- Home

- »

- Consumer F&B

- »

-

U.S. Plant-based Meat Market Size, Industry Report, 2030GVR Report cover

![U.S. Plant-based Meat Market Size, Share & Trends Report]()

U.S. Plant-based Meat Market (2025 - 2030) Size, Share & Trends Analysis Report By Source (soy, pea, wheat), By Product (Burgers, Sausages, Patties), By Type, By End-user, By Storage, And Segment Forecasts

- Report ID: GVR-4-68040-076-7

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Plant-based Meat Market Size & Trends

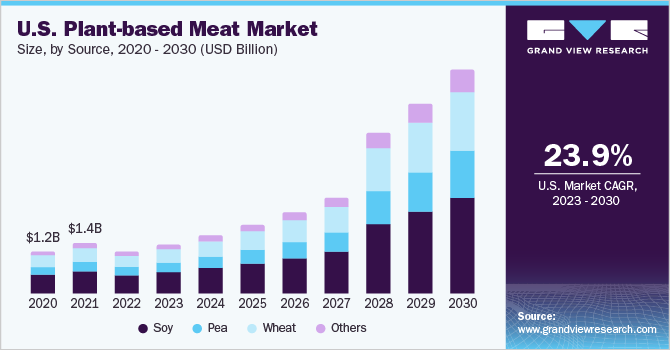

The U.S. plant-based meat market size was estimated at USD 3.21 billion in 2024 and is projected to grow at a CAGR of 18.1% from 2025 to 2030. Consumers are becoming more health-conscious and are looking for alternatives to traditional meat products that are lower in saturated fat and cholesterol. Therefore, plant-based meat is becoming increasingly important in the context of vegan diets, which involve avoiding animal-based foods. Many individuals adopt this lifestyle for health and ethical reasons, while others choose vegetarian ingredients to promote sustainability and avoid animal cruelty in food and beverage products. Soy, which contains all nine essential amino acids required for human growth, is a popular raw material for plant-based meat products. Its ability to enhance water absorption, solubility, emulsification, viscosity, anti-oxidation, and texture of the final product is expected to drive its demand in this industry in the years to come.

The popularity of various types of plant-based meat is continuously increasing, leading to a broader and more diverse product category. In addition to plant-based beef, there is a growing demand for plant-based chicken, pork, and seafood, which is contributing to the market expansion. The refrigerated plant-based meat segment is expected to experience rapid growth between 2025 and 2030, thanks to advancements in product development and marketing strategies within the plant-based industry. This trend underscores a significant shift in the way consumers perceive and purchase meat substitutes.

The distribution of plant-based meat through the foodservice channel was severely impacted, while panic buying and stockpiling resulted in a substantial surge in retail sales compared to the previous year. Several types of plant-based meat witnessed remarkable growth during the initial phase of stockpiling.

In recent years, there has been a noticeable surge in the demand for plant-based meat in the U.S. This is largely attributed to an increasing awareness among consumers regarding the health benefits associated with veganism. Consumers are seeking out vegetarian food options that are rich in fiber, vitamin C, and iron while containing minimal levels of processed saturated fats. To meet this growing demand, manufacturers are working tirelessly to create products with extended shelf lives, improved textures and aromas, and enhanced nutritional profiles. It is expected that these efforts will continue to drive market growth in the U.S.

Source Insights

Soy-based meat led the market and accounted for 44.4% share of the U.S. revenue in 2024. Soy is expected to experience consistent growth in the foreseeable future due to its potential to improve exercise performance, aid in post-workout recovery, and promote muscle development and strength. This is primarily attributed to soy being a rich source of branch chain amino acids (BCAAs).

The market for pea-based meat products is expected to grow due to their cost-effectiveness and lower carbon footprint compared to traditional animal and dairy-based foods. This is further fueled by the increasing demand for these products due to their improved microwave-ability and slice-ability. Pea-based burgers, which have high protein content and meat-like texture, can easily replace traditional meat-based burgers. Additionally, factors such as easy availability and quick preparation are driving the growth of pea-based meat products at a rate of 19.0% over the forecast period.

Product Insights

Plant-based burgers led the market and accounted for 28.4% share of the U.S. revenue in 2024. Burgers are designed to replicate the taste, texture, and aroma of meat, using a variety of plant-based ingredients. The Impossible Burger, produced by Impossible Foods, incorporates genetically modified elements that mimic the natural heme-iron found in animals, resulting in a unique and meat-like flavor. Several companies in the U.S. offer their own distinct versions of plant-based burgers, including Kellogg NA Co., Quorn, Amy's Kitchen, Inc., Kraft Foods, Inc., Yves Veggie Cuisine, and Beyond Meat.

Plant-based sausages are expected to grow at a CAGR of 19.1% from 2025 to 2030. The production of plant-based sausages aimed to replicate the appearance, texture, sizzle, and satisfaction of pork sausages. Notably, companies like Lightlife Foods, Inc. and Beyond Meat are now offering juicy and meaty alternatives that are free from hormones, nitrates, nitrites, GMOs, gluten, and soy. The market for plant-based sausages is expected to grow as these companies continue to invest in introducing new and innovative flavors, including hot Italian, and spinach pesto. Leading players in this market include Marlow Foods Ltd., Impossible Foods Inc., and Moving Mountains.

Type Insights

The plant-based chicken segment led the market and accounted for 37.5% share of the U.S. revenue in 2024. The conventional meat industry commonly uses chicken as the primary component in a variety of food products like nuggets, patties, and cutlets, owing to its high content of animal fats, cholesterol, and protein. On the other hand, plant-based chicken alternatives offer approximately equivalent amounts of protein, but the other nutrients may differ depending on the specific product.

Plant-based pork is expected to grow at a CAGR of 18.9% from 2025 to 2030. Veggie bacon, also referred to as bacon or vegetarian bacon, is a plant-based alternative to pork bacon that is being promoted in the market. It is made from soy and pea protein, which are rich sources of protein and fiber, and is low in fat with no cholesterol. Several prominent manufacturers, including Morningstar Farms, Yves Veggie Cuisine, and Smart Bacon, offer these products.

End User Insights

Sales of plant-based meat through hotel/Restaurant/Café (HORECA) led the market and accounted for 53.4% share of the U.S. revenue in 2024. With the increasing popularity of flexitarian vegan diets, numerous fast-food chains, restaurants, and casual dining venues are now allocating a specific section of their menu exclusively to "meat-free" choices. This trend is expected to boost the growth of the market. Key players in the industry are capitalizing on shifting consumer preferences and the rising demand for a more personable, tailored service.

Sales of plant-based meat through retail are expected to grow at a CAGR of 18.6% from 2025 to 2030. Fast-food chains are increasingly offering plant-based meat alternatives like burger patties, nuggets, and strips, which are becoming popular among health-conscious consumers. In an effort to cater to this trend, several brands have introduced their own unique plant-based meat products. For instance, Beyond Meat has partnered with Yum! Brands RSC to supply plant-based fried chicken to select KFC locations across the U.S.

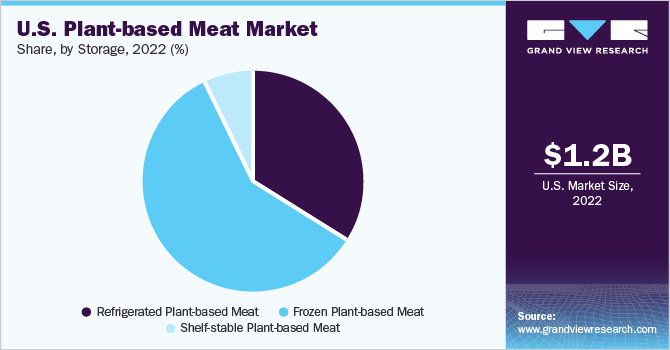

Storage Insights

Frozen plant-based meat products led the market and accounted for a 58.0% share of the U.S. revenue in 2024. The increasing popularity of vegetarian options has resulted in a significant increase in the creation of new products in the ambient, chilled, and frozen food categories. As a result, consumers now have access to a wider range of plant-based meat alternatives from various brands. This has led to greater visibility and availability of these products on store shelves.

The refrigerated plant-based meat products is likely to exhibit the fastest growth and is projected to grow at a CAGR of 18.6% in terms of revenue from 2024 to 2030. The COVID-19 pandemic and meat shortages have been significant contributors to a growing trend of consumers shifting away from meat consumption. Additionally, concerns over the spread of the virus in meat processing facilities have heightened these concerns. Although frozen plant-based meat products have been less popular than their refrigerated counterparts during the pandemic, the shift towards vegetarian food products is expected to continue due to increasing environmental awareness among consumers.

Key U.S. Plant-based Meat Market Company Insights

The U.S. plant-based meat market companies are primarily concentrating on R&D efforts to create novel meat alternatives that imitate the flavor and texture of uncommon meats like lobster and veal. Additionally, some firms are prioritizing expansion in burgeoning plant-based meat markets within the U.S. Their aim is to diversify their product range and introduce innovative alternatives that can cater to the growing demand for plant-based options. Major players in the market are characterized by a robust sales channel with restaurants and retail chains in U.S. for the distribution of their faux meat products.

Key U.S. Plant-based Meat Companies:

- Beyond Meat

- Impossible Foods Inc.

- Maple Leaf Foods (Field Roast & Maple Leaf)

- Conagra, Inc. (Gardein Protein International)

- Kellogg NA Co. (MorningStar Farms)

- Amy's Kitchen, Inc.

- Tofurky

- Kraft Foods,Inc.

- Lightlife Foods, Inc

- Trader Joe's

- Yves Veggie Cuisine (The Hain-Celestial Canada, ULC)

- Eat JUST Inc.

- No Evil Foods

Recent Developments

-

In September 2024, Beyond Meat launched a new whole-muscle steak alternative aimed at mimicking the flavor and texture of filet mignon, as part of a strategic shift to attract health-conscious consumers. This initiative comes after the company revealed plans to simplify its ingredient lists and emphasize the health benefits of plant-based diets, moving away from previous partnerships with fast-food chains.

-

In June 2024, in a collaboration between The Kraft Heinz Company and TheNotCo, a new joint venture named The Kraft Heinz Not Co. launched its first plant-based meat products: NotHotDogs and NotSausages. These offerings aim to replicate the savory flavors associated with Oscar Mayer, appealing to both vegans and those exploring plant-based diets. CEO Lucho Lopez-May emphasized the goal of providing delicious, accessible plant-based options that leverage NotCo's AI technology alongside the legacy of Oscar Mayer.

-

In March 2023, Beyond Meat and PepsiCo launched a plant-based jerky made with protein from peas and mung beans. It's the first product under their joint venture, PLANeT Partnership, and is available in three flavours. This allows Beyond to leverage Pepsi's production and marketing expertise, while Pepsi can invest in the plant-based market. It's an opportunity for Beyond to rejuvenate their grocery sales.

U.S. Plant-based Meat Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3787.2 million

Revenue forecast in 2030

USD 8.70 billion

Growth rate

CAGR of 18.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Source, product, type, end user, storage

Country scope

U.S.

Key companies profiled

Beyond Meat; Impossible Foods Inc.; Maple Leaf Foods (Field Roast & Maple Leaf); Conagra, Inc. (Gardein Protein International); Kellogg NA Co. (MorningStar Farms); Amy's Kitchen, Inc.; Tofurky; Kraft Foods,Inc.; Lightlife Foods, Inc; Trader Joe's; Yves Veggie Cuisine (The Hain-Celestial Canada, ULC); Eat JUST Inc.; No Evil Foods

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Plant-based Meat Market Report Segmentation

This report forecasts revenue growth at the country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the U.S. plant-based meat market report based on source, product, type, end user, and storage:

-

Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Soy

-

Pea

-

Wheat

-

Others

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Burgers

-

Sausages

-

Patties

-

Nuggets, Tenders & Cutlets

-

Grounds

-

Others

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Chicken

-

Pork

-

Beef

-

Fish

-

Others

-

-

End User Outlook (Revenue, USD Million, 2018 - 2030)

-

Retail

-

HORECA (Hotel/Restaurant/Café)

-

-

Storage Outlook (Revenue, USD Million, 2018 - 2030)

-

Refrigerated Plant-based Meat

-

Frozen Plant-based Meat

-

Shelf-stable Plant-based Meat

-

Frequently Asked Questions About This Report

b. The U.S. plant-based meat market size was estimated at USD 3.21 billion in 2024 and is expected to reach USD 3787.2 million in 2025.

b. The U.S. plant-based meat market is expected to grow at a compound annual growth rate of 18.1% from 2025 to 2030 to reach USD 8.70 billion by 2030.

b. Plant-based burgers led the market and accounted for a 28.44% share of the U.S. revenue in 2024. The burgers are designed to replicate the taste, texture, and aroma of meat, using a variety of plant-based ingredients.

b. Some of the key players in the market are Beyond Meat, Impossible Foods Inc., Maple Leaf Foods (Field Roast & Maple Leaf), Yves Veggie Cuisine (The Hain-Celestial Canada, ULC), Eat JUST Inc., No Evil Foods, others

b. The growth of the U.S. plant-based meat market can be attributed to the rising veganism and increasing health consciousness among consumers

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.