- Home

- »

- Medical Devices

- »

-

U.S. Rhinoplasty Market Size & Share, Industry Report 2030GVR Report cover

![U.S. Rhinoplasty Market Size, Share & Trends Report]()

U.S. Rhinoplasty Market (2024 - 2030) Size, Share & Trends Analysis Report By Treatment Type (Augmentation, Reduction), By Technique (Open Rhinoplasty, Closed Rhinoplasty), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-279-3

- Number of Report Pages: 70

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Rhinoplasty Market Size & Trends

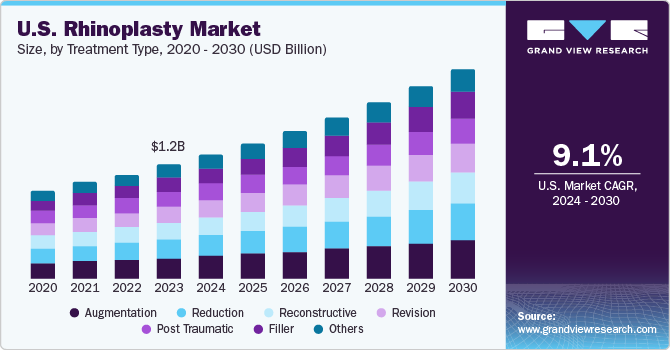

The U.S. rhinoplasty market size was estimated at USD 1.2 billion in 2023 and is projected to grow at a CAGR of 9.1% from 2024 to 2030. The increasing demand for cosmetic procedures and technological advancements in surgical procedures is projected to drive market growth. Rhinoplasty is a surgical procedure to improve the aesthetic appearance and structural integrity of the nose. It offers a balanced facial profile and corrects deformities from injury or congenital conditions.

According to the National Library of Medicine, 3,50,000 nose-reshaping procedures are performed each year in the U.S., and rhinoplasty remains the most common plastic surgery. One of the primary factors driving the market growth is the increasing demand for cosmetic procedures in the U.S. The increasing aging population and a growing focus on health and wellness drive more individuals to seek cosmetic procedures to maintain a youthful appearance. In addition, cultural influences and societal norms regarding beauty standards contribute to the demand for rhinoplasty among diverse demographic groups. The influence of celebrities and social media influencers showcasing their cosmetic enhancements and a growing acceptance of cosmetic surgery as a means of self-improvement drive the market growth.

Advancements in medical technology have also played a crucial role in shaping the U.S. market. Innovations in surgical techniques, such as minimally invasive procedures and computer-assisted imaging, have made rhinoplasty safer and more precise. These technological advancements have led to reduced recovery times, less scarring, and improved outcomes for patients undergoing rhinoplasty surgery. One notable trend in the U.S. market is the shift towards more personalized and natural-looking results. Patients are increasingly seeking subtle changes that enhance their facial features rather than drastic transformations. This trend has led to the development of advanced surgical techniques that focus on achieving more refined outcomes while preserving the individual’s unique facial characteristics.

Market Concentration & Characteristics

The market growth stage is high, and pace is accelerating. The degree of innovation in the industry has been steadily increasing over the years. Advancements in technology, such as 3D imaging and simulation software, have revolutionized the way surgeons plan and execute rhinoplasty procedures. These innovations have led to more precise outcomes, reduced risks, and improved patient satisfaction. In addition, the introduction of new materials and techniques, such as absorbable implants and non-surgical rhinoplasty options, has expanded the treatment options available to patients.

The market has seen a moderate level of merger and acquisition (M&A) activities in recent years. Larger companies have been acquiring smaller firms to expand their portfolios or gain access to new technologies. These M&A activities have also been driven by the desire to enter new markets or strengthen market positions. Overall, M&A activities in the rhinoplasty market have contributed to industry consolidation and increased competition among key players.

Regulations play a significant role in shaping the rhinoplasty market landscape. Regulatory bodies, such as the FDA in the U.S., set standards for product safety, efficacy, and marketing practices. Compliance with these regulations is essential for companies operating in the global rhinoplasty market to ensure patient safety and maintain market access. Changes in regulations can impact product development timelines, market entry strategies, and overall business operations within the industry.

Service expansion in the rhinoplasty market has been driven by a growing demand for minimally invasive procedures and personalized treatment options. Companies are investing in research and development to introduce new techniques that address specific patient needs and preferences.

Regional expansion strategies are crucial for companies looking to capitalize on emerging markets and diversify their revenue streams. The demand for rhinoplasty procedures varies across regions due to cultural norms, economic factors, and healthcare infrastructure. Companies are expanding their presence through partnerships, distribution agreements, and direct investments to access new patient populations and increase brand visibility.

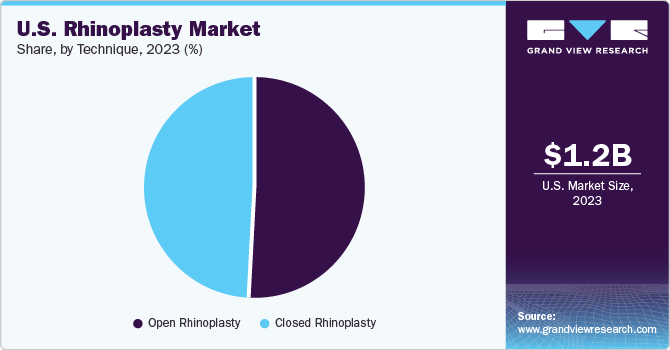

Technique Insights

Based on technique, the open rhinoplasty segment led the market with the largest revenue share of 51.35% in 2023 and is expected to grow at the fastest CAGR over the forecast period. This growth is attributable to its versatility and effectiveness in addressing a wide range of nasal deformities. This technique involves making an external incision on the columella (the strip of skin between the nostrils) to access and reshape the nasal structures with precision. Open rhinoplasty allows surgeons better visibility and access to nasal structures, resulting in more precise surgical outcomes compared to closed rhinoplasty techniques. According to the ASPS statistics, nose surgeries are gaining vast popularity and have become the 3rd most popular aesthetic procedure in the U.S. The average cost of the rhinoplasty in the U.S. can vary widely depending on the location, surgeon’s experience, and complexity of the procedure. However, according to a report by ASPS, the average cost of rhinoplasty is USD 6,324.

The open rhinoplasty segment is preferred for complex cases that require extensive reshaping or reconstruction of the nasal framework. Its ability to address intricate deformities contributes to its growing popularity among surgeons and patients alike. Closed rhinoplasty, also known as endonasal rhinoplasty, is another common technique where incisions are made inside the nostrils, resulting in no visible scarring. While closed rhinoplasty is less invasive and offers quicker recovery times, it may have limitations in addressing complex nasal deformities compared to open rhinoplasty.

Treatment Type Insights

Based on treatment type, the market is segmented into augmentation, reconstructive, post-traumatic, revision, reduction, filler, and others. The augmentation segment led the market with the largest revenue share of 17.74% in 2023 and is expected to grow at the fastest CAGR during the forecast period. Augmentation rhinoplasty can be used to treat a variety of respiratory conditions, such as sleep apnea and chronic sinusitis. It involves procedures such as dorsal hump reduction and tip refinement, which have emerged as a dominant force in the rhinoplasty market. As more people become aware of these conditions and their treatment options, the demand for augmentation rhinoplasty is likely to increase.

The increasing number of failures in rhinoplasty surgeries has led to a rise in patients undergoing secondary nose reshaping procedures to correct deformities caused by the initial surgery. Consequently, there has been a global increase in the demand for revision rhinoplasty. According to the National Library of Medicine, the revision rate of rhinoplasty is around 17%.

Key U.S. Rhinoplasty Company Insights

Some of the key players operating in the market include Stryker; Grover Aesthetics; Sunset Cosmetic Surgery; Implantech; and Surgiform Technologies LLC.

-

Stryker Corporation is a medical technology company specializing in developing innovative products and services. Stryker provides a wide range of instruments for rhinoplasty procedures, such as osteotomes, rasps, and forceps. These instruments are designed to facilitate precise cuts and shaping of nasal bones, allowing surgeons to achieve the desired aesthetic outcome. It also offers image-guided surgery systems that allow surgeons to visualize patient-specific anatomy in real-time

-

Surgiform Technologies LLC is a Columbia-based bio medical company which provides nasal implants made from various materials such as silicone, Gore-Tex, or Medpor. These implants are designed to enhance the shape and structure of the nose during rhinoplasty surgery

Key U.S. Rhinoplasty Companies:

- Stryker

- Grover Aesthetics

- Sunset Cosmetic Surgery

- Implantech

- Surgiform Technologies LLC

Recent Developments

- In February 2023, Acclarent, Inc., which is a subsidiary of Johnson & Johnson, introduced its Balloon Sinuplasty Systems, RELIEVE SPINPLUS. This innovative system utilizes endoscopic techniques to help patients with sinusitis and breathing difficulties by expanding obstructed sinus ostia and passageways with the help of qualified otolaryngologists. In addition, it can be utilized for nasal reshaping procedures.

U.S. Rhinoplasty Market Report Scope

Report Attribute

Details

Market value in 2024

USD 1.3 billion

Revenue forecast in 2030

USD 2.2 billion

Growth rate

CAGR of 9.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Treatment type, technique, region

Country scope

U.S.

Key companies profiled

Stryker; Grover Aesthetics; Sunset Cosmetic Surgery; Implantech; and Surgiform Technologies LLC

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Rhinoplasty Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. rhinoplasty market report based on treatment type and technique.

-

Treatment Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Augmentation

-

Reduction

-

Post traumatic

-

Reconstructive

-

Revision

-

Filler

-

Others

-

-

Technique Outlook (Revenue, USD Million, 2018 - 2030)

-

Open rhinoplasty

-

Closed rhinoplasty

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

U.S.

-

West

-

Midwest

-

Northeast

-

Southwest

-

Southeast

-

-

Frequently Asked Questions About This Report

b. The U.S. rhinoplasty market size was estimated at USD 1.2 billion in 2023 and is expected to reach USD 1.3 billion in 2024.

b. The U.S. rhinoplasty market is projected to grow at a compound annual growth rate (CAGR) of 9.1% from 2024 to 2030 to reach USD 2.2 billion by 2030.

b. The augmentation segment dominated the market with a revenue share of more than 17.7% in 2023 and is expected to grow at the fastest CAGR during the forecast period. Augmentation rhinoplasty can be used to treat a variety of respiratory conditions, such as sleep apnea and chronic sinusitis.

b. Some of the key players operating in the market include Stryker; Grover Aesthetics; Sunset Cosmetic Surgery; Implantech; and Surgiform Technologies LLC.

b. Rhinoplasty is a surgical procedure to improve the aesthetic appearance and structural integrity of the nose. It offers a balanced facial profile and corrects deformities from injury or congenital conditions. The increasing demand for cosmetic procedures and technological advancements in surgical procedures is projected to drive market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.