offline, Online), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-229-0

- Number of Report Pages: 75

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Market Size & Trends

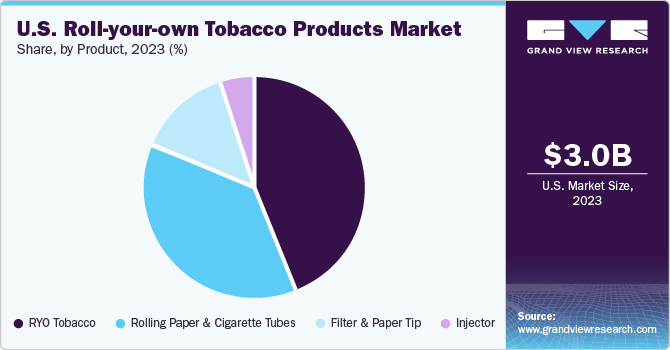

The U.S. roll-your-own tobacco products market size was estimated at USD 3.01 billion in 2023 and is expected to grow at a CAGR of 4.1% from 2024 to 2030. The market for roll-your-own (RYO) tobacco products has been driven by consumers' increased preference for hand-rolled or handcrafted cigarettes due to their comparative affordability in comparison with factory-made (FM) cigarettes.

The U.S. market accounted for a share of 9.2% of the global roll-your-own tobacco products market in 2023. There are few laws and taxes governing handmade cigarettes. These goods are therefore becoming more and more well-liked among younger, budget-conscious consumers and those with smaller yearly incomes. Nonetheless, some research indicates that the use of RYO tobacco products has been rising in affluent nations over time. In addition, a lot of people who use homemade cigarettes think that RYO tobacco products aren't as bad as cigarettes. The market's expansion has also been aided by this tendency.

In the U.S., the demand for tobacco products like cigarettes, cigars and cigarillos is rising significantly. For example, the Centers for Disease Control and Prevention (CDC) report that youth tobacco smoking and related product use has been steadily increasing in the U.S. In 2019, about 1 in 4 schoolchildren and 1 in 14 high school students used products that contained tobacco.

Significant economies globally have also observed a reasonable youth tobacco product utilization. As of December 2019, 4 out of every 100 middle school pupils and roughly 11 out of every 100 high school students in the U.S. had used two or more tobacco products since November 2019, according to the Centers for Disease Control and Prevention. Over the course of the projection period, it is expected that these consumer trends will fuel market expansion.

In the U.S., more women are turning to hand-rolled cigarettes and other tobacco products. For example, the CDC estimates that in 2018, over 34.2 million Americans, or 13.7% of the country's total population, were cigarette smokers. In addition, 12 percent of American women who were 18 years of age or older smoked cigarettes. This is increasing the nation's demand for tobacco and related items. The consumption of tobacco products, particularly cigarettes, has been rising among women in European nations. Tobacco use was once limited to men in a few of the region's wealthy nations, but these days, rates of tobacco use among men are seen to be falling while rates among women are rising.

Market Concentration & Characteristics

Apart from developing novel cigarette products, tobacco corporations have three primary avenues for growth in a diminishing cigarette market: expansions, mergers and acquisitions, and the launch of non-combustible nicotine delivery systems. These are a few tactics that businesses use to continue making money.

These businesses are anticipated to rule the sector due to their sizable customer bases, well-known brands, and extensive distribution systems. To stay competitive, businesses have been using a variety of tactics, including mergers and acquisitions and the introduction of new products.

The industry's leading companies have been making some crucial strategic choices in an effort to forge solid foundations and hold onto clients. Companies to increase their customer base and acquire a competitive edge have introduced innovative and eco-friendly products.

The market for roll-your-own tobacco products in the U.S. is quite dynamic, with numerous domestic and foreign companies vying for market share.

Much of the industry is dominated by local businesses. A number of businesses owns famous brands for filters, rolling papers, and fine-cut tobaccos. Roll-your-own tobacco products are becoming more and more popular due in large part to their cheaper price when compared to other options such as cigarettes.

Product Insights

RYO tobacco accounted for a revenue share of 43.7% in 2023. Rolling your own tobacco is becoming more and more popular due to the misconception that it is a healthier alternative to commercially made standard filtered cigarettes or a strategy to reduce smoking. Because roll-your-own tobacco products are more natural, many smokers also believe that they are safer.

The demand for filter & paper tip is projected to grow at a CAGR of 4.5% from 2024 to 2030. For consumers who would rather roll their tobacco but would like the option of filtered smoke, filter tips are excellent. They are composed of asbestos, phenol-formaldehyde resins, paper or activated charcoal, and cellulose acetate fiber. Acetic acid is used to esterify bleached cotton or wood pulp to create cellulose acetate. Smokers are using filters more frequently to reduce their intake of tar and other hazardous substances.

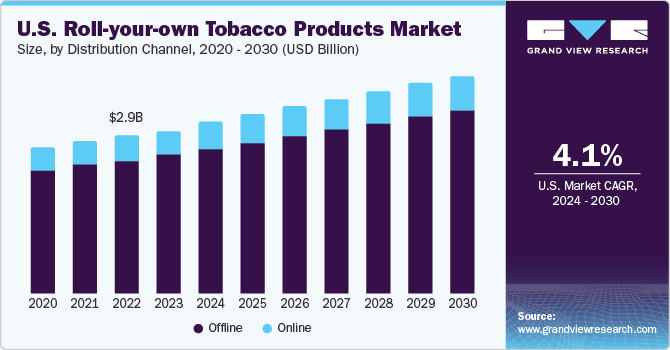

Distribution Channel Insights

Offline sales dominated the market for roll-your-own tobacco products in 2023, with a revenue share of 84.5%. Convenience stores, supermarkets, pharmacies, newsstands, and liquor stores are all included in this category. Strict regulations govern the sale of roll-your-own tobacco, which is mostly handled through smoke shops or retail stores. Although these products are also available online, the number of transactions is far lower than through conventional distribution channels due to strict regulations.

Online sales are expected to grow at a CAGR of 4.6% from 2024 to 2030. The segment is being driven by the increasing ubiquity of app-based merchants and delivery services, which are particularly well-liked by younger consumers, in addition to traditional mail-order sales and the numerous internet-based stores.

Key U.S. Roll-your-own Tobacco Products Company Insights

The market for U.S. roll-your-own tobacco products is characterized by the presence of various well-established players and several small and medium players. The major players are expected to dominate the industry over the coming years as they have large consumer bases, strong brand recognition, and vast distribution networks. Companies have been implementing various strategies, such as mergers and acquisitions and new product launches, to stay ahead in the game.

Key U.S. Roll-your-own Tobacco Products Companies:

- Imperial Brands

- British American Tobacco

- Scandinavian Tobacco Group A/S

- Altria Group, Inc.

- Philip Morris International

- HBI International

- Curved Papers, Inc.

- Karma Filter Tips

- Shine Brands

- Japan Tobacco International

Recent Developments

-

In October 2020, Davidoff, a division of Imperial Brands, introduced the Zino Platinum Crown Series Limited Edition 2020. The series uses the best tobaccos available, blended to delight even the most discriminating palate, to provide a very complex yet well-balanced smoking experience. In November, the product was released for purchase in the U.S.

-

In April 2020, The Scandinavian Tobacco Group declared that it will be closing its production facilities at Moca, Dominican Republic, and Eersel and Duizel, Netherlands. It also announced that it would be restructuring its operational facilities. Aside from this, the Tucker, Georgia plant was completely closed in November of that year.

U.S. Roll-your-own Tobacco Products Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.14 billion

Revenue forecast in 2030

USD 3.99 billion

Growth rate

CAGR of 4.1% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel

Country scope

U.S.

Key companies profiled

Imperial Brands; British American Tobacco; Scandinavian Tobacco Group A/S; Altria Group, Inc.; Philip Morris International; HBI International; Curved Papers, Inc.; Karma Filter Tips; Shine Brands; Japan Tobacco International

Customization scope

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

U.S. Roll-your-own Tobacco Products Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. roll-your-own tobacco products market report based on product and distribution channel:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

RYO Tobacco

-

Rolling Paper & Cigarette Tubes

-

Injector

-

Filter & Paper Tip

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Online

-

Frequently Asked Questions About This Report

b. The U.S. roll-your-own tobacco products market size was estimated at USD 3.01 billion in 2023 and is expected to reach USD 3.14 billion in 2024.

b. The U.S. roll-your-own tobacco products market is expected to grow at a compound annual growth rate of 4.1% from 2024 to 2030 to reach USD 3.99 billion by 2030.

b. RYo tobacco dominated the U.S. roll-your-own tobacco products market with a share of 44.4% in 2023. This is attributable to the growing consumer perception of rolling own tobacco being safer and better than cigarettes.

b. Some key players operating in the U.S. roll-your-own tobacco products market include Imperial Brands, British American Tobacco, Scandinavian Tobacco Group A/S, Altria Group, Inc., Philip Morris International, HBI International, Curved Papers, Inc., Karma Filter Tips, Shine Brands, and Japan Tobacco International.

b. Key factors that are driving the market growth include consumers' increased preference for hand-rolled or handcrafted cigarettes due to their comparative affordability in comparison with factory-made (FM) cigarettes.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."