- Home

- »

- Consumer F&B

- »

-

U.S. Potato Chips Market Size, Share, Industry Report,2030GVR Report cover

![U.S. Potato Chips Market Size, Share & Trends Report]()

U.S. Potato Chips Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Fried, Baked), By Flavor (Plain/Salted, Flavored), By Distribution Channel, And Segment Forecasts

- Report ID: GVR-2-68038-409-3

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Potato Chips Market Size & Trends

The U.S. potato chips market size was valued at USD 10.07 billion in 2023 and is projected to grow at a CAGR of 5.7% from 2024 to 2030. The growing trend towards snacking convenience and on-the-go consumption drives the demand for potato chips in the country. Potato chips are perceived as a convenient and satisfying snack option that requires no preparation, making them ideal for busy lifestyles and casual snacking occasions.

Another factor contributing to the rising demand is the continuous innovation and variety within the potato chip market. Manufacturers have introduced new flavors, textures, and healthier alternatives to cater to diverse consumer tastes and dietary preferences. This variety caters to a broad demographic, including health-conscious consumers looking for options with reduced fat and salt or made from organic ingredients. Additionally, potato chips' affordability and widespread availability contribute to their popularity. They are readily accessible in grocery stores, convenience stores, and vending machines across the country, making them a convenient impulse purchase for consumers of all ages.

Furthermore, marketing and branding strategies play a crucial role in driving demand. Effective advertising campaigns, endorsements by popular influencers, and strategic product placements enhance consumer awareness and influence purchasing decisions. Brands often leverage nostalgia, taste preferences, and cultural associations to create strong brand loyalty among consumers.

Lastly, social and cultural factors also impact the demand for potato chips. They are often consumed during social gatherings, sporting events, and parties, reinforcing their role as a staple snack food in American culture. As consumer lifestyles evolve and snacking habits continue to diversify, potato chips remain a versatile and beloved snack choice, contributing to their sustained growth in demand across the US market.

Product Insights

The fried potato chips segment dominated the market and accounted for a market share of 59.1% in 2023. Fried potato chips are widely favored for their crispy texture and savory flavor, which is preferred by many consumers seeking snack options. This preference is notably higher among younger demographics and families, who often view potato chips as convenient and enjoyable snacks for various occasions, from movie nights to on-the-go munching. Another significant driver of the increased demand is the variety and innovation seen in the fried potato chips segment. Manufacturers have been introducing new flavors, textures, and even healthier options like reduced-fat or kettle-cooked varieties, catering to evolving consumer preferences for taste and health considerations.

Baked potato chips segment is expected to witness the fastest growth with a CAGR of 6.1% over the forecast period. The demand for baked potato chips is increasing in the US market primarily due to shifting consumer preferences towards healthier snack options. As awareness about health and wellness increases, more consumers are seeking snacks that are perceived as healthier alternatives to traditional fried potato chips. Another factor driving the demand for baked potato chips is emphasizing dietary preferences such as gluten-free, vegan, and non-GMO options. Baked chips often cater to these nutritional needs by offering products that meet specific lifestyle choices, expanding their consumer base beyond traditional snack eaters. For instance, in February 2024, Popchips announced the launch of a new vegan nacho flavor variant that boasts 50% less fat compared to traditional fried chips. This launch was a part of Popchips' commitment to offering healthier snack options. The new flavor is available on their website and in select grocery stores, catering to consumers looking for tasty, lower-fat snack alternatives.

Flavor Insights

Plain/salted flavored chips dominated the market in 2023. plain or salted chips appeal to a broad consumer base due to their simplicity and traditional flavor profile. Many consumers prefer the classic taste of lightly salted chips without additional flavors or seasonings, making them a reliable choice for occasions such as snacking or pairing with other foods. Moreover, plain or salted chips' adaptability contributes to their popularity. These chips serve as a neutral base that can complement a wide range of dips, sauces, or toppings, enhancing their appeal for social gatherings, parties, or casual snacking at home. This versatility allows consumers to customize their snacking experience according to personal preferences or dietary restrictions, further boosting their demand.

Flavored segment is expected witness the highest CAGR over the forecasted period. Consumers' evolving taste preferences, which seek variety and novel experiences in their snacks, drive the demand for flavored potato chips. Flavored potato chips cater to this demand by offering a wide range of taste options beyond traditional flavors like salted or plain. Varieties such as barbecue, sour cream and onion, jalapeno, and even exotic flavors like truffle or kimchi attract consumers looking for unique and adventurous snacking experiences. Moreover, flavored potato chips often tap into cultural trends and culinary innovations. Companies leverage popular food trends or regional flavors to create unique chip varieties that resonate with diverse consumer tastes. For example, flavors inspired by international cuisines or seasonal ingredients capitalize on consumer interest in global flavors and freshness.

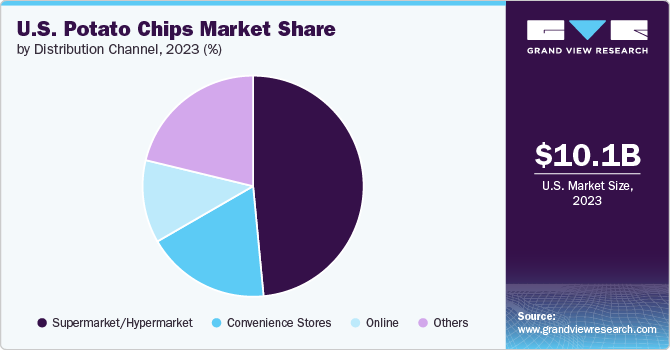

Distribution Channel Insights

Super market/hypermarket segment dominated the market in 2023. supermarkets and hypermarkets offer extensive shelf space and a wide variety of products, including potato chips, attracting many consumers. These retail giants benefit from economies of scale, allowing them to negotiate lower prices with manufacturers and distributors, which can translate into competitive consumer pricing. Moreover, supermarkets and hypermarkets often invest heavily in promotional activities and in-store marketing strategies. They use prominent displays, discounts, and promotions to attract consumers' attention and encourage impulse purchases. This proactive marketing approach helps boost the sales of potato chips and other snack items. Additionally, consumer preferences are shifting towards one-stop shopping experiences where they can fulfill multiple needs in a single trip. Supermarkets and hypermarkets cater to this preference by offering a comprehensive range of products under one roof, from fresh produce to household essentials, alongside snacks like potato chips. This convenience factor enhances consumer satisfaction and encourages repeat visits.

The online segment is projected to grow at the fastest CAGR of 6.6% in the forecasted period. Consumers increasingly prefer the ease of browsing and purchasing products from the comfort of their homes or via mobile devices. Moreover, the variety and availability offered by online platforms contribute to their popularity in the potato chips market. E-commerce allows consumers access to a broader range of flavors, brands, and specialty products that may not be readily available in traditional brick-and-mortar stores. This diversity in product offerings caters to different consumer preferences and allows for more personalized shopping experiences. Furthermore, advancements in logistics and distribution networks have enhanced the efficiency of online channels. Faster delivery times and improved supply chain management ensure that perishable products like potato chips reach consumers promptly and in optimal condition, addressing previous concerns about the freshness and quality of food purchased online.

Key U.S. Potato Chips Company Insights

Some of the key companies include Barcel USA, Better Made Snacks Food, PepsiCo, Kellanova, Utz Brands, Inc.

-

Barcel USA provides a wide range of kettle-cooked potato chips in its Artisan Style line available in several flavors such as fuego, lime-chipotle, jalapeno, habanero, and diabla. The Delicious range of flavors attract children and teenage consumers in the U.S.

-

Better Made Snacks Food uses high-quality potatoes, salt, and cottonseed oil to ensure the freshness of their products. Customers have the option to purchase directly from the factory, obtaining chips that are just hours old, or have them delivered to any location worldwide. Better Made has the capacity to process over 60 million pounds of potatoes each year, with a production process that turns them into chips in about seven minutes.

Key U.S. Potato Chips Companies:

- PepsiCo

- Kellanova

- Utz Brands, Inc.

- Campbell Soup Company

- Herr's

- Wise Snacks

- Intersnack Foods GmbH & Co. KG

- Clayton Dubilier & Rice

- Better Made Snack Foods

- Barcel USA

Recent Developments

-

In June 2024, Herr's announced the launch of a new line called "Flavored by Philly." This series will include four flavors inspired by Philadelphia's culinary culture: Philly Cheesesteak, Philly Soft Pretzel, Philly Cheesecake, and Creamy Chesapeake Bay Crab. The launch aims to celebrate Philadelphia's iconic flavors and offer consumers a taste of local favorites in snack form.

-

In March 2024, Takis, under Barcel USA, expanded its snacking portfolio with the launch of a new potato chip addition called Takis Waves. These snacks feature a wavy texture and will be available in two flavors: Angry Burger and Crunchy Fajitas. The launch aims to cater to consumer demand for innovative snack options with intense flavors.

U.S. Potato Chips Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 10.61 billion

Revenue forecast in 2030

USD 14.78 billion

Growth Rate

CAGR of 5.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

August 2024

Quantitative units

Revenue in USD Million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, flavor, distribution channel

Key companies profiled

PepsiCo; Kellanova; Utz Brands, Inc.; Campbell Soup Company; Herr's; Wise Snacks; Intersnack Foods GmbH & Co. KG; Clayton Dubilier & Rice; Better Made Snack Foods; Barcel USA

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Potato Chips Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. potato chips market report based on product, flavor, and distribution channel:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Fried

-

Baked

-

-

Flavor Outlook (Revenue, USD Million, 2018 - 2030)

-

Plain/Salted

-

Flavored

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarket/Hypermarket

-

Convenience Stores

-

Online

-

Others

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.