U.S. RFID in Healthcare Market Size, Share & Trends Analysis Report By Product (Systems & Software, Tags), By Application (Blood Tracking, Patient Tracking, Pharmaceutical Tracking), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-311-2

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

U.S. RFID In Healthcare Market Trends

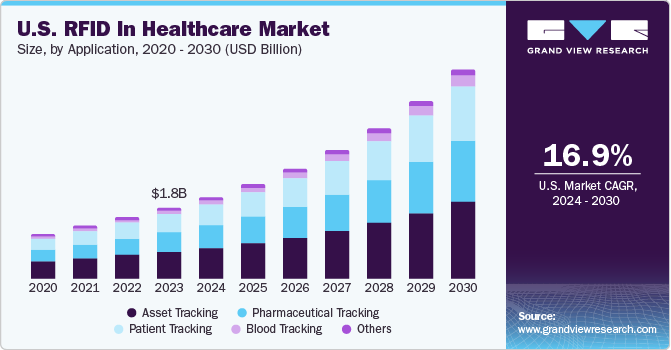

The U.S. RFID in healthcare market size was estimated at USD 1.78 billion in 2023 and is projected to grow at a CAGR of 16.95% from 2024 to 2030. Rising demand for asset management, rising patient safety and care, increasing need for efficient workflow management, and increased compliance and regulatory requirements are some of the key drivers. In May 2023, according to Pharmacy Times,RFID-enabled automation is becoming more prominent in the pharmaceutical industry and hospitals.

Integrating Radio Frequency Identification (RFID) technology into the healthcare industry in the U.S. has been a game-changer, revolutionizing how businesses manage their inventory and resources. RFID technology offers many benefits contributing to its growing popularity and market expansion. One of the key advantages of RFID is its ability to improve inventory management significantly. Moreover, the global RFID in healthcare market is expanding due to its widespread adoption across medical institutions for workflow optimization, inventory management, and minimizing errors, driven by the demand for cost-efficient therapies and pharmacy automation. According to the Code of Food and Drug Administration of Health and Human Services, in March 2023, all labeling and packaging materials must adhere to written standards for receiving, identification, storage, handling, sampling, examination, and testing in order to gain approval and be released for use.

RFID technology plays a vital role in enhancing patient safety. By tagging medical supplies and equipment with RFID tags, healthcare facilities efficiently track the location and usage of crucial items, particularly during surgeries and other critical procedures. This ensures that the necessary equipment and supplies are readily available when needed, reducing the risk of medical errors and improving patient outcomes. In July 2023, according to CNN Health, approximately 371,000 inhabitants die and about 424,000 withstand permanent disabilities due to misdiagnosis and medical errors every year in the U.S. RFID technology has made a significant impact on the medical sector, particularly in pharmaceutical companies, blood banks, and hospitals, providing efficient workflow management, crucial for patient care and safety. By leveraging the capabilities of RFID technology, these institutions streamline their operations, minimize errors, and optimize the utilization of healthcare assets.

The growing adoption of pharmacy automation in hospitals and pharmacies is another factor driving the growth of the RFID market. By integrating RFID technology with automated dispensing systems, healthcare facilities are able to optimize their inventory management and workflow processes, providing faster and more accurate medication delivery to patients. According to ScienceSoft Healthcare,implementing RFID technology in hospitals for tracking medications, patients, and staff, there is a reduction in operational costs, optimization in workflow, enhancement in asset utilization, minimization of medical errors, and improvement in overall patient safety. Moreover, the heightened emphasis on patient safety and comfort is contributing to the expansion of the RFID market in the medical sector in the U.S. As patients demand higher levels of care and personalized attention, healthcare providers are turning to innovative technologies such as RFID to ensure that their needs are met efficiently and effectively.

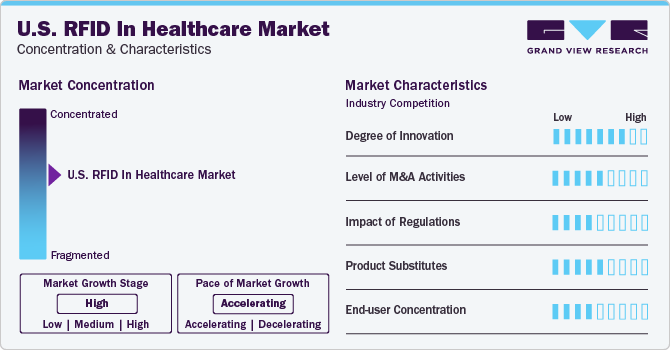

Market Concentration & Characteristics

Market growth stage is medium, and pace of the market growth is accelerating. The U.S. RFID in healthcare market is characterized by a high degree of innovation owing to the rapid technological advancements driven by factors such as advancements in RFID readers’ device hardware and sustainable RFID tags. According to RFID Journal LIVE, in April 2024, the RFID Journal LIVE is expected to launch new RFID and related technologies in the largest global event with over 100 exhibitors from 26 countries and is expected to highlight innovative and cutting-edge RFID tags, readers, software, and implementation services.

The U.S. RFID in healthcare market is also characterized by a high level of merger and acquisition (M&A) activity by the leading players. This is due to several factors, including the desire to gain access to emerging technologies, advanced features and increase geographical expansion. For instance, in March 2024, Surgere, a company that specializes in IoT technology, partnered with RF Controls LLC and introduced the first device in its Apex Series of readers, designed to assist organizations in seamlessly implementing efficient RFID solutions at their dock doors or conveyor systems in large quantities.

The U.S. RFID in healthcare market is also subject to regulatory scrutiny. The regulatory landscape for Radio Frequency Identification (RFID) technology in the U.S. primarily involves the Federal Communications Commission (FCC) and the Food and Drug Administration (FDA), among other organizations. The FCC is responsible for regulating the usage of radio frequency spectrum, ensuring that RFID devices operate within the prescribed guidelines to avoid interference with other wireless systems. On the other hand, the FDA focuses on the safety and effectiveness of RFID devices used in medical applications, particularly in healthcare and pharmaceutical sectors.

These regulatory bodies work in tandem to establish guidelines and standards for the deployment of RFID technology within the U.S. market, promoting both innovation and safety. According toNational Institute of Standards and Technology (NIST)guidelines for securing radio frequency identification (RFID) systems, the RFID usage policy states, “the usage of RFID technology in organizations involves both authorized and unauthorized applications, along with designated roles for personnel managing RFID system tasks that are provided by federal agencies adhering to FIPS Publication 199, that outlines standards for categorizing security levels of federal information and information systems.

Substitutes such as barcode systems or manual data entry can offer lower upfront costs and easier implementation, potentially diverting demand away from RFID solutions. Moreover, technological advancements in alternative tracking systems may enhance their performance and reliability, further challenging the adoption of RFID. For instance, in July 2018, Zebra Technologies Corp. introduced two cutting-edge healthcare barcode printing solutions designed to streamline patient and specimen identification processes at the point of care. The innovative ZD510-HC direct thermal wristband printer and ZQ600-Healthcare series label printer allow healthcare facilities to produce durable labels and patient identification wristbands easily. These solutions facilitate the accurate pairing of patients with their corresponding medical records, medications, and care staff, enhancing efficiency and patient safety within healthcare settings.

The market growth is being driven by various factors, including industry consolidation, where larger healthcare systems acquire smaller facilities, thereby centralizing decision-making and procurement processes. In addition, factors such as interoperability requirements, standardization efforts, and the need for streamlined operations encourage end users to select RFID solutions that can seamlessly integrate with existing systems, leading to concentration around specific technologies or providers. For instance, in February 2023, HID Global Corporation (HID), a global operator in trusted identity solutions, completed the acquisition of Guard RFID Solutions Inc., a provider of real-time location services (RTLS) hardware and software solutions tailored for the healthcare sector. This acquisition significantly broadened HID's portfolio and strengthened its presence in the active RFID and RTLS domain, enabling enhanced support for a wide range of applications specific to healthcare facilities.

Product Insights

The tags segment dominated the market with a share of 61.3% in 2023 and is expected to grow at the fastest CAGR of 17.06% over the forecast period. Key factors driving this segment's growth include rising patient safety and care and efficient workflow management. As the U.S. healthcare industry continues to evolve and adopt innovative technologies, including RFID, the product segment within the RFID market is expected to grow and diversify. For instance, in October 2023, AVERY DENNISON CORPORATION launched a range of eco-friendly RFID tags and inlays, named the Pure Line, specifically designed for the retail, healthcare, and logistics sectors. The Pure and Pure 95 products within this line are made from 100% or 95% plastic-free materials, rendering them recyclable when attached to paper or cardboard items at the end of their life cycle.

The systems & software segment is anticipated to grow significantly over the forecast period due to technological advancements in hardware and software systems; the adoption of RFID is expected to rise in healthcare. RFID software solutions help healthcare providers analyze, manage, and interpret the data collected by the RFID hardware. These solutions typically include middleware, which bridges RFID hardware and existing hospital information systems. In addition, specialized applications for inventory management, asset tracking, and patient safety further enhance healthcare operations' overall efficiency.

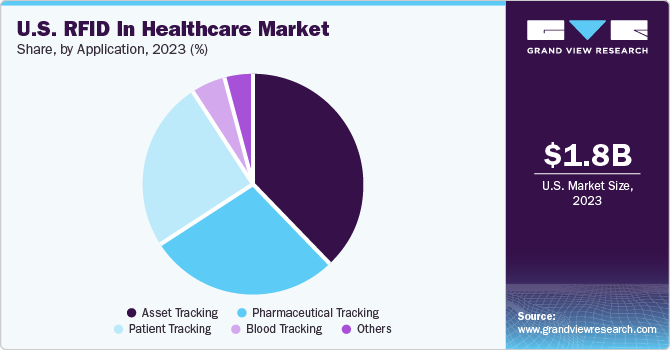

Application Insights

The asset tracking segment held the largest revenue share in 2023, owing to the rising demand for asset management in the healthcare setting. Hospitals, pharmaceutical companies, and blood banks are improving and maintaining their supply chain and inventory. Asset tracking, patient tracking, pharmaceutical tracking, and blood tracking are done efficiently with the RFID, providing efficient management and preventing loss and threat of theft. RFID technology is used to enhance patient safety by ensuring the correct administration of medication, reducing the risk of medical errors, and maintaining accurate patient records. In July 2023, according to the Association of Health Care Journalists (AHCJ), medical error is the third leading cause of mortality in the U.S. RFID-enabled patient wristbands provide a secure and reliable method for identifying patients and tracking their movements within the hospital, ensuring that they receive the right treatment at the right time.

The pharmaceutical tracking market segment is anticipated to register the fastest CAGR from 2024 to 2030 due to the rising demand by hospital pharmacies for pharmaceutical products. RFID-enabled inventory management systems help healthcare organizations maintain an accurate and real-time record of their stock levels, reducing the risk of stockouts and overstocking. This is particularly important in the pharmaceutical industry, where accurate tracking of medication and vaccines is critical for patient safety.

Key U.S. RFID In Healthcare Company Insights

Some of the key companies operating in the U.S. RFID in Healthcare Market include Impinj, Inc., Siemens Healthineers, Zebra Technologies Corporation.

-

Siemens Healthineers is a subsidiary of Siemens AG, a global medical technology company that provides innovative diagnostics and therapeutic process solutions. They offer various RFID (Radio Frequency Identification) products and services for healthcare applications, including Syngo Vita RFID, RFID-enabled Infusion Pumps, RFID-enabled Operating Room Solutions, and RFID-enabled Asset Management.

-

Zebra Technologies Corporation is a global player in providing innovative solutions and products that empower businesses and organizations to thrive in a connected world. They specialize in areas such as barcode printing, scanning, RFID, and real-time location services.

GE Healthcare, Honeywell International Inc., CenTrak Inc. are some of the other market participants in the U.S. RFID in healthcare market.

Key U.S. RFID In Healthcare Companies:

- Impinj, Inc.

- Zebra Technologies Corporation

- Siemens Healthineers AG

- International Business Machines Corporation (IBM)

- GE Healthcare

- Honeywell International Inc.

- CenTrak, Inc.

- Savi Technology

- AVERY DENNISON CORPORATION

- SMARTRAC N.V.

- Texas Instruments Incorporated

- ThingMagic (A Motorola Solutions Company)

- Invengo Information Technology Co., Ltd.

- Confidex Ltd.

- Nedap N.V.

- SML Group

- RF Controls LLC

Recent Developments

-

In August 2023, SML launched its latest Clarity RFID in delivery vehicle solution, aimed at enhancing proof-of-delivery efficiency in various industries.

-

In May 2022, Avery Dennison introduced innovative dual-frequency RFID inlays, designed to cater to the needs of both retail and medical sectors.

-

In October 2020, Sandoz Group AG introduced its first three injectable medications with Radio Frequency Identification (RFID) tags in collaboration with Kit Check, Inc., enhancing medication tracking and management in U.S. hospitals.

U.S. RFID In Healthcare Market Report Scope

|

Report Attribute |

Details |

|

Revenue forecast in 2030 |

USD 5.24 billion |

|

Growth rate |

CAGR of 16.95% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, application |

|

Country scope |

U.S. |

|

Key companies profiled |

Impinj, Inc.; Zebra Technologies Corporation; Siemens Healthineers AG; International Business Machines Corporation (IBM); GE Healthcare; Honeywell International Inc.; CenTrak, Inc.; Savi Technology; AVERY DENNISON CORPORATION; SMARTRAC N.V.; Texas Instruments Incorporated; ThingMagic (A Motorola Solutions Company); Invengo Information Technology Co., Ltd.; Confidex Ltd.; Nedap N.V.; SML Group; RF Controls LLC |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

U.S. RFID In Healthcare Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. RFID in healthcare market report based on product and application.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Systems & Software

-

Tags

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Asset Tracking

-

Patient Tracking

-

Pharmaceutical Tracking

-

Blood Tracking

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. RFID in healthcare market size was estimated at USD 1.78 billion in 2023 and is expected to reach USD 2.05 billion in 2024.

b. The U.S. RFID in healthcare market is expected to grow at a compound annual growth rate of 16.95% from 2024 to 2030 to reach USD 5.24 billion by 2030.

b. Asset tracking segment dominated the U.S. RFID in healthcare market with a share of 38.06% in 2023. This is attributable to increasing demand for efficient medical equipment tracking systems.

b. Some key players operating in the U.S. RFID in healthcare market include Alien Technology, LLC; Zebra Technologies Corp.; Avery Dennison Corporation; Impinj, Inc.; GAO RFID Inc.; LogiTag Systems; Mobile Aspects; CenTrak, Inc.; Terso Solutions, Inc.; Tagsys RFID.

b. Key factors that are driving the U.S. RFID in healthcare market growth include increasing utilization of RFID technology for effective inventory management and enhanced patient security by hospitals, biotechnology firms, and pharmacies.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."