U.S. Remote Patient Monitoring System Market Size, Share & Trends Analysis Report By Product (Specialized Monitors), By Application, By Infections, By End-use, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-306-1

- Number of Report Pages: 85

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

The U.S. remote patient monitoring system market size was estimated at USD 1.95 billion in 2023 and is projected to grow at a CAGR of 18.4% from 2024 to 2030. These devices enable healthcare providers to monitor patients' health status remotely, allowing for early detection of potential health issues and timely intervention. This can lead to better health outcomes, reduced hospitalizations, and improved overall patient care. Moreover, the prevalence of chronic diseases such as diabetes, hypertension, and heart disease has been steadily increasing and these devices can help patients manage their health more effectively, leading to better disease management and reduced complications that, in turn, contributes to the market growth.

Continuous technological advancements have made remote patient monitoring devices more accessible, user-friendly, and cost-effective. This has increased their adoption among both patients and healthcare providers. Healthcare organizations are increasingly focusing on population health management to improve the overall health of their patients. Remote patient monitoring devices can play a crucial role in this effort by providing valuable data and insights for targeted interventions and preventive measures. The devices allow healthcare providers to monitor patients' vital signs, symptoms, and other health parameters in real-time leading to the early detection of potential health issues, such as abnormal blood pressure readings or changes in glucose levels, which can help prevent complications or worsening of conditions.

According to the Centers for Disease Control and Prevention (CDC), in August 2022, 38.4 million people in the U.S. had diabetes, constituting 11.6% of the total population. The treatment of such chronic diseases requires routine testing and monitoring, which is expected to drive the demand for remote patient monitoring devices in the country. The new acquisitions, collaborations, and partnerships also lead to increased investments by major firms in the market. Personalized telemedicine apps can provide a communication platform and help in remote and real-time monitoring of patients, bridging the gap between healthcare professionals and the patient. For instance, according to the National Library of Medicine in July 2021, telemedicine saves both the time of the patient and the healthcare providers and further helps reduce the treatment costs. Moreover, the efficiency of these monitors can help streamline the workflow of hospitals and clinics.

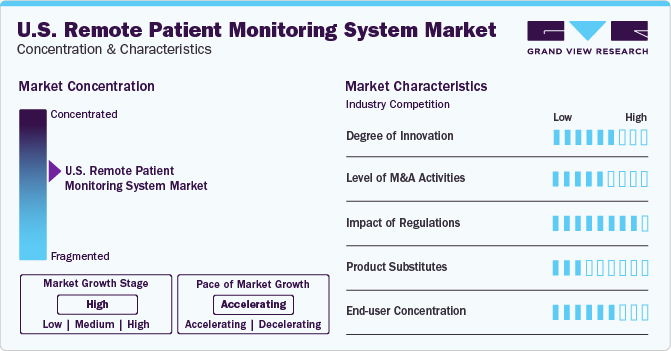

Market Concentration & Characteristics

The market growth stage is high, and the pace of growth is accelerating. As the global population ages, there is a growing need for healthcare solutions that can support the needs of elderly individuals with chronic conditions which, in turn, creates a demand for these devices. For instance, according to the Population Reference Bureau, in January 2024, the number of Americans aged 65 and older is projected to increase from 58 million in 2022 to 82 million by 2050.

The high market growth stage for remote patient monitoring devices can be attributed to factors such as an increasing aging population, technological advancements, cost-effectiveness, focus on population health management, chronic disease prevalence, patient empowerment and engagement, pandemic response, accessibility in remote locations, post-discharge care, government initiatives, and reimbursement policies. These factors collectively contribute to the rapid expansion and adoption of remote patient monitoring devices in the healthcare industry.

The market is also characterized by a moderate level of merger and acquisition (M&A) activity by the leading players to gain a higher market share. For instance, in February 2021, Koninklijke Philips N.V. acquired BioTelemetry, Inc., a U.S.-based company specializing in remote cardiac diagnostics and monitoring. The acquisition is likely to help the company gain a competitive edge against other players in patient care management solutions.

TheU.S. remote patient monitoring system market is also impacted by various U.S. Food and Drug Administration (FDA) regulations to ensure product safety and quality. In October 2023, the FDA released an enforcement policy related to non-invasive remote monitoring devices. The policy allowed manufacturers of remote monitoring devices to make certain modifications and bring these modified devices to market without having to undertake the 510(k)-clearance process. This is likely to encourage innovation and drive market growth.

There are very few direct product substitutes for remote monitoring systems. Remote monitoring systems are the most effective way to monitor a patient’s progress during the treatment of any disorder. Remote patient monitoring systems deal with sensitive and complex healthcare data, which requires a high level of accuracy and precision. Developing a substitute that can match the performance of these existing systems is challenging, as it needs to be compatible with various medical devices, healthcare protocols, and patient needs.

End-user concentration is a significant factor in the U.S. market for remote patient monitoring system since several end-user industries drive demand for these devices to routine-check and avoid traveling to the hospitals every time. The market is characterized by the growing prevalence of diseases such as diabetes and hypertension, the development of newer technologies in healthcare, and the influence of regulations.

Product Insights

The specialized monitors segment dominated the market and accounted for a revenue share of 82.6% in 2023. Specialized monitors are designed to measure specific parameters with greater accuracy than general devices. They often come with advanced features and capabilities tailored to specific needs. For instance, a fetal heart rate monitor provides real-time information about the baby's well-being during labor, which is crucial for the health of both the mother and the baby. In November 2023, Owlet US received FDA clearance for its baby sock designed to monitor the health information of infants, including pulse rate and oxygen saturation levels. Specialized monitors can also streamline workflows in healthcare settings by providing targeted information and reducing the need for multiple devices.

The vital sign monitors segment is expected to register the fastest CAGR during the forecast period. Vital sign monitors are in high demand due to their ability to facilitate early detection and prevention, continuous monitoring, remote monitoring, accurate diagnosis, efficient workflow, patient safety, post-operative care, disease management, telemedicine, and public health surveillance. These devices help healthcare providers track essential health indicators, such as heart rate, blood pressure, respiratory rate, and body temperature. Early detection of changes in these vital signs can help identify potential health issues, enabling timely interventions and preventing complications.

Application Insights

The diabetes segment accounted for the largest revenue share in 2023 and is expected to register the fastest CAGR during the forecast period. Diabetes requires ongoing monitoring and management. Diabetic patients often need to monitor their blood glucose levels multiple times a day to maintain optimal control. These devices can help patients track their blood glucose levels, insulin doses, and other vital signs regularly, ensuring consistent monitoring and better control of the condition. According to the Diabetes Care Survey published in 2023, approximately 47% of people with type 2 diabetes agreed that a remote patient monitoring program could help them manage their health in a better way.

Remote patient monitoring devices are needed mostly in diabetes management due to the chronic nature of the condition, the frequency of monitoring required, self-management support, remote access to healthcare, early detection of complications, personalized care, continuous data collection, reduced healthcare costs, improved patient outcomes, and support for lifestyle changes.

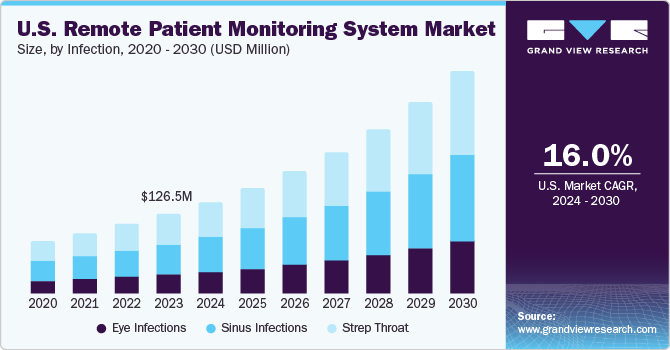

Infections Insights

The sinus infections segment dominated the market in 2023. Sinus infections can be challenging to diagnose and treat, as symptoms may not always be consistent or easily identifiable. These devices can help detect early signs of complications or worsening symptoms, allowing healthcare providers to intervene promptly and prevent further complications. This is particularly important for patients with chronic sinus infections or those at higher risk of developing secondary infections or other health issues.

According to the CDC, the number of people affected with sinusitis are 28.9 million in the U.S., which constitutes to be 11.6% of the total population. Moreover, managing sinus infections often involves making lifestyle changes, such as improving hygiene practices, managing allergies, and maintaining a healthy diet. The devices can help patients track their progress and provide motivation to maintain these changes, leading to better overall health outcomes.

The eye infections segment is projected to grow at the fastest CAGR over the forecast period. Eye infections can progress rapidly, and continuous monitoring can help healthcare providers track the progression of the infection and adjust treatment plans accordingly. These devices can help detect eye infections at an early stage, allowing for prompt intervention and treatment. Early detection is crucial in preventing complications and ensuring better treatment outcomes.

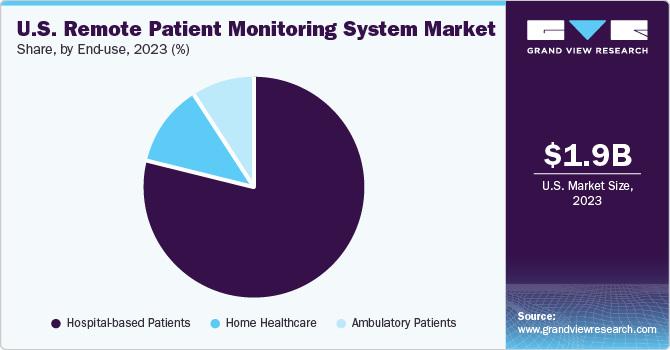

End-use Insights

The hospital-based patients segment dominated the market in 2023. Remote patient monitoring devices provide hospitals with continuous access to patient data, allowing healthcare providers to track patients' progress and make necessary adjustments to their treatment plans. These devices enable healthcare providers to monitor patients' health status remotely, allowing for timely interventions and better management of chronic conditions. The devices help hospitals reduce costs associated with hospitalizations, emergency room visits, and inpatient care. By enabling more efficient resource allocation and reducing the need for in-person visits, hospitals can achieve significant cost savings.

The home healthcare segment, on the other hand, is expected to register the fastest CAGR during the forecast period. RPM devices enable patients to monitor their health status from the comfort of their own homes, reducing the need for frequent visits to healthcare facilities.

Key U.S. Remote Patient Monitoring System Company Insights

Some of the key companies operating in the U.S. remote patient monitoring devices market include Shenzhen Mindray Bio- medical Electronics Co. Ltd.; Nihon Kohden Corporation, Omron Corporation; and OSI Systems, Inc.

-

Shenzhen Mindray Bio-Medical Electronics Co., Ltd. is a leading medical device manufacturer that offers a range of remote patient monitoring devices such as BeneVision, Patient Monitoring and Management, Vital Signs Monitoring, Tele-ICU, and CareTouch.

-

Nihon Kohden Corporation, a Japanese medical equipment manufacturer, offers a range of remote patient monitoring (RPM) devices under various brands such as CardioMaster, BioMonitor, NeuroMaster, SleepMaster, and PulseCheck.

Philips N.V.; Welch Allyn, Smiths Medical; Abbott, Inc. are some other market participants.

Key U.S. Remote Patient Monitoring System Companies:

- Welch Allyn

- Smiths Medical

- Abbott

- Boston Scientific Corporation

- Dräger Medical

- GE Healthcare

- Honeywell

- Johnson & Johnson

- LifeWatch

- Medtronic

- Masimo

- Vitls, Inc

- CareValidate

- Biotronik

- American Telecare

Recent Developments

-

In October 2023, Ricoh USA, Inc. announced the launch of RICOH Remote Patient Monitoring (RPM) Enablement, the newest end-to-end managed services offering for health systems. This launch improved patient and care delivery team experiences and virtual care delivery.

-

In August 2023, GE HealthCare announced its U.S. launch of Portrait Mobile, a patient monitoring system. This launch helped the group to enhance and expand in the U.S. market.

-

In December 2022, Mindray launched a new wearable patient monitoring system. This launch supported comprehensive and precise measurements of patient status.

-

In April 2022, LivaNova announced the commercial launch of its patient monitoring system. This launch used a patient-tailored approach to improve clinical efficiency and the quality of patient care during cardiopulmonary bypass (CPB) procedures.

-

In October 2021, Honeywell launched a real-time health monitoring system. This launch acted as a bridge between caregiver and patient that integrated hardware and software to improve care delivery, enhance healthcare worker productivity, and enable process efficiency.

U.S. Remote Patient Monitoring System Market Report Scope

|

Report Attribute |

Details |

|

Revenue forecast in 2030 |

USD 6.3 billion |

|

Growth rate |

CAGR of 18.4% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, application, infection, end use |

|

Country scope |

U.S. |

|

Key companies profiled |

Welch Allyn; Smiths Medical; Abbott; Boston Scientific Corporation; Dräger Medical, GE Healthcare; Honeywell; Johnson & Johnson; LifeWatch; Medtronic; Masimo; Vitls, Inc; CareValidate; Biotronik; American Telecare |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

U.S. Remote Patient Monitoring System Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. remote patient monitoring system market report based on product, application, infection, and end-use:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Vital Sign Monitors

-

Blood Pressure Monitors

-

Pulse Oximeters

-

Heart Rate Monitor (ECG)

-

Temperature Monitor

-

Respiratory Rate Monitor

-

Capnographs

-

Spirometers

-

-

Brain Monitoring (EEG)

-

-

Specialized Monitors

-

Anesthesia Monitors

-

Blood Glucose Monitors

-

Cardiac Rhythm Monitor

-

Respiratory Monitor

-

Fetal Heart Monitors

-

Prothrombin Monitors

-

Multi Parameter Monitors (MPM)

-

Others (Ventilators, Infusion Pumps and others)

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Cancer

-

Cardiovascular Diseases

-

Diabetes

-

Sleep Disorder

-

Weight Management and Fitness Monitoring

-

Bronchitis

-

Infections

-

Virus

-

Dehydration

-

Hypertension

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital-based Patients

-

Ambulatory Patients

-

Home Healthcare

-

-

Infection Outlook (Revenue, USD Million, 2018 - 2030)

-

Eye Infections

-

Sinus Infections

-

Strep Throat

-

Frequently Asked Questions About This Report

b. The U.S. remote patient monitoring market size was valued at USD 1.95 billion in 2023.

b. The U.S. remote patient monitoring market is projected to grow at a compound annual growth rate (CAGR) of 18.4% from 2024 to 2030 to reach USD 6.3 billion by 2030.

b. Specialized monitors dominated the market and accounted for a share of 82.6% in 2023 as they are designed to measure specific parameters with greater accuracy compared to the general devices. They often come with advanced features and capabilities tailored to specific needs.

b. Some of the key companies operating in the U.S. remote patient monitoring devices market include Shenzhen Mindray Bio- medical Electronics Co. Ltd.; Nihon Kohden Corporation, Omron Corporation; OSI Systems, Inc., Philips N.V., Welch Allyn, Smiths Medical, and Abbott, Inc.

b. The prevalence of chronic diseases such as diabetes, hypertension, and heart disease has been steadily increasing and these devices can help patients manage their health more effectively, leading to better disease management and reduced complications that, in turn, contributes to the market growth.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."