- Home

- »

- Biotechnology

- »

-

U.S. Plasmid DNA Manufacturing Market Size Report, 2033GVR Report cover

![U.S. Plasmid DNA Manufacturing Market Size, Share & Trends Report]()

U.S. Plasmid DNA Manufacturing Market (2025 - 2033) Size, Share & Trends Analysis Report By Disease (Cancer, Infectious Diseases), By Grade (R&D, GMP), By Application, By Development Phase, And Segment Forecasts

- Report ID: GVR-4-68040-287-0

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Plasmid DNA Manufacturing Market Summary

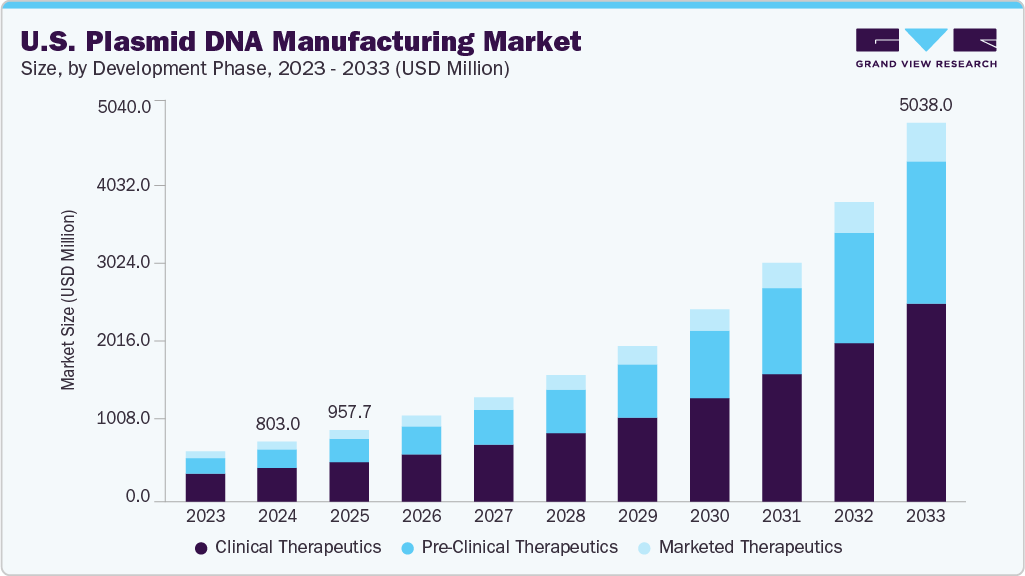

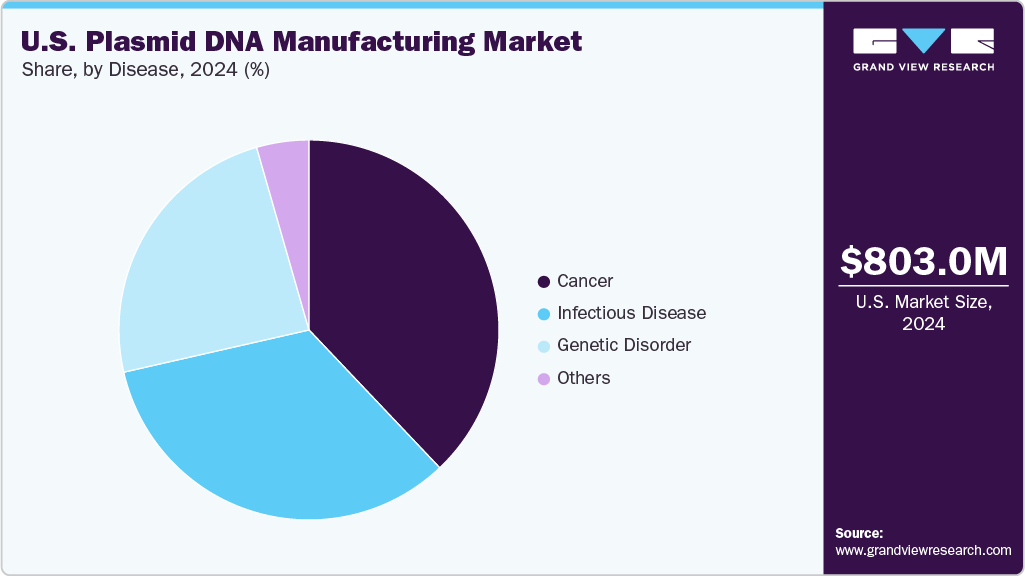

The U.S. plasmid DNA manufacturing market size was estimated at USD 803.0 million in 2024 and is projected to reach USD 5,038.0 million by 2033, growing at a CAGR of 23.06% from 2025 to 2033. This expansion is driven by increasing demand for gene therapies, DNA vaccines, and other advanced biologics that rely on high-quality plasmid DNA as a foundational component.

Key Market Trends & Insights

- By grade, the GMP grade segment held the highest market share in 2024.

- Based on development phase, the clinical therapeutics segment held the highest market share of 55.86% in 2024.

- By application, the cell & gene therapy segment held the highest market share of 56.36% in 2024.

- Based on disease, the cancer segment held the highest market share of 37.92% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 803.0 Million

- 2033 Projected Market Size: USD 5,038.0 Million

- CAGR (2025-2033): 23.06%

Continued investment in biotechnology research and supportive regulatory frameworks are expected to propel market development further over the forecast period.

Rising Prevalence of Genetic Disorders and Cancer

The rising prevalence of genetic disorders and cancer is a major factor driving growth in the U.S. plasmid DNA manufacturing industry. Advances in genetic research have highlighted the role of gene mutations and abnormalities in various diseases, leading to increased development of gene therapies aimed at treating these conditions at their source. Similarly, cancer treatment is increasingly shifting toward personalized and targeted therapies, many of which depend on plasmid DNA as a vector to deliver therapeutic genes or immune modulators. As diagnostic technologies improve and the population ages, more patients are identified as candidates for these innovative therapies, expanding the demand for plasmid DNA.

Estimated Number of New Cases for Selected Cancers by State, U.S., 2025

Rank

State

All Sites

Female Breast

Colon & Rectum

Leukemia

Lung & Bronchus

Melanoma

Lymphoma

Prostate

Urinary Bladder

Cervix

1

United States

2,041,910

316,950

154,270

66,890

226,650

104,960

80,350

313,780

84,870

13,360

2

California

199,980

32,860

16,050

6,000

16,330

11,140

8,280

29,600

7,220

1,490

3

Florida

171,960

23,920

12,330

6,980

18,530

10,290

7,550

26,920

8,070

1,160

4

Texas

150,870

23,880

12,710

5,660

14,030

5,700

5,940

21,070

5,160

1,420

5

New York

123,430

19,170

8,920

4,020

12,770

4,030

5,100

20,490

5,210

790

6

Pennsylvania

90,240

13,650

6,500

2,900

10,250

3,710

3,540

13,400

4,150

540

7

Illinois

78,870

12,160

6,110

2,430

9,270

4,220

3,090

12,350

3,220

490

8

Ohio

77,010

11,800

5,760

2,220

9,950

4,440

2,900

10,820

3,450

490

9

North Carolina

71,320

11,320

4,890

2,270

8,810

3,850

2,550

11,210

2,860

420

10

Georgia

66,210

10,180

5,160

1,980

6,810

3,520

2,150

10,360

2,390

460

11

Other States

945,990

148,060

71,150

30,340

111,470

51,000

36,690

147,310

40,170

5,430

Source: American Cancer Society

Moreover, the complex and individualized nature of genetic and cancer therapies requires highly specialized and scalable plasmid DNA manufacturing processes. Biotech companies and research institutions invest heavily in developing flexible production platforms that meet the' rigorous quality standards and volume demands of clinical and commercial applications. This increased focus on precision medicine and tailored treatments further solidifies plasmid DNA's role as a critical component in the evolving landscape of advanced therapeutics, driving sustained market expansion.

Robust Pipeline for Gene Therapies

The U.S. plasmid DNA manufacturing market is significantly propelled by the robust and continuously expanding pipeline of gene therapies under development. Gene therapy, which involves the delivery of genetic material to correct or modify disease-causing genes, is gaining widespread traction as a promising approach for treating a broad spectrum of inherited disorders, cancers, and rare diseases. The increasing number of gene therapy candidates progressing through preclinical and clinical stages reflects the growing confidence of pharmaceutical and biotechnology companies in these novel treatment modalities.

This surge in research activity has created a strong demand for high-quality plasmid DNA, a fundamental raw material for producing viral vectors and non-viral gene delivery systems. As more gene therapies approach regulatory approval and commercialization, manufacturers are scaling up their plasmid DNA production capacities to meet the anticipated market needs. Moreover, innovations in gene editing technologies, such as CRISPR, are expected to further enrich the gene therapy pipeline, thereby driving sustained demand for plasmid DNA manufacturing.

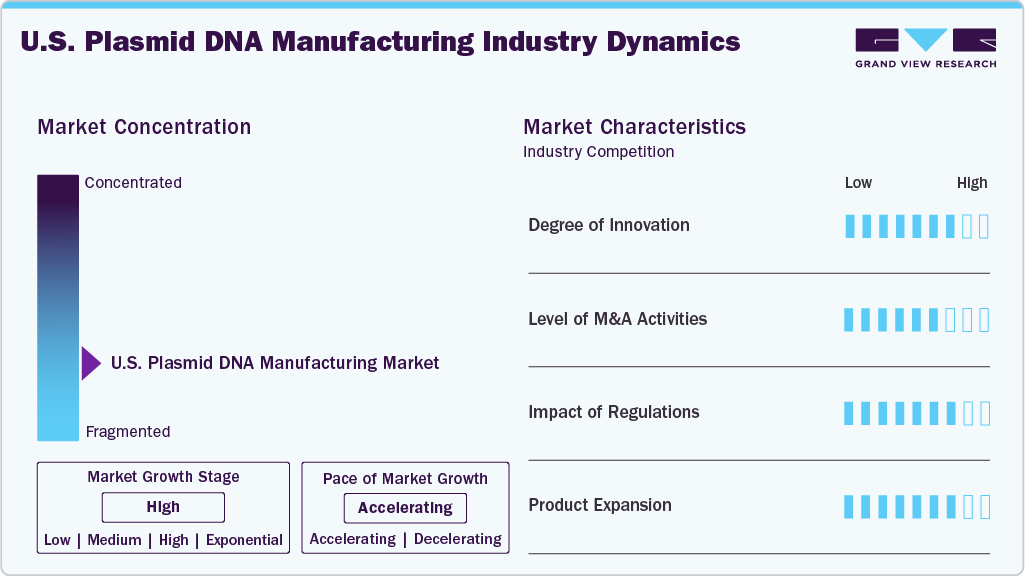

Market Concentration & Characteristics

The U.S. plasmid DNA manufacturing industry demonstrates a high degree of innovation, driven largely by the rapid advancement of gene therapies, mRNA vaccines, and synthetic biology applications. For instance, in May 2024, Charles River launched its viral vector tech transfer program in the U.S., introducing Modular and Fast Track frameworks to accelerate process transfers and safeguard gene therapy development continuity. This wave of innovation is further accelerated by collaborations between biotech firms, academic institutions, and CDMOs, as the industry seeks to meet growing demand while ensuring scalability, regulatory compliance, and cost-effectiveness.

M&A activity in the U.S. plasmid DNA manufacturing market has been relatively moderate in recent years, reflecting broader cautiousness in the biopharma sector. While overall deal volume and value have slowed due to high company valuations and regulatory scrutiny, strategic acquisitions continue to occur, primarily aimed at strengthening gene therapy and plasmid production capabilities. For instance, in March 2024, Novel Bio partnered with Culture Biosciences in the U.S. to scale up its NBx platform, enhancing plasmid DNA production capacity for advanced gene therapy applications.

Regulations significantly impact the U.S. market for plasmid DNA manufacturing, shaping innovation and operational practices. Strict FDA guidelines for plasmid DNA used in gene therapies and vaccines demand rigorous quality control, including purity, potency, and safety standards. This drives manufacturers to adopt advanced purification and analytical technologies. Compliance with Good Manufacturing Practices (GMP) ensures consistency, reduces risks, and increases production complexity and costs. Overall, regulations act as both a challenge and a catalyst, pushing the industry toward higher standards and more robust manufacturing processes.

Product expansion in the U.S. plasmid DNA manufacturing industry is driven by the growing demand for diverse applications, especially in gene therapy, mRNA vaccines, and cell and gene therapies. Manufacturers are broadening their offerings beyond traditional plasmid DNA to include specialized formats like minicircle DNA, linearized plasmids, and custom-designed vectors that improve delivery efficiency and safety. Moreover, companies are expanding into related services such as GMP-grade plasmid production, rapid prototyping, and integrated vector manufacturing solutions. This expansion aims to meet the needs of a wider range of biotech and pharmaceutical clients, support more complex therapeutic modalities, and enable faster development timelines.

Grade Insights

The GMP-grade segment dominated the U.S. plasmid DNA manufacturing market in 2024 and is expected to grow at the fastest CAGR over the forecast period. This is driven by increasing demand for high-quality plasmids in gene therapy, DNA vaccines, and advanced biologics that require stringent regulatory compliance and consistent product quality.

The demand for R&D grade plasmid DNA in the U.S. is rising rapidly due to the surge in gene and cell therapy research, the growing pipeline of nucleic acid-based therapeutics, and strong support from academic institutions and biotech companies. As the U.S. remains a global leader in biomedical innovation, there is a consistent need for cost-effective, high-quality plasmid DNA for preclinical and proof-of-concept studies. R&D grade plasmids are preferred in early-stage research because they offer faster production timelines and greater flexibility without the regulatory complexity of GMP-grade materials, making them ideal for therapeutic development's dynamic and fast-paced nature.

Development Phase Insights

The clinical therapeutics segment held the largest market share of 55.86% in 2024, fueled by the rising adoption of plasmid DNA in gene and cell therapies and DNA-based vaccines, which are transforming treatment options for various genetic and infectious diseases. This growth is supported by advancements in plasmid design that improve safety and efficacy, alongside increased regulatory approvals for gene therapies targeting rare and chronic conditions. Moreover, expanding clinical trials and growing investments in personalized medicine further drive demand in this segment, positioning it as a key revenue driver within the plasmid DNA manufacturing industry.

The preclinical therapeutics segment is expected to witness the fastest CAGR from 2025 to 2033, driven by the growing pipeline of gene and cell therapy candidates in early-stage development and increasing research investments from biotech startups and academic institutions. As demand rises for high-quality plasmid DNA to support proof-of-concept studies and regulatory submissions, manufacturers are expanding their capabilities to offer scalable, research-grade, and GMP-like plasmids tailored for preclinical use. This segment's rapid growth also reflects a broader shift toward earlier adoption of robust manufacturing standards, accelerating the transition from lab-scale research to clinical-grade production.

Application Insights

The cell & gene therapy segment held the largest market share of 56.36% in 2024, reflecting the increasing reliance on plasmid DNA as a critical starting material for viral vector production and direct gene delivery applications. The segment's dominance is driven by the surge in FDA-approved gene therapies, growing investments in CAR-T and other engineered cell therapies, and the expanding pipeline of treatments targeting rare and chronic genetic disorders. For instance, as per the article in RegMedNet, in May 2025, the U.S. FDA approved multiple advanced therapies, including Libmeldy for metachromatic leukodystrophy and Beqvez for hemophilia B, expanding gene and cell therapy treatment options nationwide. As developers prioritize quality, scalability, and regulatory compliance, demand for GMP-grade plasmid DNA tailored to these therapies has intensified, further reinforcing this segment's leadership in the market.

The DNA vaccines segment is expected to witness the fastest CAGR through the forecast period, driven by growing interest in next-generation vaccine platforms that offer rapid development, thermal stability, and strong immunogenicity. The success of DNA vaccines in veterinary medicine and their accelerated adoption during recent public health emergencies have boosted confidence in their potential for human use. Clinical trials targeting infectious diseases, cancers, and emerging pathogens further propel demand for high-quality plasmid DNA. Moreover, advancements in delivery technologies such as electroporation and needle-free injectors are improving the efficiency and acceptance of DNA vaccines, contributing to their rapid market growth.

Disease Insights

The cancer segment held the largest market share of 37.92% in 2024 and is expected to witness the fastest CAGR from 2025 to 2033 in the U.S. plasmid DNA manufacturing industry, driven by the rising use of plasmid DNA in the development of cancer gene therapies, DNA-based cancer vaccines, and engineered cell therapies such as CAR-T and TCR-T. Increasing clinical trial activity targeting solid tumors and hematologic malignancies and growing R&D funding in oncology further accelerate the demand for high-quality plasmid vectors. Moreover, advancements in tumor-targeting plasmid design and delivery systems enhance therapeutic efficacy, making cancer a key focus area for innovation and growth in plasmid DNA manufacturing.

The genetic disorder segment is expected to witness the fastest CAGR over the forecast period, due to the increasing prevalence of inherited diseases and the growing focus on gene therapy as a viable treatment option. Advancements in genetic engineering, including CRISPR and other gene-editing technologies, have accelerated the development of therapies targeting conditions such as cystic fibrosis, muscular dystrophy, and sickle cell anemia. As plasmid DNA is a key component in delivering therapeutic genes, its demand surges in clinical research and early-phase trials. Moreover, rising investments from both the public and private sectors in rare disease research are further propelling the growth of this segment.

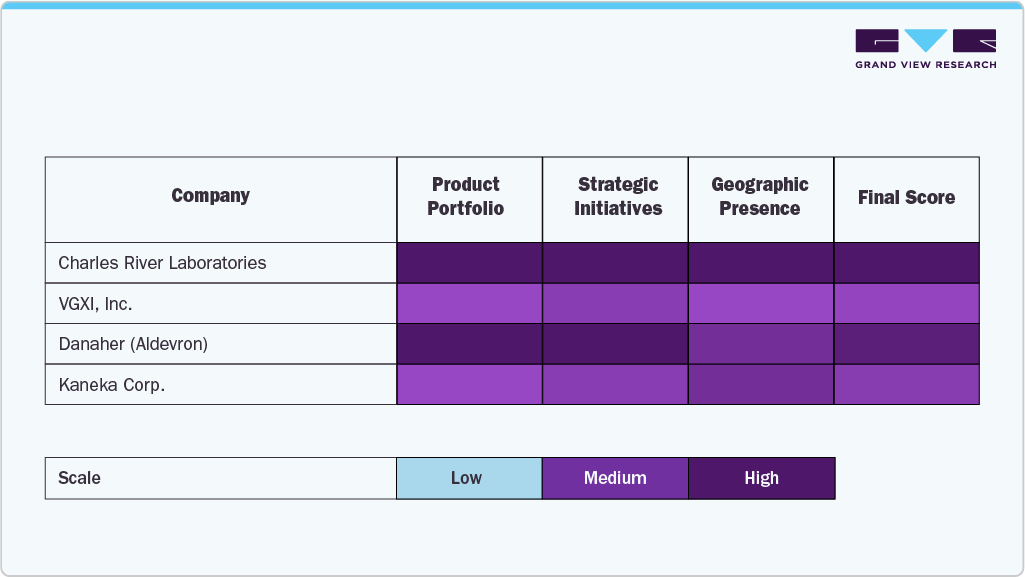

Key U.S. Plasmid DNA Manufacturing Company Insights

The U.S. plasmid DNA manufacturing industry is characterized by several well-established players that lead the industry through robust manufacturing capabilities, specialized service portfolios, and sustained investments in innovation. Companies like Charles River Laboratories, VGXI, Inc., Danaher (through its subsidiary Aldevron), and Lonza have maintained strong market positions due to their scalable GMP-grade production platforms, regulatory expertise, and integration with advanced gene therapy pipelines. These firms support various applications, including gene and cell therapy, DNA vaccines, and synthetic biology, making them indispensable partners for pharmaceutical and biotech developers.

Emerging and mid-sized companies like Nature Technology, Luminous BioSciences, LLC, Akron Biotech, and Eurofins Genomics are expanding their market by offering flexible, customized plasmid production services tailored to early-stage research and clinical trial support. Meanwhile, organizations such as Kaneka Corp. and Cell and Gene Therapy Catapult drive innovation through targeted investments in high-yield production technologies and public-private collaborations that accelerate therapeutic development timelines.

Leading players in the plasmid DNA manufacturing space continue to differentiate themselves through end-to-end service offerings, from R&D-grade plasmid production to large-scale GMP manufacturing, backed by expertise in regulatory compliance and analytical validation. With demand for high-quality plasmid DNA surging across gene editing, immunotherapy, and vaccine development, companies increasingly focus on capacity expansion, process optimization, and strategic alliances to capture growth opportunities.

Ethical manufacturing practices, supply chain resilience, and affordability will become key determinants of long-term success as the industry evolves. The U.S. plasmid DNA manufacturing market is undergoing a period of strategic consolidation and innovation, where the convergence of biomanufacturing excellence and next-generation therapeutic demand is reshaping the competitive landscape. Companies that align their technological strengths with the evolving needs of precision medicine and regulatory standards are poised to lead in this fast-growing and highly specialized sector.

Key U.S. Plasmid DNA Manufacturing Companies:

- Charles River Laboratories

- VGXI, Inc.

- Danaher (Aldevron)

- Kaneka Corp.

- Nature Technology

- Cell and Gene Therapy Catapult

- Eurofins Genomics

- Lonza

- Luminous BioSciences, LLC

- Akron Biotech

Recent Developments

-

In June 2025, ProBio opened its flagship plasmid DNA and viral vector manufacturing facility in Hopewell, New Jersey, U.S., a 128,000 sq ft GMP site boosting U.S. cell and gene therapy capacity.

-

In August 2023, Charles River inaugurated a High‑Quality plasmid DNA manufacturing collaboration with Fondazione Telethon, leveraging its U.S.-based CDMO expertise to support lentivirus production for ex vivo gene therapy in Italy.

-

In February 2023, GenScript ProBio and RVAC Medicines launched a strategic partnership across the U.S. and Singapore to manufacture GMP-grade plasmid DNA, accelerating clinical mRNA COVID‑19 vaccine development.

U.S. Plasmid DNA Manufacturing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 957.7 million

Revenue forecast in 2033

USD 5,038.0 million

Growth rate

CAGR of 23.06% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Grade, development phase, application, disease

Key companies profiled

Charles River Laboratories; VGXI, Inc.; Danaher (Aldevron); Kaneka Corp.; Nature Technology; Cell and Gene Therapy Catapult; Eurofins Genomics; Lonza; Luminous BioSciences, LLC; Akron Biotech

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

U.S. Plasmid DNA Manufacturing Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2021 to 2033. For this report, Grand View Research has segmented the U.S. plasmid DNA manufacturing market report based on grade, development phase, application, and disease:

-

Grade Outlook (Revenue, USD Million, 2021 - 2033)

-

R&D Grade

-

Viral Vector Development

-

AAV

-

Lentivirus

-

Adenovirus

-

Retrovirus

-

Others

-

-

mRNA Development

-

Antibody Development

-

DNA Vaccine Development

-

Others

-

-

GMP Grade

-

-

Development Phase Outlook (Revenue, USD Million, 2021 - 2033)

-

Pre-Clinical Therapeutics

-

Clinical Therapeutics

-

Marketed Therapeutics

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

DNA Vaccines

-

Cell & Gene Therapy

-

Immunotherapy

-

Others

-

-

Disease Outlook (Revenue, USD Million, 2021 - 2033)

-

Infectious Disease

-

Cancer

-

Genetic Disorder

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. plasmid DNA manufacturing market size was estimated at USD 803.0 million in 2024.

b. The U.S. plasmid DNA manufacturing market is expected to grow at a compound annual growth rate of 23.06% from 2025 to 2033 to reach USD 5.04 billion by 2033.

b. The cancer disease segment dominated the U.S. plasmid DNA manufacturing market with the largest market share of 37.92% in 2024.

b. Some key players operating in the U.S. plasmid DNA manufacturing market include Charles River Laboratories, VGXI, Inc., Aldevron, KANEKA CORPORATION, Nature Technology, Cell and Gene Therapy Catapult, Eurofins Genomics, Lonza, and others.

b. Key factors driving market growth include increasing awareness about cell and gene therapy. Moreover, increasing demand for plasmid DNA is also estimated to accelerate market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.