U.S. Range Cooker Market Size, Share & Trends Analysis Report By Size (20 inch, 24 inch, 30 inch), By Price Range, By Application (Residential, Commercial), By Distribution Channel (Online, Offline), And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68038-262-4

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

Market size & trends

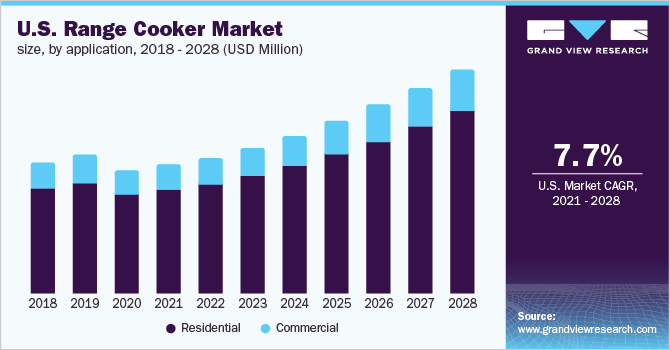

The U.S. range cooker market size was estimated at USD 1.86 billion in 2024 and is expected to expand at a CAGR of 9.4% from 2025 to 2030. The growing popularity of modular kitchens, along with rising living standards, is boosting demand for these products in both the residential and commercial sectors in the U.S. Also, the increasing trend of remodeling homes to build and accommodate modular kitchens is resulting in fast-paced product adoption in the U.S.

Online platforms sell products at low prices and promote them through the digital network by offering huge discounts. The growing trend of food-at-home cooking and the influence of social media, magazines, and TV shows regarding cooking tips and recipes have raised awareness regarding different cooking techniques. Total homeowner equity has nearly doubled in the past five years since 2019, indicating a surge in spending capacity toward home improvement. According to a blog published by KBR Kitchen & Bath in March 2021, the average cost of kitchen remodeling in an American household is currently USD 22,134, according to homeowners, and could go as high as USD 50,000. Smaller kitchen remodeling projects or minor updates can cost around USD 10,000. This budget typically covers tasks such as painting, adding a tile backsplash, replacing the sink, and updating cabinet facades.

The National Association of Realtors (NAR) reported a 10.5% year-over-year increase in existing home sales, reaching a seasonally adjusted annual rate of 6 million units in August 2020. Moreover, manufacturers are partnering with contractors and builders to build homes with appropriate range cookers in the kitchen. Technological advancements and the rising usage of IoT in kitchen appliances are expected to be the key factors favoring the growth of range cooker industry in the coming years.

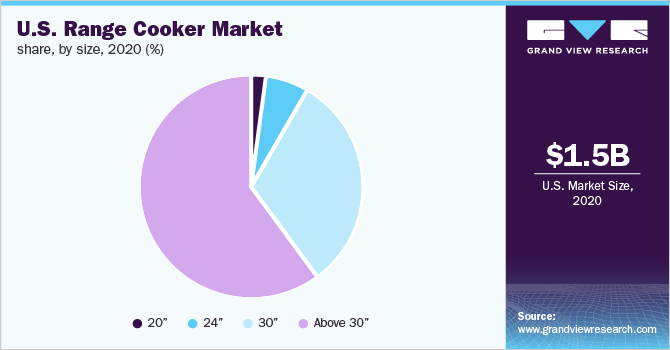

Size Insights

The 30 inch range cooker dominated the range cooker market and accounted for the largest revenue share of 32.1% in 2024. 30-inch range cookers are much more versatile than regular cookers as they offer more settings, functions, and cooking options. Many even feature a separate grill so that one can grill and roast food at the same time. GE Appliances, a Boston-based company with a dedicated team, leading technology, and global reach and capabilities, has been creating 30 inch range cookers along with various other white goods.

The range cookers above 30-inch segment is expected to grow significantly at a CAGR of 9.2% over the forecast period. Range cookers sized above 30 inches are generally used in commercial kitchens, such as restaurants and hotels. In January 2025, eating and drinking establishments recorded sales of USD 98.6 billion, marking a 0.9% increase from December’s revised total of USD 97.7 billion in the U.S. This marks the 10th consecutive month of rising sales, with nearly USD 5 billion added over the past year. Compared to January 2024, total restaurant sales were up by 5.4%. Furthermore, the increasing number of culinary shows, such as MasterChef, Hell’s Kitchen, BBQ Blitz, and BBQ Championship, on American television form a major consumer base for these products. These users require heavy-duty products, and thus, above 30 inch range cookers are preferred.

Price Range Insights

Range cookers above USD 5,000 dominated the market, with the largest revenue share of 48.1% in 2024. Many manufacturers offer high-end range cookers in the country, including Viking, KitchenAid, Thermador, Bertazzoni, and Dacor Monogram. For example, KitchenAid provides a 36-inch Smart Commercial-Style Gas Range, equipped with two 20,000 BTU Ultra Power Dual-Flame Burners, offering the power and precision required for tasks such as stir-frying, searing, simmering, and sautéing.

The demand for range cookers priced between USD 3,001 and USD 5,000 is expected to grow at the fastest CAGR of 10.2% over the forecast period. Manufacturers offering range cookers priced between USD 3,001 to 5,000 include GE, Fisher & Paykel, Bosch, Café, KitchenAid, and ZLINE. For instance, Café by Design offers Café 30”, a smart slide-in, front-control, gas range, for approximately USD 3,099. The product features an edge-to-edge cooktop with six adaptable burners and an integrated griddle, making it ideal for preparing large meals.

Application Insights

The residential application dominated the range cookers market and accounted for the largest revenue share of 81.2% in 2024. Manufacturers offer an impressive array of products to residential consumers. These are either all-electric, all-gas, or dual fuel, where they combine two sources, usually gas and electricity. Some of the latest designs include steam ovens, too. The most popular feature of the range, contributing to its adoption in residences, is its impressive cooking capacity, with up to three ovens plus a separate grill cavity.

In 2023, Bertazzoni launched a 120cm A-rated induction range cooker featuring six cooking zones, including five burners and a Teppanyaki grill. These range cookers are perfect for family events, offering ample cooking space and versatility to prepare large meals with ease and efficiency.

The demand for range cookers in the commercial sector is expected to grow at a CAGR of 8.8% over the forecast period. Hotels, restaurants, and other eateries prepare meals in minutes, and similar instances can be seen in most reality cooking shows. The lightning-fast cooking speed at these places is attributed to the range cookers designed specifically for commercial purposes.

Distribution Channel Insights

The offline channel dominated the range cooker industry and accounted for the largest revenue share in 2024. Consumers prefer this channel as they can check the product features, get detailed instructions about product features, and enjoy installation services by specialists post purchase. Furthermore, restaurants, hotels, and large builders prefer direct association with product manufacturers. As proper interaction for a better understanding of minute details is essential in B2B sales, offline channels are highly preferred. Retail stores are the major distributors of range cookers and related accessories. Moreover, the country has frequent exhibitions and fairs where prominent manufacturers launch and showcase their products, which contribute significantly to overall sales.

The online channel is expected to grow at the fastest CAGR over the forecast period on account of the growing familiarity and dependence of millennials, Generation X, and Generation Z on e-commerce and the internet. Value-added services, including discounted prices, cash-on-delivery, reviews, and paybacks offered by e-retailers, are expected to drive the growth of e-commerce in the coming years. Companies such as Amazon, eBay, Walmart, Home Depot, and Wayfair are the major online sellers of range cookers in the country.

Key U.S. Range Cooker Company Insights

Some of the major companies in the U.S. range cooker industry are Amana, GE Appliances, SAMSUNG, and Premier Marketing. Leading companies in the market are adopting various growth strategies, including partnerships and new product launches, to maintain their competitive edge. A growing number of industry players are shifting their focus to the development of innovative products. Excellent customer service, warranties, and maintenance are key to building loyalty. Companies often offer extended warranties, responsive support, and easy installation.

-

Amana is a home appliance brand based in the U.S. It is known for producing affordable, reliable products, including refrigerators, washers, dryers, and range cookers. Founded in 1934, it focuses on delivering practical, durable appliances with user-friendly features, offering a balance of quality and value for everyday consumers.

-

GE Appliances, a subsidiary of Haier Group, is a prominent American manufacturer of home appliances, including refrigerators, dishwashers, ovens, and washers. The company's history dates back to 1907 and is known for its focus on innovation, quality, energy efficiency, and offering a wide range of products to meet diverse consumer needs.

Key U.S. Range Cooker Companies:

- Amana

- GE Appliances

- SAMSUNG

- Premier Marketing

- Monogram

- LG Electronics

- Frigidaire

- VIKING RANGE, LLC

- THERMADOR

- Dacor, Inc.

- Whirlpool

Recent Developments

-

In February 2025, Rangemaster launched two next-generation range cooker families, Estel Deluxe and Edge Deluxe, setting new standards for performance, design, and craftsmanship. First previewed at KBB Birmingham 2024, the models offer enhanced features such as a larger 29-litre flexi-grill, multifunction ovens with eight functions, including the new Duo function, and tailored configurations. It is available in 90cm, 100cm, and 110cm sizes. Furthermore, the range offers both dual fuel and induction options, with upgraded hob features like a 4kW burner and dishwasher-safe griddle.

-

In January 2025, Stoves launched enhanced Richmond and Richmond Deluxe range cookers, featuring an innovative Quad-Oven design with 4 fully functioning ovens and up to 196 liters of capacity. The new models also introduce AirFry technology for faster, healthier cooking. The cookers offer improved reliability and advanced cooking features and are available in 90 cm, 100 cm, and 110 cm sizes with dual fuel, electric, and induction options.

-

In November 2024, Hafele launched a range of premium appliances, enhancing its position in the kitchen solutions market. New products include the Midora Full Steam Oven with multiple cooking functions, the Renata Cookerhoods featuring filter-free design and auto-clean technology, and the Altius Plus Hobs with advanced technology, glossy finishes, and sleek design.

-

In September 2024, at IFA 2024 in Berlin, Electrolux Group unveiled its biggest kitchen launch under the AEG brand, featuring AI-assisted cooking for the first time. The new AEG Kitchen Range included hoods, ovens, refrigeration, hobs, and dishwashers, with AI TasteAssist technology that optimizes cooking settings based on recipes. The range also introduced the CookSmart Touch Display, offering step-by-step guidance for cooking and perfecting dishes.

-

In March 2024, GE Appliances launched a new portfolio of 36 slide-in gas and electric ranges, including the premium GE 30" Slide-In Electric Convection Range with EasyWash Oven Trayand No Preheat Air Fry. The 600 series featured a removable, dishwasher-safe tray for easy cleaning, reducing cook times with modes like No Preheat Air Fry and No Preheat Pizza. Additional upgrades included PowerBoil Burners, Express Preheat, and WiFi connectivity.

U.S. Range Cooker Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 2.04 billion |

|

Revenue forecast in 2030 |

USD 3.19 billion |

|

Growth Rate |

CAGR of 9.4% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Size, price range, application, distribution channel |

|

Country scope |

U.S. |

|

Key companies profiled |

Amana; GE Appliances; SAMSUNG; Premier Marketing; Monogram; LG Electronics; Frigidaire; VIKING RANGE, LLC; THERMADOR; Dacor, Inc.; and Whirlpool |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

U.S. Range Cooker Market Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. range cooker market report based on size, price range, application, and distribution channel.

-

Size Outlook (Revenue, USD Million, 2018 - 2030)

-

20"

-

24"

-

30"

-

Above 30"

-

-

Price Range Outlook (Revenue, USD Million, 2018 - 2030)

-

USD 1000 and Below USD 1,000

-

USD 1,001 - USD 3,000

-

USD 3,001 - USD 5,000

-

Above USD 5,000

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

-

Distribution Channel Outlook (Revenue, USD Million, 2016 - 2028)

-

Online

-

Offline

-

Frequently Asked Questions About This Report

b. The U.S. range cooker market size was estimated at USD 1.86 billion in 2024 and is expected to reach USD 2.04 billion in 2024.

b. The U.S. range cooker market is expected to expand at a CAGR of 9.4% from 2025 to 2030 to reach USD 3.19 billion by 2030.

b. The 30 inch range cooker dominated the range cooker market and accounted for the largest revenue share of 32.1% in 2024. 30-inch range cookers are much more versatile than regular cookers as they offer more settings, functions, and cooking options. Many even feature a separate grill so that one can grill and roast food at the same time. GE Appliances, a Boston-based company with a dedicated team, leading technology, and global reach and capabilities, has been creating 30 inch range cookers along with various other white goods.

b. Key U.S. Range Cooker Companies Amana; GE Appliances; SAMSUNG; Premier Marketing; Monogram; LG Electronics; Frigidaire; VIKING RANGE, LLC; THERMADOR; Dacor, Inc.; and Whirlpool

b. Key factors that are driving the market growth include the growing popularity of modular kitchens, along with rising living standards, is boosting demand for these products in both the residential and commercial sectors in the U.S. Also, the increasing trend of remodeling homes to build and accommodate modular kitchens is resulting in fast-paced product adoption in the U.S.

b. Range cookers above USD 5,000 dominated the market, with the largest revenue share of 48.1% in 2024. Many manufacturers offer high-end range cookers in the country, including Viking, KitchenAid, Thermador, Bertazzoni, and Dacor Monogram. For example, KitchenAid provides a 36-inch Smart Commercial-Style Gas Range, equipped with two 20,000 BTU Ultra Power Dual-Flame Burners, offering the power and precision required for tasks such as stir-frying, searing, simmering, and sautéing.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."