- Home

- »

- Medical Devices

- »

-

U.S. Plasmid DNA Contract Manufacturing Market, Industry Report, 2030GVR Report cover

![U.S. Plasmid DNA Contract Manufacturing Market Size, Share & Trends Report]()

U.S. Plasmid DNA Contract Manufacturing Market (2023 - 2030) Size, Share & Trends Analysis Report By Application, By End-use, By Therapeutic Area, And Segment Forecasts

- Report ID: GVR-4-68040-218-8

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

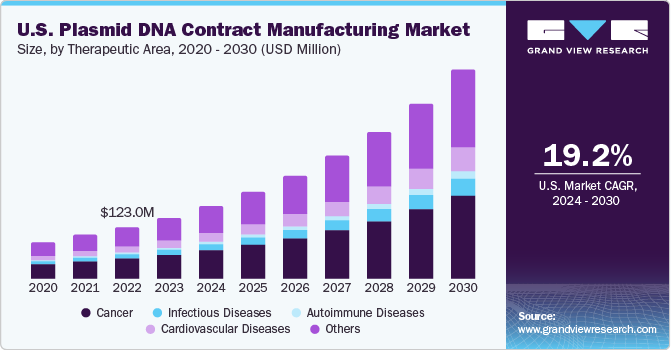

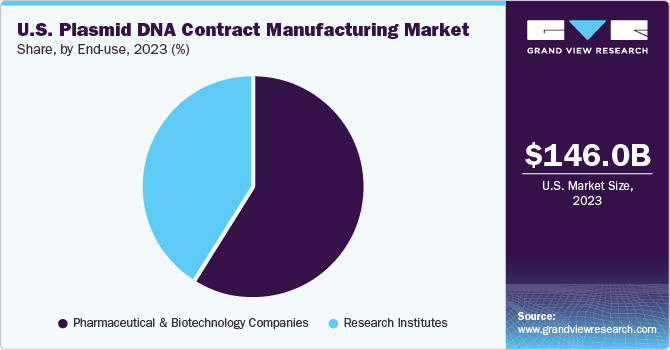

The U.S. plasmid DNA contract manufacturing market size was estimated at USD 146.0 million in 2023 and is expected to expand at a CAGR of 19.2% from 2024 to 2030. The driving factors for market include the increasing popularity of cell and gene therapy for treating various diseases. Moreover, the increasing usage of gene therapy and mostly CAR-Ts has significantly escalated the demand for plasmid DNA, thus simultaneously supporting its contract manufacturing services.

Additionally, technological advancements to overcome the challenges of conventional methods for vector production are anticipated to support growth of this plasmid DNA contract manufacturing market. The field of gene therapy significantly broadens the treatment of viral infections, malignancies,hereditary illnesses, and immunotherapy. Hence, the growing adoption of gene therapy in the treatment of cancer is propelling the growth of U.S. plasmid DNA contract manufacturing market.

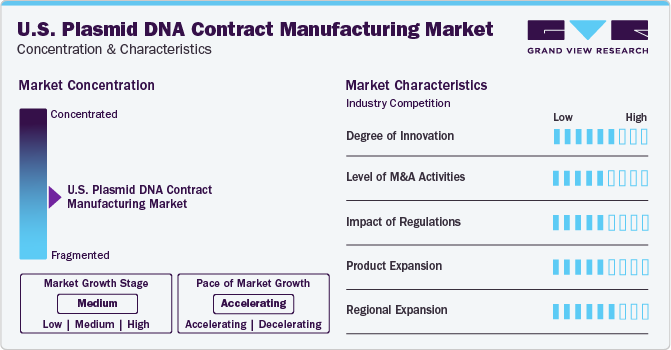

Market Characteristics & Concentration

The market growth is medium and the pace is accelerating due to a moderate degree of innovation, merger and acquistions, impact of regulation and preoduct expansion.

The U.S. plasmid DNA contract manufacturing market is influenced by a high degree of innovation to improve patient outcomes and overall services provided by contract development and manufacturing organizations (CDMO). For instance, in January 2022, Biotech company, WACKER Group announced its production facility platform of plasmid DNA (pDNA) for its customers in San Diego, USA. This platform would offer a full pledge service facility from selecting and generating productive strains, up to and including GMP-compliant manufacturing of pDNA. This facility would further help in the production of plasmid in more quantity for all the phases of clinical development and commercial purposes.

Growing merger and acquisition (M&A) activities attempted by key plasmid DNA contract manufacturing companies are expected to expand the growtmarket. For instance, in November 2023, Ajinomoto Group announced the agreement to acquire all units of Forge Biologics Holdings, LLC. for approximately USD 554 million. Through this acquisition, Ajinomoto Co. expected to deliver accelerated growth with the expansion of its oligonucleotide drugs, biopharmaceutical CDMO, regenerative medicine and antibody culture media, medical food businesses, and more. This partnership would present new treatment options for rare disease patients, aiming at the well-being of all human beings.

The approvals from regulatory bodies such U.S. FDA help for expanding the manufacturing capabilities and company portfolio geographically also plays an important role and facilitates the market growth. For instance, in January 2022, Andelyn Biosciences, a pioneering cell and gene therapy CDMO announced U.S. FDA approval for its GMP plasmid DNA drug master file (DMF), which enabled vertical integration of its clients’ manufacturing process, streamlining timelines for developers to begin manufacturing to just three months.

Key U.S. plasmid DNA contract manufacturing market companies are aiming to expand their product portfolio to acquire more clients, escalate their company’s portfolio, and streamline vendor management. For instance, in October 2022, Forge Biologics announced the initiation of a plasmid manufacturing facility for gene therapy production services. The company would integrate a pDNA production facility into its adeno-associated virus (AAV) manufacturing process. This would streamline vendor reliability, manage timeline risks, and escalate AAV manufacturing services.

Several market companies are involved in geographical expansion to enhance capabilities and have a direct presence in countries having high demand. For instance, in May 2021, Charles River Laboratories announced the acquisition of U.S.-based CDMO, Viagene Biosciences, Inc., The agreement was closed at USD 292.5 million, offering their U.S. presence. This geographical expansion of Charles River Laboratory would enhance the cell and gene therapy portfolio with a customized approach.

Application Insights

Based on application, cell and gene therapy segment held the largest market share with 60.4% in 2023 and is expected to dominate due to an increasing number of clinical trials and the subsequent increase in approved drugs. The market growth can be attributed to a growing dependability, efficiency, and safety of gene treatment in a wide range of chronic and genetic disorders.

Moreover, the active participation of CDMOs in developing new plasmid DNA boosts growth. For instance, in October 2022, Ray Therapeutics, along with Forge Biologics, a CDMO, extended their collaboration agreement for manufacturing of clinical-stage plasmid DNA to support Ray Therapeutics’ lead optogenetics gene therapy program.

The immunotherapy segment is projected to witness growth from 2024 to 2030. The growth is driven by rising R&D activities relevant to immunotherapy. As the prevalence of cancer is high, the adoption rates for novel immunotherapies for treating cancer are higher. For instance, as per the JAMA Oncology report published in 2023, about 11% and 27% adoption rates of immunotherapy have been adopted in rural clinical practice and urban clinical practice in the U.S. respectively. Such disease prevalence is likely to increase growth of this segment over the forecast years.

Therapeutic insights

Based on the therapeutic insights, cancer segment dominated this market with a share of 39.1% in 2023. The growth is highly driven by increasing prevalence of cancer and rising focus of key companies for cancer therapeutics. The growing adoption of cell & gene therapy for treating cancer is fueling the growth of U.S. Plasmid DNA contract manufacturing market. For instance, in October 2023, Charles River announced its partnership with Rznomics to manufacture viral vectors for gene therapy to treat patients with liver cancer.

The infectious segment is likely to grow at the fastest rate from 2024 to 2030. This growth is driven by rising commercialization of pDNA therapeutics for treating infectious diseases. For instance, in February 2023, GeneScript ProBio and RVAC joined together to manufacture COVID-10 Vaccine pDNA. This collaboration aims to help expedite the clinical manufacturing of RVM-V001 and future mRNA-based vaccines that target infectious diseases such as Clostriodioides difficile infection (CDI) and Respiratory syncytial virus (RSV).

End-use Insights

Based on the end-use, the pharmaceutical and biotechnology companies dominated this market with a share of 59.3% in 2023. This growth can be attributed to the increasing manufacturing of plasmid DNA-based therapeutics across the U.S. Moreover, key market companies are focusing on strategic initiatives to escalate pDNA production thereby boosting the growth of the segment. For instance, in January 2023, Charles River Laboratories International, Inc. announced the launch of the eXpDNA™ plasmid platform. This platform would help in reducing plasmid manufacturing and production timelines for gene therapy.

The research institutes segment is expected to witness the fastest growth from 2024 to 2030 due to increasing funding for cell & gene therapy-based research. Research institutes are significantly focusing on the R&D of cell and gene therapies due to the growing demand for plasmid DNA. Hence, the increasing funding coupled with the growing demand for plasmid DNA-based therapeutics will strongly escalate the segment’s growth in the plasmid DNA contract manufacturing market. For instance, in Septemeber 2019, the National Institutes of Health (NIH) revealed about 24 grants have been awarded to researchers across the United States through the Somatic Cell Genome Editing (SCGE) Program. This program was funded by the NIH Common Fund to improve genome-editing techniques and manufacturing of genome-editing therapies.

Key U.S. Plasmid DNA Contract Manufacturing Company Insights

The market landscape is consolidated, with the presence of a small number of companies holding majority stake. Key players operating in the market are Aldevron; Charles River Laboratories; Akron Biotech; VGXI, Inc., and Catalent, Inc.

The market growth is further enhanced by new expansion activities, product approvals, partnerships, mergers & acquisitions. Furthermore, there has been a significant increase in the demand for U.S. plasmid DNA contract manufacturing due to the growing research and development activities that are fueling the market growth.

Key U.S. Plasmid DNA Contract Manufacturing Companies:

- Aldevron

- Charles River Laboratories

- Akron Biotech

- VGXI, Inc.

- Catalent, Inc

- DH Life Sciences, LLC

- Recipharm AB

- TriLink BioTechnologies

- AGC Biologics

- Thermo Fisher Scientific Inc.

Recent Developments

-

In September 2023, Chares River announced a collaboration with INADcure Foundation to offer high-quality (HQ) plasmid DNA for developing the latter’s lead therapeutic candidate for treating infantile neuroaxonal dystrophy (INAD). This collaboration aims to fulfill the critical supply shortage of plasmid DNA, necessary for cell and gene therapy, and accelerate the timeline.

-

In June 2023, GenScript ProBio announced a collaboration with Comprehensive Cell Solutions (CCS) to serve integrated cell therapy solutions. This collaboration would escalate the delivery of innovative treatments to patients by leveraging GenScript ProBio's expertise in gene therapy development and CCS's proficiency in clinical cell therapy manufacturing and bone marrow transplant services.

-

In March 2023, the Center for Breakthrough Medicines (CBM) and Cell One Partners, a cell and gene therapy consulting company, announced an agreement of partnership to offer efficient end-to-end gene therapy services, including nucleic acid synthesis and plasmid production. This partnership aims to advance cell and gene therapy research from idealization to commercialization to save lives.

-

In February 2023, PackGene Biotech announced the expansion of its services with the addition of a new GMP biomanufacturing and processing facility in Houston, Texas. This consists of gene therapy programs and provides economical, reliable, and scalable AAV products. Through this expansion, the company aims to become a one-stop-shop solution provider for gene therapy developers.

-

In January 2023, Catalent announced the new EMA and US FDA-approved pDNA manufacturing facility in Belgium. Through this, Catalent launched a new range of cataloged plasmids to offer support to cell and gene therapy developers

U.S. Plasmid DNA Contract Manufacturing Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 173.5 million

Revenue Forecast in 2030

USD 497.8 million

Growth rate

CAGR of 19.2% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Applications, therapeutic area, end-use

Country scope

U.S.

Key companies profiled

Aldevron; Charles River Laboratories; Akron Biotech

VGXI, Inc.; Catalent, Inc.; DH Life Sciences, LLC; Recipharm AB; TriLink BioTechnologies; AGC BiologicsThermo Fisher; Scientific Inc.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

U.S. Plasmid DNA Contract Manufacturing Market Report Segmentation

This report forecasts revenue growth at the country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. plasmid DNA contract manufacturing market based on applications, therapeutic area, and end-use:

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cell & gene therapy

-

Immunotherapy

-

Other application

-

-

Therapeutic Area Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cancer

-

Infectious Diseases

-

Autoimmune Diseases

-

Cardiovascular Diseases

-

Others

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Pharmaceutical and Biotechnology Companies

-

Research Institutes

-

Frequently Asked Questions About This Report

b. The U.S. plasmid DNA contract manufacturing market size was estimated at USD 146.0 million in 2023 and is expected to reach USD 173.5 million in 2024.

b. The U.S. plasmid DNA contract manufacturing market is expected to grow at a CAGR of 19.2% from 2024 to 2030 to reach USD 497.8 million in 2030.

b. Based on the end-user, the pharmaceutical and biotechnology companies dominated this market with a share of 59.3% in 2023. This growth can be attributed to the increasing manufacturing of plasmid DNA-based therapeutics across the U.S.

b. The market landscape is consolidated, with the presence of a small number of companies holding majority stake. Key players operating in the market are Aldevron; Charles River Laboratories; Akron Biotech; VGXI, Inc., and Catalent, Inc.

b. The driving factors for market include the increasing popularity of cell and gene therapy for treating various diseases. Moreover, the increasing usage of gene therapy and mostly CAR-Ts has significantly escalated the demand for plasmid DNA, thus simultaneously supporting its contract manufacturing services.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.