U.S. Procalcitonin, IL-6, And IL-10 Tests Market Size, Share & Trends Analysis Report By Patient Type (Inpatient, Outpatient), By Type (Procalcitonin, IL-6, IL-10), By End Use, By Application, By Payer Type, By State, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-327-0

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

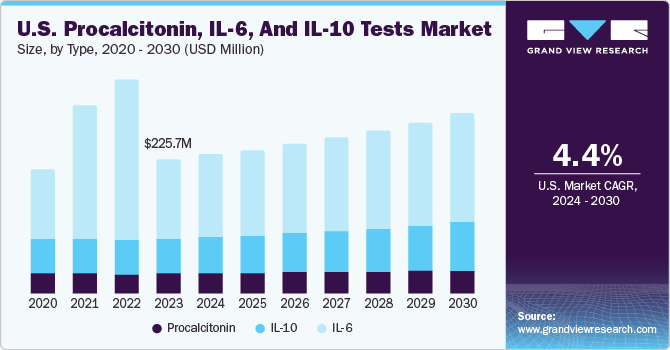

The U.S. procalcitonin, IL-6, and IL-10 tests market was estimated at USD 225.73 million in 2023 and is projected to grow at a CAGR of 4.37 % from 2024 to 2030. These tests are in high demand in the U.S. due to their critical role in guiding antibiotic therapy, particularly in bacterial infections and sepsis cases. With increasing concern over antibiotic resistance, healthcare providers rely on PCT levels to distinguish bacterial infections from viral ones, aiding in the appropriate use of antibiotics. This targeted approach helps minimize unnecessary antibiotic prescriptions, reducing the risk of resistance development, and improving patient outcomes. Moreover, PCT testing facilitates early detection of sepsis, a life-threatening condition requiring prompt intervention, thus driving its demand in clinical settings across the U.S.

The increasing prevalence of infectious diseases represents a significant market driver for Procalcitonin (PCT), Interleukin-6 (IL-6), and Interleukin-10 (IL-10) tests in the U.S. Infectious diseases substantially burden public health systems, healthcare resources, and patient outcomes, driving the demand for accurate & timely diagnostic tools to aid in their detection, management, and treatment.

One of the key infectious diseases driving the demand for biomarker-based diagnostic tests is sepsis. Sepsis is a life-threatening condition characterized by a dysregulated host response to infection, leading to organ dysfunction and systemic inflammation. Timely identification of sepsis is critical for initiating appropriate interventions and improving patient outcomes. PCT testing has emerged as a valuable tool in the early diagnosis of sepsis, as elevated PCT levels are associated with bacterial infections and septic complications. IL-6 & IL-10 testing complement PCT by providing insights into the severity of systemic inflammation and immune dysregulation, aiding in risk stratification as well as prognostication of septic patients.

Furthermore, antimicrobial stewardship initiatives serve as a significant market driver for PCT, IL-6, & IL-10 tests in the U.S., reflecting a growing emphasis on responsible antibiotic use, combating antimicrobial resistance, and optimizing patient outcomes. Antimicrobial resistance poses a global health threat, rendering previously effective antibiotics ineffective and increasing the risk of treatment failure, healthcare-associated infections, & adverse clinical outcomes. In this context, biomarker-based diagnostic tests play a pivotal role in supporting antimicrobial stewardship efforts by providing clinicians with valuable insights into the likelihood of bacterial infection, severity of systemic inflammation, and appropriateness of antibiotic therapy. One of the key objectives of antimicrobial stewardship initiatives is to reduce unnecessary antibiotic use and minimize the emergence of antimicrobial resistance.

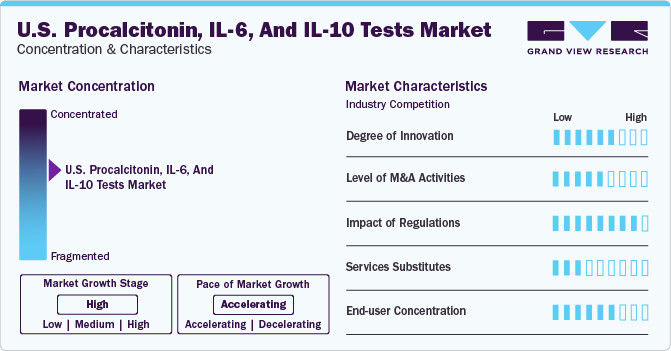

Market Concentration & Characteristics

The U.S. market for Procalcitonin, IL-6, and IL-10 tests is experiencing a significant period of innovation, driven by the need for more precise, rapid, and reliable diagnostic tools in the field of inflammation and infection management. Procalcitonin tests have gained significant attention for their utility in diagnosing bacterial infections and guiding antibiotic therapy. The innovation in this segment is focused on developing assays with faster turnaround times and higher specificity and sensitivity, which can greatly improve patient outcomes by enabling timely and appropriate treatment decisions.

The IL-6 market is witnessing the development of new testing platforms that offer quicker results and can be integrated into existing laboratory workflows, enhancing their applicability in a clinical setting. Innovations in IL-10 testing focus on enhancing the sensitivity of assays and expanding their use in personalized medicine, where understanding individual inflammatory responses can guide tailored treatment strategies.

A considerable amount of merger and acquisition activity marks the U.S. market for procalcitonin, IL-6, and IL-10 tests. This trend can be attributed to various factors, including the desire of companies to expand their product portfolios, enter new market segments, and acquire new technologies. Mergers and acquisitions enable companies to scale their operations quickly and gain access to established customer bases to enhance market competitiveness.

The impact of regulations on the U.S. market for procalcitonin, IL-6, and IL-10 tests, which are key biomarkers for inflammation and infection, is multifaceted. Regulatory policies play a crucial role in shaping the dynamics of the diagnostics market, influencing everything from product development to market access and competition. The FDA's strict approval process for diagnostic tests, including those for procalcitonin, IL-6, and IL-10, ensures that only products that meet high standards of safety and efficacy reach the market. This can lead to significant investment in research and development as companies strive to meet these stringent requirements. While this can be a barrier to entry for smaller players, it also helps maintain a high level of trust in the products available to healthcare providers and patients.

In the rapidly evolving U.S. diagnostics market, the strategic expansion of product and service portfolios in the Procalcitonin, IL-6, and IL-10 tests segment represents a significant opportunity for growth and innovation. As healthcare providers recognize the value of biomarker tests in clinical decision-making, the demand for these diagnostic tools is rising. This surge in demand highlights the necessity for companies to broaden their product offerings, ensuring they meet clinical needs.

The U.S. market for Procalcitonin, IL-6, and IL-10 tests is experiencing a dynamic phase of expansion, fueled by the growing acknowledgment of these biomarkers' clinical utility in guiding antibiotic therapy and evaluating the severity of infections and inflammation. Navigating the complex regulatory landscape is the key to this growth. Companies follow detailed guidelines set by medical associations and adhere to government regulations to expand their offerings. Through strategic partnerships and mergers, businesses are finding effective ways to manage regulatory requirements, combining resources and expertise. This collaborative approach ensures adherence to regulatory standards and accelerates the market introduction of innovative diagnostic solutions.

Patient Type Insights

The inpatient patient type segment held the largest market share of 68.3% 2023 and is anticipated to witness the fastest CAGR of 4.55% during the forecast period. In the U.S., the inpatient patient type segment dominates the Procalcitonin, IL-6, and IL-10 tests market primarily due to the high incidence of Healthcare-Associated Infections (HCAIs) and the critical role these biomarkers play in managing infections and inflammatory responses in hospitalized patients. Nearly 1.7 million hospitalized patients acquire HCAIs annually, with a significant number of these cases resulting in death.

The need for effective diagnostic and management tools for infections and inflammatory conditions in these settings is paramount. Procalcitonin is extensively used as a biomarker for bacterial infections, especially in cases of Lower Respiratory Tract Infections (LRTIs) like pneumonia and exacerbations of chronic bronchitis. Its application has been linked to reduced antibiotic prescriptions and shorter treatment durations in LRTIs.

It addresses the urgent need for appropriate antimicrobial use in hospitals where up to 50% of antimicrobial drug use is deemed unnecessary or inappropriate. IL-6 has been a focus in managing COVID-19 patients, particularly those requiring hospitalization. Elevated levels of IL-6 indicate a hyperinflammatory state, which can lead to severe complications. The dominance of the inpatient segment in the U.S. Procalcitonin, IL-6, and IL-10 tests market is also driven by the need to manage the immune response in severe cases of diseases and to prevent patient harm from drug toxicity and increased drug resistance.

The outpatient segment is expected to exhibit significant growth over the forecast period, in outpatient settings, the use of procalcitonin, IL-6, & IL-10 testing plays a crucial role in managing various infections and inflammatory conditions. Procalcitonin testing is particularly valuable in distinguishing bacterial infections from other causes of inflammation, aiding in the appropriate use of antibiotics. IL-6 & IL-10 testing provide insights into the immune response & inflammation levels, helping clinicians monitor disease progression and treatment effectiveness. The market for these tests in outpatient settings is driven by the need for more targeted and personalized approaches to infection management, reducing unnecessary antibiotic use and improving patient outcomes.

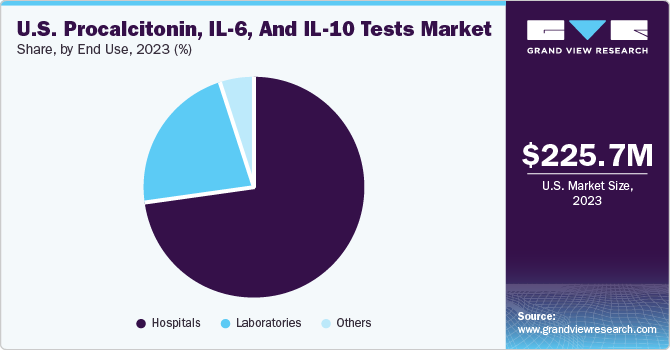

End Use Insights

The hospitals segment accounted for largest revenue share of 73.39% in 2023. Procalcitonin is widely used in hospitals as a biomarker for bacterial infections and sepsis. It helps in distinguishing between bacterial & viral infections, guiding antibiotic therapy, and reducing unnecessary antibiotic use. Hospitals use procalcitonin testing to improve patient outcomes, reduce antibiotic resistance, and lower healthcare costs. The market for procalcitonin testing in hospitals is driven by the need for accurate and rapid diagnostic tools to effectively combat infectious diseases. As hospitals strive to improve patient care and operational efficiency, the use of procalcitonin testing is likely to increase, offering opportunities for market growth and innovation in diagnostic technologies.

The laboratories segment is expected to witness a significant CAGR during the forecast period. The laboratory market for procalcitonin tests is driven by the need for improved diagnostic tools in managing sepsis and bacterial infections. The guidance from AACC could increase the adoption of procalcitonin tests in clinical practice, leading to growth in the laboratory testing market. The availability of clearer guidelines also encourages further research and development in procalcitonin testing, driving innovation in the field. Moreover, as awareness and understanding of procalcitonin tests improve, more healthcare facilities may incorporate them into their standard protocols, further contributing to market growth.

Type Insights

The IL-6 segment accounted for largest revenue share of 59.34% in 2023. IL-6 is a key biomarker for sepsis, a serious condition with high mortality rates. As sepsis awareness and early detection efforts increase, the demand for IL-6 testing is expected to grow. Moreover, IL-6 plays a crucial role in Rheumatoid Arthritis (RA), a chronic autoimmune disease. With the development of IL-6 inhibitors for RA treatment, there is a growing need for IL-6 testing to monitor disease activity and treatment efficacy. Furthermore, IL-6 is implicated in various other inflammatory diseases, including inflammatory bowel disease and certain cancer types, expanding the scope of IL-6 testing beyond sepsis and RA. Technological advancements in immunoassay technologies, such as ELISA and multiplex assays, are also driving market growth by making IL-6 testing more efficient & accessible.

IL-10 are expected to witness the fastest CAGR during the forecast period. The market for IL-10 monitoring is evolving with the emergence of electrochemical biosensors, offering precise and affordable point-of-care & home care diagnostic tools. Traditional methods like ELISAs, flow cytometry, and Western blotting require lab conditions & specialized equipment, limiting their accessibility and affordability. Integrated Graphene's Gii-Sens is a promising advancement, providing a novel 3D carbon material with graphene-like properties but without the limitations of graphene's scale-up manufacturing. This innovation enhances the accuracy and economic viability of electrochemical biosensors, surpassing the sensitivity of expensive materials such as gold.

Payer Type Insights

The insurance segment held the largest market share of 92.7% in 2023. In the U.S., the insurance payer type segment significantly influences the procalcitonin, IL-6, and IL-10 tests market, with Medicare, Medicaid, and private insurance companies playing pivotal roles. Medicare may cover these tests when deemed medically necessary and ordered by a healthcare provider. This coverage extends to a large segment of the population, particularly the elderly and certain younger individuals with disabilities. State Medicaid programs, which vary by state, also may cover Procalcitonin, IL-6, and IL-10 testing based on individual state regulations and guidelines. This coverage is crucial for low-income individuals and families, ensuring access to these important tests based on medical necessity.

The out-of-pocket segment is expected to witness a steady CAGR over the forecast period. Out-of-pocket costs for procalcitonin, IL-6, and IL-10 testing in the U.S. can vary depending on the healthcare provider, insurance coverage, and specific testing circumstances. Patients without insurance or those undergoing testing not covered by their insurance plan may be responsible for the full cost of the test. Some healthcare providers and laboratories may offer discounted rates for uninsured or underinsured patients, and financial assistance programs may be available to help offset the cost of testing in certain cases.

Application Insights

The IL-6 segment accounted for largest revenue share of 59.3% in 2023. Sepsis is a major segment in the IL-6 application segment. The market for IL-6 testing is driven by its crucial role in sepsis and its potential as a prognostic marker in various conditions. As the understanding of IL-6's significance grows, there is increasing demand for efficient and accurate IL-6 testing methods to aid in the timely diagnosis and management of sepsis and other inflammatory conditions. Current sepsis testing methods are laborious, involving lengthy laboratory procedures and in vitro blood culture testing that can take up to 72 hours. As a result, sepsis diagnosis relies on clinical judgment in the absence of timely laboratory results. There is a clear need for more rapid testing methods to improve sepsis management.

The IL-10 market in the U.S. is expected to grow at fastest CAGR during the forecast period. IL-10 plays a significant role in allergic diseases and acts as an immunosuppressive cytokine that helps regulate immune responses. In allergies, IL-10 is involved in modulating the immune system's reaction to allergens, dampening excessive inflammation and allergic responses. Studies suggest that IL-10 levels are dysregulated in allergic conditions such as asthma, allergic rhinitis, and atopic dermatitis, indicating its potential as a therapeutic target. Research into IL-10's role in allergies continues to uncover insights into its mechanisms and potential applications in developing novel treatments aimed at modulating allergic responses and improving patient outcomes.

Key U.S. Procalcitonin, IL-6, And IL-10 Tests Company Insights

The U.S. procalcitonin, IL-6, and IL-10 tests market is a dynamic and competitive industry with several key players vying for market share. The companies focus on research and development, along with strategic partnerships and product launches. The commitment to advancing care through technological innovations has contributed to substantial market share.

Key U.S. Procalcitonin, IL-6, And IL-10 Tests Companies:

- ARUP Laboratories

- Promega Corporation

- Quest Diagnostics Incorporated

- F. Hoffmann-La Roche Ltd.

- BIOMÉRIEUX

- Beckman Coulter, Inc.

- Thermo Fisher Scientific, Inc.

- QuidelOrtho Corporation

Recent Developments

-

In July 2021, The FDA granted EUA for Siemens Healthineers’ laboratory-based IL-6 assay to detect IL-6 in human serum or plasma. This assay is currently accessible throughout the U.S. on the ADVIA Centaur Immunoassay Systems, which constitute the largest installed base of instruments in the country, offering a rapid time-to-result of 18 minutes. Outside the U.S., the IL-6 assay is available with the CE mark on the ADVIA Centaur Systems, Atellica IM Analyzer, and IMMULITE Systems.

-

In November 2020, Ortho Clinical Diagnostics received FDA 510(k) clearance to market its VITROS BRAHMS PCT (Procalcitonin) assay. This assay is designed to assist clinicians in identifying sepsis and other severe bacterial infections.

-

In October 2020, Beckman Coulter received EUA for its Access IL-6 assay. The Access IL-6 assay is a fully automated immunoassay intended that detects IL-6 levels in serum and plasma. It assists physicians in identifying severe inflammatory responses and assessing the risk of intubation with mechanical ventilation in COVID-19 patients.

U.S. Procalcitonin, IL-6, And IL-10 Tests Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 232.81 million |

|

Revenue forecast in 2030 |

USD 300.95 million |

|

Growth rate |

CAGR of 4.37% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Patient type, type, application, end use, payer type, states |

|

Country scope |

U.S. |

|

Key companies profiled |

ARUP Laboratories; Promega Corporation; Quest Diagnostics Incorporated; F. Hoffmann-La Roche Ltd.; BIOMÉRIEUX; Beckman Coulter, Inc.; Thermo Fisher Scientific, Inc.; QuidelOrtho Corporation |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

U.S. Procalcitonin, IL-6, And IL-10 Tests Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. procalcitonin, IL-6, and IL-10 tests market report based on patient type, type, application, end use, payer type, and states:

-

Patient Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Inpatient

-

Outpatient

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Procalcitonin, By Type

-

Immunoassay

-

Immunochromatography

-

Others

-

-

IL-6

-

IL-10

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Procalcitonin

-

Bacterial Infection

-

Sepsis

-

COPD

-

Arthritis

-

Others

-

-

IL-6

-

Bacterial Infection

-

Sepsis

-

Rheumatoid Arthritis

-

Others

-

-

IL-10

-

Bacterial Infection

-

Allergies

-

Inflammatory Disorders

-

Others

-

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

1-100

-

101-250

-

251-500

-

500 and above

-

-

Laboratories

-

Others

-

-

Payer Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Insurance

-

Out of pocket

-

-

State Outlook (Revenue, USD Million, 2018 - 2030)

-

Alabama

-

Alaska

-

Arizona

-

Arkansas

-

California

-

Colorado

-

Connecticut

-

Delaware

-

Florida

-

Georgia

-

Hawaii

-

Idaho

-

Illinois

-

Indiana

-

Iowa

-

Kansas

-

Kentucky

-

Louisiana

-

Maine

-

Maryland

-

Massachusetts

-

Michigan

-

Minnesota

-

Mississippi

-

Missouri

-

Montana

-

Nebraska

-

Nevada

-

New Hampshire

-

New Jersey

-

New Mexico

-

New York

-

North Carolina

-

North Dakota

-

Ohio

-

Oklahoma

-

Oregon

-

Pennsylvania

-

Rhode Island

-

South Carolina

-

South Dakota

-

Tennessee

-

Texas

-

Utah

-

Vermont

-

Virginia

-

Washington

-

West Virginia

-

Wisconsin

-

Wyoming

-

Frequently Asked Questions About This Report

b. The U.S. procalcitonin, IL-6, and IL-10 tests market size was estimated at USD 225.73 million in 2023 and is expected to reach USD 232.81 million in 2024.

b. The U.S. procalcitonin, IL-6, and IL-10 tests market is expected to grow at a compound annual growth rate of 4.4% from 2024 to 2030 to reach USD 300.95 million by 2030.

b. IL-6 dominated the U.S. procalcitonin, IL-6, and IL-10 tests market with a share of 59.3% in 2023. This is attributable to high cost and adoption rate of the test across the U.S.

b. Some key players operating in the U.S. procalcitonin, IL-6, and IL-10 tests market include ARUP Laboratories; Promega Corporation; Quest Diagnostics Incorporated; BIOMÉRIEUX; F. Hoffmann-La Roche Ltd.; Beckman Coulter, Inc.; Thermo Fisher Scientific, Inc.; QuidelOrtho Corporation

b. Key factors that are driving the market growth include increasing cases of sepsis and bacterial infections within the country

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."