- Home

- »

- IT Services & Applications

- »

-

U.S. Productivity Management Software Market, Industry Report, 2030GVR Report cover

![U.S. Productivity Management Software Market Size, Share & Trends Report]()

U.S. Productivity Management Software Market (2024 - 2030) Size, Share & Trends Analysis Report By Solution (AI & Predictive Analytics, Structured Work Management), By Deployment (Cloud, On-premise), By Enterprise Size, And Segment Forecasts

- Report ID: GVR-4-68040-250-2

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

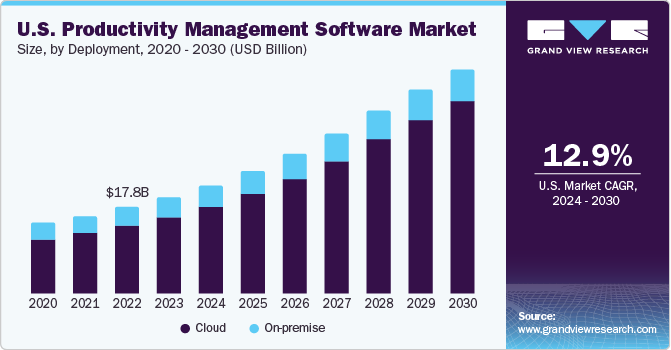

The U.S. productivity management software market size was valued at USD 19.86 billion in 2023 and is projected to grow at a CAGR of 12.9% from 2024 to 2030. The U.S. accounted for 33.2% of the global productivity management software market. Tech companies are advancing in artificial intelligence and data analytics, offering sophisticated and personalized productivity solutions suited to each organization's needs to stay competitive while focusing on operational automation, efficiency enhancement, employee engagement, and well-being. As a result, the U.S. productivity software market is witnessing growth due to increased integration of productivity software, which facilitates collaboration, communication, and task management, which allows companies to monitor productivity efficiently.

Moreover, the growing use of content management tools plays a pivotal role within productivity management software, serving as fundamental pillars for efficient operations. These software solutions empower businesses to store, organize, and share information effectively, fostering seamless collaboration among team members.

In addition, Cloud-based productivity management software offers flexibility and accessibility for businesses seeking efficient workforce management solutions. Cloud platforms enable seamless collaboration, real-time data access, remote work capabilities, and features such as task management, time tracking, and performance analytics. These factors are expected to drive growth in the U.S. productivity management software market over the forecast period.

Furthermore, companies are increasingly focused on reducing operational costs to maximize profits, and improved productivity plays a crucial role in achieving this goal. Recognizing this, organizations are turning towards technology-driven solutions like productivity management software. This software offers centralized platforms for managing productivity, fostering a more efficient work environment, and reducing costs. As a result, business entities are driving the demand for productivity management software market in the U.S.

However, U.S. businesses, particularly small and medium-sized enterprises, need more awareness of the capabilities and functionalities offered by productivity management software. Therefore, the market needs initiatives to drive growth, such as awakening businesses about the potential return on investment (ROI) and how the software can meet their specific needs.

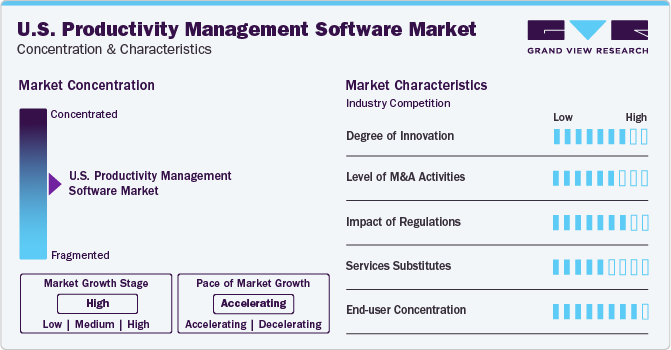

Market Concentration & Characteristics

The market growth stage is moderate, and the pace of the market growth is accelerating. The U.S. productivity management software market is fairly concentrated. Technology enables businesses to ease business operations with the help of artificial intelligence, machine learning, and cloud computing. The use of technology in business operations is helping to improve efficiency along with the well-being of the workforce. Therefore, organizations are incorporating productivity management software to gain comprehensive outcomes.

The U.S. market for productivity management software is highly innovative, as the software offers significant benefits to business entities. For instance, the software combines solutions such as customer relationship management (CRM) platforms, enterprise resource planning (ERP) systems, project management tools, and communication software. Therefore, productivity management software plays a crucial role in shaping the growth and evolution of businesses in the U.S.

The market is witnessing companies aggressively pursuing various initiatives, such as strategic partnerships, mergers & acquisitions, expansion, and new product launches, to attract new customers. For instance, in October 2023, Asana, Inc. announced the integration of artificial intelligence into multiple aspects of its work management platform.

Moreover, the U.S. productivity management software market caters to various aspects of business operations, which helps companies streamline their business functioning. There are multiple service substitutes in the market. Similarly, the market highlights the increased end-user concentration, which denotes high data privacy regulations. For instance, the California Consumer Privacy Act (CCPA) is setting stricter standards for data handling practices to monitor the productivity management software market in the U.S.

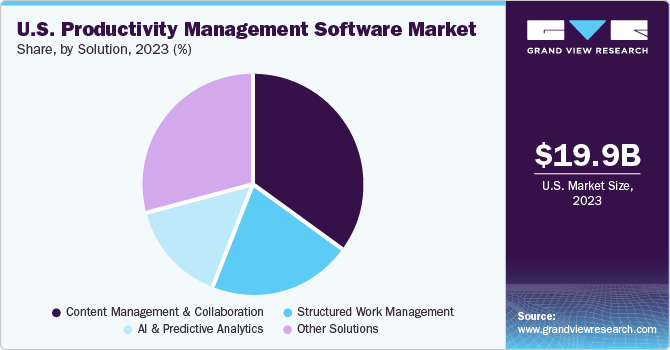

Solution Insights

Content management & collaboration segment dominated the market and accounted for the highest revenue of USD 6.90 billion in 2023. Content management and collaboration solutions offer capabilities for productivity management. They provide a centralized repository for all documents, files, and content, making it easier for employees to access and share information. This helps reduce the time spent searching for information, increasing productivity. These capabilities offered by content management and collaboration solutions are expected to drive the U.S. market growth over the forecast period.

AI & predictive analytics segment is anticipated to witness a significant CAGR of 13.9% from 2024 to 2030 in the U.S. Productivity Management Software Market. AI and predictive analytics solutions are revolutionizing productivity management software by offering advanced capabilities that empower U.S. organizations to optimize their operations and enhance efficiency. These technologies enable the analysis of vast amounts of data to uncover valuable insights, predict future trends, and automate decision-making processes.

Deployment Insights

Cloud segment led the market and accounted highest revenue share of 79.6% in 2023. The cloud-based productivity management software market refers to software solutions that are hosted on remote servers and accessed over the Internet. These solutions offer more flexibility than on-premise solutions. Moreover, in the United States, companies leaned toward technology, where cloud-based solutions are typically opted for due to their being cost-effective and more accessible to implement and scale, as they do not require the same level of hardware and infrastructure investment.

On premise segment is anticipated to witness CAGR of 6.9% from 2024 to 2030 in the U.S. Productivity Management Software Market. The on-premise productivity management software is installed and run on a company's own servers and infrastructure. Thus, it offers greater control and customization options for businesses but may also be more expensive to maintain and update. However, many business entities in U.S. are shifting to cloud services. As a result, the cloud sub-segment is showcasing stable growth compared to on-premise during the forecast period.

Enterprise Size Insights

Large enterprises segment led the market and accounted for the highest global revenue share of 50.5% in 2023. As large enterprises operate on a massive scale with extensive workforces and complex operations, there's a heightened need for efficient resource allocation and optimization. In response, productivity management software offers comprehensive solutions for task management, time tracking, and collaboration, enabling these organizations to streamline processes and maximize productivity across departments and teams. Thus, a growing number of large firms in the U.S. will drive the productivity management software market growth during the forecast period.

Small and Medium Sized Enterprises (SMEs) segment is anticipated to witness significant CAGR of 18.7% from 2024 to 2030 in the U.S. Productivity Management Software Market. There has been a growing demand for productivity management software in small and medium enterprises. Many businesses are looking for ways to streamline their operations and improve efficiency, and productivity management software can help. These solutions provide a centralized location for all documents, files, and content, making it easier for employees to access and share information. As a result, SMEs will drive the productivity management software market growth in the forecast period.

Key U.S. Productivity Management Software Company Insights

Google, Microsoft, Oracle, and others are some of the prominent participants operating in the U.S. productivity management software Market.

-

Google, a subsidiary of Alphabet Inc., provides online search and digital advertising services. The company primarily focuses on business areas such as web-based search and internet-associated products and services. Google’s businesses are reported under two segments, namely Google Services and Google Cloud. . The company’s product management tools are used for document processing, presentations, task management, product management, and communication and collaboration.

-

Microsoft is a multinational technology company known for its wide range of software products, hardware devices, and cloud computing services. The company’s operating segments are Intelligent Cloud, Productivity and Business Processes, and More Personal Computing. Its Productivity and Business Processes segment consists of products and services in a portfolio of productivity, information services, and communication, spanning various platforms and devices.

Some of the emerging companies operating in the market include HyperOffice, Asana, Inc., Basecamp, and others.

-

HyperOffice is a cloud collaboration and communication software provider for small and medium-sized businesses. The company’s solutions include online document management, intranet software, online project management, contact management software, team communication, shared calendars, online database software and web forms, and certification automation.

-

Asana, Inc. is a software company that specializes in project management and team collaboration tools. Its work management platform assists teams with work coordination, from everyday tasks to cross-functional strategic initiatives. The company offers solutions for task management, request tracking, strategic planning, remote teams, campaign management, creative production, and agile management.

Key U.S. Productivity Management Software Companies:

- Adobe

- Airtable

- Asana, Inc.

- Basecamp

- Clarizen

- Google (Alphabet Inc.)

- HyperOffice

- International Business Machines Corporation

- Microsoft

- monday.com

- Oracle

- Salesforce, Inc.

- Smartsheet

- Workfront

- Zoho Corporation Pvt. Ltd.

Recent Developments

-

In October 2023, Oracle NetSuite introduced NetSuite Enterprise Performance Management (EPM) to assist organizations to automate and unify their financial operations. NetSuite EPM integrates budgeting, planning, account reconciliation, forecasting, reporting, and financial close processes across the entire organization, aiming to elevate business visibility, improve decision-making, and foster growth.

-

In October 2023, Asana, Inc., a work management platform, announced the integration of artificial intelligence into multiple aspects of its work management platform. Leveraging its Work Graph architecture, the company aims to optimize the accountability, clarity, impact, and scalability of project works that implement the Asana work management platform.

-

In September 2023, Salesforce, Inc. and Google expanded their strategic partnership to connect Salesforce CRM and Google Workspace to enhance productivity through AI. Google Workspace is a widely used productivity tool. This collaboration is expected to introduce new bidirectional integrations, enabling customers to combine context from Salesforce and Google Workspace.

U.S. Productivity Management Software Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 22.31 billion

Revenue forecast in 2030

USD 46.19 billion

Growth rate

CAGR of 12.9% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Solution, deployment, enterprise size

Country scope

U.S.

Key companies profiled

Adobe; Airtable; Asana, Inc.; Basecamp; Clarizen; Google (Alphabet Inc.); HyperOffice; International Business Machines Corporation; Microsoft; monday.com; Oracle; Salesforce, Inc.; Smartsheet; Workfront; Zoho Corporation Pvt. Ltd

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Productivity Management Software Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. Productivity Management Software Market report based on solution, deployment, and enterprise size:

-

Solution Outlook (Revenue, USD Billion, 2018 - 2030)

-

Content Management & Collaboration

-

AI & Predictive Analytics

-

Structured Work Management

-

Other Solutions

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cloud

-

On-premise

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Small & Medium-Enterprise (SME)

-

Large Enterprise

-

Frequently Asked Questions About This Report

b. The U.S. productivity management software market size was estimated at USD 19.86 billion 2023 and is expected to reach USD 22.31 billion in 2024

b. The U.S. productivity management software market is expected to grow at a compound annual growth rate of 12.9% from 2024 to 2030 to reach USD 46.19 billion in 2030.

b. Cloud segment led the market and accounted highest revenue share of 79.6% in 2023. The cloud-based productivity management software market refers to software solutions that are hosted on remote servers and accessed over the Internet. These solutions offer more flexibility than on-premise solutions.

b. Some key players operating in the U.S. productivity management software market are Adobe; Airtable; Asana, Inc.; Basecamp; Clarizen; Google (Alphabet Inc.); HyperOffice; International Business Machines Corporation; Microsoft; monday.com; Oracle; Salesforce, Inc.; Smartsheet; Workfront; and Zoho Corporation Pvt. Ltd. among others.

b. The growing use of content management tools plays a pivotal role within productivity management software, serving as fundamental pillars for efficient operations. These software solutions empower businesses to store, organize, and share information effectively, fostering seamless collaboration among team members helping market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.