- Home

- »

- Medical Devices

- »

-

U.S. PTA Balloon Catheter Market, Industry Report, 2030GVR Report cover

![U.S. PTA Balloon Catheter Market Size, Share & Trends Report]()

U.S. PTA Balloon Catheter Market Size, Share & Trends Analysis Report By Material Type (Polyurethane, Nylon), By Application (Peripheral Artery Disease), By End-use (Hospitals), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-317-1

- Number of Report Pages: 70

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

U.S. PTA Balloon Catheter Market Trends

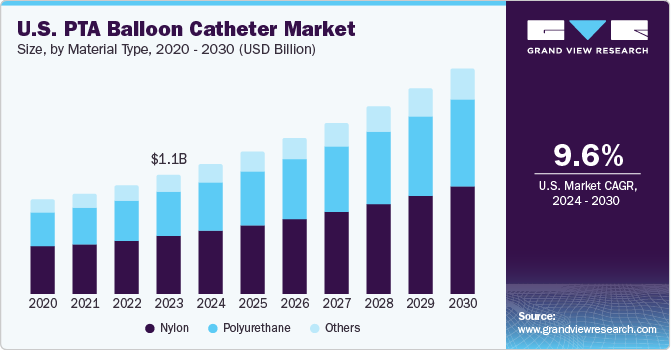

The U.S. PTA balloon catheter market size was estimated at USD 1.06 billion in 2023 and is projected to grow at a CAGR of 9.61% from 2024 to 2030. The increasing prevalence of cardiovascular diseases, the growing adoption of minimally invasive procedures, and an aging population are significant factors contributing to market growth. According to the American Heart Association, heart disease is the leading cause of death in the U.S. across all genders, races, and ethnicities. Approximately 605,000 new heart attacks and 200,000 recurring attacks occur annually.

The primary factor responsible for the growth of minimally invasive procedures using PTA balloon catheters is the rising prevalence of cardiovascular diseases such as coronary artery disease and peripheral artery disease, which are some of the leading causes of mortality in the U.S. conditions. According to the Centers for Disease Control and Prevention, the most prevalent type of heart disease is coronary heart disease, which caused the death of 375,476 individuals in 2021.

An aging population with an increased risk of developing cardiovascular disease further drives the growth of this market. As people age, their risk for cardiovascular disease (CVD) increases. This risk is further compounded by other factors such as frailty, obesity, and diabetes. Studies have shown that the prevalence of CVD also rises with age, affecting both men and women. In June 2019, the American Heart Association (AHA) reported that around 40% of people aged 40-59, 75% of people aged 60-79, and 86% of people aged 80 and above suffer from CVD. As a result, older adults pose a significant burden on the current healthcare infrastructure in the U.S. due to the high incidence of CVD.

Technological advancements have paved the way for developing more advanced PTA balloon catheters with improved performance. These innovations, including drug-coated balloons and cutting-edge materials, made PTA procedures more effective and safer, driving market growth. For Instance, in March 2024, Boston Scientific Corporation received FDA approval for their AGENT Drug-Coated Balloon, which was the first drug-coated coronary balloon in the U.S. This balloon provides a safe and efficient way to treat coronary artery disease in patients with coronary in-stent restenosis (ISR). This condition causes blockage or narrowing of a stented vessel due to plaque or scar tissue.

The global PTA balloon catheter market growth is being driven by factors such as the increasing prevalence of cardiovascular disorders and peripheral artery disease, a rising senior population, and a growing number of minimally invasive procedures. The global rise in cardiac disease incidence is adversely affecting both physical and mental well-being, leading to a heightened demand for advanced diagnostic and treatment methods like PTA balloon catheters. Consequently, the market is anticipated to expand in the upcoming forecast period. For instance, in 2021, the European Heart Network's data revealed that over 60 million individuals in the European Union are affected by cardiovascular disease, with nearly 13 million new cases diagnosed annually. This high prevalence of cardiovascular diseases globally is driving a rise in interventional heart procedures. Moreover, the PTA balloon catheter market is anticipated to grow in the upcoming period due to the escalating demand for these procedures.

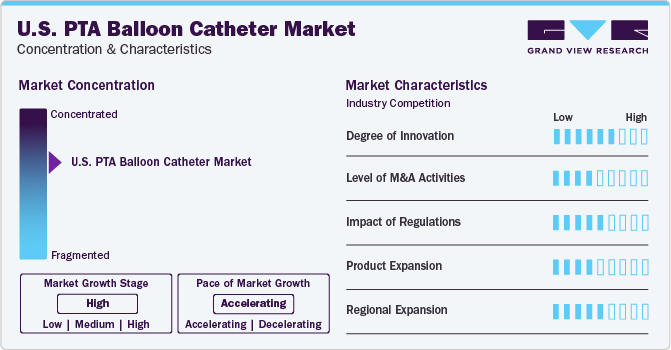

Market Concentration & Characteristics

The market growth rate is high, and the market growth is accelerating. The U.S. market is characterized by a high degree of innovation, with key players bringing innovative technologies into the market. For Instance, in June 2020, Cook Medical launched Advance Serenity hydrophilic percutaneous transluminal angioplasty (PTA) balloon catheter in the U.S., designed for treating peripheral artery disease, including below-the-knee disease. Moreover, they also launched a few additions to the existing product in 2023.

The industry comprises moderate mergers and acquisition activities, where key players are working on increasing their market share. For Instance, in February 2022, Baylis Medical Company Inc. was acquired by the Boston Scientific in order to broaden its range of electrophysiology and structural heart products. As part of the deal, Baylis Medical's cutting-edge transseptal access solutions, such as the radiofrequency NRG and VersaCross transseptal platforms, in addition to multiple guidewires, sheaths, and dilators used in left heart access procedures will be integrated into Boston Scientific's product portfolio.

The impact of regulations in the market regarding PTA balloon catheters is moderately significant. The Food and Drug (FDA) guides the approach to these devices, ensuring their safety and effectiveness in clinical applications. The FDA, which is the U.S. authority responsible for regulating healthcare products, published a guidance document dedicated to peripheral Percutaneous Transluminal Angioplasty (PTA) and specialty catheters. This document outlines the necessary steps to ensure the safety and effectiveness of these devices.

Material Type Insights

The market is segmented into polyurethane, nylon and others. The nylon segment accounted for the largest revenue share, around 50% in 2023. Nylon material is highly regarded for its exceptional strength and durability, which makes it a preferred material for medical devices such as balloon catheters. The utilization of nylon material in PTA balloon catheters provides essential properties such as flexibility, durability, and strength, contributing to their effectiveness in dilating blocked vessels and improving patient outcomes during angioplasty procedures.

The polyurethane segment is expected to grow at the fastest CAGR during the forecast period. Polyurethane material is used in PTA balloon catheters because of its unique properties. It is a synthetic polymer that offers elasticity, is lightweight, and has high resistance to corrosion and abrasion, making it highly durable and long-lasting in medical applications. These properties enhance the reliability of balloon catheters, ensuring their efficacy and efficiency.

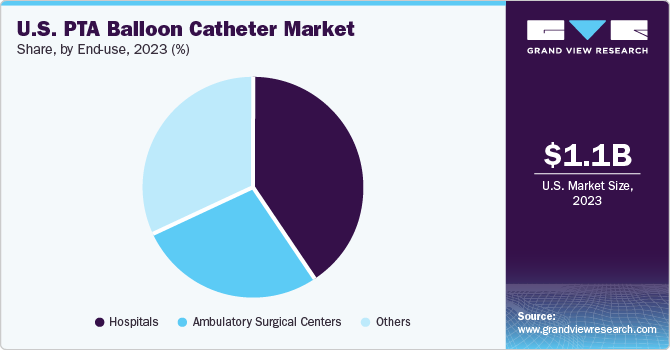

End-use Insights

The hospital segment accounted for the largest market share in 2023. This can be attributed to the increasing prevalence of cardiovascular disease, the growing number of patients, and an increase in the number of cardiac implant procedures. For Instance, a study published in the Journal of the American College of Cardiology predicts a significant increase in cardiovascular risk factors and disease rates in the U.S. by 2060.

The ambulatory service segment is expected to grow at the fastest CAGR over the forecast period due to shorter recovery times, reduced hospital stays, increased patient convenience, and cost-effectiveness. The number of ambulatory surgery centers (ASCs) in the U.S. has grown substantially since 2018. The American College of Healthcare Executives reports that the number of ASCs increased to more than 6,000 in 2022, up from a little over 5,000 in 2018.

Application Insights

The peripheral artery disease segment accounted for the largest market share in 2023, owing to the aging population and increasing disease prevalence. As per the Vascular Disease Management, the prevalence of Peripheral Arterial Disease (PAD) in the U.S. increased from 11.3 million in 1995 to 21.0 million in 2020. Due to the aging population, it was projected that the number of individuals with PAD will increase to 23.8 million by 2030. PTA balloon catheters play a crucial role in treating Peripheral Arterial Disease (PAD) by providing a safe and effective solution to arterial blockages in various segments of the peripheral vasculature. These advanced technologies significantly improved patient outcomes and expanded treatment options for individuals living with PAD.

The coronary artery disease (CAD) segment is expected to experience significant growth during the forecast period, given its high prevalence as one of the leading causes of death worldwide. In the U.S., CAD is a major health concern due to its high prevalence, mortality rates, and negative impact on people's quality of life. Various factors, including atherosclerosis and lifestyle choices such as diet, obesity, and smoking, influence the onset of coronary artery disease. Additionally, medical conditions such as high blood pressure, high cholesterol, diabetes, genetic predisposition, and environmental factors play significant roles in the progression of this cardiovascular condition. To effectively prevent and treat this widespread cardiovascular condition, it is essential to understand the causes, risk factors, and strategies for the treatment of CAD.

Key U.S. PTA Balloon Catheter Company Insights

Some of the key players operating in the market include Medtronic, Cardinal Health, Boston Scientific Corporation, and Terumo Corporation.

-

Boston Scientific Corporation specializes in providing advanced medical solutions for peripheral artery disorders and cardiovascular diseases, which is helping the organization to build strong presence in the market. Similarly, Boston Scientific is well-known for its innovative medical devices and technologies, particularly in interventional cardiology and peripheral interventions. Its products, such as Athletis PTA Balloon Catheter and Mustang PTA Balloon Dilatation Catheter, are designed to offer effective treatments in the peripheral vasculature while maintaining high quality.

-

Medtronic specializes in developing, manufacturing, and distributing medical devices in various healthcare settings. These devices are designed to improve patient outcomes, reduce healthcare costs, and enhance the quality of life for millions of people worldwide. The company significantly focuses on cardiovascular and diabetes solutions, providing innovative technologies for treating heart diseases, stroke, and diabetes.

Key U.S. PTA Balloon Catheter Companies:

- Abbott

- Andra Tec

- Biotronik

- Boston Scientific Corporation

- Cardinal Health

- Cook Group

- Medtronic

- Natec Medical

- Terumo Corporation

Recent Developments

-

In November 2023, Surmodics, Inc. launched its Preside hydrophilic medical device coating technology. This new coating technology offers improved lubricity and coating durability and is specifically designed for the latest coronary, neurovascular, and peripheral vascular devices.

-

In June 2023, Philips and BIOTRONIK established a strategic partnership to broaden the selection of cardiovascular devices available to customers using Philips SymphonySuite. The aim was to enhance personalized patient care options in out-of-hospital environments such as office-based labs and ambulatory surgery centers.

-

In December 2023, Summa Therapeutics obtained FDA approval for its advanced Finesse series of injectable angioplasty balloon catheters developed for treating peripheral artery disease. The company successfully conducted the initial injectable angioplasty procedures in patients with PAD using its Finesse TM balloon catheter. This innovative design reduces the need for extensive equipment and contrast. When utilized as a crossing catheter, the Summa Finesse catheter frequently obviated microcatheters' need to navigate arterial blockages.

U.S. PTA Balloon Catheters Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 2.02 billion

Growth rate

CAGR of 9.61% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, application, end-use, region

Country scope

U.S.

Key companies profiled

Abbott; Andra Tec; Biotronik; Boston Scientific Corporation; Cardinal Health; Cook Group; Medtronic; Natec Medical; Terumo Corportion

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. PTA Balloon Catheters Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. PTA balloon catheter market report based on material, application, end-use, and region.

-

Material Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Polyurethane

-

Nylon

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Peripheral Artery Disease

-

Coronary Artery Disease

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Surgical Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

West

-

Midwest

-

Northeast

-

Southwest

-

Southeast

-

Frequently Asked Questions About This Report

b. The U.S. PTA balloon catheter market was valued at 1.06 billion in 2023.

b. The U.S. PTA balloon catheter market is projected to grow at a compound rate (CAGR) of 9.61% from 2024 to 2030 to reach USD 2.02 billion by 2030.

b. The nylon segment accounted for the largest revenue share of around 50% in 2023. Nylon material is highly regarded for its exceptional strength and durability, which makes it a preferred material for medical devices such as balloon catheters. The utilization of nylon material in PTA balloon catheters provides essential properties such as flexibility, durability, and strength, contributing to their effectiveness in dilating blocked vessels and improving patient outcomes during angioplasty procedures.

b. Some of the key players operating in the market include Medtronic, Cardinal Health, Boston Scientific Corporation, and Terumo Corporation.

b. The increasing prevalence of cardiovascular diseases, the growing adoption of minimally invasive procedures, and an aging population are significant factors contributing to market growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."