U.S. Residential Lighting Fixtures Market Size, Share & Trends Analysis Report By Source (Fluorescent, LED & OLED), By Product, By Distribution Channel, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-056-3

- Number of Report Pages: 81

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

Market Size & Trends

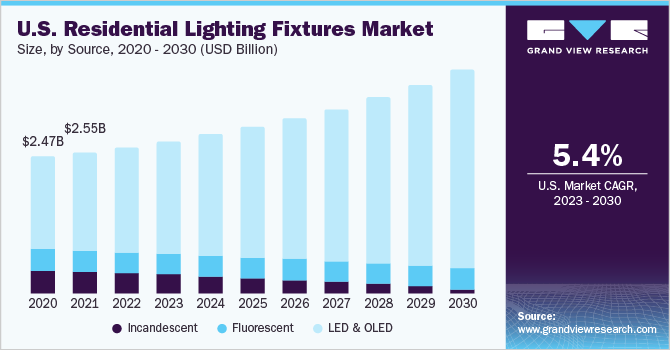

The U.S. residential lighting fixtures market was valued at USD 2.64 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.4% from 2023 to 2030. Increasing demand for decorative lighting fixtures in the residential segment and the adoption of energy-efficient products such as LEDs & OLEDs are some key factors that are expected to drive the residential lighting fixture industry during the forecast period. The smart home concept is gaining popularity, and lighting fixtures are an important aspect of house décor. In the U.S., 41.3 million houses were smart homes as of January 2021. The demand for brightness-adjustable lights has been high and these lighting fixtures aid the creation of a pleasant ambiance by allowing users to set the appropriate brightness.

According to the 2019 Commonwealth Edison (ComEd) residential lighting discounts combined evaluation report, energy savings (70%), longer bulb life (65%), and light quality (51%) are the top reasons customers opted for LEDs over other bulb technologies. Some customers said that they were motivated by monetary savings (36%), while a lesser percentage said they were motivated by environmental benefits (13%) or product discounts (13%).

Consumer lifestyles in the United States are rapidly changing. Growing disposable incomes and increasing urbanization are the two factors expected to drive market expansion over the predicted period. According to the Bureau of Economic Analysis, the disposable personal income of Americans climbed by USD 2.36 trillion, or 67%, in the first quarter of 2020, compared to a drop of USD 402.1 billion or 8.8% in the fourth quarter. Compared to a 10.1% fall in real disposable personal income in 2020, real disposable personal income climbed 61.3% in 2021.

U.S. households are increasingly switching to LED bulbs. Around 47% of households used LEDs for most or all of their indoor lighting in 2020, according to the Residential Energy Consumption Survey (RECS). The share of U.S. homes using mostly compact fluorescent bulbs for their indoor lighting declined from 32% in 2015 to 12% in 2020. Households using incandescent or halogen bulbs for most of their indoor lighting declined from 31% in 2015 to 15% in 2020.

Source Insights

The LED & OLED segment dominated the market with a share of over 70% in 2022. LED lighting is now widely employed in both residential and commercial applications and is available in a wide range of household and industrial items. LED technology's rapid advancement leads to more inventive products and increased manufacturing efficiency, resulting in lower pricing. According to the Office of Energy Efficiency and Renewable Energy, the widespread adoption of LED lighting has the highest potential impact on energy savings in the U.S. By 2027, extensive LED use can save around 348 TWh of electricity (relative to no LED use).

According to the U.S. Department of Energy, LED lights utilize 75-80% less energy than standard incandescent light bulbs and 65% less energy than halogen lamps, these also generate less heat. Their ability to reduce cooling demands contributes to lower energy costs. Commercial clients of U.S. Energy, for example, have seen energy savings of up to 35% as a result of lower cooling demands. The U.S. Department of Energy estimates that the quick adoption of LED bulbs will save USD 265 billion over the next 20 years. This changeover would also help avoid the construction of 40 new power plants and reduce greenhouse emissions into the atmosphere. Smaller size, greater reliability, and substantial energy savings are attributes contributing to the popularity of LED lighting.

The fluorescent segment is expected to grow at a CAGR of 0.3% over the forecast period from 2023 to 2030. According to the U.S. Energy Information Administration (EIA), residential lighting has shifted away from inefficient lighting solutions such as incandescent bulbs, and toward more efficient lighting solutions such as CFLs and LEDs. As per a 2020 Residential Energy Consumption Survey, owner-occupied housing units were substantially more likely than renter-occupied housing units to have CFL or LED bulbs (89% versus 79%). Since a CFL or compact fluorescent light is just as energy-efficient as linear fluorescent tubes and fits into the same socket as an incandescent, consumers prefer CFLs over incandescent light because they don't have to pay extra for the socket.

Fluorescent lights are mainly known for being energy-efficient and longer-lasting compared to incandescent and halogen light bulbs, as well as for their lower price compared to LEDs. Panasonic Corporation has created fluorescent circular tubes FCL 22D and FCL 32D, which provide non-directional light for decorative and functional luminaires. Philips compact fluorescent light bulbs provide a soft, comfortable lighting solution for a welcoming environment. These bulbs combine fluorescent lighting with the ease of use and popularity of incandescent lighting fixtures.

Distribution Channel Insights

The offline segment held the largest share of 82.80% in 2022. The majority of customers choose to buy lighting solutions from brick-and-mortar electrical stores because they often require help with product installation and prefer opting for after-sales service. The most popular distribution channel in the U.S. is brick-and-mortar stores, which allow customers to engage with product professionals and receive full instructions for effective product installation.

A big majority of customers prefer to shop at physical stores since they can physically inspect the merchandise. For instance, in 2020, in the U.S., the Supercenters had the largest footprint (average 182,000 square feet) and offered the most products and services—from groceries to appliances to clothing. The Discount Store is the next largest facility (average 106,000 square feet), offering most of what the Supercenter offers, excluding groceries and automotive care. Neighborhood Walmart is the chain's grocery retail option, with the average store measuring 38,000 square feet.

The online segment is expected to register a significant CAGR during the forecast period. Consumers spent USD 791.70 billion online at U.S. businesses in 2020, up by 32.4% year-over-year, according to the figures from the U.S. Department of Commerce. This is the highest yearly e-commerce growth in the U.S. in at least two decades. It is also more than twice the 15.1% increase in 2019. Moreover, Amazon accounted for roughly 45% of all online sales growth in the U.S. in 2020, a modest increase from 43.8% in 2019.

Since most of the offline retail shops across the world were closed owing to the lockdown or had limited capacity to maintain social separation due to the coronavirus pandemic, many customers opted for online shopping. According to CNBC, in 2020, internet spending on Black Friday increased by about 22% to USD 9 billion, setting a new high, while Cyber Monday online sales were USD 10.8 billion, making it the highest U.S. online shopping day ever.

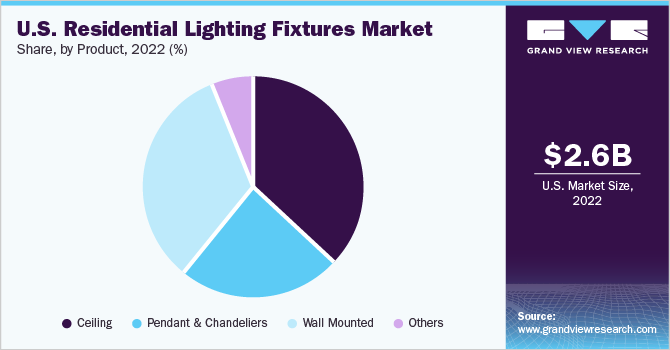

Product Insights

The ceiling segment held the largest share of 36.68% in 2022. These fixtures are mounted directly to the ceiling and have a glass or plastic shade concealing the light bulb. The lights vary in application but are mainly used as track or recessed lights. Track ceiling lights are mounted or suspended from the ceiling. Track lighting consists of a linear housing with several heads that can be positioned anywhere along the track and the direction of the heads is adjustable as well. Track lighting is often used for tasks or accent lighting.

In the U.S, the trend of ceiling fans that incorporate lights is also common. These ceiling fan lights are a terrific way to circulate the air while also adding light to a room. In addition, there has been a surge in the adoption of soft colors in the country for ceiling lights. Colors like grey and greige (grey plus beige) have become popular among homeowners. Gentle gold is also a part of the soft hue spectrum that works well in contemporary décor.

The pendant & chandeliers segment is expected to register the highest CAGR of 6.1% from 2023 to 2030. Chandeliers are suspended from the ceiling and direct their light upward, usually over a table. Pendant lights also hang from the ceiling but direct their light downward. Both these types have decorative elements that add to a room's aesthetics and can be used for ambient lighting. Nowadays, an increasing number of customers have been spending more on home décor due to the rising disposable income. Chandelier lights are usually considered fancy and are used to elevate the appearance of the living room, giving it a more graceful and regal look

Key Companies & Market Share Insights

Leading manufacturers in the industry are The Kraft Heinz Company; LACTALIS; Walmart; Fonterra Co-Operative Group Limited; SAVENCIA SA; The Bel Group; Arla Foods amba; Schreiber Foods Inc.; Land O’Lakes, Inc.; and Great Lakes Cheese Company, Inc. Key players operating in the market are adopting strategies such as acquisitions to drive the company growth in the future as well as to solidify their position in the global market.

For instance, in March 2018, Cree, Inc. acquired Infineon Technologies AG’s RF Power business for 345 million euros to further expand its business unit. The acquisition was aimed at strengthening the company’s growth strategy. Similarly, in February 2022, GE Current completed the acquisition of the commercial and industrial (C&I) lighting business of Hubbell Inc. The combined business will provide a dynamic portfolio of lighting fixtures and controls uniquely tailored to C&I, transportation markets, and lamps. Some prominent players in the U.S. residential lighting fixtures market include:

-

Koninklijke Philips N.V.(Signify N.V.)

-

Hubbell Incorporated

-

Acuity Brands, Inc.

-

NICHIA CORPORATION

-

Everlight Electronics Co., Ltd.

-

Kichler Lighting LLC

-

NBG Home

-

Visa Lighting

-

Hinkley Inc.

-

Minka Group (Ferguson)

-

SavoyHouse.com

-

Maxim Lighting

-

Artika

-

Globe Electric Company Inc.

-

Designers Fountain

-

Golden Lighting

-

Visual Comfort & Co. (Generation Lighting)

-

Hudson Valley Lighting Group (HVLG)

-

Elite Lighting

-

Livex Lighting

U.S. Residential Lighting Fixtures Market Report Scope

|

Report Attribute |

Details |

|

Revenue forecast in 2030 |

USD 4.04 billion |

|

Growth Rate (Revenue) |

CAGR of 5.4% from 2023 to 2030 |

|

Base year for estimation |

2022 |

|

Historical data |

2017 - 2021 |

|

Forecast period |

2023 - 2030 |

|

Quantitative units |

Revenue in USD million, CAGR from 2023 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, trends |

|

Segments covered |

Source, product, distribution channel |

|

Regional scope |

United States |

|

Key companies profiled |

Koninklijke Philips N.V.(Signify N.V.); Hubbell Incorporated; Acuity Brands, Inc.; NICHIA CORPORATION; Everlight Electronics Co., Ltd.; Kichler Lighting LLC; NBG Home; Visa Lighting; Hinkley Inc.; Minka Group (Ferguson); SavoyHouse.com; Maxim Lighting; Artika; Globe Electric Company Inc.; Designers Fountain; Golden Lighting; Visual Comfort & Co. (Generation Lighting); Hudson Valley Lighting Group (HVLG); Elite Lighting; Livex Lighting |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

U.S. Residential Lighting Fixtures Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the U.S. residential lighting fixtures market report based on source, product, and distribution channel:

-

Source Outlook (Revenue, USD Million, 2017 - 2030)

-

Incandescent

-

Fluorescent

-

LED & OLED

-

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Ceiling

-

Pendant & Chandeliers

-

Wall Mounted

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

Offline

-

Online

-

Frequently Asked Questions About This Report

b. The U.S. residential lighting fixtures market size was estimated at USD 2.64 billion in 2022 and is expected to reach USD 2.75 billion in 2023.

b. The U.S. residential lighting fixtures market is expected to grow at a compound annual growth rate of 5.4% from 2023 to 2030 to reach USD 4.04 billion by 2030.

b. LED & OLED segment dominated the U.S. residential lighting fixtures market with a share of 71.6% in 2022. This is attributable to widely employed in both residential and commercial applications and is available in a wide range of household and industrial items

b. Some key players operating in the U.S. residential lighting fixtures market include Koninklijke Philips N.V.(Signify N.V.), Hubbell Incorporated, Acuity Brands, Inc., NICHIA CORPORATION, Everlight Electronics Co., Ltd., Kichler Lighting LLC, NBG Home, Visa Lighting, Hinkley Inc., Minka Group (Ferguson), SavoyHouse.com, Maxim Lighting, Artika, Globe Electric Company Inc., Designers Fountain, Golden Lighting, Visual Comfort & Co. (Generation Lighting), Hudson Valley Lighting Group (HVLG), Elite Lighting, Livex Lighting

b. Key factors that are driving the market growth include increasing demand for decorative lighting fixtures in the residential segment and the adoption of energy-efficient products such as LEDs & OLEDs are some of the major factors that are expected to drive the residential lighting fixture market during the forecast period

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."