- Home

- »

- Pharmaceuticals

- »

-

U.S. Pharmaceutical Market Size, Industry Report, 2030GVR Report cover

![U.S. Pharmaceutical Market Size, Share & Trends Report]()

U.S. Pharmaceutical Market (2025 - 2030) Size, Share & Trends Analysis Report By Molecule (Biologics & Biosimilars, Conventional Drugs), By Product, By Type, By Route Of Administration, By Disease, By Age Group, By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-210-9

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Pharmaceutical Market Size & Trends

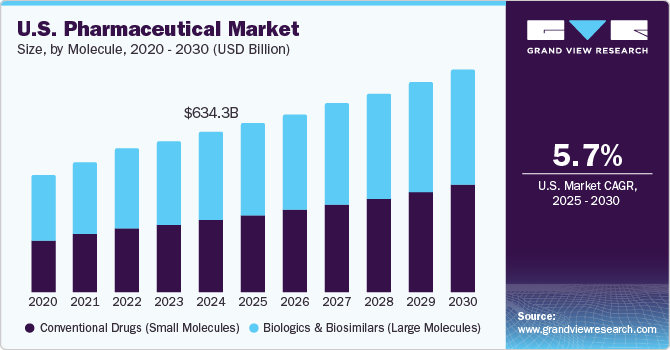

The U.S. pharmaceutical market size was estimated at USD 634.32 billion in 2024 and is expected to grow at a CAGR of 5.72% from 2025 to 2030, to reach an estimated value of USD 883.97 billion by 2030. This growth can be attributed to the rising prevalence of chronic diseases, increasing geriatric population, growing healthcare expenditure by government organizations, and extensive efforts to improve the affordability & accessibility of pharmaceuticals.

The U.S. pharmaceutical industry has experienced significant growth due to advancements in therapeutics and a robust product pipeline. The development of targeted therapies, biologics, and personalized medicine has reshaped treatment model, offering more effective solutions for complex conditions such as cancer, autoimmune diseases, and genetic disorders. Gene therapies and RNA-based treatments, like those for inherited retinal diseases and certain types of cancers, have gained FDA approvals, contributing to the industry's momentum. The approval of cutting-edge drugs such as CAR-T cell therapies for certain cancers exemplifies the market's growing focus on precision medicine, offering hope for previously untreatable conditions. A notable advancement is the continued progression in immuno-oncology treatments, which are redefining cancer care.

In the U.S. market for pharmaceuticals, the transformative clinical outcomes of GLP-1 receptor agonists and GLP-1/GIP dual agonists, have set a new benchmark for obesity treatment. As they are emerged as transformative therapies, delivering unprecedented clinical results. These medications, such as semaglutide and tirzepatide, have demonstrated weight loss of up to 25%, significantly outperforming earlier drug classes, which achieved only about 7% weight reduction. This breakthrough has reshaped the obesity treatment paradigm for both patients and providers, offering a viable medical solution to a condition long viewed as difficult to manage. Coupled with advances in digital health tools, these therapies are part of integrated care models that combine pharmacological treatments with technology, behavioral coaching, and personalized interventions. This comprehensive approach not only addresses obesity but also improves overall patient outcomes, presenting a credible pathway to overcoming a major public health challenge in the U.S.

Pharmaceutical R&D spending in the U.S. has been a pivotal driver of market growth, with the sector continuously investing in the discovery and development of new therapies. In 2023, pharmaceutical companies in the U.S. spent over USD 80 billion on R&D, a figure that continues to rise annually. Major companies like Johnson & Johnson, Merck, and Eli Lilly have earmarked significant portions of their revenues to R&D, recognizing the importance of developing innovative drugs to meet the demands of an aging population and the increasing prevalence of chronic diseases.

This high level of investment fuels the discovery of breakthrough therapies across various segments, including oncology, immunology, and rare diseases. According to an article by oxford Academic, in 2023, U.S. pharmaceutical spending rose by 13.6% to reach USD 722.5 billion. This increase was driven by a 6.5% rise in utilization, a 4.2% boost from new drugs, and a 2.9% uptick in prices. The top-selling drug of 2023 was semaglutide, followed by adalimumab and apixaban. Furthermore, In 2023, drug spending in nonfederal hospitals decreased by 1.1%, totaling USD 37.1 billion, while expenditures in clinics increased by 15.0% to USD 135.7 billion. Clinic growth was driven by higher utilization, with a minor impact from new products and price changes. In nonfederal hospitals, lower utilization led to reduced spending, while new drugs and prices had a modest influence. Several new drugs expected in 2024, especially in specialty, endocrine, and cancer treatments, will continue to drive spending.

The growing market adoption of innovative and modern medicines is another key driver of the U.S. pharmaceutical market. As patients and healthcare providers become more aware of the effectiveness of new treatments, there is an increasing demand for cutting-edge therapies that offer better outcomes and fewer side effects. The uptake of biologics, gene therapies, and immunotherapies in oncology, autoimmune diseases, and other areas has been particularly notable. For example, the rapid adoption of monoclonal antibodies, such as those used in immuno-oncology, has transformed the treatment landscape, with market leaders like Keytruda and Opdivo showing impressive year-on-year sales growth. Recently, in September 2024, the API Innovation Center received USD 14 million in strategic funding aimed at strengthening U.S. pharmaceutical independence. The funding will support the development of critical Active Pharmaceutical Ingredients (API) manufacturing capabilities within the U.S., enhancing resilience in the supply chain and reducing reliance on foreign sources. This initiative aligns with efforts to bolster domestic production, improve national security, and ensure consistent access to essential medicines.

However, Patent expiration of key pharmaceutical drugs has emerged as a significant restraint for the growth of the U.S. pharmaceutical industry. Once patents expire, generic versions of these drugs can enter the market, often leading to a sharp decline in sales for the original branded drugs. For instance, in January 2023, the patent for AbbVie’s blockbuster drug Humira (adalimumab), which generated over USD 20 billion in annual sales, expired, allowing biosimilars to compete. The shift from branded to generic drugs reduces the market share of originator companies and significantly impacts their revenue streams. The overall market dynamics are also affected by the pricing pressure brought on by these generics, forcing branded companies to reduce prices or find new market niches. This change is particularly evident in the biologics market, where patents for key products like Enbrel and Herceptin have expired, opening the door for cheaper alternatives.

Market Concentration & Characteristics

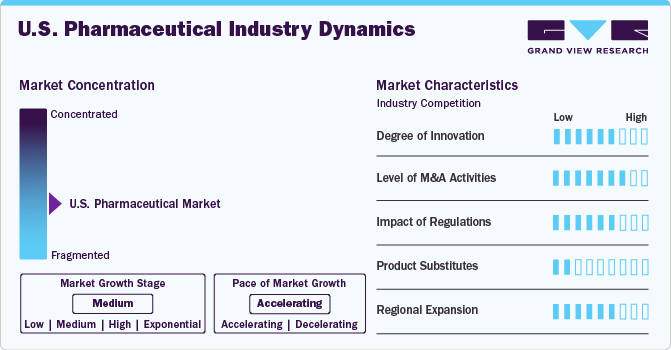

The U.S. pharmaceutical market demonstrates a high degree of innovation, driven by advancements in drug discovery, biotechnology, and personalized medicine. Key areas of focus include mRNA technologies, gene therapies, biologics, and AI-driven drug development. Continuous investment in R&D has led to breakthroughs in oncology, immunology, and rare disease treatments, significantly enhancing patient outcomes and driving market growth.

The market experiences a robust level of mergers and acquisitions (M&A), as pharmaceutical giants actively acquire smaller biotech firms to access innovative pipelines and expand their therapeutic portfolios. Recent trends include consolidation in the specialty drug and biologics segments, as well as acquisitions to strengthen manufacturing capabilities and geographic presence. Strategic partnerships between pharmaceutical companies and technology firms are also on the rise to leverage AI and big data for drug discovery and patient care.

Regulatory frameworks heavily influence the U.S. pharmaceutical industry. The FDA plays a critical role in ensuring the safety and efficacy of drugs, with expedited pathways such as Breakthrough Therapy Designation and Accelerated Approval supporting innovation for high-need conditions. However, increasing scrutiny over drug pricing and reimbursement policies creates challenges for manufacturers. Legislative efforts, such as the Inflation Reduction Act, aim to cap prescription drug costs, influencing market dynamics.

The threat of product substitutes in the pharmaceutical market varies by therapeutic area. For chronic conditions, lifestyle interventions and non-pharmacological therapies (e.g., behavioral programs or surgical options) can serve as substitutes. Additionally, the rise of biosimilars presents competition for biologics, particularly in therapeutic areas like oncology and immunology. Despite this, branded pharmaceuticals maintain a strong position due to innovation, brand loyalty, and superior efficacy in many cases.

Pharmaceutical companies focus on expanding their presence in the U.S. through strategic geographic and demographic targeting. High-growth areas include rural regions with unmet healthcare needs and urban centers with specialized care requirements. Companies are also leveraging digital health solutions and telemedicine to reach underserved populations. Collaborations with health systems and insurers aim to improve drug affordability and accessibility, further driving penetration and adoption.

Molecule Insights

Based on molecule type, the market for conventional drugs (small molecules) dominated with a revenue share of 54.7% in 2024. This growth can be attributed to a well-structured manufacturing facility, predictable pharmacokinetics, and oral bioavailability. Small molecules are anticipated to dominate the market as a technology, owing to a strong pipeline in which over two-thirds of the small molecule-based products are on accelerated pathways and are expected to enter the market in the upcoming years. As of October 2021, 58% of molecules in the drug development process are small molecules. This demonstrates a huge opportunity for contract manufacturers in the market.

The biologics & biosimilar segment is expected to grow at a CAGR of 6.83% during the forecast period.The biosimilar segment has seen high adoption and widespread product availability due to increased acceptance from both healthcare providers and patients. These biologic drugs offer a cost-effective alternative to original biologics, providing the same therapeutic benefits at lower prices. Regulatory pathways have streamlined approval processes, allowing for faster market entry of biosimilars. The growing familiarity and clinical confidence in biosimilars, along with supportive reimbursement policies, have driven their adoption across various therapeutic areas. This widespread product availability ensures more treatment options and improved access for patients, enhancing the overall healthcare landscape.

Product Insights

The branded segment dominated the U.S. pharmaceutical market with a revenue share of 66.86% in 2024. The dominance of the segment is attributed to the rising prevalence of chronic diseases, increasing R&D and approval of novel pharmaceuticals, and the rising need for the development of novel therapeutics to treat various conditions. Major players operating in the market are constantly focusing on introducing novel pharmaceuticals in the market, further propelling the growth of the segment. For instance, in June 2023, AstraZeneca announce the launch of IMJUDO, a revolutionary cancer medication that marks a significant advancement in cancer treatment. However, the patent expiry of branded drugs and entry of generic drugs into the market hampers the growth.

The generic segment is expected to show fastest CAGR over the projected period. The generic segment forms a critical part of the U.S. pharmaceutical industry, offering cost-effective alternatives to branded drugs once their patents expire. Generics are bioequivalent to branded products in efficacy and safety, making them a preferred choice for healthcare providers, payers, and patients seeking affordable treatment options. This segment is driven by several key factors, including increasing patent expirations, rising healthcare cost pressures, and supportive regulatory frameworks that streamline generic drug approvals.

Type Insights

The prescription segment held the largest revenue share of 86.76% in 2024 in U.S. Key drivers for the prescription segment include advancements in drug discovery and development, particularly in biologics and personalized medicine, which address unmet medical needs and improve patient outcomes. Regulatory approvals for new drugs and the growing acceptance of telemedicine are expanding access to prescription therapies. Furthermore, increasing insurance coverage and reimbursement policies, especially under Medicare Part D and private payers, make prescription medications more accessible to a larger patient base.

The OTC segment is expected to grow at a CAGR of 7.48% during the forecast period. Key drivers of the OTC segment include rising consumer awareness of preventive healthcare, an increasing shift toward self-medication, and the expanding availability of OTC options due to Rx-to-OTC switches. Regulatory approvals for transitioning prescription drugs to OTC status, such as in allergy and heartburn treatments, have bolstered market growth by making proven therapies more accessible. Additionally, the growth of e-commerce platforms has transformed the distribution landscape, enabling consumers to easily purchase OTC products. The segment benefits from robust demand driven by a growing focus on wellness, aging demographics requiring easy-to-use medications, and widespread marketing efforts that enhance product visibility. Furthermore, innovations in product formulations, such as non-drowsy and extended-release options, and targeted solutions for niche health needs have supported market expansion.

Disease Insights

The cancer segment dominated the overall market, contributing to a revenue share of 17.07% in 2024. The dominance of the cancer segment in the U.S. Pharmaceutical Market can be attributed to several key factors and trends such as, the rising global incidence of various types of cancer has led to an increased demand for innovative & effective treatments, driving significant investment and research in this area. In addition, advancements in personalized medicine & targeted therapies have revolutionized cancer treatment, offering higher efficacy and fewer side effects.

Furthermore, collaborations between pharmaceutical companies and research institutions have accelerated the development of novel oncology drugs. Lastly, favorable regulatory pathways & expedited approvals for breakthrough cancer therapies have further propelled the growth of this segment, solidifying its dominance in the U.S. Pharmaceutical Market.

Route of Administration Insights

Oral route of administration dominated the market, contributing a revenue share of 57.5% in 2024. Oral administration stands out as a cornerstone in pharmaceutical drug delivery due to its widespread use and patient-friendly attributes. By allowing medications to be ingested in the form of liquids, capsules, tablets, or chewable tablets, this method offers remarkable convenience to patients. The ease of administration & high patient compliance associated with oral drugs are key factors driving their popularity.

The parenteral route of drug administration is expected to grow at a CAGR of 7.31% over the foracst period. This segment involves delivering medications directly into the body through methods such as injections, infusions, or implantations. This route bypasses the digestive system, resulting in rapid & precise drug absorption. Although often reserved for situations where oral administration is not feasible, such as emergencies or cases where drug degradation in the digestive tract is a concern, the parenteral route has gained significant traction in the pharmaceutical market due to its efficacy & targeted delivery.

Age Group Insights

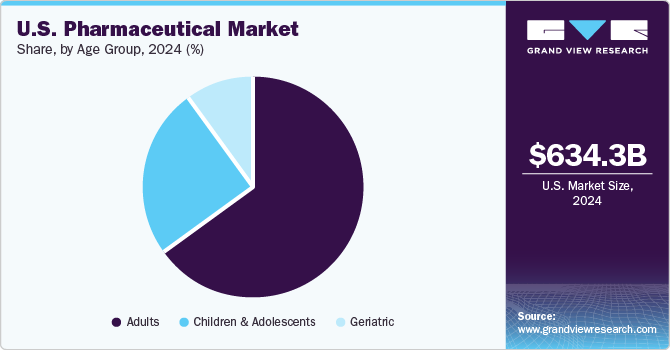

The adults segment held the largest market share of 62.84% in 2024 and is anticipated to grow at the fastest CAGR over the forecast period. The adult population aged from 15-64 years holds the largest share in the total population and are the major consumer of prescription medicine. According to CDC,in U.S., around 69.0% and in Canada, around 65.5%, accounting to nearly 7 in 10 persons aged 40-79 used at least one prescription drug. The most commonly used drug among the adult population includes lipid-lowering drugs, ACE inhibitors, analgesics, and antidepressants. The rising awareness among the adult population regarding diseases and available medicine is further propelling demand for effective therapeutics subsequently fueling growth of overall U.S. Pharmaceutical Market.

The children & adolescent segment is expected to show a significant growth rate over the forecast period. The growth of the segment is attributed to the rising number of approvals of medication for the pediatric population. For instance, in June 2023, Pfizer Inc. in collaboration with OPKO Health Inc. received approval for NGENLA, a human growth hormone medication used for treatment of pediatric patients. The product is expected to be available for prescription in August 2023. Furthermore, the rising prevalence of varios disorders in pediatric population, including respiratory conditions, infectious diseases, and several rare conditions is further anticipated to fuel growth of U.S. Pharmaceutical Market.

Distribution Channel Insights

The hospital pharmacy segment dominated with a revenue share of 53.53% in 2024. The hospital pharmacy segment plays a critical role in the space, accounting for a substantial share of the overall pharmaceutical distribution landscape. This segment is driven by the increasing burden of acute and chronic diseases, rising hospitalization rates, and advancements in specialized treatments such as oncology, critical care, and infectious diseases. With the growth of complex therapies like biologics, intravenous drugs, and high-potency medications, hospital pharmacies are positioned as essential hubs for ensuring the safe, effective, and timely administration of these therapies. Additionally, the growing demand for precision medicine and tailored treatment regimens is increasing reliance on hospital pharmacies to manage specialty drugs, particularly those requiring strict handling, cold chain storage, and real-time monitoring.

The "other" distribution channel segment in the U.S. pharmaceutical industry, encompassing specialty pharmacies, mail-order pharmacies, e-pharmacies, and direct-to-patient (DTP) models, is experiencing significant growth driven by technological innovation, consumer demand for convenience, and the increasing adoption of digital health platforms. Specialty pharmacies are critical for managing high-cost, complex therapies like biologics, oncology treatments, and immunotherapies, which require strict handling, storage, and patient support. They play a pivotal role in delivering therapies for rare diseases and chronic conditions such as multiple sclerosis and rheumatoid arthritis, ensuring personalized care and improving treatment adherence. Similarly, mail-order pharmacies continue to grow, offering cost-effective and reliable solutions for patients requiring long-term medications, particularly under government programs like Medicare Part D.

Key U.S. Pharmaceutical Company Insights

The leading companies in the pharmaceutical and drug development industries are always focusing on developing and upgrading existing technologies that serve to enhance patient outcomes and significantly increase healthcare effectiveness and efficiency. For Instance, in May 2023, Pfizer Inc. received FDA approval for PAXLOVID (nirmatrelvir tablets and ritonavir tablets) used for the treatment of patient with mild-to-moderate COVID-19. Moreover, the company also announced plans to launch 10 new formulations in the market including two oncology and immuno-inflammation medication each, and five vaccines in 2023.

Key U.S. Pharmaceutical Companies:

- F. Hoffmann-La Roche Ltd

- Novartis AG

- AbbVie Inc.

- Johnson & Johnson Services, Inc.

- Merck & Co., Inc.

- Pfizer Inc.

- Bristol-Myers Squibb Company

- Sanofi

- GSK plc.

- Takeda Pharmaceutical Company Limited

Recent Developments

-

In November 2024, Novartis acquired Kate Therapeutics in a deal valued at USD 1.1 billion. This acquisition likely reflects Novartis's strategy to strengthen its portfolio in innovative therapies, potentially targeting advanced treatments in areas like gene or cell therapy.

-

In January 2024, Sandoz announced its acquisition of Coherus BioSciences' U.S. biosimilar product Cimerli for USD 115 million upfront, plus milestones. This acquisition expands Sandoz's ophthalmology portfolio.

-

In May 2024, AbbVie and Gilgamesh Pharmaceuticals announced a collaboration and option-to-license agreement to develop next-generation therapies for psychiatric disorders. This strategic partnership combines AbbVie’s extensive neuroscience expertise and global development capabilities with Gilgamesh’s innovative approach to addressing psychiatric conditions. The agreement focuses on developing new treatments targeting unmet needs in this field, aiming to advance the understanding and management of psychiatric disorders.

U.S. Pharmaceutical Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 669.42 billion

Revenue forecast in 2030

USD 883.97 billion

Growth rate

CAGR of 5.72% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Molecule, product, type, disease, route of administration, age group, distribution channel

Key companies profiled

F. Hoffmann-La Roche Ltd; Novartis AG; AbbVie Inc.; Johnson & Johnson Services, Inc.; Merck & Co., Inc.; Pfizer Inc.; Bristol-Myers Squibb Company; Sanofi; GSK plc.; Takeda Pharmaceutical Company Limited

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Pharmaceutical Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For the purpose of this report, Grand View Research has segmented the U.S. pharmaceutical market report based on molecule, product, type, disease, route of administration, age group, and distribution channel:

-

Molecule Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Biologics & Biosimilars (Large Molecules)

-

Monoclonal Antibodies

-

Vaccines

-

Cell & Gene Therapy

-

Others

-

-

Conventional Drugs (Small Molecules)

-

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Branded

-

Generic

-

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Prescription

-

OTC

-

-

Disease Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cardiovascular diseases

-

Cancer

-

Diabetes

-

Infectious diseases

-

Neurological disorders

-

Respiratory diseases

-

Autoimmune diseases

-

Mental health disorders

-

Gastrointestinal disorders

-

Women’s Health Diseases

-

Genetic and Rare genetic diseases

-

Dermatological conditions

-

Obesity

-

Renal diseases

-

Liver conditions

-

Hematological disorders

-

Eye conditions

-

Infertility conditions

-

Endocrine disorders

-

Allergies

-

Others

-

-

Route of Administration Outlook (Revenue, USD Billion, 2018 - 2030)

-

Oral

-

Tablet Capsule

-

Suspensions

-

Other

-

-

Topical

-

Parenteral

-

Intravenous

-

Intramuscular

-

-

Inhalations

-

Other

-

-

Age Group Outlook (Revenue, USD Billion, 2018 - 2030)

-

Children & Adolescents

-

Adults

-

Geriatric

-

-

Distribution Channel Group Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hospital Pharmacy

-

Retail Pharmacy

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. pharmaceutical market size was estimated at USD 634.32 billion in 2024 and is expected to reach USD 669.42 million in 2025.

b. The U.S.pharmaceutical market is expected to grow at a compound annual growth rate of 5.72% from 2025 to 2030 to reach USD 883.97 billion by 2030.

b. The branded segment dominated the pharmaceutical market with a revenue share of 66.86% in 2024. The dominance of the segment is attributed to the rising prevalence of chronic diseases, increasing R&D and approval of novel pharmaceuticals, and the rising need for the development of novel therapeutics to treat various conditions.

b. Some key players operating in the U.S. pharmaceutical market include F. Hoffmann-La Roche Ltd.; Novartis AG; AbbVie Inc.; Johnson & Johnson Services, Inc.; Merck & Co., Inc.; Pfizer Inc.; Bristol-Myers Squibb Company; Sanofi; GSK plc; Takeda Pharmaceutical Company Limited.

b. Key factors that are driving the market growth include increasing chronic disease prevalence, rising geriatric population, increasing healthcare spending by government organizations globally, and extensive efforts to improve the affordability of pharmaceuticals.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.