- Home

- »

- Healthcare IT

- »

-

U.S. Revenue Cycle Management Market Size Report, 2030GVR Report cover

![U.S. Revenue Cycle Management Market Size, Share & Trends Report]()

U.S. Revenue Cycle Management Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Integrated System, Standalone System), By Component, By Delivery Mode, By Specialty, By Sourcing, By Function, By End-use, And Segment Forecasts

- Report ID: GVR-2-68038-680-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

The U.S. revenue cycle management market size was estimated at USD 172.24 billion in 2024 and is expected to grow at a CAGR of 10.1% from 2025 to 2030. The rapidly transforming healthcare system, including digitalization, has paved the path for implementing healthcare IT services such as revenue cycle management (RCM) systems to organize and streamline healthcare organization workflows using synchronized management software solutions. RCM solutions are an integration of payment models, reimbursement guidelines, codes, and third-party payers. Medical services are facing complex challenges in billing and precise payment, which is anticipated to drive the demand for innovative RCM solutions.

The outsourcing of RCM by U.S. players is growing due to its increasing popularity. The market is expected to grow significantly due to the complexity and labor-intensive nature of RCM processes, the scarcity of skilled healthcare professionals, the need for cost-effective solutions, and the challenges posed by stringent regulations, financial pressures, & staff shortages in the healthcare industry. Therefore, healthcare providers are increasingly opting to outsource RCM tasks to specialized companies to streamline processes, reduce costs, improve accuracy, & focus on patient care over administrative tasks. This trend is expected to continue as providers seek efficient cash flow, cost savings, and enhanced value-based care delivery.

Moreover, market players are strengthening revenue cycle platforms by integrating artificial intelligence (AI), electronic health records systems, and data analytics, which contributes to reducing administrative burdens, streamlining workflows, & improving revenue capture. For instance, in October 2023, Omega Healthcare announced the launch of its Omega Digital Platform (ODP). This platform is specifically designed to assist healthcare organizations in streamlining their administrative processes while simultaneously enhancing their financial performance. The ODP aims to address common challenges faced by healthcare providers, such as high administrative costs and inefficiencies in operations. The growing adoption of telemedicine and homecare offering value-based care is expected to support market growth.

“With rising costs and ongoing staffing shortages, healthcare organizations need technology-enabled solutions that empower them to focus on delivering care and improving the patient experience. We are excited to bring cutting edge technology advancements through the Omega Digital Platform and will continue to innovate to help our customers solve their most pressing challenges.”

-said CEO and Co-Founder of Omega.

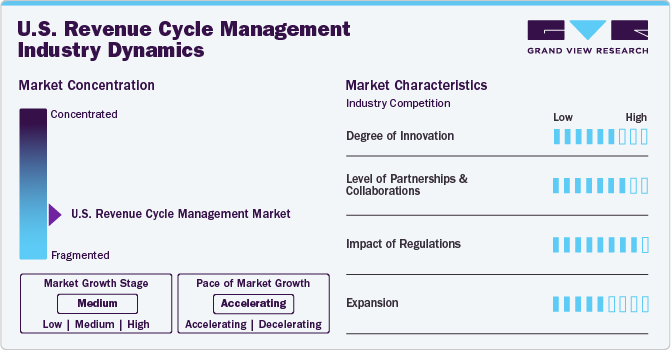

Market Concentration & Characteristics

The chart below illustrates the relationship between industry concentration, industry characteristics, and industry participants. The X-axis represents the level of market concentration, ranging from low to high. The Y-axis represents various market characteristics, including industry competition, degree of innovation, level of mergers & acquisition activities, regulatory impact, product substitutes, and regional expansion. For instance, the market is fragmented, with many small players entering the market and launching new innovative products. The degree of innovation is medium, the level of mergers & acquisitions activities is medium, and the threat of substitutes is low. The impact of regulations on the market is high, and the regional expansion of players is low.

Innovations, such as integrating AI and machine learning into various platforms, reflect a broader shift in healthcare consumer behavior toward seeking immediate and convenient care options. For instance, XiFin has been recognized by Healthcare Business Outlook as one of the “2024 Top 10 RCM Solution Providers.” This accolade highlights the company’s commitment to providing advanced revenue cycle management (RCM) solutions that leverage AI to assist healthcare providers in effectively managing their billing, reimbursement, and compliance processes.

The market saw notable consolidations as larger operators sought to expand their reach and capabilities. Key industry players, including the SSI Group, Inc.; eClinicalWorks; McKesson Corporation; Allscripts Healthcare, LLC; athenahealth, Inc.; NXGN Management, LLC; Epic Systems Corporation; and Oncospark, Inc., are involved in merger & acquisition activities to expand their industry presence. For instance, in December 2023, R1 RCM, Inc. acquired Acclara, a technology-driven RCM company from Providence, the largest health system, for USD 675 million in cash and a warrant to buy 12.2 million shares of R1 stock at a strike price of USD 10.52. This acquisition aimed to deliver innovative & cost-effective solutions to support healthcare providers across the U.S., enhance patient experience, maintain regulatory compliance, and minimize administrative burdens. The continuous policy changes and upgradation of regulations are expected to hinder market growth. RCM is relatively low due to changes in regulatory frameworks, specific demands of healthcare organizations, and varying reimbursement policies across the U.S. However, with the growing adoption of digital healthcare solutions and the increasing need for efficient RCM, the market is expected to witness significant growth in the coming years.

Case Study: Revenue Cycle Optimization

Challenge: A West Coast acute care provider with over 350 beds and USD 1.1 billion NPR faced significant challenges in revenue generation & management. Decreased revenue and increased denials posed a serious threat to its financial health. The root causes included authorization backlogs, billing inconsistencies, and subpar workflow prioritization and governance. Recognizing critical performance gaps, the organization sought expert guidance to identify opportunities and implement changes aimed at enhancing net revenue & accelerating cash collections.

Solution: An acute care provider partnered with Savista, a reputable RCM firm, to address these challenges. Savista conducted a comprehensive assessment that showcased deficiencies in process standardization, visibility & confidence in metrics, and accountability. The company devised a multifaceted solution:

-

Process Standardization: Savista outlined 25+ new policies and procedures to prevent denials and review unbilled accounts, ensuring consistency & efficiency across workflows.

-

Enhanced Metrics Visibility: Automation of 10 daily-use dashboards provided the organization with greater visibility of performance metrics, enabling informed decision-making & proactive management.

-

Accountability Reinforcement: Savista defined productivity metrics and Key Performance Indicators (KPIs) to hold staff accountable and ensure adherence to established standards.

Results: The implementation of Savista's RCM solution yielded remarkable results:

-

48% Increase in Cash Collections > 365 Days: The organization observed a substantial improvement in cash collections, enhancing its financial resilience.

-

81% Reduction in Average Daily Claims on Hold: Reducing claims on hold streamlined the billing process, leading to faster revenue realization.

-

USD 75.4 Million Collected in 1 Month: The organization generated significant revenue, surpassing expectations.

-

USD 24 Million in Denial Recoveries: Savista's expertise in denial management resulted in substantial recovery of previously denied claims.

-

9+ Day Improvement in Days Out Authorizations: Streamlined authorization processes led to improved efficiency and reduced delays.

Analyst Perspective: RCM outsourcing services represent the transformative impact of strategic interventions in healthcare revenue management. By addressing process flaws, enhancing metrics visibility, and reinforcing accountability, substantial improvements have been made in cash flow, revenue generation, and denial management for acute care providers. This case highlights the significance of partnering with RCM companies to navigate complex revenue cycle challenges effectively and sustainably.

Private Equity Investment In RCM Companies

Financial Sponsor

RCM Companies

Business Description

Veritas Capital Fund Management, L.L.C.

Coronis Health

Provides outsourced medical billing and revenue cycle management (RCM) solutions to healthcare practices and facilities in the U.S. and around the world. Coronis Health was purchased from 424 Capital in August 2022.

Welsh, Carson, Anderson, and Stowe. (WCAS)

EnableComp

Provides claims revenue services, including RCM for workers' compensation and recovery of underpayments for hospitals and healthcare providers. EnableComp was formed when EnableComp and Argos Health merged. Argos Health was purchased by WCAS from NaviMed Capital in September 2021.

Berkshire Partners LLC., Warburg Pincus LLC

Ensemble Health Partners

Provides technology driven RCM solutions for health systems, including hospitals and affiliated physician groups. Ensemble was acquired from Golden Gate Capital in March 2022.

Component Insights

The services segment dominated the market in 2024 with a market share of over 68.49% and is anticipated to grow at the fastest rate during the forecast period. Healthcare facilities are readily outsourcing RCM services from third-party vendors owing to the multiple advantages, such as cost-effectiveness, staffing & training, and compliance with rules & regulations. In addition, the segment's growth is attributed to the various strategic initiatives undertaken by established market players.

The software segment is anticipated to grow significantly during the forecast period, owing to a growing demand for digitalization and streamlining of operational workflows to improve patient care. The growing amount of unorganized data generated from multiple healthcare functionalities requires centralization and consolidation, which is anticipated to drive the software segment over the forecast period.

Product Insights

The integrated segment dominated the market in 2024 with a market share of over 71.84% and is anticipated to grow at the fastest rate during the forecast period. This is attributed to the constant technological advancements and rapid adoption of integrated RCM solutions by healthcare organizations. Furthermore, integrated solutions provide a synchronized and streamlined platform for financial activities with a standardized data collection and analysis process, which is expected to drive the market over the forecast period.

Integrated systems are end-to-end systems enhancing an organization’s data sharing and interoperability capabilities. Integrated solutions enable the healthcare workforce to enhance productivity, minimize costs, and increase net operating margins. Lastly, the growing need to reduce human errors and accelerate administrative functions can contribute to the growth of integrated RCM solutions.

Delivery Mode Insights

The web-based segment dominated the market in 2024 with a market share of over 56.76%. Web-based solutions are being increasingly implemented since these solutions are to be installed off-site and do not require additional hardware or storage. Affordability and rapid deployment are some of the benefits offered by web-based solutions. athernaOne, e-Hospital Systems, Simplex HIMES, and Advanced HIMS are examples of web-based practice management solutions. The cloud-based segment is anticipated to grow at the fastest rate during the forecast period.

Cloud computing is revolutionizing the healthcare industry; it offers increased cost-effectiveness and higher flexibility to users. Furthermore, cloud-deployed solutions offer safe and secure medical data sharing and automated backend processes. Cloud-based solutions help healthcare facilities seamlessly manage electronic health records and patient portals and operate mobile applications. Cloud-deployed solutions are deployed to improve operations, enhance resource procurement, and boost infrastructure dependability.

Specialty Insights

The cardiology segment held a significant share of 7.15% in 2024 and is expected to grow at the fastest rate during the forecast period. Cardiology treatments are expensive procedures requiring RCM services; these services help enhance the procedure's effectiveness & patient care and seamlessly manage medical billing. According to an Elsevier, Inc. paper in September 2023, approximately 6.7 million U.S. adults aged 20 years and above had heart failure, and the prevalence is projected to reach 8.5 million by 2030. The rising prevalence of cardiovascular diseases directly increases the workload burden on healthcare providers and healthcare payers, which is expected to drive the segment.

The billing workforce must have a comprehensive knowledge of the correct codes and converters necessary in cardiology, such as various percutaneous coronary intrusions, pacemakers, & peripheral vascular methods. RCM in oncology involves strategically handling financial processes related to oncology practices to optimize revenue capture and billing efficiency. The complexity of managing healthcare reimbursements and the need for streamlined financial processes are expected to fuel the demand for RCM in oncology. Advanced technologies, such as AI and automation, have significantly improved the efficiency & accuracy of RCM processes in oncology.

Sourcing Insights

The in-house segment dominated the market in 2024 and accounted for a revenue share of over 70.82%. The segment growth is attributed to associated benefits, such as complete control of coding operations, patient information confidentiality, and accessibility of in-house medical billers. One of the major challenges in-house RCM services face is the requirement of a large medical staff to handle the patient’s medical data. Healthcare providers need to employ trained billers and coders, which can result in backlogs if one of them is ineffective, jeopardizing the entire revenue cycle.

The outsourced RCM services segment is expected to grow at the fastest rate during the forecast period. Outsourced RCM services are an attractive opportunity for small, medium, and large healthcare companies as executives & providers are focused on decreasing costs & improving efficiency. In addition, the healthcare industry is observing an increase in the outsourcing of billing activities by physicians and hospitals due to mandatory implementation of the intricate ICD-10 coding structure, growing care costs, and regulatory pressure to implement electronic medical records to sustain compensation levels.

Outsourcing of RCM can lower staff responsibility and improve collection level & pace by decreasing denials. In addition, the contracted companies generally deliver on-demand details regarding everyday finances. However, these services can be expensive, with fees centered on subscriptions or collection percentages. Many companies are undertaking mergers, collaborations, and partnerships to improve their services. For instance, in October 2023, CPSI, a community healthcare solutions provider, acquired Viewgol, a provider of complementary outsourcing services and ambulatory RCM analytics. This acquisition aimed to accelerate offshore initiatives, with over 80% of its workforce based offshore.

End-use Insights

Based on end use, the hospitals segment held the market with the largest revenue share in 2024. This is attributed to the growing presence of renowned and well-established hospitals in the U.S. and the rising number of patient care regulatory reforms & guidelines introduced by regulatory agencies. Hospitals are focusing on implementing innovative RCM solutions by collaborating with vendors to transform the reimbursement scenario, which is anticipated to boost segment growth. Moreover, the growing demand to optimize hospitals’ workflow to improve efficiency and productivity is expected to boost the adoption of integrated RCM systems in hospitals.

The physician back-office segment is expected to grow at the fastest rate during the forecast period. A rising focus on increasing the number of physicians and medical facilities across the region is expected to drive market growth. Private physician offices undergo numerous economic challenges, such as physician reimbursement, increasing operating expenses, and patient content. Private physician offices are outsourcing RCM solutions and services to align with medical and financial needs.

Function Insights

The claims management segment dominated the market in 2024 with a market share of over 52.78%. This is attributed to the swiftly expanding patient pool, the rising geriatric population, and the introduction of advantageous government programs related to medical insurance coverage. In addition, the adoption of risk- or value-based reimbursement models is boosting the implementation of enhanced supervision and revenue cycle prediction, particularly for high-risk & vulnerable patient groups.

The care management segment is anticipated to grow at the fastest rate during the forecast period, which is attributed to the increasing demand for virtual health applications to handle healthcare emergencies. The growing prevalence of chronic disorders is a major concern. Chronic conditions result in the highest morbidity & mortality in the U.S., and the monetary costs are also high. According to the CDC, in the U.S., the expenditure on treating chronic illnesses & mental health conditions is over USD 4.5 trillion. These health consequences and high costs are largely avoidable as some chronic conditions are avoided or controlled to lower their impact. Mobile health apps can change the healthcare business by easing a patient’s capability to handle circumstances.

Key U.S. Revenue Cycle Management Company Insights

Some emerging companies in the market are Aidéo Technologies, Access Healthcare, TELCOR, CorroHealth, and others. Key players' strategies to strengthen their market presence include new product launches, partnerships & collaborations, mergers & acquisitions, and geographical expansion.

Key U.S. Revenue Cycle Management Companies:

- athenahealth, Inc.

- Cerner Corporation

- eClinicalWorks

- Epic Systems Corporation

- McKesson Corporation

- NXGN Management, LLC

- Oncospark, Inc.

- R1 RCM, Inc.

- The SSI Group, Inc.

- Veradigm LLC (Allscripts Healthcare LLC)

Recent Developments

-

In January 2025, Access Healthcare received a strategic investment from New Mountain Capital, LLC. This investment is noteworthy because it originates from a reputable, growth-focused firm that manages around USD 55 billion in assets. The partnership intends to enhance Access Healthcare's capabilities and support its expansion into new markets.

-

In September 2024, CorroHealth, completed the acquisition of the Xtend healthcare revenue cycle management business from Navient. This strategic move is significant for several reasons, which will be explored in detail below. As part of this transaction, over 925 employees from Xtend have joined CorroHealth’s workforce. This addition not only expands CorroHealth’s team but also brings in valuable expertise that can enhance their operational capabilities.

-

In January 2024, Aidéo Technologies and MedEvolve, Inc. announced a strategic partnership aimed at enhancing the efficiency of healthcare organizations through the integration of AI-powered coding and revenue cycle workflow automation. This collaboration is designed to streamline operations within healthcare settings by leveraging advanced artificial intelligence technologies to improve coding accuracy and optimize revenue cycle management.

-

In February 2024, Janus entered into a partnership agreement with Availity, which operates the largest real-time health information network in the U.S. This collaboration aims to improve healthcare revenue cycle operations by leveraging both companies’ strengths in automation and operational intelligence.

U.S. Revenue Cycle Management Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 308.2 billion

Growth rate

CAGR of 10.11% from 2025 to 2030

Actual data

2018 - 2024

Forecast data

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, component, delivery mode, specialty, sourcing, function, end-use

Country scope

U.S.

Key companies profiled

athenahealth, Inc.; Cerner Corporation; eClinicalWorks; Epic Systems Corporation; McKesson Corporation; NXGN Management, LLC; Oncospark, Inc.; R1 RCM, Inc.; The SSI Group, Inc.; Veradigm LLC (Allscripts Healthcare LLC)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Revenue Cycle Management Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. revenue cycle management market report based on product, component, delivery mode, specialty, sourcing, function, and end-use:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Integrated System

-

Standalone System

-

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Software

-

Services

-

-

Delivery Mode Outlook (Revenue, USD Billion, 2018 - 2030)

-

On-premise

-

Web-based

-

Cloud-based

-

-

Specialty Outlook (Revenue, USD Billion, 2018 - 2030)

-

Oncology

-

Dermatology

-

Plastic Surgery and Aesthetics

-

Cardiology

-

Anesthesia

-

Radiology

-

Pathology

-

Pain Management

-

Emergency Services

-

Others

-

-

Sourcing Outlook (Revenue, USD Billion, 2018 - 2030)

-

In-House

-

External RCM Apps/Software

-

Outsourced RCM Services

-

-

Function Outlook (Revenue, USD Billion, 2018 - 2030)

-

Product Development

-

Member Engagement

-

Network Management

-

Care Management

-

Claim Management

-

Risk and Compliances

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Physician Back Office

-

Hospitals

-

Diagnostic Laboratories

-

Other Settings

-

Frequently Asked Questions About This Report

b. The U.S. revenue cycle management market size was estimated at USD 172.24 billion in 2024 and is expected to reach USD 190.40 billion in 2025.

b. The U.S. revenue cycle management market is expected to grow at a compound annual growth rate of 10.11% from 2025 to 2030 to reach USD 308.2 billion by 2030.

b. The hospitals dominated the market with a share of over 58% in 2023. This is attributable to the the presence of well-established hospitals and growing healthcare IT. infrastructure.

b. Some key players operating in the U.S. RCM market include athenahealth, Inc., Cerner Corporation, eClinicalWorks, Epic Systems Corporation, McKesson Corporation, NXGN Management, LLC, OncoSpark, Inc., R1 RCM, Inc., The SSI Group, Inc., and Veradigm LLC (AllScripts Healthcare LLC).

b. Key factors that are driving the U.S. revenue cycle management market growth include increase in outsourcing of RCM, increasing adoption of mHealth, growth of High-deductible Health Plans (HDHPs), and technological advancements.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.