U.S. Protein Purification And Isolation Market Size, Share & Trends Analysis Report By Product (Instruments, Consumables), By Technology (Ultrafiltration, Precipitation), By Application, By End-use, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-242-8

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

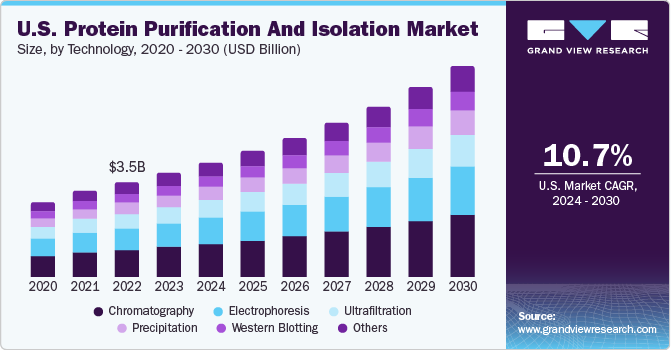

The U.S. protein purification and isolation market size was estimated at USD 3.8 billion in 2023 and is expected to grow at a CAGR of 10.7% from 2024 to 2030. The demand for protein purification and isolation is fueled by the increasing research in the pharmaceutical and biotechnology sectors to create new drugs. The market growth is expected to be propelled by pharmaceutical companies' escalating investments in R&D. The pandemic caused disruptions in the market, but with increased government funding for R&D and technological advancement, the market is expected to have significant growth in the forecast period.

The U.S. accounted for over 41.2% of the global protein purification and isolation market 2023. These techniques are crucial for protein research as they help separate, concentrate, stabilize, and remove contaminants like endotoxins, viruses, and nucleic acid. They are primarily used to understand a protein’s function, structure, and interactions. Common methods include affinity chromatography, immunoprecipitation, proteomics, and enzyme assays. However, the sudden emergence of the COVID-19 pandemic led to the enforcement of lockdown measures worldwide, resulting in delays in the import and export of protein purification and isolation. Protein purification and isolation involve a series of processes to extract a particular protein from a complex mixture of cells, organisms, or tissues.

Moreover, the market is growing due to the increasing importance of finding new ligands, such as protein-based therapeutic compounds. The demand for purification kits used in quick screening tests is also rising. The shift towards more technologically advanced tools for protein purification, the expansion of the proteomics market, and increased research and development in the pharmaceutical and biotechnological sectors all contribute to this growth. However, there are some challenges. Instruments with a lower acceptance rate, the complexity of maintaining purification kits suitable for all applications, and the high cost of these tools are all obstacles to market growth. Despite these challenges, the protein purification and isolation industry finds opportunities in untapped markets and protein therapies.

Government investments in R&D and initiatives are boosting the growth of pharmaceutical and biotech markets. Tax breaks, grants, and favorable regulations also incentivize these sectors. The pharmaceutical industry heavily invests in protein purification and isolation for developing biomarker-specific molecules, which is crucial in preclinical drug development. Moreover, increasing technological progress is propelling the protein purification and isolation solutions market. Systems using magnetic and protein beads and ligand tagging are gaining favor over older methods like agarose beads and other resins. In addition, the growing use of automated analyzers is expected to fuel the demand for these purification and isolation solutions.

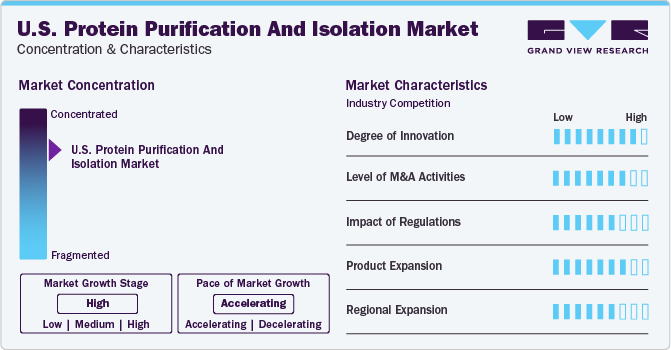

Market Concentration & Characteristics

The U.S. protein purification and isolation industry is concentrated in nature, marked by the dominance of leading players in the sector. Companies such as Thermo Fisher Scientific Inc., Merck KGaA, QIAGEN, Bio-Rad Laboratories, Inc., and Promega Corporation possess considerable industry shares. These key players operate grandly and significantly influence industry trends and dynamics. Their strategic maneuvers, including regional/geographic expansion, mergers, acquisitions, and collaborations, further reinforce their standings in the industry.

Innovation plays a crucial role in the industry by driving competitiveness, enhancing product development, and meeting evolving industry demands. For instance, In March 2021, Promega Corporation introduced XpressAmp Direct Amplification Reagents. This innovation allows for RNA extraction-free sample preparation that is compatible with automation. This new tool provides COVID-19 testing laboratories with the ability to bypass the potentially congested RNA extraction phase and proceed directly to the PCR amplification stage of the workflow.

Companies improve their capabilities, broaden their reach, and adopt new technologies through strategic mergers, acquisitions, and partnerships. These strategies promote innovation, stimulate growth, and enhance competitiveness, leading to greater industry share and profits. For instance, in January 2020, Abcam plc, a global leader in life science reagents and tools, successfully acquired Expedeon’s Proteomics and Immunology business, including Innova and TGR Biosciences. Both Abcam and Expedeon are dedicated to ensuring uninterrupted access to Expedeon’s products and support for the life science community.

Regulations are crucial for companies in the industry to ensure quality, safety, and compliance with industry standards. Regulatory bodies like the Food and Drug Administration (FDA), Environmental Protection Agency (EPA), and Occupational Safety and Health Administration (OSHA) oversee aspects such as product quality, environmental impact, and workplace safety. Adhering to these regulations is essential for maintaining the integrity of research, development, and production processes in the protein purification and isolation industry.

Product diversification allows businesses to broaden their reach and enhance productivity. Technological progress empowers them to deliver advanced solutions, outperform rivals, and tackle new obstacles efficiently, guaranteeing continuous expansion and industry significance. Norgen Biotek Corp. excels in supplying a variety of protein purification kits, providing researchers with top-notch and effective solutions. Their offerings meet diverse requirements, presenting cutting-edge resources for protein isolation and purification from various origins, thereby improving the dependability and quality of subsequent applications.

Geographic expansion plays a crucial role for companies in the industry by enabling them to reach new customers, tap into diverse industries, and strengthen their competitive position. By expanding geographically, companies can access new opportunities, enhance brand visibility, and benefit from local resources and talent. This strategic move fosters growth, drives innovation, and allows companies to establish a broader presence in the industry, ultimately leading to increased share and profitability.

Technology Insights

Chromatography dominated the market and held the largest revenue share of 29.27% in 2023 and is expected to grow at the fastest CAGR during the forecast period. This technique is highly accurate and sensitive for protein isolation and purification. As a result, many companies focus on launching new products based on this technology to broaden their product range. For instance, Bio-Rad introduced ChromLab Software in 2018, a unique software for protein purification using NGC chromatography systems. The availability of various chromatography techniques suitable for a wide range of applications further propels the segment’s growth.

Electrophoresis held the second-largest revenue market share in 2023 due to its effectiveness in separating proteins based on various properties like size, charge, and shape, allowing for precise purification. This technique is crucial for protein characterization, ensuring sample purity, and enabling detailed analysis of proteins. Electrophoresis, particularly gel electrophoresis, is widely used in laboratories for its ability to separate proteins efficiently, making it a fundamental step in proteomics analysis. The high resolution and accuracy of electrophoresis, especially in techniques like SDS-PAGE and 2D electrophoresis, contribute to its popularity and essential role in protein purification workflows.

Product Insights

Consumables dominated the market and held the largest share of 61.77% in 2023 and is expected to grow at the fastest CAGR from 2024 to 2030. The broad consumables category includes various commonly used items such as columns, reagents, kits, resins, and magnetic beads. In 2023, the kits segment emerged as the dominant player within the consumable product category. The popularity of kits can be attributed to their convenience and the numerous advantages. One such advantage is their effective use in isolating GST-tagged proteins from either crude or cleared lysate.

Instruments are expected to show lucrative growth during the forecast period due to the advancement of precise, sensitive, and portable instruments. This growth is further fueled by the increased utilization and commercialization of cutting-edge equipment for protein analysis, ensuring accurate outcomes. The emphasis on technological innovation and the demand for more efficient purification methods are driving the expansion of this segment. As a result, the instruments sector is expected to experience lucrative growth during the forecast period, catering to the evolving needs of the protein purification and isolation industry.

Application Insights

Protein-protein interaction studies dominated the market and held the largest revenue share of 32.05% in 2023 due to their crucial role in understanding biological processes and developing targeted therapies. Researchers can uncover disease mechanisms, identify drug targets, and design more effective treatments by investigating how proteins interact. This focus on protein interactions has driven demand for purification and isolation products, especially in academic institutes and research organizations, leading to significant market growth. The emphasis on studying protein-protein interactions reflects a strategic approach to advancing biomedical research and drug development.

Drug screening is estimated to grow at the highest CAGR of 11.4% during the forecast period. This process plays a crucial role in discovering new drugs with diverse applications. It involves the creation of drugs that are more effective and have fewer side effects than traditional ones. Furthermore, the rise in R&D investments by manufacturers for the screening of new drugs, particularly through structure-based studies and protein-protein interactions, is expected to fuel the growth of this segment.

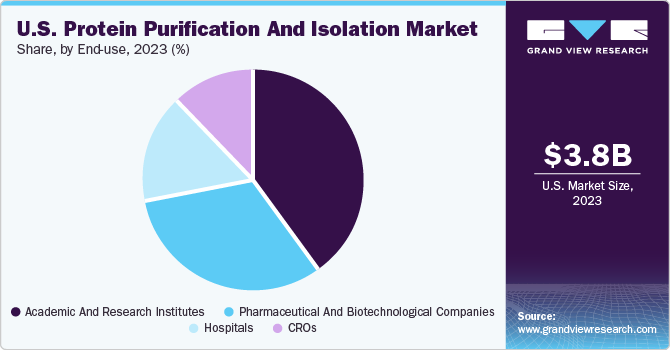

End-use Insights

Academic and research institutes dominated the market and held the largest revenue share of 40.15% in 2023. This can be attributed to the increasing number of research initiatives these institutes undertake. These initiatives primarily focus on structural and functional proteomics, comprehensive kinetic analysis, and the study of protein-protein interactions. The growing interest and investment in these research areas have increased the demand for protein purification and isolation solutions. These solutions are critical for successfully executing these research initiatives, thereby driving their adoption in academic and research institutes. This trend is expected to continue, further solidifying the position of these institutes in the market.

Hospitals are estimated to witness the highest growth of CAGR of 11.6% over the forecast period due to their significant role in various medical applications. These products are essential for studying protein structure, function, and interactions and are vital for diagnostics, therapeutics, and research. They are used in drug development, studying protein interactions, and researching protein-based therapeutics, all crucial for medical advancements. The demand for high-quality proteins in pharmaceuticals and biotechnology, often used in hospitals, further drives the need for these products. Thus, the high demand for these products in hospitals stems from proteins' critical role in various medical applications.

Key U.S. Protein Purification And Isolation Company Insights

Key U.S. protein purification and isolation companies are actively participating in product development, innovation, regional expansion, mergers & acquisitions, partnerships, and collaborations to increase their market share. For instance, in August 2021, Danaher Life Sciences acquired Aldevron. After the purchase, Aldevron independently functions under Danaher’s Life Science division while maintaining its original brand identity. This acquisition also signifies an expansion in Danaher’s portfolio in the life sciences sector.

Key U.S. Protein Purification And Isolation Companies:

- Thermo Fisher Scientific, Inc.

- Merck KGaA

- QIAGEN N.V

- Bio-Rad Laboratories, Inc.

- Agilent Technologies

- GE Healthcare

- Promega Corporation

- Norgen Biotek Corp.

- Abcam plc

- Danaher

Recent Developments

-

In August 2023, Thermo Fisher Scientific finalized the purchase of CorEvitas, LLC from Audax Private Equity. This aligns with the rising need for protein purification and isolation solutions driven by increased research in pharmaceuticals and biotech, alongside global R&D investments. This strategic focus positions Thermo Fisher Scientific strongly in a competitive market evolving with advancements in protein purification technologies.

-

In March 2023, Waters Corporation introduced the Alliance iS, a state-of-the-art HPLC system. This new system is equipped with advanced error detection and troubleshooting features, designed to optimize workflow efficiency for various chromatography processes, including but not limited to protein purification.

-

In January 2022, QIAGEN N.V. launched the QIAwave product line, which includes three nucleic acid extraction kits that use various components. This development enhances their portfolio in the biotechnology sector.

-

In December 2021, GE Healthcare Life Sciences declared its successful acquisition of BK Medical from Altaris Capital Partners, LLC. The transaction was completed with an immediate cash payment of USD 1.45 billion. This strategic move expands GE Healthcare’s portfolio in the healthcare sector.

U.S. Protein Purification And Isolation Market Report Scope

|

Report Attribute |

Details |

|

Revenue forecast in 2030 |

USD 7.71 billion |

|

Growth rate |

CAGR of 10.7% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, technology, application, end-use |

|

Country scope |

U.S. |

|

Key companies profiled |

Thermo Fisher Scientific, Inc.; Merck KGaA; QIAGEN N.V; Bio-Rad Laboratories, Inc.; Agilent Technologies; GE Healthcare; Promega Corporation; Norgen Biotek Corp.; Abcam plc; Danaher |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

U.S. Protein Purification And Isolation Market Report Segmentation

This report forecasts revenue growth in the U.S. market and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. protein purification and isolation market report based on product, technology, application, and end-use:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Instruments

-

Consumables

-

Kits

-

Reagents

-

Columns

-

Magnetic Beads

-

Resins

-

Others

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Ultrafiltration

-

Precipitation

-

Chromatography

-

Ion Exchange Chromatography

-

Affinity Chromatography

-

Reversed-phase Chromatography

-

Size Exclusion Chromatography

-

Hydrophobic Interaction Chromatography

-

Electrophoresis

-

Gel Electrophoresis

-

Isoelectric Focusing

-

Capillary Electrophoresis

-

Western Blotting

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Drug Screening

-

Biomarker Discovery

-

Protein-protein Interaction Studies

-

Diagnostics

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Academic And Research Institutes

-

Hospitals

-

Pharmaceutical And Biotechnological Companies

-

CROs

-

Frequently Asked Questions About This Report

b. The U.S. protein purification and isolation market size was estimated at USD 3.8 billion in 2023.

b. The U.S. protein purification and isolation market is expected to grow at a compound annual growth rate (CAGR) of 10.7% from 2024 to 2030 to reach USD 7.71 billion by 2030

b. Protein–protein interaction studies dominated the market and held the largest revenue share of 32.05% in 2023 due to their crucial role in understanding biological processes and developing targeted therapies.

b. Some prominent players in the U.S. protein purification and isolation market include Thermo Fisher Scientific, Inc.; Merck KGaA; QIAGEN N.V; Bio-Rad Laboratories, Inc.; Agilent Technologies; GE

b. The demand for protein purification and isolation is fueled by the increasing research in the pharmaceutical and biotechnology sectors to create new drugs.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."