U.S. Plastics Market Size, Share & Trends Analysis Report By Product (Polyethylene, Polypropylene, Polyurethane, Polyvinyl Chloride, Polystyrene, And Others), By End-use, By Application, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-213-4

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

U.S. Plastics Market Size & Trends

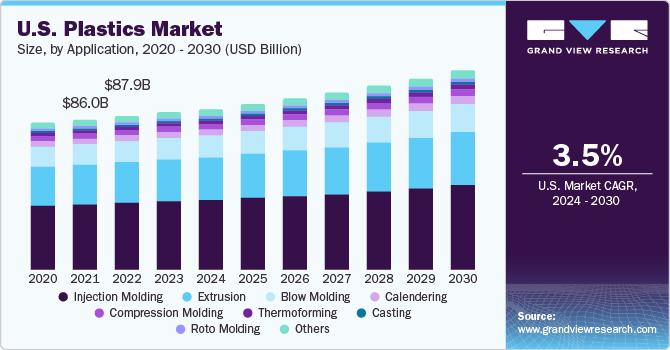

The U.S. plastics market size was estimated at USD 90.14 billion in 2023. The market is projected to grow at a CAGR of 3.5% from 2024 to 2030. The growth of the market is fuelled by the increasing use of plastics in various end-use industries such as automotive, packaging and manufacturing industries. The rising demand for light-weight vehicles is promoting the usage of different types of plastics such as polypropylene in the automotive industry. Usage of plastic products in sectors such as recreational toys, packaging, containers and others is expected to add to the market growth during the forecast period.

The rising demand of packaging plastics in e-commerce industry is another factor driving the market for plastics in the U.S. The population of U.S. prefer to shop from online retail stores over brick-and-mortar stores. These shopping patterns have severely impacted the e-commerce industry in the country. Surge in U.S. e-commerce industry is increasing the demand for packaging materials further fuelling the country’s plastic market.

Another driving factor behind the plastics industry in U.S. is the robust manufacturing sector in the country. Polystyrene (a type of plastic) is widely used in manufacturing of items such as toys, electronics, and disposable utensils. A constant requirement of these items has been a stabilizing force for the market. Polypropylene (PP) finds its wide usage in the automotive industry for parts such as bumpers facias, instrumental panels, and door trims. This is due the high durability and chemical resistance properties of PP. In the past few years, U.S. automotive industry has seen rise in demands for light weight vehicles due to their high fuel efficiency. With enough R&D, the automotive industry has been successful in creating light weight vehicles using polypropylene, without compromising the safety of the vehicle.

Market Concentration & Characteristics

Increasing demand for plastic polymers across the globe from industries, including automotive, electrical & electronics, textile, food & beverage, packaging, consumer goods, and various others, has propelled the competitive environment in the market. Companies are opting for strategies such as introduction of new products, investment in research & development, and expansion of production capacities.

The 3D printing industry is rapidly growing and innovating. 3D printed furniture, automotive vehicles, aerospace technology, houses, and other commercial products are some of the innovations of the plastics market. These innovations are expected to be disruptive in nature and may replace the traditional products offering faster production and efficient product.

Plastics industry is competitive and is dominated by large MNCs making it moderately concentrated. Competition amongst key players is revolving around product innovations and pricing. Large companies are focusing on acquiring smaller companies to expand their product portfolio.

Government regulations have a significant impact on the market’s growth and trends. Stringent regulations by the U.S. government towards the reduction of single-use plastics and mindful disposal of plastic waste have resulted in higher recycling practices. For instance, the U.S. Department of Interiors has implemented Secretary’s Order 3407 aiming to reduce the procurement, sale and distribution of single-use plastics. This regulation has been implemented with a goal of phasing out all single-use plastic products on all Department- managed lands by 2032.

Rising use of bio-based polymers is expected to hinder the growth of conventional plastics products. Bioplastics have higher tensile strength and are eco-friendly as compared to the traditional plastics. Thus, demand for bioplastics is expected to rise in the coming years.

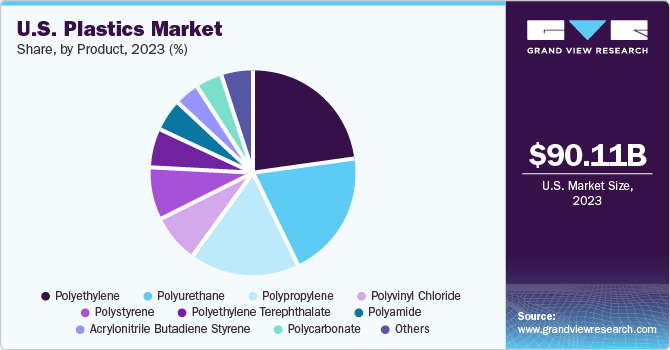

Product Insights

The polyethylene (PE) segment dominated the market with a revenue share of 23% in 2023. The easy availability and affordability of PE are aiding the segment growth. Regular innovations and new developments of additives for polyethylene manufacture are expected to enhance its performance, further opening new market avenues for PE over the forecast period. Polyethylene is widely used in CNC (computer numerical control) machines and 3D printers. High density PE provides high moisture barrier and cost-effectiveness to the end product. However, low density polyethylene is preferred over high intensity polyethylene due to properties such as high elongation, heat seal ability, and softness.

The epoxy polymers segment is estimated to witness fastest CAGR of 7.65% in the forecast period. Epoxy polymers are widely used in medical industry for the manufacturing of disposables and devices such as catheters and surgical equipment. The epoxy polymer finds its applications in industries such as aerospace, adhesives, automotive, electronics, industrial coatings, and constructions. The growth of end-use industries is expected to further boost the growth of epoxy polymers segment in the U.S. plastics market.

End-use Insights

The packaging segment dominated the market with the highest revenue share in 2023. The rise in food and beverage industry in the U.S. is fuelling the growth of packaging plastics. Furthermore, the expansion of industries such as personal care, medicines, and e-retail are driving the demand for plastic packaging. Plastics are widely used in the packaging industry due to their high performance, affordable prices, and longer durability as compared to other packaging. Many varieties of plastics are designed to withstand extreme environmental conditions making them an ideal choice for packaging.

The agriculture segment is expected to witness fastest CAGR of 6.80% during the forecast period. Usage of polyethylene is expected to grow in agriculture industry due to the surge in demand for drippers, microtubes, nozzles, and emission pipes in irrigation systems. The increased use of plastic tools and gears in agriculture is seeing boost in crop productivity, improved food quality, and reduced environmental imprints. In agriculture, plastic is also used in form of sheets and films to decrease moisture loss and regulate soil temperature. In addition, pesticide emission in atmosphere or ground water is also reduced as it sticks to the plastic sheets. This results in better yields both in quality and quantity. The rise in health awareness and clean eating habits amongst the U.S. population and adoption of vegan lifestyle is expected to fuel the agricultural industry further boosting the plastic demands in agriculture.

Application Insights

The injection molding segment dominated the U.S. plastics market with a revenue share of 43% in 2023. Injection molding process requires use of machines, plastic raw materials and molds. This method is commonly used in the production of automobile parts, medical devices, plastic containers and others. Thus, the growth in these industries is expected to boost the injection molding segment further fuelling the growth of the U.S. plastics market. A significant acceleration is expected in the popularity of heat and pressure resistant materials. This is due to the extensive infrastructure development activities further increasing the usage of plastic injection molding equipment by manufacturers of building products.

The roto molding segment is expected to witness the fastest CAGR during the forecast period. The roto molding or rotational molding technique is ideal for creating products which are hollow at the centre. The technique is widely utilized in construction activities due to its durable nature. As compared to other molding methods, roto molding allows more design freedom, making it a top choice amongst other molding methods. Construction is one of the major contributors in the U.S. economy which is expected to further fuel the demand of roto molding segment.

Key U.S. Plastics Companies Insights

The U.S. plastics market is competitive in nature and it is moderately concentrated. The market leaders are collectively contributing to the revenue share and market trends.

Key U.S. Plastics Companies:

- ExxonMobil Chemical

- Dow, Inc.

- Chevron Phillips Chemical Co., LLC

- Westlake Chemical

- DuPont

- Celanese Corporation

- Eastman Chemical Company

- Huntsman International LLC

- RTP Company

Recent Developments

-

In February 2023, Chevron Phillips Chemical Co., LLC has signed a long-term commercial contract with Nexus Circular for the supply of a significant volume of plastic feedstock from an advanced recycling facility to produce Marlex Anew Circular Polyethylene.

-

In May 2023, DuPont entered into a definitive agreement to acquire Spectrum Plastics Group (Spectrum) from AEA investors. The combination is expected to provide highly engineered solutions for critical healthcare applications.

-

In September 2023, Huntsman International LLC developedSMARTLITE O, a liquid TPU (thermoplastic polyurethane) for the footwear industry. The innovative product enables manufacturers to produce high-performance midsoles best suited for sports and athleisure footwear.

-

In November 2023, Eastman Chemical Company partnered with Ostium Group to integrate sustainable packaging solutions for medical devices. The motive of this collaboration is to incorporate Eastman’s sustainable packaging solution, Eastar 6763 Renew copolyester, into Ostium Group’s innovative CILLAR Acetabular and Femoral kits for total hip replacements.

U.S. Plastics Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 92.6 billion |

|

Revenue forecast in 2030 |

USD 114.65 billion |

|

Growth Rate |

CAGR of 3.5% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Volume in kilotons, revenue in USD million, and CAGR from 2024 to 2030 |

|

Report coverage |

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, end-use, application |

|

Key Companies |

ExxonMobil Chemical; Dow, Inc.; Chevron Phillips Chemical Co., LLC; Westlake Chemical; DuPont; Celanese Corporation; Eastman Chemical Company; Huntsman International LLC; RTP Company |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

U.S. Plastics Market Report Segmentation

This report forecasts revenue and volume growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. plastics market report based on type, end-user, and application:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Polyethylene (PE)

-

Polypropylene (PP)

-

Polyurethane (PU)

-

Polyvinyl Chloride (PVC)

-

Polyethylene Terephthalate (PET)

-

Polystyrene (PS)

-

Acrylonitrile Butadiene Styrene (ABS)

-

Polybutylene Terephthalate (PBT)

-

Polyphenylene Oxide (PPO)

-

Epoxy Polymers

-

Liquid Crystal Polymers (LCP)

-

Polyether Ether Ketone (PEEK)

-

Polycarbonate (PC)

-

Polyamide (PA)

-

Polysulfone (PSU)

-

Polyphenylsulfone (PPSU)

-

Others

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Packaging

-

Building & construction

-

Electrical & electronics

-

Automotive

-

Medical devices

-

Agriculture

-

Furniture & bedding

-

Consumer goods

-

Utility

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Injection Molding

-

Blow Molding

-

Roto Molding

-

Compression Molding

-

Casting

-

Thermoforming

-

Extrusion

-

Calendering

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. plastics market was valued at USD 90.14 billion in the year 2023 and is expected to reach USD 92.6 billion in 2024.

b. The U.S. plastics market is expected to grow at a compound annual growth rate of 3.5% from 2024 to 2030 to reach USD 114.65 billion by 2030.

b. The polyethylene (PE) segment emerged largest with a value share above 23% in 2023 due to affordability of PE are aiding growth along with enhanced properties.

b. The key market player in the U.S. plastics market includes ExxonMobil Chemical; Dow, Inc.; Chevron Phillips Chemical Co., LLC; Westlake Chemical; DuPont; Celanese Corporation; Eastman Chemical Company; Huntsman International LLC; and RTP Company.

b. The key factors that are driving the U.S. plastics market include, increasing use of plastics in various end-use industries such as automotive, packaging and manufacturing industries.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."