U.S. Property Management Software Market Size, Share & Trends Analysis Report By Deployment (Cloud, On-premise), By Solution (Software, Services), By Application (Residential, Commercial), By End-user, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-158-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2023 - 2030

- Industry: Technology

Market Size & Trends

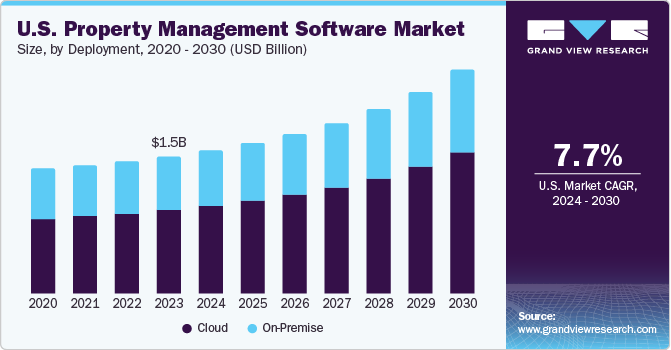

The U.S. Property Management Software Market size was valued at USD 1,536.4 million in 2023 and is expected to register a compounded annual growth rate (CAGR) of 7.7% from 2024 to 2030. The market is undergoing transformative changes driven by key trends, such as the evolving trend of workforce mobility and an increasing number of smart buildings that are reshaping the industry landscape. Increasing prevalence of smart buildings equipped with sensors, devices, and automation systems that enable real-time data collection and analysis is boosting market growth. Property management software (PMS) plays a significant role in harnessing the potential of smart building technologies, offering real-estate managers the ability to remotely monitor and control various building systems, optimize energy usage, and proactively address maintenance issues.

This trend not only enhances operational efficiency and cost savings but also contributes to a more personalized and secure tenant experience, aligning with the broader shift toward intelligent and interconnected real-estate management solutions. Another prominent trend shaping the U.S. market is the growing popularity of the Software-as-a-Service (SaaS) model. Real estate management companies are increasingly adopting SaaS solutions due to their cost-effectiveness, scalability, and accessibility. The pay-as-you-go subscription model allows businesses to reduce upfront costs, scale software according to their needs, and promote remote work and collaboration. SaaS providers prioritize data security, offering encryption and multi-factor authentication to protect sensitive information.

A rise in new apartment deliveries in major U.S. cities further strengthens the demand for efficient real-estate management solutions, and the SaaS model emerges as a strategic imperative for property management firms striving to remain competitive and agile in the dynamic real estate market. In addition, the evolving trend of workplace mobility is presenting a significant growth opportunity for property management professionals in the U.S. Leveraging technological advancements and mobile devices; real-estate managers can access critical property data, collaborate seamlessly, and address tasks efficiently from anywhere. Real-time communication features within PMS facilitate quick issue resolution and improved tenant satisfaction.

Workplace mobility not only benefits real-estate managers in terms of increased productivity and work-life balance but also enhances tenant experiences, leading to higher satisfaction levels and increased tenant retention. As the U.S. market embraces these trends, companies are recognizing the importance of adopting software solutions that cater to smart building integration, SaaS models, and workplace mobility to stay competitive and meet the evolving industry needs. High implementation costs pose a considerable restraint for the adoption of PMS, especially for small- and medium-sized firms with limited budgets. The expenses associated with software licensing, hardware setup, data migration, employee training, and ongoing maintenance can be a deterrent for businesses considering software adoption.

The complexity of integrating new software with existing systems and the need for customized configurations further contribute to establishment costs, potentially discouraging potential buyers who may be hesitant to transition from manual processes. Despite these initial challenges, property management firms are urged to recognize the long-term benefits, including enhanced operational efficiency, streamlined workflows, and task automation, which can lead to increased productivity, improved tenant satisfaction, better data management, and, ultimately, significant returns on investment over time.

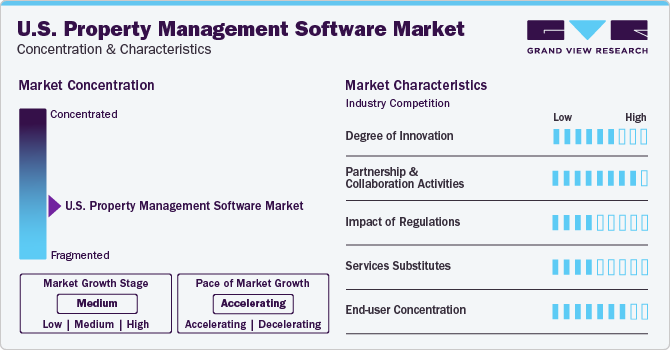

Market Concentration & Characteristics

The growth stage of the U.S. property management software market is moderate. The market is characterized by a high degree of innovation, driven by technological advancements and the increasing demand for streamlined property management solutions. Industry players continuously introduce new features and functionalities to enhance efficiency and user experience. For example, cloud-based platforms have become prevalent, enabling property managers to access real-time data and perform tasks remotely. The integration of artificial intelligence and machine learning is another notable development, providing predictive analytics for maintenance and optimizing resource allocation. Additionally, mobile applications with intuitive interfaces have emerged to cater to the need for on-the-go property management.

The level of new product/service launches in the U.S. Property Management Software Market is significant. This can be attributed to the rapid evolution of technology and the increasing digitalization of the real estate industry, which drive continuous innovation. Companies within this market strive to stay ahead by introducing solutions that leverage emerging technologies such as artificial intelligence, machine learning, and automation. The growing demand for more comprehensive and user-friendly property management tools fuels competition among providers to offer feature-rich platforms. Additionally, the diverse and evolving needs of property managers and landlords necessitate the development of tailored solutions, prompting frequent product upgrades and service launches.

Government regulations have a significant impact on the U.S. Property Management Software Market. Regulations, such as data privacy laws and housing regulations, exert a substantial influence on the design and functionalities of software solutions to ensure compliance. Property management software must incorporate features that facilitate regulatory compliance and reporting to adhere to local and national housing laws. The complexity of these regulations necessitates continuous updates and modifications to software, resulting in a higher impact on the market.

The availability of substitutes for the Property Management Software is generally low. This is primarily due to the specialized nature of property management solutions, which cater to the unique needs of real estate professionals, landlords, and property managers. While there may be alternative tools for certain aspects of property management, such as generic project management software, the comprehensive features required for effective property management are often specific to dedicated property management software.

The industry demands functionalities like lease management, maintenance tracking, and financial reporting, which are not easily replicated by generic substitutes. The integration of these multifaceted features makes it challenging for alternative solutions to provide the same level of efficiency and convenience, resulting in low availability of substitutes in the U.S. Property Management Software Market.

The U.S. Property Management Software Market typically exhibits a diverse end-user concentration, resulting in a relatively low concentration. Property management software caters to a broad range of users, including individual landlords, property management firms, real estate professionals, and large enterprises. Each of these end-users has distinct needs and preferences, preventing a significant concentration of market demand among a small number of customers.

The varied nature of the end-users is influenced by factors such as the specialized expertise required for affordable housing programs, the provision of property management services by real estate brokers, and the need for compliance with licensing requirements. Additionally, the real estate industry's inherent diversity in property types, sizes, and geographic locations contributes to a dispersed user base.

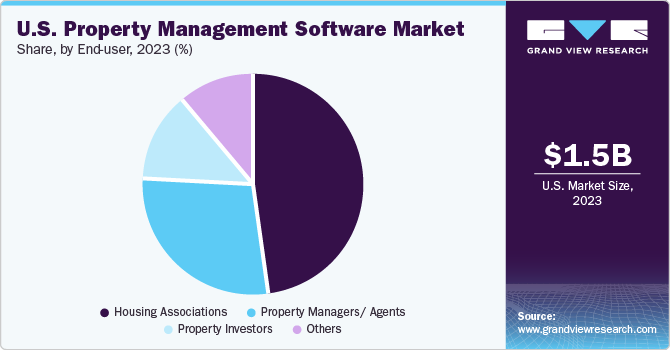

End-User Insights

The property managers/agents segment accounted for the largest revenue share of 38.1% in 2023 owing to their heavy reliance on PMS solutions to efficiently oversee their diverse property portfolios. The software streamlines essential tasks, such as tenant management, lease administration, rent tracking, and maintenance coordination. Tailored features within these solutions address specific needs, including property listings, tenant screening, lease management, rent collection, and maintenance tracking. Property managers benefit from centralized platforms that provide real-time data insights, allowing them to access and update property information effortlessly.

These solutions foster transparent communication between property owners and tenants, with added financial reporting and accounting features simplifying financial management and aiding in budget planning. By automating routine tasks, property managers can prioritize strategic decision-making and deliver exceptional services, ultimately enhancing operational efficiency, boosting tenant satisfaction, and achieving success in the competitive real estate landscape. The housing associations segment held a market share of 31.0% in 2023.

This growth is attributed to the growing recognition of the challenges unique to managing diverse properties and meeting the needs of homeowners and tenants. PMS solutions have become indispensable for housing associations by offering streamlined processes, centralized data management, and automated workflows. These solutions contribute to efficient oversight of multiple properties, ensuring smooth operations and optimizing occupancy rates. Resident portals within these solutions empower homeowners and tenants, facilitating convenient access to crucial information, rent payments, and maintenance request submissions

Deployment Insights

Cloud segment accounted for the highest revenue share of 61.1% in 2023 and is also expected to continue its dominance over the forecast period. Cloud-based PMS has become highly popular and dominant, playing a key role in streamlining real estate management. These solutions enhance efficiency and convenience for all stakeholders by offering a scalable and flexible approach to property management. The adoption of cloud-based solutions is increasing, with users transitioning out from traditional on-premises software. Cloud-based systems leverage remote servers, enabling property managers to access critical data from any location with internet connectivity facilitating efficient oversight of multiple properties.

Key players are responding to the growing demand for cloud-based solutions. For instance, in December 2020, CoreLogic, a prominent U.S.-based proptech solutions provider, announced a partnership with Amazon Web Services, Inc. (AWS). Through this strategic collaboration, CoreLogic would make its comprehensive property data solutions and critical real estate data accessible via the AWS Data Exchange platform. On-premise segment is expected to register considerable growth over the forecast period. The on-premises segment involves traditional software deployment, where applications are locally installed on servers or computers within a real-estate management company's premises. Unlike cloud-based solutions, on-premises software operates independently without relying on remote servers or internet connectivity.

This deployment method provides a sense of control and security, making it valuable for companies handling sensitive client data and adhering to data protection regulations. Real-estate managers gain confidence by hosting software and data on local servers. On-premises solutions are preferred in areas with limited or unreliable internet connectivity, ensuring uninterrupted operations even during poor internet access. However, this deployment model comes with challenges, requiring a significant upfront investment in hardware, software licenses, and IT infrastructure. Ongoing expenses for maintenance, updates, and technical support further contribute to the overall cost of ownership.

Application Insights

Residential segment accounted for the largest revenue share of 59.1% in 2023 and is anticipated to continue its dominance from 2024-2030. The residential PMS segment is pivotal, providing essential features, such as efficient tenant management, automated maintenance tracking, improved communication, remote access, mobility, reduced costs, and enhanced compliance support. The residential property management solutions are tailored for single-family housing associations, multi-family housing/apartments, condo associations, property agents, and asset managers. These solutions automate tenant screening, lease management, rent collection, maintenance tracking, and tenant communication, fostering operational efficiency, tenant satisfaction, and data-driven decision-making.

These software solutions offer centralized data management and real-time insights, allowing real-estate managers to optimize rental performance. Online portals for tenants facilitate rent payments, maintenance requests, and document access, fostering transparent communication and improving the overall tenant experience. This integration contributes to higher tenant retention rates and increased real-estate profitability. The commercial segment is expected to register the fastest CAGR of 8.4% from 2024 to 2030. Commercial PMS addresses unique challenges faced by commercial property managers, streamlining tasks like lease management, rent collection, tenant communication, maintenance tracking, and financial reporting.

These solutions enhance operational efficiency by centralizing data management & providing real-time insights, enabling data-driven decision-making & improved tenant satisfaction. Tenant portals facilitate seamless communication, allowing them to access information, make payments, and submit maintenance requests, fostering stronger relationships and increasing retention rates. The appropriate software allows managers to stay ahead, maximize property potential, and achieve favorable financial outcomes. For retail spaces, specialized software offers tailored features for lease management, monitoring lease terms, and ensuring timely rent collection. Real-time reporting capabilities provide insights into occupancy rates, foot traffic, and sales data, supporting data-driven decision-making for retail property owners and managers.

Solution Insights

The software segment accounted for the largest revenue share in 2023, and is anticipated to continue its dominance over the forecast period. The COVID-19 pandemic expedited the process of digital transformation, compelling property management enterprises to embrace efficient solutions for centralized operations. The demand for robust software platforms has risen due to the growing intricacies of property management, offering automation, data analytics, and remote access functionalities. This upward trend is further bolstered by property managers' acknowledgment of the competitive edge provided by software, resulting in increased investments to enhance tenant experiences, occupancy rates, and resource allocation.

The growth of the services segment can be attributed to the rising demand for specialized expertise in handling property management tasks. Service providers offer customized solutions for areas such as legal compliance, tenant relations, marketing, and strategic planning, effectively addressing the multifaceted nature of property management. This segment not only provides valuable industry insights and a personalized approach but also enhances software platforms through training, customer support, and customization, making a substantial contribution to its impressive growth.

Key U.S. Property Management Software Company Insights

Some of the key players operating in the market include AppFolio, Inc., Console Group, Entrata, Inc., and Yardi Systems, Inc., among others.

-

AppFolio, Inc. provides cloud-based software solutions that cater to the needs of Small and Medium-sized Businesses (SMBs) in the property management and legal sectors. Property Manager, the company's flagship product, offers a comprehensive end-to-end solution for property managers, streamlining their operations efficiently. In addition, its investment management caters to real estate investment managers, offering specialized tools and services to manage investor relationships effectively. The company also offers value-added services such as website design and electronic payment solutions. It primarily operates in the U.S. and generates revenue from its diverse software offerings through subscription fees.

-

Entrata, Inc. offers a cloud-based property management solution designed for enterprise-level use. The solution’s comprehensive features encompass property accounting, facilities management, and resident management capabilities. Moreover, the company's software offers various online tools, including renters' insurance, payment processing, utility billing, lead and resident management, accounting, and lease signing, which enable managers and owners to manage their properties efficiently.

CoreLogic and MRI Software LLC are some of the emerging companies in the global U.S. Property Management Software Market.

-

CoreLogic is a company that provides comprehensive property insights and services tailored to meet the needs of the real estate industry’s stakeholders, including real estate professionals, financial institutions, insurance carriers, government agencies, and other participants in the housing market. The company’s offerings encompass data and analytics specifically designed for the real estate sector. These offerings can maintain a robust database that includes property and mortgage information, judgments and liens, building and replacement costs, and parcel and geospatial data. The company operates in Western Europe, North America, and Asia Pacific regions.

-

MRI Software LLC provides comprehensive business management software solutions. The company’s offerings include real estate enterprise software applications and hosted solutions for budgeting and forecasting, encompassing investment analysis, portfolio modeling, fund and lease accounting, and commercial management. These software and solutions cater to different types of real estate portfolios, from residential and commercial properties to mixed-use and multifamily developments. The company provides services in more than 170 countries with offices in Canada, U.S., Australia, Singapore, Hong Kong, South Africa, and U.K.

Key U.S. Property Management Software Companies:

The following are the leading companies in the U.S. property management software market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these U.S. property management software companies are analyzed to map the supply network.

- AppFolio, Inc

- CoreLogic

- Entrata, Inc.

- innQuest

- IQware Inc.

- MRI Software LLC

- RealPage Inc.

- Yardi Systems, Inc.

- MFTB Holdco, Inc. a Zillow affiliate

- ManageCasa

Recent Developments

-

In June 2023, AppFolio, Inc. introduced a range of new capabilities to enhance its services for property management customers and residents. One of these capabilities is AppFolio Realm, which consolidates all AppFolio Inc.'s existing AI-powered features, along with several transformative new additions into a unified suite. In addition, the company has introduced an affordable housing solution that enables property managers to handle affordable housing units efficiently. It has also expanded its AppFolio Stack Marketplace, allowing users to seamlessly integrate specialized point solutions with their centralized property management software platform.

-

In June 2023, CoreLogic collaborated with Databricks Marketplace, a secure platform for sharing data products. The collaboration would help CoreLogic to increase the accessibility of its extensive datasets and advanced analytics tools. This collaboration offered real estate, insurance, and mortgage professionals significant opportunities to seamlessly incorporate CoreLogic's valuable data and insights into their workflows.

U.S. Property Management Software Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 1,602.6 million |

|

Revenue forecast in 2030 |

USD 2,502.0 million |

|

Growth Rate |

CAGR of 7.7% from 2024 to 2030 |

|

Actual Data |

2017 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD Million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Deployment, solution, application, end-user, region |

|

Key companies profiled |

AppFolio, Inc; CoreLogic; Entrata, Inc.; inquest, IQware Inc.; MRI Software LLC; RealPage Inc.; Yardi Systems, Inc.; MFTB Holdco, Inc.; a Zillow affiliate; ManageCasa. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

U.S. Property Management Software Market Report Segmentation

This report forecasts revenue growths at global, regional, and country levels and provides an analysis of the industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the U.S. Property Management Software Market based on deployment, solution, application, end-user, and region.

-

U.S. Property Management Software Market Deployment Outlook (Revenue, USD Million; 2017 - 2030)

-

Cloud

-

On-Premise

-

-

U.S. Property Management Software Market Solution Outlook (Revenue, USD Million; 2017 - 2030)

-

Software

-

Rental Listings Management

-

Applicant Management

-

Reporting & Analytics

-

Maintenance Activities Management

-

Others

-

-

Services

-

Professional Services

-

Managed Services

-

-

-

U.S. Property Management Software Market Application Outlook (Revenue, USD Million; 2017 - 2030)

-

Residential

-

Multi-family Housing/ Apartments

-

Single-family Housing

-

Others

-

-

Commercial

-

Retail Spaces

-

Office Spaces

-

Hotels

-

Others

-

-

-

U.S. Property Management Software Market End-user Outlook (Revenue, USD Million; 2017 - 2030)

-

Housing Associations

-

Property Managers/ Agents

-

Property Investors

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. property management software market size was estimated at USD 1.70 billion in 2022 and is expected to reach USD 1.76 billion in 2023.

b. The U.S. property management software market is expected to grow at a compound annual growth rate of 6.8% from 2023 to 2030 to reach USD 2.86 billion by 2030.

b. The residential segment accounted for the largest revenue share of 59.3% in 2022 and is anticipated to continue its dominance over the forecast period.

b. The key players in the U.S. property management software market include AppFolio, Inc., CoreLogic, Entrata, Inc., innQuest Software, IQware Inc., MRI Software LLC, RealPage, Inc., Yardi Systems Inc., Zillow Group, Inc., and ManageCasa.

b. The key factors driving the U.S. property management software market are the evolving trend of workforce mobility and an increasing number of smart buildings that are reshaping the industry landscape.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."