- Home

- »

- Medical Devices

- »

-

U.S. Reprocessed Medical Devices Market, Report, 2030GVR Report cover

![U.S. Reprocessed Medical Devices Market Size, Share & Trends Report]()

U.S. Reprocessed Medical Devices Market (2024 - 2030) Size, Share & Trends Analysis Report By Product Type (Cardiovascular), By Type (Third-party Reprocessing, In-house Reprocessing), By End-use (Hospitals), And Segment Forecasts

- Report ID: GVR-4-68040-310-4

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

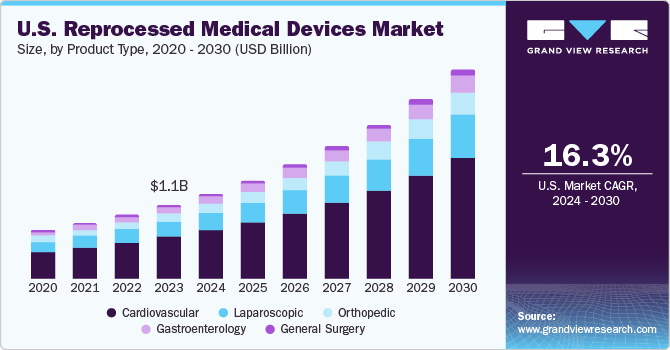

The U.S. reprocessed medical devices market size was estimated at USD 688.1 million in 2023 and is projected to grow at a CAGR of 16.2% from 2024 to 2030. Reprocessing medical devices contribute to a more sustainable healthcare system by reducing waste and conserving resources. It helps to minimize the environmental impact associated with manufacturing, packaging, and disposing of new medical devices. In addition, reprocessed medical devices are often more affordable than their new counterparts, making them an attractive option for healthcare facilities and patients seeking to reduce expenses.

Governments and regulatory bodies in the U.S. are recognizing the value of reprocessed medical devices and are implementing policies and guidelines to support their use. For instance, according to the Association of Medical Device Reprocessors (AMDR), hospitals in the U.S. could save around USD 2.28 billion annually by maximizing their use of reprocessed single-use medical devices. According to the same source, in 2020, the U.S. hospitals saved approximately USD 372 million by reprocessing single-use medical devices, as reprocessed devices costed 25% to 40% less than manufacturing new devices.

In addition, certain factors including the increasing prevalence of cardiovascular disorders, enhancement in the healthcare infrastructure, and increasing proportion of aging population, are anticipated to contribute to the market growth. According to the information published by the Population Reference Bureau in January 2024, the 65 and older population in the U.S. is expected to increase to 82 million in 2050 from 58 million in 2022. The increasing proportion of this population is expected to drive demand for reprocessed medical devices owing to their higher susceptibility to diseases.

Reprocessing of medical equipment provides a solution that reduces medical waste, decreases greenhouse gas emissions, and encourages a safer, cleaner, and more environmentally friendly healthcare system. The rising prevalence of chronic diseases fuels the market demand for reprocessed medical devices utilized in various surgical procedures. The adoption of these devices enables healthcare facilities to achieve cost savings without compromising patient care or safety.

Market Concentration & Characteristics

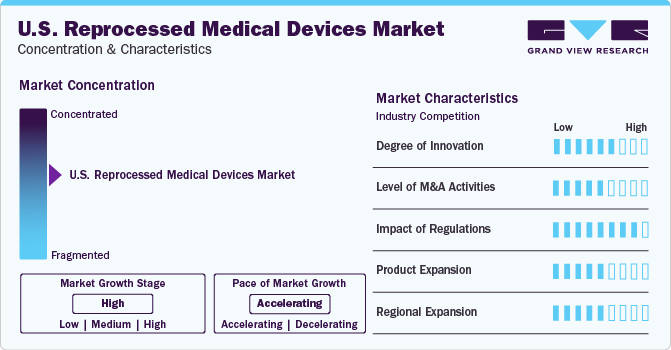

The market growth stage is high, and the pace of the market growth is accelerating. The reprocessed medical devices industry is experiencing accelerated growth due to cost savings, sustainability efforts, regulatory support, and increasing awareness among healthcare professionals and patients. Moreover, advancements in sterilization, cleaning, and inspection technologies enable reprocessors to provide devices that meet high safety and efficacy standards. These technological advancements contribute to the growing confidence in reprocessed devices, accelerating market growth. For instance, Arjo ReNu is one of the environmentally sustainable solutions provided by the Arjo for reprocessing noninvasive medical devices to offer advanced clinical, operational, and financial efficiency.

The industry is also characterized by a medium level of merger and acquisition (M&A) activities by the leading players owing to the increasing emphasize on accessing new technologies and talent needed to consolidate in a rapidly growing market. For instance, in October 2023, Getinge announced the acquisition of Healthmark Industries for approximately USD 320 million, which is expected to help it enhance its presence in the U.S. and improve its sterilization and reprocessing equipment.

The U.S. reprocessed medical devices market is subject to increasing regulatory scrutiny. Reprocessed medical devices fall under the "single-use devices" category that are cleaned, sterilized, and repackaged for reuse. The FDA regulates these devices under the Medical Device Amendments to the Federal Food, Drug, and Cosmetic Act. Manufacturers of reprocessed devices have to follow specific quality system regulations and obtain FDA clearance or approval before marketing their products. The FDA and Centers for Medicare & Medicaid Services (CMS) also regulate the reprocessed medical devices market in the U.S., ensuring safety and effectiveness, and CMS relies on FDA clearance or approval for devices used in healthcare settings covered by Medicare.

Product Type Insights

The cardiovascular segment dominated the market and accounted for a share of 56.5% in 2023 and is expected to register the fastest CAGR during the forecast period. Cardiovascular diseases, such as heart disease, strokes, and hypertension, are among the leading cardiovascular diseases and disability worldwide. According to the Centers for Disease Control and Prevention, in May 2023, heart disease is one of the major causes of death in the U.S. It is estimated that one person dies every 33 seconds in the country from cardiovascular diseases. Moreover, about 695,000 people in the U.S. died from heart disease in 2021-that's 1 in every five deaths. This high prevalence leads to a significant demand for medical devices used in cardiovascular treatments and diagnostics, which, in turn, creates demand for reprocessed medical devices.

Hospitals and healthcare facilities can benefit from using reprocessed cardiovascular devices, as they can be up to 60-90% less expensive than new, single-use devices. The cardiovascular segment encompasses a diverse array of medical devices, such as catheters, pacemakers, defibrillators, and monitoring equipment. This variety allows for a more significant impact on the reprocessed medical devices market, as multiple types of devices can be reprocessed and reused, catering to different cardiovascular procedures and treatments.

End-use Insights

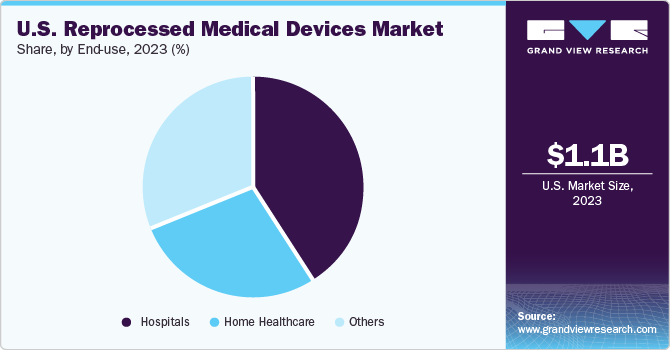

The hospitals segment dominated the market in 2023 and is expected to register the fastest CAGR during the forecast period. Hospitals and healthcare facilities face increasing financial pressures due to rising costs of healthcare services and equipment. Reprocessed medical devices offer significant cost savings compared to purchasing new, single-use devices. This cost-effectiveness makes reprocessed devices more appealing to hospitals, as it helps them manage their budgets more efficiently. Moreover, the healthcare industry generates a large amount of waste, including medical devices and equipment. Reprocessing medical devices helps reduce the environmental impact of healthcare facilities by minimizing the amount of waste generated from single-use devices.

In some cases, there may be shortages of specific medical devices due to supply chain disruptions, manufacturing issues, or high demand. Reprocessed devices can help bridge these gaps by providing an alternative source of medical equipment that is still safe and effective for use. Regulatory authorities such as FDA also work to ensure safety of these devices by reviewing premarket and postmarket information from manufacturers to reduce the risk of hospital acquired infections through these devices.

Type Insights

3rd party reprocessing accounted for the largest market revenue share in 2023 and is expected to register the fastest CAGR during the forecast period. Third-party reprocessing companies often offer cost-effective solutions for reprocessing medical devices. These companies consolidate reprocessing activities in specialized facilities to achieve economies of scale, which in turn leads to lower prices for reprocessed devices compared to purchasing new, single-use devices. Third-party reprocessors often have established processes and protocols for reprocessing various types of medical devices. This standardization helps ensure consistency in the quality of reprocessed devices across different manufacturers and models.

The preference for third-party reprocessing in the reprocessed medical devices market stems from the cost savings, quality assurance, standardization, and reduced burden on healthcare facilities that these companies provide. This allows healthcare providers to access high-quality, reprocessed medical devices at a lower cost, ultimately benefiting both patients and healthcare institutions. For instance, according to the information published by Stryker, in 2023, their sustainability solutions helped customers shift around 5 million pounds of waste through reprocessing programs and saved them around 3,250 customers, approximately USD 238 million.

Key U.S. Reprocessed Medical Devices Company Insights

Some of the key companies operating in the U.S. reprocessed medical devices market include Stryker; Cardinal Health, NEScientific, Inc; Medline Industries, Inc; Arjo, Vanguard AG, INNOVATIVE HEALTH, SureTek Medical.

-

Stryker is a global medical technology company that offers innovative medical solutions related to MedSurg, Orthopaedics, Spine, and Neurotechnology to improve patient outcomes. The company also engages in the medical devices reprocessing and supplies these devices to approximately 3,500 hospitals in the U.S.

-

Cardinal Health is a global distributor and manufacturer of medical and laboratory products. The company provides services to approximately 90% of the total hospitals in the U.S., over 60,000 U.S. pharmacies, 10,000 specialty physician offices and clinics. The company focuses on the collection and cleaning of single-use devices for safe re-use following the standards set forth by the FDA.

Key U.S. Reprocessed Medical Devices Companies:

- Stryker

- Innovative Health

- NEScientific, Inc.

- Medline Industries, LP.

- Arjo

- Vanguard AG

- Cardinal Health

- SureTek Medical

- Soma Tech Intl

- Johnson & Johnson Services, Inc.

Recent Developments

-

In November 2023, Medline announced expansion of its medical devices reprocessing facility in Oregon. This announcement was aimed at reprocessing medical devices that would otherwise end up in a landfill.

-

In November 2022, Cardinal Health expanded its Sustainable Technologies facility in Florida, which engages in the reprocessing of single-use medical devices. The expansion is expected to help the company to meet the increasing customer demand for these devices.

U.S. Reprocessed Medical Devices Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 3.09 billion

Growth rate

CAGR of 16.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, type, end-use

Country scope

U.S.

Key companies profiled

Stryker; Innovative Health; NEScientific, Inc.; Medline Industries, Inc; Arjo; Vanguard AG; Cardinal Health; SureTek Medical; Soma Tech Intl; Johnson & Johnson Services, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Reprocessed Medical Devices Market Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. reprocessed medical devices market report based on product type, type, and end-use:

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Cardiovascular

-

Blood Pressure Cuffs

-

Positioning Devices

-

Cardiac Stabilization Devices

-

Diagnostic Electrophysiology Catheters

-

Deep Vein Thrombosis Compression Sleeves

-

Electrophysiology Cables

-

-

Laparoscopic

-

Harmonic Scalpels

-

Endoscopic Trocars

-

-

Gastroenterology

-

Biopsy Forceps

-

Others

-

-

General Surgery

-

Pressure Bags

-

Balloon Inflation Devices

-

-

Orthopedic

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

3rd Party Reprocessing

-

In-House Reprocessing

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Home Healthcare

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. reprocessed medical devices market size was valued at USD 688.1 million in 2023.

b. The U.S. reprocessed medical devices market is projected to grow at a compound annual growth rate (CAGR) of 16.2% from 2024 to 2030 to reach USD 3.09 billion by 2030.

b. The cardiovascular segment dominated the market and accounted for a share of 56.5% in 2023 and is expected to register the fastest CAGR during the forecast period. Cardiovascular diseases, such as heart disease, strokes, and hypertension, are among the leading cardiovascular diseases and disability worldwide.

b. Some of the key companies operating in the U.S. reprocessed medical devices market include Stryker; Cardinal Health, NEScientific, Inc; Medline Industries, Inc; Arjo, Vanguard AG, INNOVATIVE HEALTH, and SureTek Medical.

b. Reprocessing medical devices contribute to a more sustainable healthcare system by reducing waste and conserving resources. It helps to minimize the environmental impact associated with manufacturing, packaging, and disposing of new medical devices. In addition, reprocessed medical devices are often more affordable than their new counterparts, making them an attractive option for healthcare facilities and patients seeking to reduce expenses.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.