U.S. Reusable Water Bottle Market Size, Share & Trend Analysis Report By Material (Glass, Plastic, Stainless Steel, Silicone), By Distribution Channel (Supermarkets & Hypermarkets, Convenience Stores, Specialty Stores, Online), And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-054-0

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

U.S. Reusable Water Bottle Market Trends

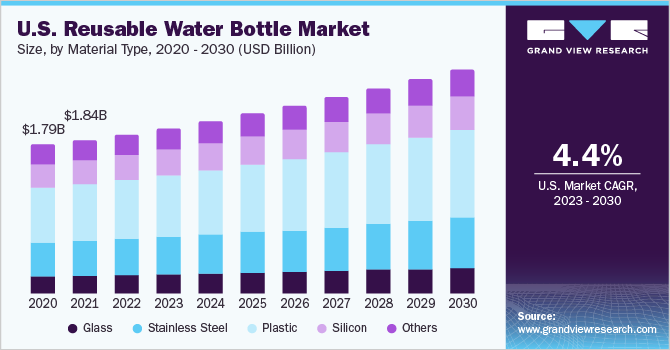

The U.S. reusable water bottle market size was estimated at USD 2.06 billion in 2024 and is projected to grow at a CAGR of 4.5% from 2025 to 2030. The heightened consumer awareness surrounding environmental issues, particularly plastic pollution, drives the demand for reusable water bottles. Single-use plastic bottles contribute significantly to landfill waste and ocean pollution, prompting more individuals to adopt sustainable practices, including the use of reusable bottles. Many consumers are motivated by the desire to make eco-friendly choices and reduce their reliance on disposable plastics, aligning with broader sustainability trends.

Changing consumer attitudes toward sustainability and growing environmental awareness are increasingly driving the adoption of reusable water bottles in the U.S. With the growing awareness of environmental issues such as plastic pollution and climate change, and consumers are actively seeking products that align with their values of reducing waste and minimizing environmental impact.

Reusable water bottles offer a practical solution to single-use plastic consumption, appealing to eco-conscious consumers who prioritize sustainability in their purchasing decisions. According to a Global Sustainability Study 2021, including the Americas by Simon Kucher & Partners, 85% of consumers have shifted toward more sustainable purchasing behaviors in the last five years. This trend highlights a global movement where people increasingly prioritize sustainable choices, influencing the rising demand for reusable water bottles.

The increasing participation in outdoor recreational activities across the U.S. is expected to drive the demand for reusable water bottles. As more Americans engage in activities such as hiking, camping, biking, and outdoor sports, there is a growing need for durable, portable hydration solutions. Reusable water bottles offer practical benefits such as convenience, reliability in various environmental conditions, and the ability to maintain beverage temperature over extended periods.

In addition to environmental and health benefits, the design and functionality of reusable water bottles have improved significantly. Brands now offer a wide range of aesthetically appealing and durable options, featuring innovations such as insulated bottles that maintain temperature, smart bottles that track hydration, and bottles with built-in filtration systems. These features make reusable bottles a more attractive and practical choice for various lifestyles, from fitness enthusiasts to office workers.

Brands like Hydro Flask and Yeti have capitalized on this trend by offering insulated stainless steel bottles that appeal to outdoor enthusiasts seeking dependable hydration solutions. This shift not only supports sustainability goals by reducing single-use plastic waste but also aligns with the lifestyle preferences of active individuals who prioritize durability and performance in their gear.

Recognizing the demand for hydration solutions among outdoor enthusiasts, in November 2022, YETI Coolers, LLC, one of the leading brands in America, launched a new product line, the Yonder Drinkware collection, featuring lightweight and durable water bottles in two sizes and four color options.

Material Insights

Based on material, the plastic segment led the market with the largest revenue share of 38.26% in 2024. Plastic reusable water bottles offer unparalleled convenience and portability, catering to the fast-paced lifestyles of modern U.S. consumers. Their lightweight and durable construction make them ideal companions for on-the-go hydration, whether commuting to work, exercising at the gym, or embarking on outdoor adventures. The ease of carrying and storing plastic bottles aligns with the evolving needs and preferences of individuals seeking practical solutions for staying hydrated throughout the day.

The stainless steel segment is expected to grow at the fastest CAGR of 4.7% from 2025 to 2030. Steel-based reusable water bottles are estimated to showcase strong growth in the coming years. Steel water bottles are inherently hygienic and easy to clean, owing to their non-porous surface and resistance to bacterial growth. Unlike porous materials that trap residues and odors, stainless steel repels stains, odors, and bacteria, ensuring a clean and sanitary drinking vessel. With simple rinsing or dishwasher-safe cleaning, stainless steel bottles maintain their pristine condition, promoting health and hygiene for users.

Distribution Channel Insights

Based on distribution channel, the supermarkets & hypermarkets segment led the market with the largest revenue share of 33.89% in 2024. Supermarkets and hypermarkets often stock a wide range of reusable bottles in different styles, materials, and price points, making it easier for customers to find options that suit their needs. In addition, many of these stores are strategically located in urban and suburban areas, ensuring that a broad customer base has easy access to these products. The large variety of product availability under one roof and influential layout motivates consumers to purchase products from these stores. In addition, the availability of a store associate helps consumers in choosing the right products, as well as instant buying of the product rather than waiting for its delivery, as in the case of online purchasing, is also a major motivating factor for consumers to choose this channel of sales.

The online sales is expected to grow at a CAGR of 6.0% from 2024 to 2030. The rise in penetration of e-commerce and smart devices, with easy payment options, and discount offers are the factors contributing to the growth of this segment. According to the statistics published by the Census Bureau of the Department of Commerce in November 2022, U.S. retail e-commerce sales for the third quarter of 2022 witnessed 3.0% growth compared to the second quarter of 2022. The customization options of personalized printing on the bottle and easy comparison of a variety of products online are driving the segment. Moreover, the easy availability of selling reusable bottles through unique logo printing is also causing many producers to opt for this channel of distribution.

Key U.S. Reusable Water Bottle Company Insights

The U.S. market is highly competitive, with key players like Hydro Flask, YETI, S’well, CamelBak, and Nalgene dominating through brand recognition and product variety. These brands emphasize quality, insulation technology, and design aesthetics, appealing to consumers seeking durability and sustainability. Emerging brands are also gaining traction by focusing on eco-friendly materials and unique features such as built-in filters, motivational tracking, and ergonomic designs. Market competition is driven by increasing consumer awareness of environmental impacts and health benefits associated with reusable options, pushing companies to innovate with customizable designs, smart hydration technology, and exclusive collaborations to capture more market share.

Key U.S. Reusable Water Bottle Companies:

- Tupperware Brands Corporation

- SIGG Switzerland AG, GmBH

- CamelBak Products, LLC

- Klean Kanteen

- Contigo

- Aquasana Inc.

- Hydaway

- Nalgene

- S’well

- STANLEY

View a comprehensive list of companies in the U.S. Reusable Water Bottle Market

Recent Developments

-

In March 2024, STANLEY launched the innovative Stanley Cross Bottle, designed for convenience and hydration during the hot summer months. This latest release features a thick, woven jacquard shoulder strap that ensures comfortable carrying without slipping or digging into the shoulder. The removable strap adds versatility, allowing for easy cleaning and space-saving when carried in larger totes, making it an ideal choice for summer travel and long afternoon walks.

-

In March 2024, Camelbak introduced the Podium Steel and Podium Titanium vacuum-insulated bike water bottle series. The new vacuum-insulated design addresses a common issue faced by cyclists during summer rides-the warming of water throughout the journey-by delivering superior thermal efficiency to maintain a consistent water temperature for extended periods. The Podium vacuum-insulated bottle series includes stainless steel options in two widely preferred sizes: 530 ml priced at USD 35 and 650 ml priced at USD 40, along with a titanium version in 530 ml offered at USD 100.

-

In January 2024, S'well introduced the S'well Explorer, its newest hydration innovation. Designed with a focus on performance and functionality, the S'well Explorer incorporates the technology found in S'well's Original Bottles and Tumblers. It features a fresh shape and enhanced usability, making it ideal for on-the-go hydration.

U.S. Reusable Water Bottle MarketReport Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 2.15 billion |

|

Revenue forecast in 2030 |

USD 2.68 billion |

|

Growth rate |

CAGR of 4.5% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Material, distribution channel |

|

Country scope |

U.S. |

|

Key companies profiled |

Tupperware Brands Corporation; SIGG Switzerland AG, GmBH; CamelBak Products, LLC; Klean Kanteen; Contigo; Aquasana Inc.; Hydaway; Nalgene; S’well; STANLEY |

|

Customization |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

U.S. Reusable Water Bottle Market Report Segmentation

This report forecasts revenue growth at the country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. reusable water bottle market report based on material, and distribution channel.

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Glass

-

Stainless Steel

-

Plastic

-

Silicone

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarkets & Hypermarkets

-

Convenience Stores

-

Specialty Stores

-

Online

-

Others

-

Frequently Asked Questions About This Report

b. The plastic bottles segment dominated the reusable water bottle market with a share of around 38% in 2024. Low cost, ease of usage, and a wide range of product offerings are driving the demand for plastic water bottles among consumers.

b. Some key players operating in the U.S. reusable water bottle market include Tupperware Brands Corporation; SIGG Switzerland AG, GmBH; CamelBak Products, LLC; Klean Kanteen; Contigo; Aquasana Inc.; Hydaway; Nalgene; S’well; STANLEY.

b. Key factors that are driving the U.S. reusable water bottle market growth includes stringent government policies targeting single-use plastic water bottles, awareness about the harmful effects of plastic on oceans and landfills, increasing participation in outdoor recreational activities, and technological advancements in the sector.

b. The U.S. reusable water bottle market was estimated at USD 2.06 billion in 2024 and is expected to reach USD 2.15 billion in 2025.

b. The U.S. reusable water bottle market is expected to grow at a compound annual growth rate of 4.5% from 2025 to 2030 to reach USD 2.68 billion by 2030.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."