- Home

- »

- Advanced Interior Materials

- »

-

U.S. Power Tools Market Size & Share Report 2021-2028GVR Report cover

![U.S. Power Tools Market Size, Share & Trends Report]()

U.S. Power Tools Market (2021 - 2028) Size, Share & Trends Analysis Report By Product (Drills, Saws, Wrenches, Grinders, Sanders), By Mode of Operation, By Application, By Type, By Sales Channel, And Segment Forecasts

- Report ID: GVR-4-68039-687-3

- Number of Report Pages: 105

- Format: PDF

- Historical Range: 2018 - 2019

- Forecast Period: 2021 - 2028

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

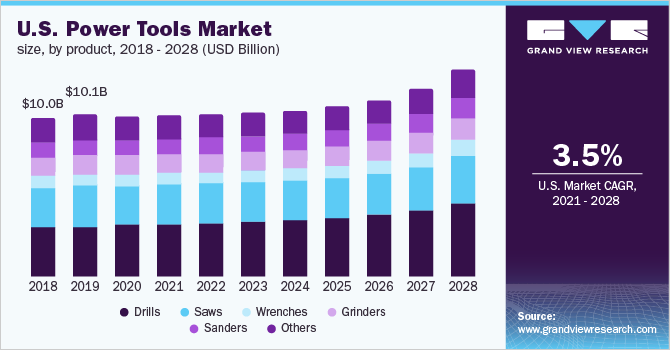

The U.S. power tools market size was valued at USD 10.14 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 3.5% from 2021 to 2028. During the first half of 2020, the spread of COVID-19 led to a decrease in orders owing to the temporary suspension of production activities, supply chain disruptions, and decreased consumer spending. However, the demand elevated in the second half of the year, and the market experienced modest year-on-year growth. Post COVID-19, the market is anticipated to record stable growth over the forecast period on account of the resurgence of major end-use industries, such as construction and automotive.

Power tools reduce manual efforts as they operate on power sources such as electricity and rechargeable batteries. The ease of operation makes them a preferred tool for applications such as production and assembly lines and maintenance and repair, which involve high-intensity operations and require high efficiency. Power tools also offer benefits such as reduced labor and time requirements and ease of portability. Such benefits are expected to positively influence their adoption over the forecast period.

Increasing construction spending is one of the primary factors driving the adoption of power tools in the U.S. The country has witnessed a considerable increase in construction spending over the last few years, which is projected to continue in near future as well. This can be attributed to various favorable initiatives taken by the government. For instance, the infrastructure plan announced by the U.S. government in January 2021 envisages upgrading airports, modernizing aging road infrastructure and transit systems, and retrofitting over two million homes and commercial buildings. Such initiatives are expected to lead to aggressive investments in non-residential construction projects, subsequently driving the growth of the market.

The pandemic has resulted in increased time spent at home, encouraging people to undertake home improvement projects and DIY activities. Home improvement projects have witnessed a paradigm shift from professional contractors to homeowners, thereby driving the adoption of power tools among homeowners. To capitalize on the growing preference for DIY projects, vendors have introduced affordable and easy-to-use power tools featuring long-lasting batteries that are well-suited for household usage. A diverse range of power tools is available in the market for various applications, such as roofing, landscaping, and kitchen and bathroom remodeling. The increasing number of home improvement and maintenance projects is expected to create a new pool of end users and open new avenues for market growth over the coming years.

However, the high costs associated with power tools pose a challenge to market growth. Due to the use of electronic components and assemblies, such as batteries, motors, and power circuitry, the price of power tools is higher compared to conventional hand tools. Additionally, dust exposure, heavy-duty operations, and extensive use can lead to excessive wear and tear of these tools, which is adding to the maintenance costs. Besides, the growth of the market is also impeded by regulatory compliance requirements. Since end users range from professional technicians to hobbyists and residential consumers, manufacturers have to abide by the industrial safety standards to ensure the safety of these end users.

Product Insights

Based on products, the U.S. power tools market is further segmented into drills, saws, wrenches, grinders, sanders, and others. The drills segment held the largest revenue share in 2020, accounting for 31.4% of the overall market. Drills are one of the most popular tools in residential as well as industrial setups. They are widely used for applications that include holes drilling, home improvement, equipment maintenance, fixation of drywalls, and other operational activities. Additionally, drills are easier to operate and cheaper than other tools, which contributes to the large share of the segment. The advent of lightweight power drills is anticipated to upkeep the segment growth over the forecast period.

The wrenches segment is projected to record a CAGR of 4.7% from 2021 to 2028. The growth of this segment is attributable to the ability of power wrenches to significantly reduce the time and effort required in fastening. Production and assembly units widely adopt power wrenches as they involve continuous assembling operations that require a lot of fastening and unfastening of bolts.

Mode of Operation Insights

The electric segment was the most popular mode of operation in 2020, accounting for a revenue share of almost 60%. The segment is anticipated to continue its dominance over the forecast period due to the easy mobility offered by electric tools. The pneumatic segment is also expected to record healthy growth over the next seven years. Air-powered tools provide more speed and power compared to electric-powered tools. The RPM difference is a significant factor contributing to the growth of the pneumatic segment.

The cordless sub-segment dominated the electric tools segment, accounting for over 60% of the overall segment share in 2020. The rapid adoption of Lithium-ion (Li-ion) batteries in power tools is anticipated to drive the demand for cordless electric power tools. These batteries are lightweight and long-lasting owing to their higher energy density. Therefore, such battery technologies are becoming popular among professional contractors and homeowners and are extensively used in harsh environments.

Type Insights

The demand for new tools surpassed that of aftermarket products in 2020, contributing almost 74% to the overall market revenue. Technological advancements primarily drive the demand for new products as companies are focused on introducing suitable products for the U.S. market. Power tool manufacturers in the country are introducing products with dust extraction systems that are compliant with the U.S. Department of Labor’s OSHA standards. For instance, BOSCH’s PRO+GUARD dust solution machines have HEPA filters that capture 99.97% of the generated dust, resulting in a cleaner working environment.

Power tool manufacturers also provide enhanced solution offerings that ease the process of integrating their products with AI platforms to transfer knowledge and train workers. For instance, in July 2020, Stanley Black & Decker, Inc. partnered with DeepHow to implement the latter’s AI platform, Stephanie, into its upskilling programs. This advanced platform enhances knowledge capture, improves training efficiency, promotes workplace safety, and assists the existing user base in construction and industrial operations.

Sales Channel Insights

The indirect sales channel segment led the U.S. market for power tools in 2020, accounting for a 61.7% share of the overall revenue. The segment encompasses independent distributors, retailers, mobile tool distributors, industrial distributors, home centers, and retail lumberyards. Home Depot Product Authority, LLC and Lowe’s contributed a large share to the market revenue. Since these stores offer products catering to several categories, customers generally revisit the stores several times a month and buy tools from them regularly.

The direct sales channel segment includes companies’ sales representatives and online sales websites. The segment is projected to record the fastest growth from 2021 to 2028, catapulted by the COVID-19 pandemic, which has propelled companies to focus on online sales in 2020. Moreover, there is a growing preference among end users for procuring tools through online channels as it saves time and offers convenience in the buying process.

Application Insights

The industrial segment dominated the market in 2020, contributing 64.4% to the overall revenue. The large share is ascribed to the high adoption of power tools in the construction and automotive industries. Power tools help in improving operational efficiency by reducing the time associated with redundant tasks in these industries. As automotive manufacturers continue to increase their production capacities, the use of power tools has become necessary to manage the volume of work operations. Similarly, the need to reduce the time associated with construction jobs whilst maintaining quality has also accelerated the demand for power tools in the construction industry.

The residential segment is poised for healthy growth, recording a CAGR of over 4% over the next seven years. The growing trend of DIY activities in the country is the primary factor anticipated to drive the segment growth. People are undertaking home improvement projects such as kitchen remodeling, landscaping activities, and patio or deck renovation, which augments the demand for power tools. Furthermore, innovations in power tools to provide a lightweight and easy-to-use power drills and hammers are expected to upkeep the growth of the residential segment.

Key Companies & Market Share Insights

Prominent players operating in the market include Stanley Black and Decker.; Robert Bosch Tool Corporation; Makita Corporation; Techtronic Industries Co. Ltd.; Hilti Corporation; and Emerson Electric, Co.; among others. Product upgrades and new product developments are the key growth strategies adopted by these players to strengthen their market position. Techtronic Industries Co. Ltd., Robert Bosch Tool Corporation, and Makita Corporation are some of the key vendors engaged in offering innovative products and upgrades. For instance, in July 2020, Techtronic Industries Co. Ltd., through its MILWAUKEE brand, launched M12 FUEL HATCHET 6 pruning saws equipped with REDLITHIUM batteries.

Similarly, in December 2020, Makita Corporation launched angle grinders with a non-removable guard. The non-removable guard is intended to ensure safety while operating tools at job sites. In light of these factors, the demand for power tools is expected to witness significant growth over the forecast period. Many vendors are also focused on inorganic growth strategies such as mergers & acquisitions to increase their customer base and strengthen their foothold in the market. For instance, in June 2021, Hilti Zimbabwe, one of the subsidiaries of Hilti Corporation, merged with Lighting World, a lighting and electrical manufacturer. This enabled the company to open a new shop and repair center in Lighting World’s Harare showroom. The merger is expected to help the company increase its customer base and international market presence. Some of the key players operating in the U.S. power tools market are:

-

Apex Tool Group

-

Atlas Copco AB

-

Hilti Corporation

-

Ingersoll-Rand PLC

-

Makita Corporation

-

Robert Bosch Group

-

Stanley Black & Decker

-

Techtronic Industries Co., Ltd.

U.S. Power Tools Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 10.18 billion

Revenue forecast in 2028

USD 12.98 billion

Growth Rate

CAGR of 3.5% from 2021 to 2028

Base year for estimation

2020

Historical data

2018 - 2019

Forecast period

2021 - 2028

Quantitative Units

Revenue in USD million and CAGR from 2021 to 2028

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments Covered

Product, mode of operation, application, type, sales channel

Country Scope

U.S.

Key Companies Profiled

Emerson Electric, Co.; Hilti Corporation; Ingersoll-Rand PLC; Koki Holdings Co., Ltd.; Makita Corporation; Robert Bosch Group; Stanley Black & Decker; Techtronic Industries Co. Ltd.

Customization Scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThe report forecasts revenue growth at the country level and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2028. For this study, Grand View Research has segmented the U.S. power tools market report based on product, mode of operation, application, type, and sales channel:

-

Product Outlook (Revenue, USD Million, 2018 - 2028)

-

Drills

-

Saws

-

Wrenches

-

Grinders

-

Sanders

-

Others

-

-

Mode of Operation Outlook (Revenue, USD Million, 2018 - 2028)

-

Electric

-

Corded

-

Cordless

-

-

Pneumatic

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2028)

-

Industrial

-

Residential

-

-

Type Outlook (Revenue, USD Million, 2018 - 2028)

-

New

-

Aftermarket

-

-

Sales Channel Outlook (Revenue, USD Million, 2018 - 2028)

-

Indirect Channel

-

Direct Channel

-

Frequently Asked Questions About This Report

b. The U.S. power tools market size was estimated at USD 10.14 billion in 2020 and is expected to reach USD 10.18 billion in 2021.

b. The U.S. power tools market is expected to grow at a compound annual growth rate of 3.5% from 2021 to 2028 to reach USD 12.98 billion by 2028.

b. The drills segment dominated the U.S. power tools market with a share of 31.4% in 2020. This is attributable to varied applications, relatively lower prices, and ease of operation of power drills

b. Some key players operating in the U.S. power tools market include Emerson Electric, Co.; Hilti Corporation; Ingersoll-Rand PLC; Koki Holdings Co., Ltd.; Makita Corporation; Robert Bosch Group; Stanley Black & Decker; and Techtronic Industries Co. Ltd.

b. Key factors that are driving the U.S. power tools market growth include increasing construction sector spending, growing automotive industry, rising inclination towards home improvement, and DIY activities among customers.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.