U.S. Physician Groups Market Size, Share & Trends Analysis Report By Practice Type (Single Specialty Group, Multi-Specialty Group), By Practice Size (5 to 10, 11 to 24), By Ownership (Physician-owned, Hospital-owned), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-134-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

U.S. Physician Groups Market Size & Trends

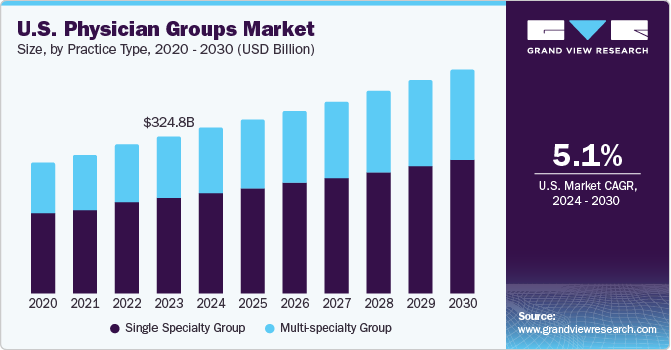

The U.S. physician groups market size was estimated at USD 349.49 billion in 2024 and is projected to grow at a CAGR of 7.62% from 2025 to 2030. The market is expected to grow significantly owing to government initiatives to improve revenue for physician groups, a shift towards value-based care models, and the growing trend of solo practitioners opting to join large physician groups. Recently, physicians have shifted towards large healthcare organizations from self-employed or part of small practices.

The rising trend of solo practitioners transitioning to larger physician groups is positively contributing to the market growth in the U.S. Cost-effectiveness is one of the main factors that increased the number of solo practitioners joining the larger physician group in the U.S. The implementation of the Health Information Technology for Economic and Clinical Health (HITECH) Act incentivizes EHR system adoption, which is expected to drive this trend. According to a study conducted by the Physicians Advocacy Institute in collaboration with Avalere Health, the number of physicians employed by the hospital or corporate-owned practices was around 484,100 in 2022 compared to 375,400 in 2019 and witnessed an increase of 28.9%. This surge in employment by larger organizations has reduced the number of solo practitioners, indicative of a broader consolidation trend within the healthcare sector.

Moreover, reforms in healthcare payment models have significantly impacted the revenue of physicians. There is a substantial difference between the average annual revenue and salary generated by a care provider compared to a specialist physician. In 2023, according to AMN Healthcare’s 2023 Physician Billing report, a primary care physician’s ann ual revenue was USD 1,770,564, whereas revenue generated by a specialty physician was USD 4,650,750.

Furthermore, the development and sale of value-added services are crucial in enhancing patient care, improving operational efficiency, and driving revenue growth for healthcare providers. In the market, value-added services encompass various offerings beyond traditional medical care, such as telemedicine, chronic disease management programs, patient education resources, wellness programs, and preventive care initiatives. By offering these services, physician groups differentiate themselves in the market, attract new patients, and improve patient outcomes. For instance, in August 2023, Northwestern Medical Group (Northwestern Medicine) launched the Northwestern Medicine Canning Thoracic Institute Hispanic Program, offering personalized care to Hispanic patients suffering from thoracic and lung disease in their native language.

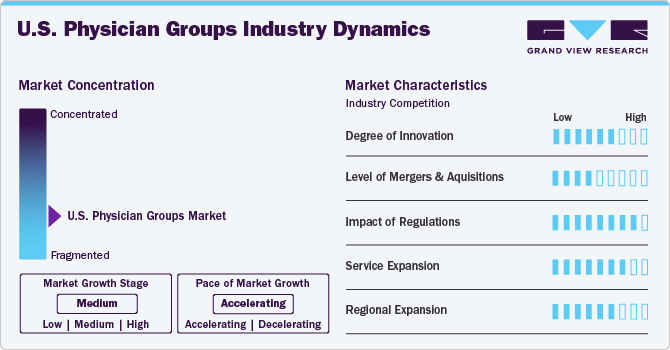

Market Concentration & Characteristics

The chart below illustrates the relationship between market concentration, market characteristics, and market participants. The x-axis represents the level of market concentration, ranging from low to high. The y-axis represents various market characteristics, including the degree of innovation, industry competition, service substitutes, and impact of regulations, level of partnerships & collaboration activities, and geographic expansion. For instance, the U.S. physician groups industry is fragmented, with many small players entering the market and launching new innovative services. The degree of innovation is medium, the level of partnerships & collaboration activities is high, the impact of regulations on the market is high, the service expansion is medium, and regional expansion of the market is low.

Innovations such as the integration of digital health tools, such as mobile health apps, wearable devices, and AI-driven health monitoring platforms, allow physician groups to enhance the delivery of value-added services. Furthermore, the growing emphasis on value-based care models and alternative payment arrangements incentivizes physician groups to invest in value-added services that improve patient outcomes and reduce healthcare costs. For instance, in April 2025, Carrum Health announced a significant expansion of its Centers of Excellence [ (COE) network, which now includes over 1,000 locations across the U.S. This expansion is designed to enhance access to high-quality specialty care for a larger segment of the population, with 90% of Americans now located within 50 miles of a Carrum COE.

The market saw notable consolidations as larger operators sought to expand their reach and capabilities. In January 2024, the Cleveland Guardians and their longstanding partner, the Cleveland Clinic, renewed their partnership agreement. The extended deal enabled the Cleveland Clinic to be the Official Healthcare Provider for the Cleveland Guardians. Moreover, it continued as the claims partner of the Family Deck and the representing sponsor of the Family Value Pack ticket offer.

The impact of regulations on the industry is high, with strict guidelines influencing device development and deployment. Physician groups participating in Medicare and Medicaid programs must comply with specific regulations related to billing, documentation, and quality reporting to ensure appropriate reimbursement and quality of care for program beneficiaries. For instance, in January 2023, the Centers for Medicare and Medicaid Services (CMS) release new regulatory initiatives for physician groups, which include prior authorization reforms, price transparency and cost estimate mandates, the “next” stage of Cures Act data sharing rules, implementation of once-in-a-decade ACO reforms, and bipartisan telehealth, behavioral health, and Medicare payment laws.

Market players leverage the strategy of service expansion to increase their service capabilities and promote the reach of their service offerings. For instance, in July 2023, UT Physicians launched the Interventional Psychiatry Clinic, which offers services tailored to patients with treatment-resistant psychiatric conditions, conveniently available in a single location. It aims to adopt existing interventional psychiatry services and expand & innovate by developing new ones.

The level of regional expansion in the market is low due to various government programs and initiatives. Some prominent companies in the market are implementing various strategies, such as launching new services and geographical expansion, to consolidate their market position across the country. For instance, in January 2024, Northwell Health Physician Partners expanded its dental m edicine services in Nassau County by acquiring two established practices with a history of service in their respective communities.

Physician Practice Options: Key Takeaways

|

Practice Type |

Ownership Status |

Clinical Autonomy |

Operational Risk |

Financial Risk |

Key Notes |

|

Solo Practice |

Owner |

High |

High |

High |

Full control, high risk, either build from scratch or buy an existing practice. AMA resources help with efficiency and payment models. |

|

Group Practice (Equity Owner) |

Co-owner (Equity Owner) |

Moderate to High |

Shared |

Shared |

Shared risks and responsibilities, benefits of shared infrastructure, and patient base. |

|

Group Practice (Employee) |

Employee |

Moderate |

Low |

Low |

Stable employment, less autonomy than owners, operational tasks managed by practice owners. |

|

Hospital / Health System |

Employee |

Moderate to Low |

Low |

Low |

Stability, benefits, lower autonomy. Focus on patient care; less influence on operations and finances. |

|

Academic Institution |

Employee |

Moderate to Low |

Low |

Low |

Focus on teaching/research + clinical practice. Access to academic resources and stable environment. |

Practice Type Insights

Based on practice type, the single specialty segment led the market with the largest revenue share of 60.74% in 2024. The growth of the segment can be attributed to a decrease in patient volume, financial instability, and a reduction in patient visits to a single specialty group. The factors driving this shift toward group practices include profitability, negotiating leverage, lifestyle considerations, and enhanced quality of patient care. According to a survey conducted by the American Medical Association (AMA), in 2022, the largest proportion of physicians were affiliated with single-specialty practices, accounting for 41.8% . Furthermore, physicians in single-specialty groups have more independence and control over clinical decision-making, practice management, and financial operations compared to employed positions within larger healthcare organizations

The multi-specialty group segment is expected to grow at the fastest CAGR over the forecast period. These offer a wide range of medical specialties and services at a single facility, providing patients with comprehensive healthcare. This eliminates the need for patients to visit multiple providers at different locations for their healthcare needs.

Moreover, these facilities are adopting several technologically advanced products to cater to the demand of the growing patient population in the U.S. These technologies improve patient care, support data-driven decision-making, and streamline operations. For instance, in February 2023, Privia Health, a technology-driven, national-physician enableme nt provider, partnered with Community Medical Group (CMG) to launch a Clinically Integrated Network (CIN) known as Privia Quality Network of Connecticut (PQN CT) in Connecticut. The CIN consists of around 430 primary care providers out of over 1,100 multi-specialty providers in over 450 practice locations.

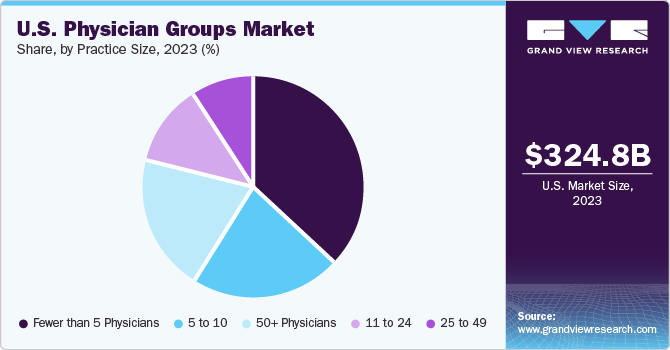

Practice Size Insights

Based on practice size, the fewer than five physicians segment led the market with the largest revenue share of 36.49% in 2024. This can be attributed to autonomy and control over clinical decisions and practice management with the high quality of services through the smaller practices. However, the acquisition of small practices by private equity firms and the shift of physicians toward hospital settings is anticipated to drive the market's growth over the forecast period.

Small physician groups often focus on providing personalized, patient-centered care. They emphasize building relationships with patients, understanding their unique healthcare needs, and delivering high-quality services. According to the American Medical Association, around 20% worked with 5 to 10 physicians. Patients often develop strong bonds with their physicians in smaller settings due to the personalized care and attention they receive. This leads to increased patient loyalty and positive word-of-mouth referrals, which can contribute to the practice's growth.

The 50+ physicians’ segment is expected to grow at the fastest CAGR of over the forecast period. The rising growth of the segment can be attributed to the shift of physicians aged 40 years and above towards the 50+ physician groups. According to the American Medical Association’s Physician Practice Benchmark Survey, around 38.1 % of physicians aged 40 years worked in physician groups of size 50+ physicians.

Case Study: Marshfield Clinic - Driving Affordability in U.S. Physician Groups

-

Overview:

-

Marshfield Clinic, one of the largest private multi-specialty physician groups in the U.S., employs ~700 physicians and operates outpatient centers, labs, and its own health plan.

-

-

Strategy Highlights:

-

Focus on Affordability: Leveraging its in-house analytics, Marshfield uses statewide claims data to benchmark resource use and identify efficiency gaps across specialties.

-

Physician Engagement: Affordability metrics are included in PCP compensation, but penalties are rare and targeted only at extreme underperformers to encourage intrinsic motivation.

-

Data-Driven Improvement: Practice patterns are reviewed to align with best practices without compromising care quality.

-

-

Market Relevance:

-

Marshfield reflects a wider trend in the U.S. physician groups industry toward value-based care, operational efficiency, and balanced physician incentives.

-

Ownership Insights

Based on ownership, the physician-owned segment led the market with the largest revenue share of 48.88% in 2024. The growth of the physician-owned segment is driven by the high-profit margins, economies of scale, and higher quality of services associated with these practices. Moreover, hospitals have increased their ownership stake in physician groups, and the acquisition of physician practices has also increased. For instance, in January 2024, UnitedHealth Group aims to acquire Corvallis Clinic, a physician-owned provider of radiology and other specialty services in Oregon at 11 locations.

The private equity segment is expected to grow at the fastest CAGR during the forecast period. Private equity investment has been a significant growth factor in the U.S. physician groups industry. Private equity firms have increasingly been acquiring physician practices, providing financial resources and expertise to support their growth & expansion driven by several factors. For instance, in August 2023, Kaiser Foundation Health Plan, Inc. acquired Geisinger Health, a Pennsylvania-bas ed health system consisting of 10 hospitals, 1,700 physicians, and a 600,000-member health plan across 3 states to start a new national healthcare organization, Risant Health. Kaiser aims to invest USD 5 billion in Risant over the next 5 years to expand its presence across the country to compete with players such as UnitedHealth Group, Amazon.com, Inc.; Walmart Health; and Aetna Inc. These acquisitions provide the necessary funding and resources to expand their practices & improve operational efficiency.

Alignment Strategies Adopted by Hospital-Owned Physician Groups

|

Governance |

|

|

Finance |

|

|

Operations |

|

|

Clinical services |

|

Region Insights

The Southeast region dominated the U.S. physician groups market with the largest revenue share of 25.32% in 2024. Physician groups in the Southeast U.S. have experienced significant transformation, and this trend is growing. In states such as Florida and Georgia, independent practices collaborate to form more extensive networks, enabling better care coordination and enhanced resource access. For instance, in November 2024, QuikMedic expanded nationwide through a new partnership with MyCare Medical Group in Pinellas County, Florida. Operating in 14 markets across eight states, QuikMedic offers mobile urgent, preventive, and wellness healthcare services whenever and wherever patients need them.

“QuikMedic was instrumental in helping launch MyCare's At-Home program in Florida," shared. My team is excited about this budding relationship, and our patients are already benefiting from the partnership," Raj added.”

- Raj Shrestha, MyCare's CEO

The Western region of the U.S. physician groups market is expected to grow at the fastest CAGR during the forecast period. The growth of this region is due to the increasing acquisition of physician practices by hospitals in the region. As per a report published in July 2023 by a joint project by the Nicholas C. Petris Center on Health C are Markets and Consumer Welfare, the American Antitrust Institute, the Washington Center for Equitable Growth, and the University of California, Berkeley, there is an increase in the acquisition physician practices by private equity firms across a number of physician specialties from 75 deals to 484 deals between 2019 to 2021 and is anticipated to reach six-time deals in a decade.

Key U.S. Physician Groups Company Insights

The market is fragmented, with the presence of multiple major players. Key players are adopting growth strategies to enhance their market presence, including collaborations and mergers & acquisitions. The integrated physician group model - characterized by shared governance, unified financial strategies, centralized operations, and value-based clinical services - is becoming increasingly prominent in the U.S. healthcare market.

|

Aspect |

Key Characteristics |

Competitive Dynamics |

|

Market Composition |

Fragmented but consolidating. Includes solo practices, small independent groups, large multispecialty groups, hospital-owned groups, and private equity-backed platforms. |

Hospital acquisitions and private equity investments are accelerating consolidation. Independent groups are under pressure but still relevant in specific markets. |

|

Key Players |

- Large Integrated Health Systems (e.g., Kaiser Permanente, Mayo Clinic, Cleveland Clinic) - Private Equity-backed Platforms (e.g., US Anesthesia Partners, Unified Women's Healthcare) - Independent Physician Associations (IPAs) - Academic Medical Centers |

Large systems leverage scale, while PE-backed groups drive aggressive growth via acquisitions. Independent groups compete on personalized care and local market relationships. |

|

Ownership Models |

- Employed physicians (by hospitals/health systems) - Physician-owned groups - Private equity-owned networks |

Employed models dominate urban areas; physician ownership remains common in rural and suburban markets. PE ownership increasing rapidly, especially in specialties like dermatology, orthopedics, and anesthesia. |

|

Technology Adoption |

Rapid investment in EHRs, telehealth platforms, and population health management tools. Increasing use of analytics for quality and cost management. |

Tech-enabled physician groups (such as Oak Street Health) gain competitive advantage by improving patient engagement and managing risk contracts effectively. |

|

M&A and Consolidation |

Intense M&A activity across specialties and geographies. Private equity and health systems actively acquiring physician groups to build scale and negotiate better with payers. |

Consolidation helps create negotiating power, but regulatory scrutiny on competition and patient access is increasing. |

|

Physician Employment Trends |

Over 70% of physicians now employed (hospital systems, corporate entities). Decline in independent practice ownership. |

Employment models offer stability but may reduce clinical autonomy. Recruitment and retention hinge on culture, autonomy, and compensation models. |

Key U.S. Physician Groups Companies:

- Cleveland Clinic

- Kaiser Foundation Health Plan, Inc. (The Permanente Medical Group, Inc.)

- UNITEDHEALTH GROUP (Optum, Inc.)

- Select Medical (Select Physical Therapy)

- C-HCA, Inc. (HCA Florida Healthcare Physicians (HCA, Inc.))

- University of Pittsburgh Physicians (UPMC Physicians)

- NYU Langone Health (NYU Langone Hospitals)

- Northwestern Memorial HealthCare (Northwestern Medicine)

- HealthCare Partners IPA (HealthCare Partners, MSO)

- Northwell Health (Northwell Health Physician Partners)

- RWJ Barnabas Health Medical Group

- Ascension

- Penn Medicine Physicians (The Trustees of the University of Pennsylvania)

Recent Developments

-

In January 2024, The Cleveland Guardians and their longstanding partner, the Cleveland Clinic, renewed their partnership agreement. The extended deal enabled the Cleveland Clinic to be the Official Healthcare Provider for the Cleveland Guardians. Moreover, it continued as the claims partner of the Family Deck and the representing sponsor of the Family Value Pack ticket offer.

-

In January 2024, Northwestern Medicine and Countryside Fire Protection District and the South Elgin collaborated to provide the South Elgin area and surrounding northwestern suburbs with life-saving stroke treatment & diagnosis. Through the collaboration, Northwestern Medicine’s Mobile Stroke Unit (MSU) can be deployed, effectively establishing an emergency room in a parking lot, thereby saving crucial minutes.

-

In October 2023, Optum, Inc., and ProHealth entered a strategic partnership to elevate patient care, introduce innovative technology solutions, and assist ProHealth Care in maintaining its dedication to serving patients & the community.

-

In May 2023, South Shore Neurologic Associates and NYU Langone Health collaborated to improve the quality of specialized care in Suffolk County. This collaboration establishes three NYU Langone South Shore Neurologic Associates locations in Riverhead, Patchogue, and Islip.

U.S. Physician Groups Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 376.0 billion |

|

Revenue forecast in 2030 |

USD 542.99 billion |

|

Growth rate |

CAGR of 7.62% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast data |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Practice type, practice size, ownership, region |

|

Country scope |

U.S. |

|

Key companies profiled |

Cleveland Clinic; Kaiser Foundation Health Plan, Inc. (The Permanente Medical Group, Inc.); UNITEDHEALTH GROUP (Optum, Inc.); Select Medical (Select Physical Therapy); C-HCA, Inc. (HCA Florida Healthcare Physicians (HCA, Inc.)); University of Pittsburgh Physicians (UPMC Physicians); NYU Langone Health (NYU Langone Hospitals); Northwestern Memorial HealthCare (Northwestern Medicine); HealthCare Partners IPA (HealthCare Partners, MSO); Northwell Health (Northwell Health Physician Partners); RWJ Barnabas Health Medical Group; Ascension; Penn Medicine Physicians (The Trustees of the University of Pennsy |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

U.S. Physician Groups Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. physician groups market report based on practice type, practice size, ownership, and region:

-

Practice Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Single Specialty Group

-

Primary Care

-

OB/GYN

-

Ophthalmology

-

Surgical

-

Psychiatry

-

Cardiology

-

Anesthesiology

-

Dermatology

-

Radiology

-

Emergency Medicine

-

Others

-

-

Multi-specialty Group

-

Primary Care

-

OB/GYN

-

Ophthalmology

-

Surgical

-

Psychiatry

-

Cardiology

-

Anesthesiology

-

Dermatology

-

Radiology

-

Emergency Medicine

-

Others

-

-

-

Practice Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Fewer than 5 Physicians

-

5 to 10

-

11 to 24

-

25 to 49

-

50+ Physicians

-

-

Ownership Outlook (Revenue, USD Billion, 2018 - 2030)

-

Physician-owned

-

Hospital-owned

-

Private Equity-owned

-

Others

-

-

Region Outlook (Revenue, USD Billion, 2018 - 2030)

-

Northeast

-

Southeast

-

Southwest

-

Midwest

-

West

-

Frequently Asked Questions About This Report

b. The U.S. physician groups market size was estimated at USD 349.49 billion in 2024 and is expected to reach USD 376.04 billion in 2025.

b. The U.S. physician groups market is expected to grow at a compound annual growth rate of 7.62% from 2025 to 2030 to reach USD 542.99 billion by 2030.

b. Single specialty Group segment dominated the U.S. physician groups market with a share of 60.74% in 2024 owing to value-based and patient centric services provided by single specialty groups.

b. Some key players operating in the U.S. physician groups market include Cleveland Clinic, The Permanente Medical Group, Optum, Inc., Select Physical Therapy, HCA Florida Healthcare Physicians (HCA, Inc.), University of Pittsburgh Physicians (UPMC Physicians), NYU Langone Health Physicians (NYC University Physicians Network), Northwestern Medical Group (Northwestern Medicine), HealthCare Partners IPA (HealthCare Partners, MSO), Northwell Health Physician Partners (Northwell Health), RWJBarnabas Health Medical Group, Ascension, Penn Medicine Physicians (The Trustees of the University of Pennsylvania).

b. Key factors that are driving the U.S. physician groups market growth include shift of physicians from solo practices to group practices, shift towards value-based care models, and rising government initiatives for the groups.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."