- Home

- »

- Biotechnology

- »

-

U.S. Research Antibodies Market, Industry Report, 2030GVR Report cover

![U.S. Research Antibodies Market Size, Share & Trends Report]()

U.S. Research Antibodies Market Size, Share & Trends Analysis Report By Product, By Specificity (Monoclonal, Polyclonal), By Technology, By Source, By Application, By End-use, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-244-1

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

U.S. Research Antibodies Market Trends

The U.S. research antibodies market size was estimated at USD 559.14 million in 2023 and is expected to grow CAGR of 4.0% from 2024 to 2030. The steady rise in research and development (R&D) activities, led by biopharmaceutical and pharmaceutical companies and paired with increased public-private investments in R&D, are expected to boost demand for research antibodies, thus contributing to market growth.

The U.S. research antibodies market led the global research antibodies market in 2023, accounting for over 30% of the revenue share generated, owing to several factors such as the increasing use of these complex products in research & academic institutions, as well as major pharmaceutical and biotechnology companies.

A significant factor contributing to the high market share is the growing focus on biomedical, stem cell, and cancer research. The increasing prevalence of chronic diseases, such as cardiovascular and blood disorders, is expected to further fuel market growth. As per the American Cancer Society’s 2021 Cancer Facts & Figures, an estimated 1.9 million new cancer cases and over 608,570 cancer deaths were projected to occur in the country in 2021, with a heightened emphasis on cancer research and stem cell research activities.

Stem cell therapy has emerged as a promising technique for treating severe medical conditions, including cancer and blood diseases. Consequently, biotechnology and biopharmaceutical companies are increasingly adopting advanced research antibodies for stem cell research. This trend is anticipated to drive the market significantly.

Investing in recombinant technology is crucial for scaling antibody production to meet researchers’ needs and addressing new issues as new host species are introduced in the future. For instance, ZooMAb recombinant monoclonal antibodies support researchers in the early stages of biopharmaceutical testing, enabling them to progress with downstream processes and allowing access to the highest-quality antibodies, opening up more opportunities for research in the country.

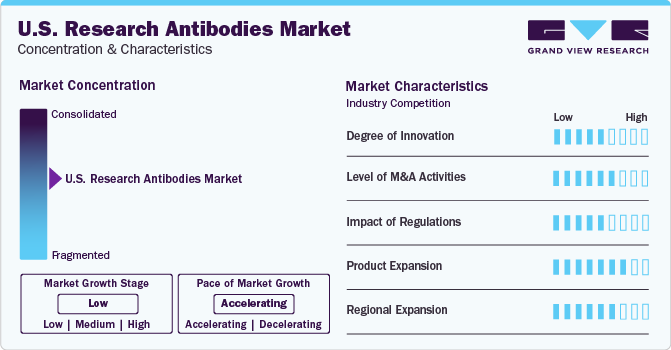

Market Concentration & Characteristics

The U.S. research antibodies market is characterized by moderate levels of concentration with few large companies accounting the majority market share. These companies are constantly involved in M&A activities, product innovation & new product development, and geographic expansion to improve their market position.

The industry is driven by technological advancements, improving turnaround time, accuracy, and disease diagnosis. Developments in ELISA exemplify the rapid innovation witnessed by prominent companies. For instance, in February 2023, Charles River Laboratories launched a novel IgY-based ELISA kit for detecting and quantifying residual host cell proteins in CHO-based biotherapeutics, which provided an alternative detection technology with benefits such as strong immune response against mammalian antigens and consistent, high-quality antibodies.

International and national industry participants are expanding their presence in the country using aggressive marketing strategies. This entry into more states and the subsequent rise in demand for antibodies, along with related consumables such as stains, reagents, enzymes, and others, is anticipated to impact industry growth positively. For instance, Thermo Fisher Scientific’s acquisition of CorEvitas, a leading provider of regulatory-grade real-world evidence solutions, in August 2023, aimed to enhance the company’s clinical research capabilities and support decision-making in drug development.

Regulatory initiatives to boost antibody production for therapeutic purposes contribute positively to industry growth. Increased collaborations between government and academic institutions for early chronic disease detection and drug development also create favorable growth opportunities in the industry. For instance, in September 2023, the U.S. Department of Health and Human Services (HHS) extended its partnership with Regeneron to develop life-saving monoclonal antibodies for COVID-19 under Project NextGen, fostering advancements in monoclonal antibody development for COVID-19 prevention.

The industry is driven by product diversification through innovations like monoclonal and bispecific antibodies, advancements in antibody development technologies, and focus on biosimilar antibodies and antibody-drug conjugates (ADCs). Companies are investing in personalized medicine, enhancing their focus on novel antibody therapies, and expanding into biosimilars to cater to industry demands.

The increasing healthcare expenditure in the industry has facilitated high growth opportunities for new players. Thus, companies are also opting to expand their geographical reach in the country to utilize the helpful regulatory framework in the country. In December 2020, Abcam Plc announced the opening of a cell engineering facility in the Bay Area in California. This strategic initiative aims at expanding the company’s presence globally.

Product Insights

Primary antibodies held the dominant share of the market in 2023, accounting for over 70% of the revenue generated, and are anticipated to grow at the fastest CAGR over the forecast period. This isprimarily attributable to the rising development of primary antibodies sourced from host species like rabbits, goats, mice, and others. Moreover, this growth can be credited to the diverse range of forms these antibodies are supplied in, catering to the varying research requirements. The frequent use of primary antibodies in targeting commonly researched biological components contributes to the segment’s expected exponential growth.

Secondary antibodies are anticipated to register significant growth from 2024 to 2030. These antibodies play a crucial role in facilitating tasks such as sorting, detecting, and purifying target antigens, thereby enhancing the overall efficiency of research activities. Another factor contributing to their increasing demand is the ease of development and cost-effectiveness of secondary antibodies. Furthermore, their availability in ready-to-use forms is expected to boost their popularity and usage in various research applications in the coming years.

Specificity Insights

Monoclonal antibodies led the market in 2023 with 60.6% of the total revenue share, owing to their high specificity for detection of antigens and efficient staining properties with less background noise. Moreover, the segment is expected to register the fastest growth over the forecast period, which is attributable to its potential to effectively bind to or inhibit antigens on cancer cells makes them valuable tools in the identification and development of novel cancer treatments for various types of cancer. This capability is likely to enhance the growth prospects for this segment in the foreseeable future.

On the contrary, polyclonal antibodies are anticipated to grow at a significant rate owing to ability to recognize multiple epitopes and possess greater tolerance to change in antigens. Polyclonal antibodies hold significant importance in histopathological tissue analysis and antigen purification. The growing awareness concerning cancer treatments and other diseases has led to increased demand for these antibodies. Compared to monoclonal antibodies, polyclonal antibodies are more cost-effective, which may boost their usage in low-budget and non-funded research projects. It is crucial to note that polyclonal antibodies may vary between batches due to manufacturing and quality control factors, and they can recognize multiple epitopes, potentially increasing the likelihood of non-specific antigen binding.

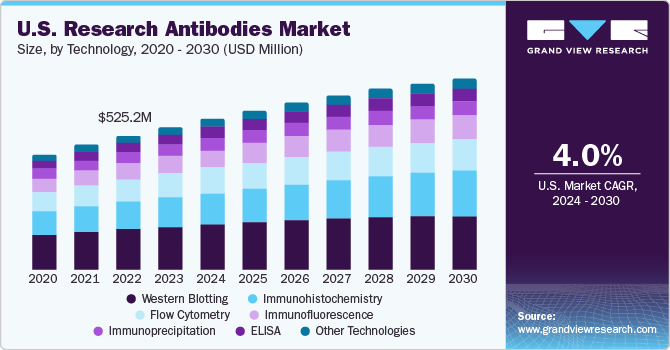

Technology Insights

Western blotting was the dominant technology used in the market in 2023 with 30.5% of the total revenue share.As of 2022, the Center for Disease Control and Prevention (CDC) reported that approximately 1.2 million Americans are living with HIV, with California accounting for the highest diagnoses in the country. The increasing prevalence of HIV in the country has led to a significant demand for antibodies in western blotting tests. Western blotting is preferred over ELISA tests for detecting HIV due to its higher accuracy in identifying HIV antibodies in patient blood samples.

The immunohistochemistry (IHC) segment is expected to register the fastest CAGR during the forecast period. Widely used in cancer diagnosis, IHC’s growth is driven by the consistent rise in cancer cases. It plays a significant role in tumor prognosis and has been increasingly incorporated. IHC identifies enzymes, antigens, tumor suppressor genes, and tumor cell proliferation, offering advantages over traditional staining techniques due to specific reactions. IHC’s adoption in clinical diagnostics and life science research is fueled by increased healthcare spending, improved infrastructure, and enhanced research facilities.

Source Insights

Rabbits generated over 50% of the total revenue share in 2023, dominating the market by a landslide. Rabbit antibodies’ extensive use in antibody production is due to their advantages, such as higher affinity and specificity compared to antisera from other animal hosts. This high specificity enables their application in detecting small molecules like pollutants, toxins, hormones, drugs, non-protein targets, and post-translational changes. In disease diagnosis, rabbit antibodies showcase enhanced immune response to small epitopes.

Mice are expected to grow the fastest from 2024 to 2030, as the growing use of murine monoclonal antibodies in research is driving overall market growth. Mice are preferred due to their structural similarities with human antibodies and cost-effectiveness. Their shorter lifespan makes them suitable for aging and drug efficacy studies. Mice are vital in complex disease research, such as hypertension and atherosclerosis. The increasing prevalence of cancer and Alzheimer’s disease has led to higher demand for mouse monoclonal antibodies as research reagents.

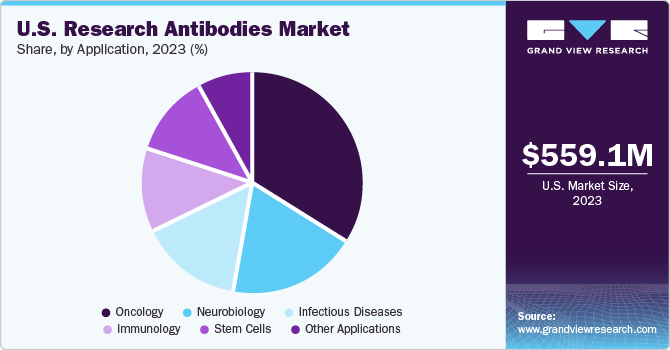

Application Insights

Oncology held the most substantial share of the application segment in 2023, accounting for 34.3% of the total market revenue. Research antibodies are vital in targeted cancer therapy, revolutionizing treatment by specifically binding to cancer cell antigens. This precision allows for selectively targeting and destroying cancer cells while preserving healthy tissues. The FDA’s growing approvals of monoclonal antibodies for specific biomarkers have significantly boosted their usage in oncology, making them a foundation of modern cancer therapy.

Infectious diseases are expected to have the fastest CAGR over the forecast period. The increasing prevalence of infectious diseases, an aging population, and growing awareness about communicable diseases have emerged as significant drivers for the growth of the diagnostic devices market. Consequently, the market is experiencing higher demand for rapid diagnostic tools such as point-of-care tests for qualitative analysis of infections, enabling timely preventive measures.

End-use Insights

Academic & research applications occupied the largest revenue share in the market of nearly 61% in 2023 and are expected to grow at the fastest CAGR over the forecast period. Academic research applications are expected to experience continuous expansion due to the involvement of diverse academic research groups studying intricate biological systems with advanced reagents. This trend will offer the segment significant growth prospects, leading to a deeper comprehension of biological processes and complex systems.

The pharma and biotech companies segment is anticipated to grow significantly from 2024 to 2030, owing to the increased use of assays in the pharmaceutical and biotechnological companies. This heightened demand is fueled by the rising prevalence of conditions like cancer and autoimmune diseases such as Type 1 Diabetes, necessitating antibodies for treatment and diagnostics. Antibodies, alongside other consumables, play a vital role in the treatment and development processes within these industries. The market is further boosted by the growing R&D activities in pharmaceutical and biotechnology sectors.

Key U.S. Research Antibodies Company Insights

The U.S. research antibodies market is moderately consolidated and highly competitive due to low entry barriers. The observed growth in this particular sector can be attributed to the implementation of comprehensive expansion strategies, new product development, geographical expansions, and mergers & acquisitions. Companies in the U.S. research antibodies market have been proactive in adopting such strategies to enhance their market presence and drive growth.

For instance, in December 2023, C4 Therapeutics partnered with Merck to develop degrader-antibody conjugates for cancer treatment. This collaboration aimed to combine degraders’ efficiency with antibodies’ specificity. Some companies in the U.S. research antibodies market include Abcam Plc.; Merck KGaA; Thermo Fisher Scientific, Inc.; Cell Signalling Technology, Inc.; Santa Cruz Biotechnology Inc.; and PerkinElmer, Inc.

Key U.S. Research Antibodies Companies:

- Abcam Plc.

- Merck KGaA

- Thermo Fisher Scientific, Inc.

- Cell Signalling Technology, Inc.

- Santa Cruz Biotechnology Inc.

- PerkinElmer, Inc.

- Becton, Dickinson and Company

- Bio-Techne Corporation

- Proteintech Group, Inc.

- Jackson ImmunoResearch Inc.

Recent Developments

-

In March 2024, Rapid Novor and MAbSilico collaborated to introduce the first AI-guided epitope mapping service for antibodies using HDX-MS technology, combining computational modeling with experimental data to enhance antibody structure analysis.

-

In January 2024, Johnson & Johnson acquired Ambrx Biopharma, a clinical-stage biopharmaceutical company with a proprietary synthetic biology technology platform. This acquisition allowed Johnson & Johnson to strengthen its oncology therapeutics portfolio and accelerate the development of next-generation ADCs.

-

In August 2023, ERS Genomics granted Santa Cruz Biotechnology, a U.S.-based global leader in biomedical research, access to its CRISPR/Cas9 patent portfolio through a new license agreement. This collaboration leveraged ERS’s comprehensive gene editing technology rights, enhancing Santa Cruz Biotechnology’s position in the research antibodies market with innovative CRISPR products, bolstering scientific advancements.

-

In August 2023, Regeneron partnered with BARDA to develop a novel monoclonal antibody therapy for COVID-19 prevention, receiving partial funding under ‘Project NextGen.’

-

In February 2023, Roche introduced two new antibodies, IDH1 R132H and ATRX, to identify key mutations in brain cancer patients. These additions to Roche’s neuropathology portfolio, which comprise 29 biomarkers, enhanced the understanding of brain tumor molecular alterations and aid in personalized patient care.

U.S. Research Antibodies Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 559.14 million

Revenue forecast in 2030

USD 749.16 million

Growth rate

CAGR of 4.00% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, specificity, technology, source, application, end-use

Country scope

U.S.

Key companies profiled

Abcam Plc.; Merck KGaA; Thermo Fisher Scientific, Inc.; Cell Signalling Technology, Inc.; Santa Cruz Biotechnology Inc.; PerkinElmer, Inc.; Becton, Dickinson and Company; Bio-Techne Corporation; Proteintech Group, Inc.; Jackson ImmunoResearch Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Research Antibodies Market Report Segmentation

This report forecasts revenue growth at the country level and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. research antibodies market report based on product, specificity, technology, source, application, and end-use.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Primary

-

Secondary

-

-

Specificity Outlook (Revenue, USD Million, 2018 - 2030)

-

Monoclonal Antibodies

-

Polyclonal Antibodies

-

-

Technology Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

Immunohistochemistry

-

Immunofluorescence

-

Western Blotting

-

Flow Cytometry

-

Immunoprecipitation

-

ELISA

-

Other Technologies

-

-

Source Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

Mice

-

Rabbit

-

Goat

-

Other Sources

-

-

Application Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

Infectious Diseases

-

Immunology

-

Oncology

-

Stem Cells

-

Neurobiology

-

Other Applications

-

-

End-use Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

Academic & Research Institutes

-

Contract Research Organizations

-

Pharma & Biotech Companies

-

Frequently Asked Questions About This Report

b. Primary antibodies held the dominant share of the market in 2023, accounting for over 70% of the revenue generated, and are anticipated to grow at the fastest CAGR over the forecast period.

b. Some companies in the U.S. research antibodies market include Abcam Plc.; Merck KGaA; Thermo Fisher Scientific, Inc.; Cell Signalling Technology, Inc.; Santa Cruz Biotechnology Inc.; and PerkinElmer, Inc.

b. The steady rise in research and development (R&D) activities, led by biopharmaceutical and pharmaceutical companies and paired with increased public-private investments in R&D, are expected to boost demand for research antibodies, thus contributing to market growth.

b. The U.S. research antibodies market size was estimated at USD 559.14 million in 2023.

b. The U.S. research antibodies market is expected to register a compound annual growth rate (CAGR) of 4.0% from 2024 to 2030 to reach USD 749.16 million by 2026.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."