- Home

- »

- Medical Devices

- »

-

U.S. Radiodermatitis Market Size, Industry Report, 2030GVR Report cover

![U.S. Radiodermatitis Market Size, Share & Trends Report]()

U.S. Radiodermatitis Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Topical, Dressings), By Distribution Channel, By Facility Type (Hospital-based Radiotherapy Centers, Independent Radiotherapy Centers), And Segment Forecasts

- Report ID: GVR-4-68040-307-1

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Radiodermatitis Market Size & Trends

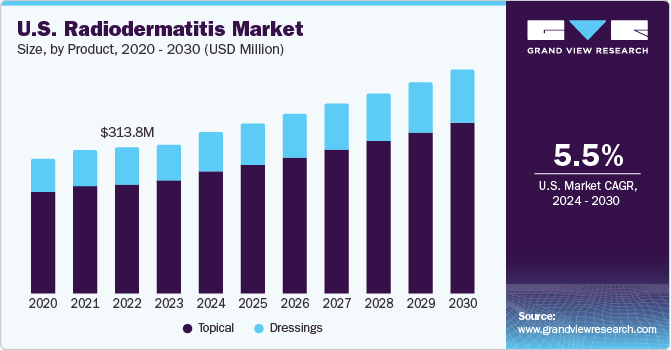

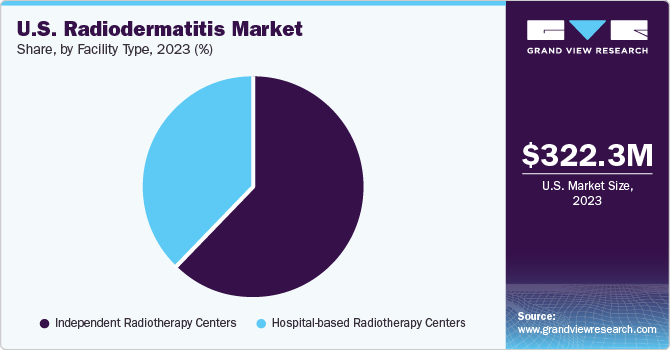

The U.S. radiodermatitis market size was estimated at USD 322.28 million in 2023 and is projected to grow at a CAGR of 5.5% from 2024 to 2030. This growth can be attributed to the increasing number of patients suffering from radiodermatitis as an adverse effect of radiation therapy. According to recent estimates, 95.0% of cancer patients receiving radiation therapy experience radiodermatitis, characterized by erythema and dry/moist desquamation. This has created a significant need for radiodermatitis treatment products, driving the market.

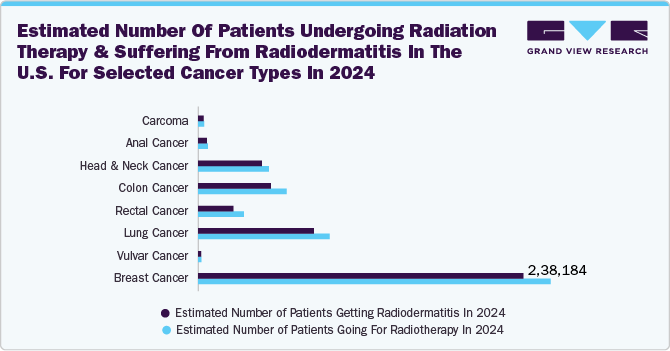

Radiodermatitis, a prevalent complication of radiation therapy, particularly affects patients undergoing treatment for breast and vulvar cancer. A significant number of patients are expected to develop this condition by the end of 2024. It is estimated that nearly 238,184 patients will develop breast cancer-related radiodermatitis and 2,032 patients will develop vulvar cancer-related radiodermatitis in 2024, highlighting the importance of effective prevention strategies. Key prevention methods include maintaining skin cleanliness, moisturizing, avoiding irritants, and adhering to prescribed treatments, which may involve using creams or dressings.

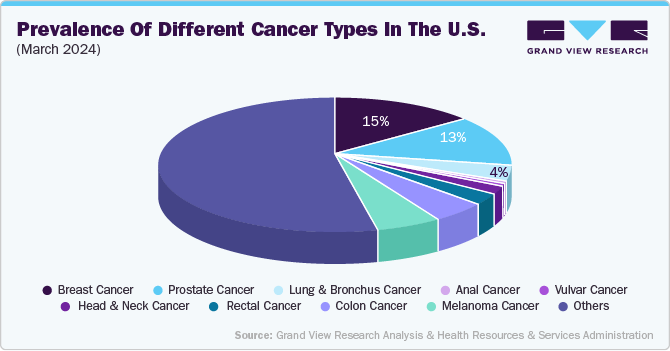

The growing incidence of cancer is likely to boost the U.S. market. Breast cancer, for instance, holds the dominant share among all cancer types, with an estimated 5-year prevalence of 1.2 million cases. This prevalence underscores the significant number of individuals who undergo radiation therapy as part of their treatment, leading to a corresponding increase in incidence of radiodermatitis.

Anal & vulvar cancers, with their significant prevalence and relatively high survival rates, represent a notable segment of the U.S. radiodermatitis market, given the adverse effects associated with radiation therapy for these cancers. The expected 5-year prevalence of anal cancer is 42,000 cases and 21,568 cases for vulvar cancer. In addition, the 5-year survival rates of anal and vulvar cancers are approximately 70.6% and 69.6%, respectively, highlighting the importance of effective radiodermatitis management strategies. The lifetime risk of developing these types of cancer is 0.2% for anal cancer and slightly higher at 0.3% for vulvar cancer. This underscores the importance of early detection & comprehensive treatment plans, including radiodermatitis management, to improve patient outcomes and reduce the burden of these diseases on individuals & healthcare systems.

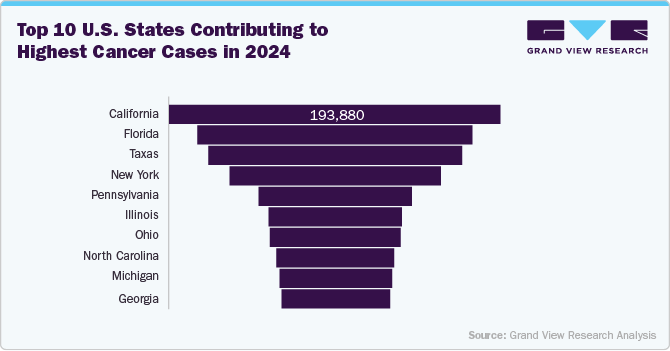

Furthermore, the 5-year survival rate for breast cancer patients is nearly 91.2%, indicating that a substantial portion of these patients are likely to experience radiodermatitis as an adverse effect of radiation therapy. In addition, the lifetime risk of developing breast cancer in the U.S. was around 13.0%, suggesting a continuous demand for effective radiodermatitis treatments as new cases emerge. The market is significantly influenced by the prevalence of various cancers across different states. California leads in the number of patients undergoing radiotherapy for various cancer types, including female breast, colon & rectum, leukemia, lung & bronchus, melanoma of the skin, non-Hodgkin lymphoma, prostate, urinary bladder, uterine cervix, and uterine corpus. The high incidence in California suggests a substantial demand for radiodermatitis management solutions within the state, potentially driving market growth due to the need for effective treatment options. The data underscores the importance of tailored radiodermatitis management strategies that can cater to the diverse needs of patients across different cancer types and geographical locations, highlighting the potential for targeted interventions & innovations in the radiodermatitis treatment market.

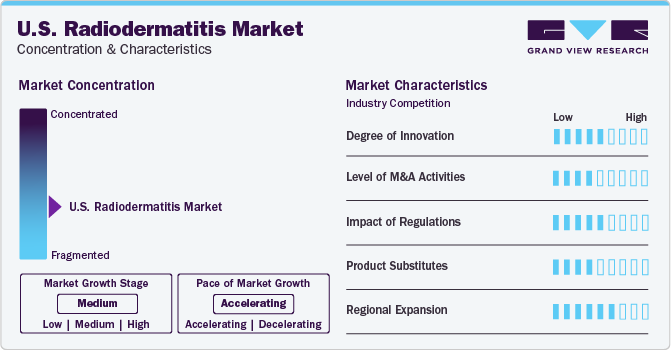

Market Concentration & Characteristics

The industry growth stage is medium, and pace of the market growth is accelerating. This can be attributed to the increasing prevalence of cancer, especially breast and prostate cancers, which often require radiation therapy as part of their treatment. The market’s growth is fueled by the rising awareness and knowledge about radiodermatitis among healthcare professionals & patients, facilitated by efforts of governmental & private healthcare organizations. These organizations are actively publishing information and guidelines on the management and treatment of radiodermatitis, which is expected to enhance the growth potential.

The U.S. market is characterized by a moderate level of mergers and acquisitions by leading players. For instance, in October 2019, 3M announced the acquisition of Acelity L.P. Inc., expanding its footprint in advanced and surgical wound care. The deal includes Acelity’s KCI subsidiaries worldwide and was valued at approximately USD 6.7 billion, including debt assumption, pending closing, & adjustments. Regulations are crucial in shaping the radiodermatitis market, ensuring high-quality, safe products. In the U.S., the Food and Drug Administration (FDA) plays a pivotal role in regulating radiation-emitting products, including those used in medical imaging, surgery & other applications where radiation exposure might occur. The FDA regulations cover a broad spectrum of products, from drugs and medical devices to radiation-emitting products, ensuring that all products meet stringent safety standards. This regulatory oversight is essential for maintaining the market’s integrity, protecting consumers from substandard or unsafe products, and fostering innovations & novel treatments for radiodermatitis.

In addition to product expansion, the market is witnessing advancements in treatment approaches, including novel therapies, such as Photobiomodulation (PBM) and cryotherapy. PBM, also known as low-level laser therapy, has shown promise in reducing inflammation and promoting tissue repair, which may benefit patients with radiodermatitis. Cryotherapy, on the other hand, involves the application of cold temperatures to the skin, which can help alleviate symptoms such as itching and pain. These innovative treatment options reflect a growing focus on improving patient comfort and outcomes in managing radiodermatitis. The U.S. market is witnessing significant regional expansion as companies seek to capitalize on the growing demand for alternate technologies. Key companies in the radiodermatitis market are focusing on market expansion. For instance, in January 2021, Integra LifeSciences Holdings Corporation acquired ACell, Inc., enabling it to provide comprehensive complex wound management solutions and cater to the needs of radiodermatitis patients.

Product Insights

The topical product segment held the largest share of 75.68% in 2023 and is anticipated to grow at the fastest CAGR of 5.7% during the forecast period. These products, including creams, gels, and ointments, are widely used to treat & prevent radiodermatitis. Formulated with ingredients that soothe and shield the skin, these products help reduce inflammation and promote healing. The launch of new topical creams by major pharmaceutical companies exemplifies this trend. For instance, in February 2024, Lutris Pharma’s novel topically applied BRAF inhibitor LUT014 received FDA orphan drug designation for treating EGFR inhibitor-induced acneiform rash, addressing an unmet need in the market. The cream’s unique natural ingredient blend demonstrated significant efficacy in managing radiodermatitis symptoms, leading to strong sales and high demand from patients & healthcare providers.

The dressings market is expected to exhibit significant growth over the forecast period, driven by a wide range of products and their extensive applications in wound management, especially in treating radiation burns. Dressings such as foam-based, hydrogel, hydrocolloid, silicone-coated, and silver-leaf have proven effective across various grades of radiation burns, contributing to their anticipated moderate growth. Hydrogel and hydrocolloid dressings, known for quick healing, minimal discomfort, & high protection against infection, are increasingly preferred for radiation burn treatment. The development of innovative foam dressings, such as ConvaTec’s FoamLite, which cater to various levels of wound exudation, is contributing to the expansion of the foam dressing market. These technological advancements offer improved solutions for managing wounds with different exudate levels, driving the segment growth.

Distribution Channel Insights

The retail pharmacies segment accounted for the largest revenue share of 39.62% in 2023. Retail pharmacies play a vital role in the market by providing accessible distribution points for treatment products. Sold by drugstores and mass retailers, patients can easily obtain prescribed medications and treatments at their convenience. Retail pharmacies offer extended hours and weekend availability, making it easier for patients to access necessary treatments. Many retail pharmacies offer patient support programs, such as Medication Therapy Management (MTM) services, which can help patients effectively manage their radiodermatitis symptoms. A study published in the Journal of the American Pharmacists Association 2020 found that pharmacist-led interventions in retail settings can significantly improve patient outcomes for chronic conditions, including skin conditions like radiodermatitis.

Online pharmacies are expected to witness the fastest CAGR of 6.1% during the forecast period. Online pharmacies are an important part of the U.S. market, offering patients convenient and accessible options for obtaining radiodermatitis treatment products. E-commerce and digital health technologies have enabled patients to order prescribed medications & treatments from the comfort of their homes, often with expedited shipping options. This convenience is particularly beneficial for patients with mobility issues or limited access to transportation. In addition to their convenience, online pharmacies also play a growing role in patient education and support for radiodermatitis management.

Facility Type Insights

The independent radiotherapy centers segment accounted for the largest revenue share of 62.47% in 2023 and is expected to grow at the fastest CAGR of 5.8% during the forecast period. The segment is gaining prominence due to specialized care and treatment offerings for patients undergoing radiation therapy, with a significant focus on managing the adverse effects of radiation therapy, such as radiodermatitis. This is crucial for cancer patients, and Integrated Radiation Centers (IRCs) are pivotal in this process. Recent trends indicate a growing emphasis on improving the quality of care and treatment protocols across multiple centers, including IRCs, driven by the recognition that more than half of patients treated with radiation therapy develop radiodermatitis at some point during treatment. There is a growing emphasis on more targeted and effective treatments in the market, focusing on topical drugs, dressings, and oral medications. This shift signifies the increasing awareness and dedication in IRCs to offer comprehensive care to patients, encompassing radiodermatitis management.

Several prominent companies in the global radiodermatitis market are actively pursuing various strategies to expand their market presence and drive innovation, including mergers, acquisitions, & collaborations, to boost their product portfolios and capitalize on new opportunities. The radiodermatitis market in the U.S. is observing a growing emphasis on hospital-based radiotherapy centers due to the growing prevalence of radiodermatitis as an adverse effect of radiotherapy in cancer patients, especially those with breast cancer. The rising incidence of cancer, influenced by the increasing prevalence of diabetes & obesity, is anticipated to boost the demand for radiodermatitis treatment products in these centers. A study published by BMC Respiratory Research in 2021 states that diabetes mellitus is a widespread chronic metabolic disease, and the annual occurrence of complications resulting from diabetes is increasing. Recent research has revealed that diabetes is a substantial risk factor for radiation toxicity following radiotherapy for various types of tumors, which highlights the importance of developing effective radiodermatitis treatment options.

Key U.S. Radiodermatitis Company Insights

The U.S. radiodermatitis market is a dynamic and competitive industry with several key players focused on gaining higher share. The companies in this market focus on R&D, strategic partnerships, and product launches. Their commitment to advancing care through technological innovations has contributed to their substantial market share.

Key U.S. Radiodermatitis Companies:

- Stratpharma AG

- Smith & Nephew plc

- Molnlycke Health Care AB

- Derma Sciences, Inc.

- Convatec, Inc.

- 3M

- Alliqua BioMedical

- BMG Pharma spA

Recent Developments

-

In April 2024, Mölnlycke entered an agreement to acquire a prominent wound-cleansing manufacturer, a move that can strengthen its position as a global leader in wound care.

-

In January 2024, Smith+Nephew, a global medical technology company, finalized the acquisition of CartiHeal, the developer of Agili-C, an innovative sports medicine technology designed for knee cartilage regeneration.

-

In January 2023, Convatec announced the U.S. launch of ConvaFoam, a range of advanced foam dressings tailored to meet the needs of healthcare providers and patients. ConvaFoam is suitable for various wound types & stages, simplifying dressing selection for wound care and skin protection

U.S. Radiodermatitis Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 348.76 million

Revenue forecast in 2030

USD 481.07 million

Growth rate

CAGR of 5.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, facility type

Key companies profiled

Stratpharma AG; Smith & Nephew plc; Molnlycke Health Care AB; Derma Sciences, Inc.; Convatec, Inc.; 3M; Alliqua BioMedical; BMG Pharma spA

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country or regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Radiodermatitis Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. radiodermatitis market report based on product, distribution channel, and facility type:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Topical

-

Corticosteroids

-

Hydrophilic Creams

-

Antibiotics

-

Others

-

-

Dressings

-

Hydrogel and Hydrocolloid Dressings

-

No Sting Barrier Films

-

Honey-Impregnated Gauze

-

Silicone-Coated Dressings

-

Others

-

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacies

-

Retail Pharmacies

-

Online Pharmacies

-

-

Facility Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital-based Radiotherapy Centers

-

Independent Radiotherapy Centers

-

Frequently Asked Questions About This Report

b. The U.S. radiodermatitis size was estimated at USD 322.8 million in 2023 and is expected to reach USD 348.76 million in 2024.

b. The U.S. radiodermatitis market is expected to grow at a compound annual growth rate of 5.5% from 2024 to 2030 to reach USD 481.07 million by 2030.

b. Topical product segment held largest market share of 75.68% in 2023 and is anticipated to witness the fastest CAGR of 5.7% during the forecast period. These products, which include creams, gels, and ointments, are widely used to treat and prevent radiodermatitis.

b. Some of the key players in the market include Stratpharma AG, Smith & Nephew plc, Molnlycke Health Care AB, Derma Sciences Inc, Convatec Inc, 3M Company, Alliqua BioMedical, BMG Pharma spA.

b. The growing incidences of cancer aid the U.S. radiodermatitis market, primarily due to the high prevalence and treatment requirements of certain types of cancer.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.