- Home

- »

- Medical Devices

- »

-

U.S. Regulatory Affairs Market Size, Industry Report, 2030GVR Report cover

![U.S. Regulatory Affairs Market Size, Share & Trends Report]()

U.S. Regulatory Affairs Market Size, Share & Trends Analysis Report By Services, By Category, By Indication, By Product Stage, By Service Provider, By Company Size, By End-use, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-278-3

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

U.S. Regulatory Affairs Market Size & Trends

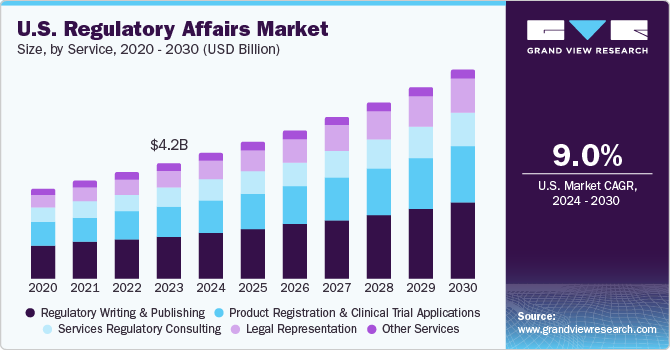

The U.S. regulatory affairs market size was estimated at USD 4.23 billion in 2023 and is projected to grow at a CAGR of 9.0% from 2024 to 2030. The growth in emerging fields, including immunotherapies, orphan drugs, personalized medicines, combination therapies, and specialty therapies, fluctuations in regulatory necessities, and an increase in the occurrence of novel diseases that need effective therapies and vaccines, which require governing strategies to sustain quality, efficiency, and safety.

A rising number of companies aiming at inorganic expansion approaches such as partnerships, acquisitions, and mergers are expected to improve the growth of the regulatory affairs market. As per Reuters update of Jan 2024, many U.S. law corporations are expected to enter into merger agreements in 2024. Stockton & Kilpatrick Townsend announced to merge with smaller companies. In addition, Fennemore Craig, a Phoenix-founded medium size company announced it expansion into Seattle in the current year. Market players including Accell Clinical Research, LLC, Genpact, Criterium, Inc., ICON plc, Promedica International, WuXi AppTec, Pharmalex GmbH, and Medscape are investing significantly in the research and development of U.S. regulatory affairs. These companies are working to make healthcare regulation more accessible for individual use-cases.

The increasing governmental interventions across various countries and the rising financial burden on individuals are expected to drive market growth during the forecast period. Simultaneously, advancements in the healthcare sector and significant research and development efforts are key factors fueling market expansion.

In addition, the rising demand to reduce costs in the life-sciences industry is driving the need for third-party services in regulatory affairs. In addition, the development of efficient software that manages regulatory affairs records is expected to significantly boost market growth in the forecast period. Moreover,the pharmaceutical and healthcare sectors are rapidly expanding worldwide due to factors like an aging population, rising healthcare spending, and advancements in medical treatments and devices. This growth presents a significant opportunity for regulatory affairs outsourcing as companies aim to efficiently navigate complex regulatory environments and expedite product launches.

The outbreak of COVID-19 prompted regulatory authorities such as the FDA and EU to authorize the emergency use of various COVID-19 testing equipment, significantly boosting market growth during the lockdown.

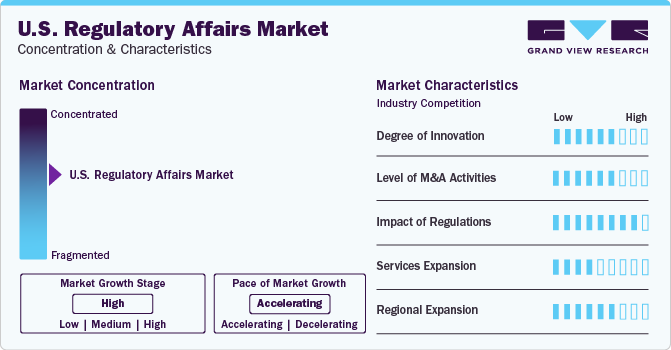

Market Concentration & Characteristics

Industry growth stage is high, and the industry growth is accelerating. The U.S. regulatory affairs industry is characterized by a high degree of innovation due to technological advancements, such as artificial intelligence, machine learning, big data analytics, and automation, which have revolutionized the sector. These technologies enable companies to streamline regulatory processes, enhance compliance, and accelerate product approvals.

The U.S. regulatory affairs market has witnessed significant merger and acquisition (M&A) activities. Companies in this sector have actively engaged in M&A deals to expand their market presence, enhance their service offerings, and gain a competitive edge. The regulatory affairs market plays a crucial role in ensuring compliance with regulations and guidelines set by government authorities, making it a vital sector for businesses operating in various industries.

The government plays a significant role in the U.S. regulatory affairs market, influencing various aspects of regulation, compliance, and enforcement. The regulatory environment in the U.S. is complex and multifaceted, with numerous agencies overseeing different industries and sectors. Government intervention in regulatory affairs can positively and negatively impact businesses, consumers, and the overall economy.

The U.S. Regulatory Affairs market primarily deals with managing and overseeing various industries to ensure compliance with governmental rules and guidelines. The primary service substitutes in the U.S. Regulatory Affairs market are consulting firms. These companies provide expert advice and guidance to businesses navigating complex regulatory environments. The law firms specializing in regulatory affairs offer legal services to help clients navigate the intricacies of regulatory compliance. Technology has become an essential tool for managing regulatory affairs in the digital age. Compliance software and technology providers offer platforms and solutions that help organizations automate and streamline their regulatory processes.

Service Insights

The regulatory writing & publishing segment dominated the market and accounted for a share of over 15% in 2023. The U.S. market for regulatory affairs can be classified into legal representation, regulatory consulting, product registration & clinical trial applications, regulatory writing & publishing, and other services. The increasing outsources of these services are by mid- and large-size medical devices and biopharmaceutical firms. Large medical device and pharma companies outsource regulatory affairs functions, including regulatory writing and publishing services, which helps them, emphasize their central competencies and effectively supervise their internal sources. Large medical device and biopharmaceutical companies with prevailing regulatory affairs sectors are anticipated to boost demand for regulatory writing & publishing services.

Thelegal representation segment is expected to rise with the fastest CAGR over the forecast period. The growth is attributed to the increasing complication in healthcare regulations and the rising healthcare reforms in the country. For instance, as per the JAMA Health Forum study published in October 2023, a survey was conducted by Kaiser Family Foundation (KFF) with a sample population of over 3600 publicly & privately insured adults with healthcare plans. The survey states that in 2022, around 6 in 10 individuals registered an issue in using their health insurance. Complications differ somewhat by coverage category, with problems usually less dominant in Medicare than in private coverage with major types of health insurance including Medicare, employer-provided, Medicaid, or from the Affordable Care Act (ACA) market stated that they faced a problem while using their insurance coverage.

Category Insights

Medical devices accounted for the largest market revenue share in 2023 and are anticipated to grow at the fastest CAGR over the forecast period. This is attributable to pharmaceutical firms' rising outsourcing activities of medical devices, allowing them to focus on their underlying competencies. Growing demand for wearable medical devices, rapid advancements in material sciences and complexities of drug-device combinations are among the factors anticipated to propel the growth of this segment.

The biology segment is expected to witness lucrative growth during the forecast period. In the biotechnology market, the product-making process is complicated, as even a minor environmental alteration can unpleasantly alter a biological product's cells and structure. Moreover, the production process, resources, and equipment aim to avoid bacterial infection during the procedure, as an infected product can be dangerous for patients. Hence, the approaches used during the process ensure a safe & sterilized product. The necessity for retaining a zero-error margin in the biotechnology process is projected to raise the requirement for regulatory affairs services. Thus, growing authorizations of biologics is one of the key factors encouraging the segment's growth in the regulatory affairs market.

Indication Insights

Oncology accounted for the largest market revenue share in 2023.This can be attributed to the growing prevalence of cancer cases, encouraging demand for effective and safe treatment selections. In addition, oncology is one of the beneficial markets for biotechnology & pharmaceutical companies, thus raising the R&D strategies commenced by the companies. For instance, as per the Businesswire news published in December 2023, the U.S. Oncology Network announced that it had joined SCRI Oncology Partners situated in Nashville, Tennessee, for its further expansion. The center provides patients with specified cancer care and opportunities to contribute to clinical trials with novel medications.

The immunology segment is expected to grow at the fastest CAGR during the forecast period owing to its capability to facilitate the treatment of several neurological, cardiovascular, inflammatory, and oncological diseases. This can be attributed to the existence of immune cells all through the body, together with the occurrence of tissue-specific immune cells in organs. The vigorous immunology channel of biopharmaceutical and pharmaceutical companies is projected to propel segment growth.

Product Stage Insights

Clinical studies accounted for the largest market revenue share in 2023. The growing incidences of new diseases and the increasing occurrence of chronic illnesses are expected to enhance the quantity of clinical trials conducted to sustain healthcare requirements. These protocols ensure that the clinical experiments are conducted evidently & guided so that the trials are reliable, effectively shown to individuals, and display realistic data.

The preclinical product stage is expected to grow fastest during the forecast period. The growth is attributed to the growing need for innovative disease treatments, including Zika virus, Ebola, and COVID-19, together with the rising incidence of numerous prevailing diseases, including cancer, neurological diseases, and cardiovascular diseases (CVDs).

Service Provider Insights

Outsourced service providers accounted for the largest market revenue share in 2023 and are anticipated to grow at the fastest CAGR over the forecast period. The growth can be attributed to the growing acceptance of these facilities as outsourcing allows healthcare corporations to decrease costs & staff training periods, prioritize planned projects, expand overall effectiveness, and offer better flexibility. The availability of several outsourcing models appropriate for numerous company sizes is also projected to propel the outsourced market further.

Company Size Insights

The medium-sized companies accounted for the largest market revenue share in 2023 owing to several mid-sized recognized providers, specifically privately held, which are anticipated to promote the segment’s growth. These firms have a strong presence in numerous specific markets across the globe and offer many services, from a few to full-length.

The large-size companies segment is projected to register the fastest CAGR during the forecast period. Large-size companies are prevalent among the known biotechnology, medical device, and pharma companies. The existence of a wide-ranging service and the accessibility of these providers in various geographies enables ease of organization. Hence, it is the major factor supporting their recognition, especially among large firms. Moreover, large pharma corporations usually choose to have a long-period partnership with their service providers to avoid unexpected turbulences in their procedures and, therefore, select a service provider that can meet their supervisory requirements to support their several ramp-up and cross-scale processes.

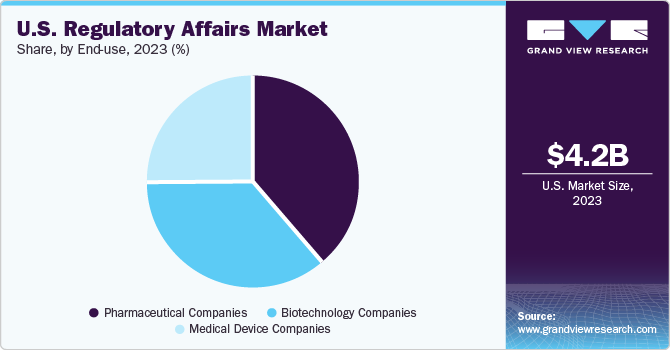

End-use Insights

The pharmaceutical companies segment dominated the market in 2023 and is anticipated to grow at the fastest CAGR over the forecast period, attributed to the expansion in the number of authorized pharmaceutical products. For instance, as per the U.S. Food and Drug Administration, 2021 witnessed the launch of 50 novel drugs. Thus, a rise in the commercialization of new drugs in the U.S. is anticipated to increase the demand for product approval, registration, licensing, and related regulatory services.

The biotechnology companies segment is projected to be the second-fastest-growing segment during the forecast period. The growth is attributed to the high demand & the increasing investment in biologics manufacturing and infrastructure developments, which are expected to increase the demand for regulatory services, including quality & assurance, audit & validation, BLA filings, patent filings, and GMP practices.

Chicago has been constantly contributing to developing healthcare medication and facilities and making them accessible to public health by promoting enacted regulations and spreading their importance. For instance, in March 2023, the Barclays Global Healthcare Conference was held in Chicago. AbbVie, a U.S.-based pharmaceutical R&D Co., participated in the conference to discover and provide developed medications to treat serious health problems and deal with future medical threats. The Barclays Global Healthcare Conference, 2024, will take place in Miami, Florida, in March, which is expected to propel the U.S. regulatory affairs market further.

Key U.S. Regulatory Affairs Company Insights

Some of the key players operating in the market include Accell Clinical Research, LLC, ICON plc and NDA Group AB.

-

Accell Clinical Research, LLC is a contract research organization (CRO) that operates in the U.S. regulatory affairs market, which involves navigating the complex regulatory landscape to ensure compliance with federal and state laws governing the development, testing, and approval of new drugs, devices, and therapies.

-

ICON plc is a global provider of drug development solutions, including regulatory affairs services, that plays a significant role in the U.S. Regulatory Affairs market. The company helps pharmaceutical, biotechnology, and medical device companies efficiently navigate the complex regulatory landscape to bring their products to market.

-

ProMedica, Cambridge Regulatory Services, and Medpace are other market participants in the U.S. regulatory affairs market.

-

ProMedica International is a leading provider of regulatory affairs consulting services in the U.S. The company assists clients in navigating complex regulatory environments and ensuring compliance with various federal and state regulatory requirements.

-

Cambridge Regulatory Services specializes in assisting clients with navigating the complex regulatory landscape, ensuring compliance with relevant laws and regulations, and facilitating the approval process for products and services.

Key U.S. Regulatory Affairs Companies:

- Accell Clinical Research, LLC

- Genpact

- CRITERIUM, INC.

- ICON plc

- Promedica International

- WuXi AppTec

- Medpace

- Charles River Laboratories

- Labcorp Drug Development

- Parexel International (MA) Corporation

- Freyr

- Pharmalex GmbH

- NDA Group AB

- Qvigilance

- BlueReg

- Cambridge Regulatory Services

- VCLS

Recent Developments

-

In October 2023, the U.S. Integrity and Odds-on Compliance announced a merger to introduce the industry’s first global compliance and integrity solution. The merger aims to deliver continuous innovative governing technology solutions & unique compliance proficiency to the growing gaming and sports betting sphere.

-

In February 2023, the U.S. FDA announced acknowledged requests to join the START Pilot Program and chose only three applicants from centers, including the Center for Biologics Evaluation and Research (CBER) and the Center for Drug Evaluation and Research (CDER).

-

In August 2022, ProPharma Group announced that it had acquired OneSource Regulatory & OneSource Regulatory Technology. The acquisition aims to combine superior solutions and services to the life sciences sector.

U.S. Regulatory Affairs Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 7.71 billion

Growth rate

CAGR of 9.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

June 2024

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Services, category, indication, product stage, service provider, company size, end-use

Country scope

U.S.

Key companies profiled

Accell Clinical Research, LLC; Genpact; CRITERIUM, INC.; ICON plc; Promedica International; WuXi AppTec; Medpace; Charles River Laboratories; Labcorp Drug Development; Parexel International (MA) Corporation; Freyr; Pharmalex GmbH; NDA Group AB; Qvigilance; BlueReg; Cambridge Regulatory Services; VCLS

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Regulatory Affairs Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. regulatory affairs market report based on services, category, indication, product stage, service provider, company size, end-use, and country:

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Services Regulatory consulting

-

Legal Representation

-

Regulatory Writing & Publishing

-

Writing

-

Publishing

-

Product registration & Clinical Trial Applications

-

Other Services

-

-

Category Outlook (Revenue, USD Million, 2018 - 2030)

-

Drugs

-

Innovator

-

Preclinical

-

Clinical

-

Pre-Market Approval (PMA)

-

Generics

-

Preclinical

-

Clinical

-

Pre-Market Approval (PMA)

-

-

Biologics

-

Biotech

-

Preclinical

-

Clinical

-

Pre-Maker Approval (PMA)

-

-

ATMP

-

Preclinical

-

Clinical

-

Pre-Maker Approval (PMA)

-

-

-

Biosimilars

-

Preclinical

-

Clinical

-

Pre-Market Approval (PMA)

-

Medical Devices

-

Diagnostics

-

Preclinical

-

Clinical

-

Pre-Market Approval (PMA)

-

Therapeutics

-

Preclinical

-

Clinical

-

Pre-Market Approval (PMA)

-

-

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Oncology

-

Neurology

-

Cardiology

-

Immunology

-

Others

-

-

Product Stage Outlook (Revenue, USD Million, 2018 - 2030)

-

Preclinical

-

Clinical studies

-

PMA

-

-

Service Provider Outlook (Revenue, USD Million, 2018 - 2030)

-

In-house

-

Outsourced

-

-

Company Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Small

-

Medium

-

Large

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Medical Device Companies

-

Pharmaceutical Companies

-

Biotechnology Companies

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

West

-

Midwest

-

Northeast

-

Southwest

-

Southeast

-

Frequently Asked Questions About This Report

b. The U.S. regulatory affairs market size was estimated at USD 4.23 billion in 2023 and is expected to reach USD 4.59 billion in 2024.

b. The U.S. regulatory affairs market is expected to grow at a compound annual growth rate of 9.0% from 2024 to 2030 to reach USD 7.71 million by 2030.

b. The regulatory writing & publishing segment dominated the market in 2023 with a market share of 36.51%. Growth in the segment can be attributed to the acceptance of these facilities, prioritize planned projects, expand overall effectiveness, and offer better flexibility

b. Accell Clinical Research, LLC; Genpact; CRITERIUM, INC.; ICON plc; Promedica International; WuXi AppTec; Medpace; Charles River Laboratories; Labcorp Drug Development; Parexel International (MA) Corporation; Freyr; Pharmalex GmbH; NDA Group AB; Qvigilance; BlueReg; and Cambridge Regulatory Services among others.

b. The growth in emerging fields, including immunotherapies, orphan drugs, personalized medicines, combination therapies, and specialty therapies, fluctuations in regulatory necessities, and an increase in the occurrence of novel diseases that need effective therapies and vaccines, which require governing strategies to sustain quality, efficiency, and safety.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."