- Home

- »

- Medical Devices

- »

-

U.S. PPG Biosensors Market Size, Industry Report, 2030GVR Report cover

![U.S. PPG Biosensors Market Size, Share & Trends Report]()

U.S. PPG Biosensors Market Size, Share & Trends Analysis Report By Product (Pulse Oximeters, Smart Watches), By Application (Heart Rate Monitoring, Blood-Oxygen Saturation, Blood Pressure), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-272-3

- Number of Report Pages: 85

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

U.S. PPG Biosensors Market Size & Trends

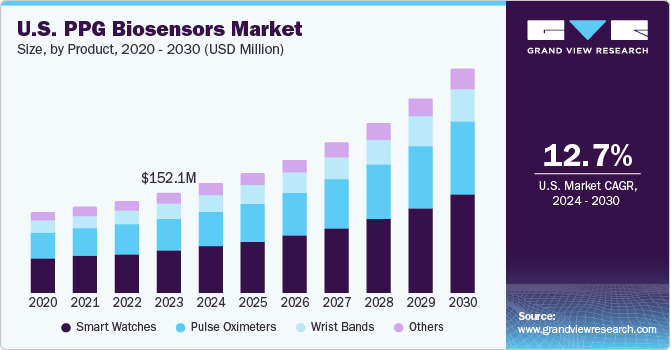

The U.S. PPG biosensors market size was estimated at USD 152.1 million in 2023 and is projected to grow at a CAGR of 12.7% from 2024 to 2030. The use of photoplethysmography (PPG) technology as an alternative heart rate monitoring strategy has increased rapidly due to the ease of use and cost-effectiveness, rising prevalence of cardiovascular disorders (CVDs), and high adoption of wearable devices & smart watches. Photoplethysmography technology offers flexibility, enabling its integration into various devices, such as watches, rings, patches, and earbuds. The COVID-19 pandemic highlighted the importance of harnessing and leveraging digital technology for remote patient tracking.

COVID-19, like other viral illnesses, is associated with a number of physiological changes that are tracked with wearable sensors. For instance, Valencell’s PerformTek PPG sensor technology is the only continuous heart rate sensor technology proven accurate during virtually any exercise and in virtually any environment. Numerous cardiac rhythm indicators, such as heart rate (HR), heart rate variability (HRV), blood-volume saturation, and respiration rate (RR), served as possible markers of COVID-19 infection and were able to already to be measured by smart wearables that use PPG technology. For instance, in May 2019, Masimo received FDA clearance for its Tetherless Radius PPG sensors that aid the placement of point-of-care monitors outside of a patient’s room, safeguarding constant monitoring from a distance.

The increasing prevalence of CVDs is majorly expected to propel the market growth. According to the Centers for Disease Control and Prevention (CDC), approximately 695,000 U.S. inhabitants die from CVDs. Thus, the association of this technique with advances in technology seems to proportionate the detection of cardiopathies rapidly, enhance medical treatment with remote control & surveillance of the patient in a healthcare setting, and minimize the number of deaths caused by CVDs. PPG is a non-invasive, inexpensive technique as compared to the ECG sensors and it is also easily incorporated on several sites, such as fingers, toes, ear, wrist, chest, and head, for measuring the signal.

The non-invasive PPG technique for measuring oxygen saturation (SpO2) and heart rate (HR) is widely used in personal handheld devices and clinical pulse oximetry due to its simplicity and ability to perform continuous readings. It is considered a compact, low-cost device with a basic application that is also non-invasive and applicable in a variety of settings. In addition, the development of signal processing algorithms adds robustness that contributes to the advancement of this technology. Hence, owing to several advantages offered by PPG, the demand for these biosensors is expected to increase in the forecast period leading to market growth.

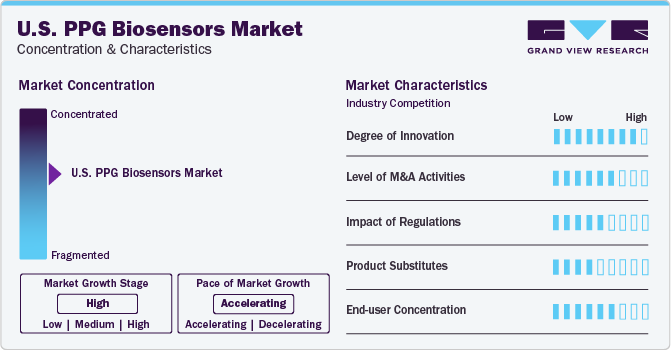

Market Concentration & Characteristics

The global PPG biosensors market growth stage is high, and the pace of its growth is accelerating. The market is characterized by a high degree of innovation owing to the rapid technological advancements driven by factors, such as advancements in sensors and wearable devices.

The U.S. PPG biosensors market is also characterized by a high level of merger and acquisition (M&A) activities by the leading players. This is due to several factors, including the desire to gain access to advanced & innovative technologies and expansion in the market.

The U.S. Food and Drug Administration (FDA) is crucial in regulating wearable devices with PPG biosensors. The FDA classifies these devices based on their intended use and level of risk. Low-risk devices, such as fitness trackers with PPG biosensors, are classified as Class I medical devices and do not require pre-market approval (PMA). However, high-risk devices are classified as Class II or III medical devices and require PMA or pre-market notification (PMN) before they are marketed.

Product Insights

The smart watch segment held the largest share of more than 40% in 2023 and is expected to witness the fastest CAGR from 2024 to 2030. On the basis of product, the market has been sub-segmented into pulse oximeters, smart watches, smart wristbands, and others (patches, rings, etc.). PPG biosensors have lately been extensively used in consumer smart watches to monitor user health conditions during sports, sleep, and everyday activities. According to the Consumer Technology Association, in 2021, 20.1 million units of smart watches were sold in the U.S. The majority of such products, including the Apple Watch, Fitbit, Garmin, and many other smart watches have heart rate monitors that use photoplethysmography. Changes in the blood flow flowing through the wrist caused by the peripheral pulse are monitored using light beams and light-sensitive sensors on the smart watch to produce a PPG, which is then used to determine the heart rate.

The pulse oximeters segment is anticipated to witness substantial growth during the forecast period. The primary application of dual-wavelength PPG is pulse oximetry, which calculates arterial SpO2 noninvasively. The adoption of smart, medical-grade pulse oximeters remains strong, but new markets for lower-cost, commoditized products may emerge in the future. In April 2021, Health-tech startup MFine launched “MFine Pulse”, an application-based SPO2 monitoring device that is expected to aid people in monitoring their oxygen saturation levels through their smartphones. Furthermore, the rising prevalence of CVDs and a spike in the geriatric population, as well as the increasing demand for wearable monitoring devices, are driving the segment growth.

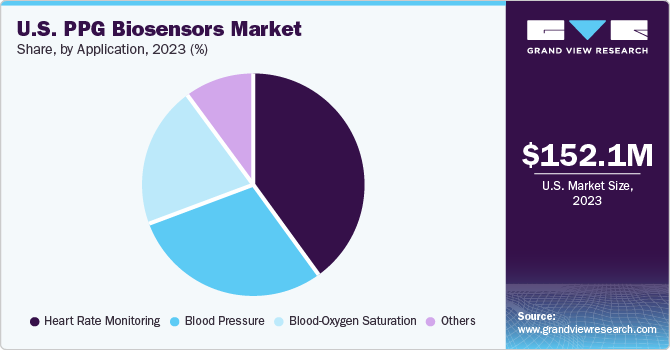

Application Insights

The heart rate monitoring segment held the largest share in 2023 and is anticipated to grow considerably over the forecast period. Smart wearables with heart rate monitors mostly use PPG. On the basis of application, the market has been segmented into heart rate monitoring, blood-oxygen saturation, blood pressure, and others (respiration, sleep monitoring, etc.). Cardiovascular Disease (CVD) is the primary cause of death in the world and patients suffering from CVD require continual monitoring. According to the American Heart Association, almost half of all adults in the U.S. have some form of CVD. More than 130 million adults, or 45.1% of the U.S. population, are expected to have CVD by 2035.

The blood-oxygen saturation segment is anticipated to witness the fastest CAGR from 2024 to 2030. PPG is an optical method for assessing blood flow variations. Dual-wavelength PPG is commonly used for non-invasive measurement of arterial oxygen saturation (SpO2), such as in pulse oximetry. Recently, various smartphone-connected or wearable PPG sensors for monitoring heart rate and rhythm from fingers, face, and wrists have gained approval. In February 2024, Masimo announced the FDA's clearance of MightySat Medical, marking it as the first and only FDA-approved medical fingertip pulse oximeter available Over The Counter (OTC) directly to consumers without requiring a prescription, ultimately driving the market growth.

Key U.S. PPG Biosensors Company Insights

Some of the key companies operating in the U.S. PPG biosensors market include Masimo Corporation; Valencell. Inc.; and Maxim Integrated.

-

Masimo Corp. is a leading manufacturer of innovative PPG sensors and monitoring devices. Some of its well-known brands and products that incorporate PPG sensors include Rad-57 Pulse Oximeter,Rad-97 Pulse CO-Oximeter,Radius-7 Pulse CO-Oximeter,Rad-5 Adult Finger Pulse Oximeter, Rad-8 Vital Signs Monitor, and Rad-87 Neonatal Pulse CO-Oximeter

-

Valencell, Inc. is a leading innovator in biometric sensor technology, particularly in the field of PPG (Photoplethysmography) biosensors. They develop and license their proprietary audio-based biometric sensor technology to various brands in the consumer electronics, sports, and healthcare industries

Nonin Medical, Inc., Omron Healthcare, BioTech Instruments, Inc., CureX, Inc., Inc. are some of the other market participants in the U.S. PPG biosensors market.

Key U.S. PPG Biosensors Companies:

- Masimo Corporation

- Valencell. Inc.

- Maxim Integrated

- Nonin Medical, Inc.

- Rockley Photonics

- Omron Healthcare

- BioTech Instruments, Inc.

- CureX, Inc.

- Preventice Solutions

Recent Developments

-

In December 2023, Rockley Photonics resumed its marketing efforts for Bioptx biosensing wearables equipped with advanced PPG (Photoplethysmography) sensors enabling users to monitor their health and wellness by tracking vital signs, such as heart rate and blood oxygen levels

-

In November 2023, GE HealthCare and Masimo collaborated to integrate Masimo SET Pulse Oximetry technology into the GE HealthCare Portrait Mobile Platform, aiming to incorporate Masimo's advanced pulse oximetry capabilities into GE HealthCare's wireless and wearable devices, enabling users to monitor vital signs, such as heart rate and blood oxygen levels, with high precision

U.S. PPG Biosensors Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 340.1 million

Growth rate

CAGR of 12.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application

Country scope

U.S.

Key companies profiled

Masimo Corp.; Valencell. Inc.; Maxim Integrated; Nonin Medical, Inc.; Rockley Photonics; Omron Healthcare; BioTech Instruments, Inc.; CureX, Inc.; Preventice Solutions

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. PPG Biosensors Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. PPG biosensors market report based on product, and application:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Pulse Oximeters

-

Smart Watches

-

Wrist Bands

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Heart Rate Monitoring

-

Blood-oxygen Saturation

-

Blood Pressure

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. photoplethysmography biosensors market size was valued at USD 152.1 million in 2023.

b. The U.S. photoplethysmography biosensors market is projected to grow at a compound annual growth rate (CAGR) of 12.7% from 2024 to 2030 to reach USD 340.1 million by 2030

b. The smartwatch segment held the largest share of more than 40% in 2023. According to the Consumer Technology Association, in 2021, 20.1 million units of smartwatches were sold in the U.S. The majority of such products, including the Apple Watch, Fitbit, Garmin, and many other smartwatches have heart rate monitors that use photoplethysmography.

b. Some of the key companies operating in the U.S. PPG biosensors market include Masimo Corporation; Valencell. Inc.; Maxim Integrated; Nonin Medical, Inc., Omron Healthcare, BioTech Instruments, Inc., and CureX, Inc.

b. The use of PPG technology as an alternative heart rate monitoring strategy has increased rapidly, primarily owing to the rising prevalence of CVDs, rising adoption of wearable devices and smart watches, ease of use, and cost-effectiveness. PPG technology offers flexibility, enabling its integration into various devices such as watches, rings, patches, and earbuds.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."