- Home

- »

- Clothing, Footwear & Accessories

- »

-

U.S. Racket Sports Market Size, Share, Industry Report, 2030GVR Report cover

![U.S. Racket Sports Market Size, Share & Trends Report]()

U.S. Racket Sports Market (2025 - 2030) Size, Share & Trends Analysis Report By Sport (Badminton, Squash, Pickleball, Table Tennis, Tennis, and Racquetball), By Product, By End User, By Player Category, By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-374-0

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Racket Sports Market Size & Trends

The U.S. racket sports market size was estimated at USD 5.15 billion in 2024 and is expected to grow at a CAGR of 6.8% from 2025 to 2030. This growth is largely fueled by a rising number of health-conscious consumers and the increasing participation in sports such as tennis, badminton, and squash. Advancements in equipment technology, particularly the integration of high-performance materials, are driving demand for premium products and improving the overall consumer experience. Moreover, the expansion of sports infrastructure, along with heightened visibility from global sporting events, is attracting a broader consumer base to the market. Advancements in equipment technology, especially the incorporation of high-performance materials, are driving demand for premium products and elevating the overall consumer experience.

The market growth is primarily driven by a surge in health-conscious consumers and the rising participation in sports such as tennis, badminton, and squash. Technological innovations in equipment, particularly the use of high-performance materials are fueling demand for premium products and enhancing the overall consumer experience. In addition, the increasing availability of sports infrastructure, coupled with the visibility provided by global sporting events, is broadening the market’s consumer base. These factors collectively position the U.S. racket sports market for sustained growth and present lucrative opportunities for industry players to capitalize on emerging trends and innovations.

Technological advancements in equipment design also play a crucial role in market expansion. The incorporation of high-performance materials such as carbon fiber and graphene into rackets enhances durability, control, and power, appealing to both professional athletes and recreational players. These innovations contribute to the development of premium product segments, which cater to more discerning consumers seeking superior performance. As a result, businesses in the racket sports industry are capitalizing on the demand for cutting-edge equipment, thereby boosting their competitive positioning.

For instance, in January 2025, Wilson Sporting Goods Co. launched the Clash v3 tennis racket, designed for players seeking enhanced power and comfort on the court. This latest model features innovative SI3D technology that combines flexibility with stability, improving performance on off-center shots through the Hit Stabilizer system. The racket’s design includes a user-friendly “Click & Go” bumper and grommet system made from eco-friendly materials, alongside a refreshed color scheme.

Furthermore, improved accessibility to racket sports, through the development of infrastructure and sports facilities worldwide, is broadening the market’s reach. The construction of tennis courts, badminton gyms, and squash facilities, particularly in emerging markets, enables greater participation. In addition, global events such as the Olympics and prestigious tournaments elevate the visibility of racket sports, further driving interest and engagement. As the industry continues to benefit from grassroots initiatives and sports organization support, the racket sports market is poised for sustained growth and profitability.

In February 2025, Hunters Run Country Club in Boynton Beach announced that it is undergoing significant renovations to enhance its racquet sports facilities. The club is set to add new pickleball courts and refurbish existing tennis courts, reflecting the growing popularity of these sports among its members. This expansion aims to provide a more comprehensive recreational experience, catering to both seasoned players and newcomers alike. The improvements are part of a broader initiative to modernize the club’s amenities and attract more residents to the community.

Furthermore, companies operating in the market are focusing on enhancing market penetration by increasing brand awareness via TV commercials and print media, the internet, social media platforms, team sponsorships, and partnerships with the athletes of various sports and fitness enthusiasts. In addition, social media influencers and favorite sports personnel are endorsing various brands, which are likely to support the growth of the market during the forecast period.

Sport Insights

Tennis sports market accounted for a share of 53.6% in 2024. The growth market is driven by increasing health awareness, rising participation across all age groups, and expanding sports infrastructure. Technological advancements in racquets, apparel, and footwear are enhancing performance and attracting both amateur and professional players. In addition, high-profile tournaments and media coverage are boosting visibility and engagement. Public and private investments in facilities, along with initiatives to make the sport more accessible, are further accelerating market growth.

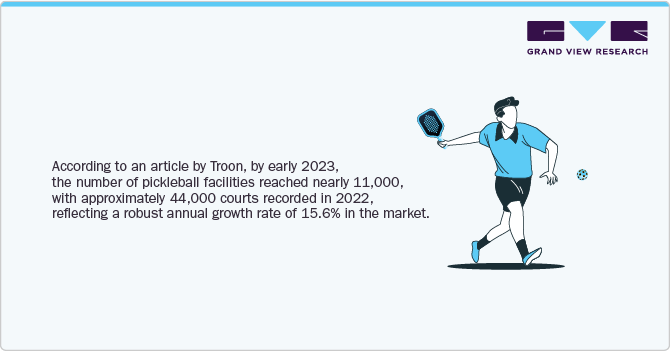

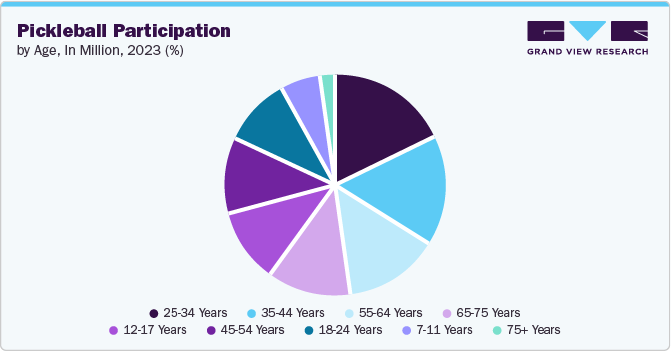

The pickelball sports market is expected to grow at a CAGR of 12.2% from 2025 to 2030 with its adoption expected to increase significantly, driven by substantial public and private investments in courts and equipment. The rise of pickleball has created significant demand for equipment, apparel, and facilities, contributing to the overall growth of the racket sports sector. The popularity of pickleball, alongside the continued growth of tennis and badminton, indicates the increasing diversification of the racket sports market, catering to different preferences and skill levels. As per the National Sporting Goods Association (NSGA), the popularity of pickleball has skyrocketed to unprecedented levels, with the number of participants surging to 6.4 million in 2022, compared to approximately 2.1 million participants in 2019.

Product Insights

The apparel segment accounted for a revenue share of 59.48% in 2024. This segment is further segmented into top wear, bottom wear, and inner wear. The growing popularity of athleisure wear, which combines athletic and fashion elements, is expected to fuel demand for stylish and functional apparel designed explicitly for racket sports. Moreover, the increasing participation of women and youth in racket sports is also expected to drive product demand. Well-established brands such as Nike, Adidas, and Under Armour play a dominant role in this market. Their extensive marketing campaigns and celebrity endorsements have created strong brand loyalty among consumers, who are willing to pay a premium for the latest apparel from these brands.

The equipment segment is estimated to grow at a CAGR of 7.7% from 2025 to 2030. The Technological advancements in equipment design and materials have enhanced the performance and durability of rackets, strings, and balls. The introduction of lightweight and powerful rackets, high-performance strings, and advanced ball designs has increased the appeal of racquet sports among players of all levels. This has led to increased spending on equipment as players strive to improve their game.

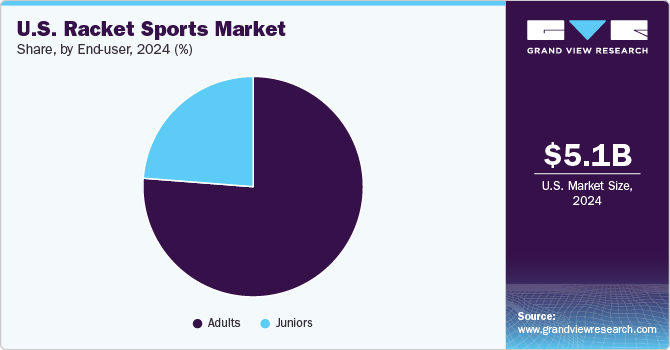

End User Insights

Adults accounted for a share of 76.23% of the market revenue in 2024, reflecting the growing consumer shift toward digital transactions. This high percentage is attributed to factors such as increased awareness of health and fitness, the popularity of social and recreational sports, and the growing trend of adults engaging in leisure activities that promote physical well-being. This segment is further divided into men and women. Sports such as tennis, pickleball, and badminton have gained traction among adults due to their accessibility and suitability for various skill levels. The demand for quality equipment, club memberships, and professional coaching has further reinforced the strong presence of adults in the market.

The junior segment is projected to grow at a CAGR of 1.4% from 2025 to 2030. Schools, sports academies, and community programs are actively promoting racket sports such as tennis and pickleball, encouraging early skill development. In addition, brands are investing in junior-friendly equipment and training programs, making the sport more accessible for young players. With growing interest in professional racket sports and an increasing number of junior tournaments, this segment is expected to expand rapidly in the coming years.

Player Category Insights

Recreational players accounted for a share of 76.00% in 2024, due to the widespread appeal of sports such as tennis, pickleball, and badminton as social and fitness activities. The accessibility of public courts, affordable equipment, and flexible playing schedules have encouraged casual participation. In addition, the rising popularity of group play, particularly among older adults and weekend enthusiasts, has fueled market growth. Many players engage in these sports for leisure and wellness rather than competition, making recreational players the largest segment in the market.

The professional players segment is projected to grow at a CAGR of 5.3% from 2025 to 2030. riven by rising investments in coaching, training facilities, and sponsorships. Increased media coverage, high-profile tournaments, and the success of professional athletes have inspired more young players to pursue careers in racket sports. In addition, advancements in sports technology and performance analytics are enhancing player development, attracting talent at an early age. With growing prize money and endorsements, the professional segment is rapidly expanding as more players seek competitive careers in sport.

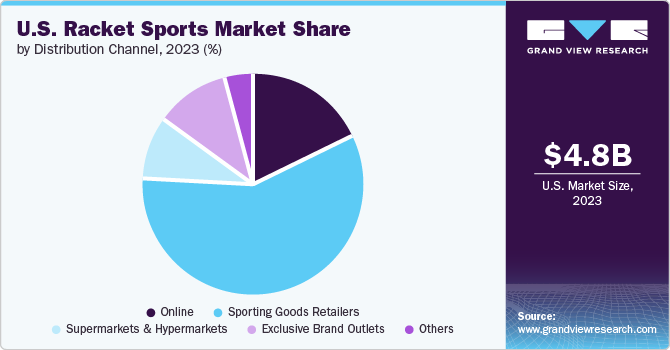

Distribution Channel Insights

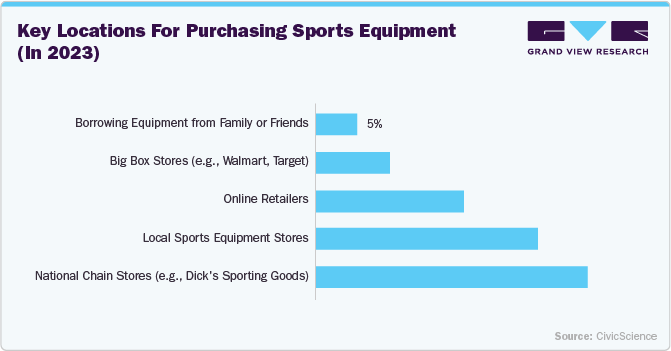

The sporting goods retailers segment accounted for a revenue share of 38.86% in 2024. Sporting goods retailers offer convenient access to racket sports equipment, with numerous store locations and online platforms catering to casual players and seasoned athletes. Moreover, these retailers often host in-store clinics and demonstrations, providing expert guidance and fostering a sense of community among players. This personalized approach enhances customer experience and drives loyalty, further contributing to the market's growth.

The online segment is estimated to grow at a CAGR of 8.8% from 2025 to 2030. The convenience, affordability, and wide selection available through e-commerce platforms have attracted consumers to purchase their racket sports equipment and accessories online. Moreover, the ability for consumers to compare prices and read reviews from other customers has enhanced their confidence in online purchases, leading to increased demand for racket sports equipment and accessories through this channel. Besides, the rise of social media and influencer marketing has also played a crucial role in driving online sales, as consumers are exposed to product reviews, demonstrations, and endorsements through these digital channels.

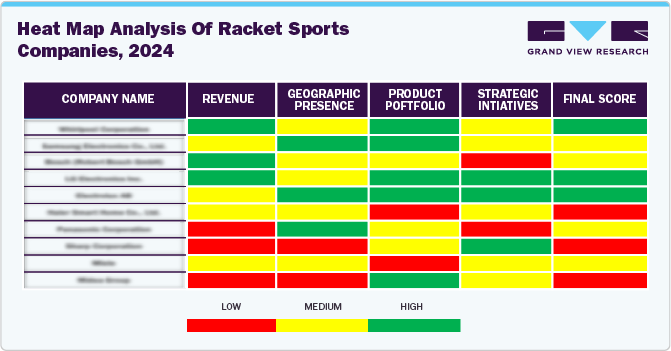

Key U.S. Racket Sports Company Insights

Companies in the U.S. racket sports market are constantly innovating and introducing new products to meet the evolving needs of players across tennis, badminton, squash, and pickleball. They are focusing on enhancing product quality and durability to withstand intense gameplay and various playing conditions. This includes the use of advanced materials, cutting-edge manufacturing techniques, and stringent testing processes to ensure high performance and longevity. Many manufacturers in the outdoor sporting goods market are collaborating with athletes, influencers, and sports enthusiasts to increase their brand presence among consumers. Moreover, these manufacturers are partnering with and even providing sponsorships to sports organizations to increase their market visibility. A brand market share analysis reveals that leading companies are leveraging these strategies to strengthen their market position and drive growth in the highly competitive racket sports industry.

Key U.S. Racket Sports Companies:

- Wilson Sporting Goods

- HEAD

- Prince Sports

- Babolat

- Yonex USA

- DUNLOP SPORTS GROUP AMERICAS INC.

- Gamma Sports

- Paddletek, LLC

- ProKennex

- Franklin Sports Inc.

- Selkirk Sport

- Diadem Sports

- Viking Athletics

- Onix Pickleball

- Gearbox

Recent Developments

-

In March 2025, Wilson launched the Intrigue Tour, marking the brand's first high-performance tennis shoe designed exclusively for women. This shoe was engineered for comfort, style, and a fast-paced modern game, offering a fit informed by extensive athlete feedback and advanced technology. The Intrigue aimed to empower women to play with grace and win with grit, redefining what it means to play fast. Developed in close collaboration with Wilson Athlete Marta Kostyuk, the footwear team at Wilson worked on an expedited timeline to create a sneaker that was responsive, comfortable, and allowed for a more dynamic, aggressive style of play. Extensive testing led to the development of a new women’s-specific last, setting a new standard of fit for Wilson’s women’s-specific tennis footwear.

-

In February 2025, PB5star launched the PB5 Court2, a high-performance pickleball shoe designed to meet the sport's specific demands, such as quick directional changes and explosive movements. Featuring the innovative Dynamic Stability Assist system inspired by automotive engineering, the shoe offers superior control, balance, and stability. Key elements include five multi-directional rubber pods for enhanced traction, a cushioned midsole with a wishbone shank for mid-foot support, and an interior design that secures the foot such as a racing seat.

-

In February 2025, USA Racquetball announced a three-year partnership with Gearbox Sports, making Gearbox the Official Brand of USA Racquetball, covering both racquets and balls. This expanded partnership strengthens Gearbox's involvement in racquetball, providing consistent support for national programs and events.

U.S. Racket Sports Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.58 billion

Revenue forecast in 2030

USD 7.74 billion

Growth rate (Revenue)

CAGR of 6.8% from 2025 to 2030

Actuals

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Sports, product, end user, player category, distribution channel

Country scope

U.S.

Key companies profiled

Wilson Sporting Goods; HEAD; Prince Sports; Babolat; Yonex USA; DUNLOP SPORTS GROUP AMERICAS INC.; Gamma Sports; Paddletek, LLC; ProKennex; Franklin Sports Inc.; Selkirk Sport; Diadem Sports; Viking Athletics; Onix Pickleball; Gearbox

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Racket Sports Market Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the U.S. racket sports market report on the basis of sports, product, end user, player category and distribution channel.

-

Sports Outlook (Revenue, USD Million, 2018 - 2030)

-

Badminton

-

Squash

-

Pickleball

-

Table Tennis

-

Tennis

-

Racquetball

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Apparel

-

Top Wear

-

Bottom Wear

-

Inner Wear

-

-

Racket Sports Shoes

-

Equipment

-

Rackets/ Paddles

-

Shuttlecock/ Balls

-

Strings & Accessories

-

Others

-

-

-

End User Outlook (Revenue, USD Million, 2018 - 2030)

-

Adults

-

Men

-

Women

-

-

Junior

-

-

Player Category Outlook (Revenue, USD Million, 2018 - 2030)

-

Professional Players

-

Recreational Players

-

-

Distribution Channel Category Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Sports Goods Retailers

-

Hypermarkets & Supermarkets

-

Exclusive Brand Outlets

-

Others

-

Frequently Asked Questions About This Report

b. Tennis dominated the U.S. racket sports market with a share of 53.62% in 2024. Tennis is becoming increasingly popular, with more and more people picking up the sport for recreation, fitness, and competition. This is driven by the growing awareness of the physical and mental benefits of tennis and the increased accessibility of facilities.

b. Some of the key market players in the U.S. racket sports market are ASICS Corporation; Babolat; Mizuno Corporation; Yonex Co., Ltd.; Li Ning (China) Sports Goods Co., Ltd; Apacs Sports (M) Sdn Bhd; FELET International Holdings Sdn. Bhd.; Victor Rackets Ind. Corp; Gosen Co., Ltd.; and Yehlex.

b. The U.S. racket sports market has experienced significant growth in recent years, driven by the increasing popularity of sports and the increasing participation of children and women in various sports. Moreover, increasing innovation in sportswear manufacturing and new product launches by manufacturers are expected to drive the market further over the forecast period.

b. The U.S. racket sports market was estimated at USD 5.15 billion in 2024 and is expected to reach USD 5.58 billion in 2025.

b. The U.S. racket sports market is expected to grow at a compound annual growth rate (CAGR) of 6.8% from 2025 to 2030 to reach USD 7.74 billion by 2030.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.