- Home

- »

- Medical Devices

- »

-

U.S. Pharmacy Automation Devices Market, Industry Report, 2030GVR Report cover

![U.S. Pharmacy Automation Devices Market Size, Share & Trends Report]()

U.S. Pharmacy Automation Devices Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Medication Dispensing Systems, Tabletop Tablet Counters), By End-use (Retail Pharmacies, Inpatient Pharmacies), And Segment Forecasts

- Report ID: GVR-4-68040-289-8

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

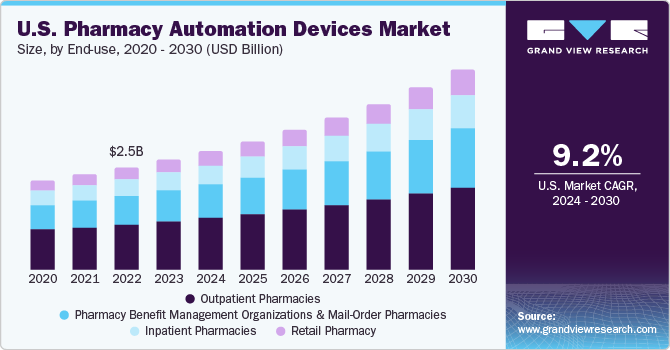

The U.S. pharmacy automation devices market size was estimated at USD 2.73 billion in 2023 and is expected to grow at a CAGR of 9.2% from 2024 to 2030. Increasing burden of chronic diseases and growing geriatric population are leading to a surge in the number of prescriptions. This in turn is resulting in a rise in the number of medication errors. It has been stated that medical errors result in the death of approximately 251,454 individuals annually in U.S. hospitals, ranking it as the country’s third most common cause of death. Data on patient safety from 2022 shows a significant 256,679 serious incidents and events, but interestingly, there was a marked reduction in medication errors compared to the year before. This is driving the growth of pharmacy automation devices market. Moreover, increase in initiatives by various organizations such as American Society of Health-System Pharmacists to reduce medication errors is positively impacting the market growth.

The U.S. accounted for over 45.6% of the global pharmacy automation devices market in 2023. The escalating global health issues and the growing reliance on prescription drugs is the reason this. For example, a KFF tracking poll in 2022 revealed that between September and October 2021, approximately 62% of U.S. residents were on prescribed medication. This surge in prescription usage is fuelling the need for automated technology to minimize medication errors and expedite prescription dispensing. Furthermore, pharmacy automation tools aid in preventing product contamination and mistakes, thereby lowering liability risks, and enhancing patient safety. These tools also help in reducing medication waste, which ultimately cuts costs in the long term. For instance, Omnicell Inc. reported that pharmacy automation led to no drug waste and a 90% reduction in pharmacy checks. Therefore, automation allows pharmacists to devote more time to patient care.

Pharmacy automation devices provide advantages such as reduced vulnerability to shortage of medications, decreased medication waste, reduced medication cost per dose, and enhanced patient safety. Moreover, these devices reduce labor costs & medication errors and enhance accuracy & speed. The digital transformation of processes and workflow enhancements are enabling end-users to better control costs and enhance efficiency throughout the care continuum, leading to improved outcomes and performance, and freeing up time to concentrate on patient care. For instance, in March 2022, Walgreens Boots Alliance inaugurated 22 micro-fulfillment centers in the U.S., employing robots to fulfill customer prescriptions, signifying a shift in the roles of stores and pharmacists. A single robot can process 300 prescriptions per hour, equivalent to the daily output of a typical Walgreens pharmacy staffed by several employees. Therefore, the market is expected to grow in the future due to advancements in pharmacy automation technology.

The market was significantly affected by the COVID-19 pandemic, with numerous pharmacy automation device firms experiencing a drop in sales revenue. The pandemic has also revealed weaknesses and obstacles in the pharmacy supply chain, emphasizing the need for advanced automation and intelligence capabilities to efficiently manage medications in the years following COVID-19. A study by the National Community Pharmacists Association (NCPA) in April 2020 found that approximately 90% of community pharmacies sought small business federal aid under the CARES Act to support them during this period.

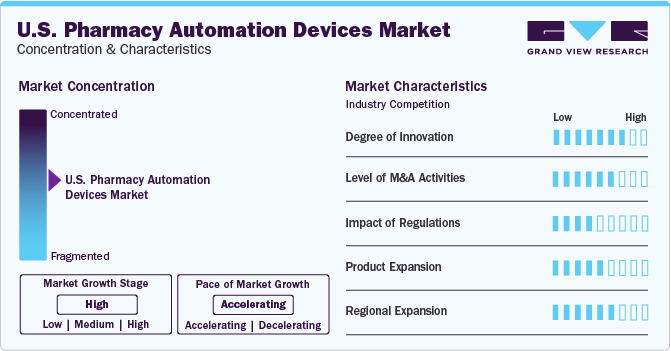

Market Concentration & Characteristics

Major deals & strategic alliances between companies operating in industry are analyzed based on various factors, including geographic expansion, collaborations, partnerships, product launches, acquisitions, and investments. Companies are highly focused on M&As and technology developments to expand their product portfolios and geographic presence. For instance, in November 2020, Omnicell, Inc. has unveiled new innovations in its medication management solutions. These include intelligence for improved pharmacy supply chain management, automation for streamlined workflows, and technology-enabled services for regulatory compliance and efficiency. These advancements aim to enhance medication inventory visibility, aiding hospitals in achieving their operational, clinical, and financial goals.

Innovation plays a crucial role in driving growth and efficiency. Several key innovations are transforming the landscape of pharmacy automation, enhancing workflows, patient safety, and operational effectiveness. The companies are extensively investing in R&D to introduce new products and gain a competitive edge in the industry. In October 2020, Omnicell launched EnlivenHealth, a division focused on enabling retail pharmacies and health plans that can help improve patient outcomes.

Increase in the number of mergers & acquisitions and rise in number of agreements among various companies is another key factor for the industry’s growth. This is majorly for the extension of their product capabilities. In September 2020, Auxo Investment Partner acquired Euclid Medical Products along with Paramount Tube, a subsidiary of Precision Products Group (PPG) company. Through this acquisition, the company will aggressively pursue growth by developing and expanding the industry’s key segments and broadening its product offerings in medication adherence and automated packaging machines.

Government and various health regulatory agencies such as FDA and NHS are working toward decreasing medication errors. This in turn is positively impacting pharmacy automation devices, as these devices significantly reduce medication errors. In May 2018, Baxter received U.S. FDA approval for Spectrum IQ Infusion System with Dose IQ Safety Software integrated with patient EMR to enhance patient safety and automate drug delivery to patient.

Prominent players like Swisslog Healthcare provide UniPick, a system that automates the dispensing of medication, which is efficient, fast, and precise, catering to the needs of outpatient pharmacies. The dispensing capabilities of this system contribute to enhanced productivity, a decrease in medication errors, and more time for patient counseling on medication usage. This, in turn, helps to increase the overall revenue of the hospital, thereby propelling the growth of the industry.

Geographic expansion in the industry involves expanding the network of pharmacy automated devices across different regions in and out of U.S., aiming to increase accessibility, drive revenue growth, and enhance operational efficiency through strategic initiatives and technological advancements.In March 2022, Swisslog Healthcare partnered with TriaTech Medical Systems, offered MedSMART, a range of automated dispensing cabinets to various healthcare centers in Europe.

End-use Insights

Retail pharmacy dominated the market and accounted for the largest market share of 43.0% in 2023. The growth of solutions in retail pharmacies is being propelled by the expanding use of pharmacy automation in tasks such as prescription filling. This automation helps reduce costs and errors, track inventory, and streamline operations. Additionally, RxSafe’s automated robotic storage and retrieval systems, like the RxSafe 1800, provide retail pharmacies with benefits such as speed, space efficiency, accuracy, and convenience. These benefits are achieved through a combination of real-time inventory tracking, prescription dispensing, and workflow optimization.

Pharmacy benefit management organizations and mail-order is expected to witness a lucrative CAGR of above 10% during the forecast period. Pharmacy benefit management organizations (PBMs) serve as a bridge between drug manufacturers and third-party payers, which include employers, managed care organizations, labour unions, and state-sponsored drug assistance programs for seniors. PBMs manage prescription drug benefits by bargaining for discounts with drug manufacturers and transferring the savings to insurance companies. In addition, PBMs oversee mail-order pharmacies, which enable patients to get their medications delivered by mail. These activities not only streamline administrative tasks and cut costs, but also fuel market expansion. This makes PBMs and mail-order pharmacies crucial in the healthcare sector.

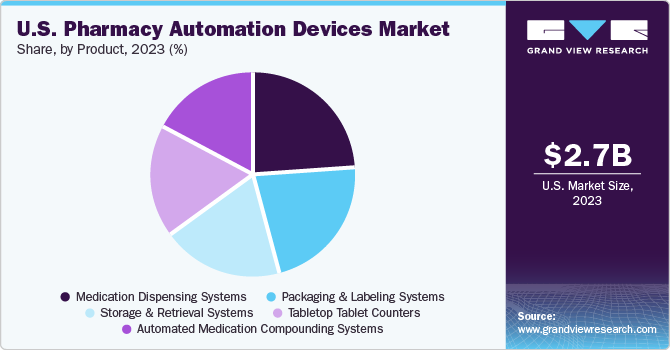

Product Insights

Medication dispensing systems dominated the market and accounted for the largest revenue share of 23.6% in 2023. The rise in deaths due to medication and dispensing errors, along with strict government policies, is pushing healthcare institutes and pharmacists to adopt medication dispensing systems. These systems offer numerous benefits such as reduced medication errors, improved inventory management, better patient care, and reduced administrative burden, which are driving their adoption. An example of such a system is UniPick by Swisslog Healthcare, which efficiently handles drug dispensing for outpatient pharmacies, thereby increasing productivity, reducing errors, and providing more time for patient counselling. These systems also offer revenue management tools that help streamline pricing, simplify reimbursement, and manage billing workflow. Thus, the multiple benefits of medication dispensing systems are driving their adoption.

Automated medication compounding systems is expected to witness the fastest CAGR of 9.7% during the forecast period. The increased use of personalized chemotherapy and the need to reduce medication errors are driving the uptake of automated medication compounding systems. COMECER S.p.A.'s Pharmoduct, for example, is an automated device for sterile preparation of personalized oncology drugs. Automated robotic sterile compounding solutions enhance dosage accuracy, make IV pharmacy compounding safer, reduce costs, and ensure compliance. The growing use of sterile compounding is a key factor propelling this sector’s growth.

Key U.S. Pharmacy Automation Devices Company Insights

Leading U.S. pharmacy automated devices companies are concentrating on a variety of strategic actions, such as forming alliances, expanding their products and services, merging & acquiring other businesses, and investing in research and development to create sophisticated applications for gaining a competitive edge.

Key U.S. Pharmacy Automation Devices Companies:

- Amerisource Bergen Corporation

- Accu-Chart Plus Healthcare Systems, Inc.

- Omnicell, Inc.

- McKesson Corporation

- Pearson Medical Technologies

- Baxter

- Talyst, LLC (Swisslog Healthcare)

- Scriptpro LLC

- Becton Dickinson and Company

- Fulcrum Pharmacy Management, Inc.

- Medacist Solutions Group, LLC

- Aesynt, Inc

- Capsa Healthcare

- Cerner Oracle

- iA

- ARxIUM

- Touchpoint Medical

- Swisslog Healthcare

Recent Developments

-

In September 2022, Amerisource Bergen Corporation made a strategic move by purchasing PharmaLex Holding GmbH, a company that offers specialized services to the life sciences sector, for a cash deal of USD 1.29 billion. This acquisition not only broadens Amerisource Bergen’s global solutions portfolio but also strengthens its position as a favored collaborator for biopharmaceutical manufacturers. PharmaLex provides a range of services, including regulatory affairs, development consulting, scientific affairs, pharmacovigilance, and quality management and compliance.

-

In January 2021, b and Walgreens Boots Alliance entered into a strategic alliance. Amerisource Bergen acquired Alliance Healthcare Business from Walgreens Boots, allowing it to increase its focus on growing its retail pharmacy business. Through this strategic partnership, the two companies planned to extend and expand their commercial agreements.

-

In January 2021, Omnicell announced its intent to partner with Guy’s and St Thomas’ NHS Foundation Trust to provide them with inventory optimization and intelligence service solutions.

U.S. Pharmacy Automation Devices Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 5.01 billion

Growth rate

CAGR of 9.2% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use

Country scope

U.S.

Key companies profiled

Amerisource Bergen Corporation; Accu-Chart Plus Healthcare Systems, Inc.; Omnicell, Inc.; McKesson Corporation; Pearson Medical Technologies; Baxter; Talyst, LLC (Swisslog Healthcare); Scriptpro LLC; Becton Dickinson and Company; Fulcrum Pharmacy Management, Inc.; Medacist Solutions Group, LLC; Aesynt, Inc; Becton Dickinson and Company; Capsa Healthcare; Cerner Oracle; iA; ARxIUM; Touchpoint Medical; Swisslog Healthcare

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Pharmacy Automation Devices Market Report Segmentation

This report forecasts revenue growth in the U.S. market and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. pharmacy automation devices market based on product, and end-use:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Medication Dispensing Systems

-

Robots/Robotic Automated Dispensing Systems

-

Carousels

-

Automated Dispensing Cabinets

-

Packaging And Labeling Systems

-

Storage And Retrieval Systems

-

Automated Medication Compounding Systems

-

Tabletop Tablet Counters

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Retail Pharmacy

-

Inpatient Pharmacies

-

Outpatient Pharmacies

-

Pharmacy Benefit Management Organizations and Mail-Order Pharmacies

-

Frequently Asked Questions About This Report

b. The U.S. pharmacy automation devices market size was estimated at USD 2.73 billion in 2023 and is expected to reach USD 2.96 billion in 2024.

b. The U.S. pharmacy automation devices market is expected to grow at a compound annual growth rate of 9.2% from 2024 to 2030 to reach USD 5.01 billion by 2030.

b. The medication dispensing systems segment dominated the U.S. pharmacy automation devices market with a share of 23.60% in 2023 owing to stringent government policies regarding medication and dispensing errors, which created pressure on healthcare institutes and pharmacists to include various medication dispensing systems to improve patient care services.

b. Some key players operating in the U.S. pharmacy automation devices market include Amerisource Bergen Corporation; Accu-Chart Plus; Healthcare Systems, Inc.; Omnicell, Inc.; McKesson Corporation; Pearson Medical Technologies; Baxter; Talyst, LLC; Scriptpro LLC; Fulcrum Pharmacy Management, Inc.; Health Robotics S.R.L.; Medacist Solutions Group, LLC; Aesynt, Inc; Pyxis Corporation; Kirby Lester; Cerner Oracle; Forhealth Technologies iA; ARxIUM; Touchpoint Medical; Deenova S.R.L Parata Systems, LLC; Swisslog Healthcare; Yuyama Co. Ltd/Yuyama MFG Co. Ltd; CareFusion.

b. Key factors that are driving the U.S. pharmacy automation devices market growth include rise in medication errors, surge in adoption of pharmacy automation technology owing to its advantages, and growing technological advancements.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.