- Home

- »

- Homecare & Decor

- »

-

U.S. Pet Odor Control & Clean-up Products Market, Report 2030GVR Report cover

![U.S. Pet Odor Control & Clean-up Products Market Size, Share & Trends Report]()

U.S. Pet Odor Control & Clean-up Products Market Size, Share & Trends Analysis Report By Product (Litter, Sprays & Aerosols), By Distribution Channel (Supermarkets/Hypermarkets, Specialty Store), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-482-1

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Market Size & Trends

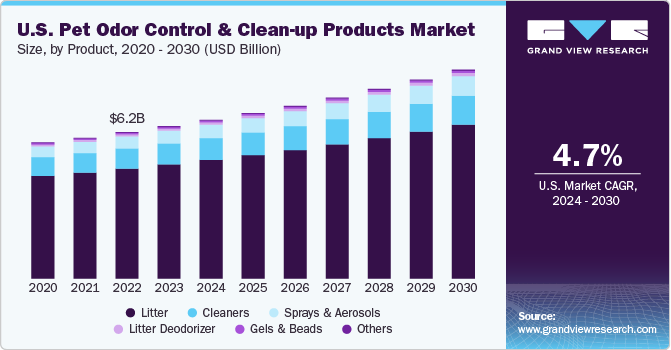

The U.S. pet odor control & clean-up products market size was valued at USD 6.47 billion in 2023 and is expected to grow at a CAGR of 4.7% from 2024 to 2030. The increasing pet ownership and rising spending on pet care drive the market growth. As more households in the U.S. welcome pets, the demand for products that maintain home hygiene and address pet-related odors has surged. Pet owners are more willing than ever to invest in high-quality solutions to manage pet waste and minimize unpleasant smells in their homes, fostering a strong demand for specialized odor control and clean-up products.

As of 2024, 66% of U.S. households (86.9 million) owned a pet, up from 56% in 1988, with many pet owners treating animals as family members (Forbes, 2024). In fact, 97% of pet owners saw their pets as part of the family, and over half (51%) viewed them as equal to human family members. This trend further boosts the demand for the pet odor control & clean-up products industry.

Furthermore, there has been a notable shift toward prioritizing home hygiene and cleanliness, especially in the wake of the COVID-19 pandemic. Consumers are more aware of maintaining cleaner living environments, particularly in homes with pets. The concern over potential health issues from lingering pet odors and messes has prompted an increasing number of pet owners to adopt regular cleaning practices. This heightened focus on hygiene has driven the demand for innovative, effective, and environmentally friendly pet odor control products. The combination of these factors ensures continued market growth as consumers seek out reliable products that balance their love for pets with the need for a clean and healthy home environment.

According to a 2021 study by OnePoll on behalf of Trane Heating and Air Conditioning, pet owners in the U.S. spend a staggering 832 hours a year cleaning homes. The survey of over 2,000 pet owners found that three in four say having a pet has made them clean more than ever before. This increased focus on maintaining a clean, odor-free environment directly drives demand for pet odor control and clean-up products in the U.S. As pet ownership grows, so does the need for effective solutions to manage pet-related odors and mess, making this a booming market segment in the pet care industry.

E-commerce has significantly accelerated the growth of the pet care industry in the U.S., with the percentage of pet products purchased online soaring from 8% in 2015 to 30% in 2020, according to Packaged Facts. This shift has been driven by the convenience of online shopping and the broadening range of products and services available, including pet food, supplies, and veterinary care. The COVID-19 pandemic has further accelerated this trend, with e-commerce expected to account for half of all pet product spending by 2025. This surge in online pet product purchases presents a substantial opportunity for the U.S. pet odor control and clean-up products market.

Additionally, the premiumization trend in the U.S. pet care industry has significantly boosted the demand for high-quality pet odor control and clean-up products. As pet owners increasingly view pets as family members, they seek premium products that reflect care and affection, opting for items made with superior ingredients and advanced technologies. Products with natural, eco-friendly formulations, long-lasting odor control, and sustainable packaging are particularly popular.

For instance, Bougie Poochie, founded by Priscilla Camacho, launched a new line of pet-safe luxury candles in July 2024. This collection, blending Camacho’s expertise in luxury fashion, beauty, and fragrance, aimed to eliminate unwanted pet odors using deodorizing ingredients while avoiding harmful chemicals like phthalates, parabens, and sulfates. The candles, made with vegan coconut apricot wax and organic cotton wicks, were free from essential oils. Featuring three unique fragrances-Morning Walk, Leader of the Pack, and Under the Covers-developed with DSM-Firmenich’s EmotiWave technology to evoke specific emotional responses, the line highlighted a trend toward eco-conscious, pet-safe home fragrances.

Product Insights

Litter accounted for the largest share of around 75% in 2023. The increasing number of cat owners worldwide is expected to positively impact market growth. Furthermore, the rising number of single-person households, coupled with the increasing willingness to own at least one pet, has been majorly contributing to the growth of the cat litter products market over the past few years. Consumers prefer cat litter that is biodegradable, renewable and does not contain chemicals or any fragrances. Companies are therefore investing in research and development (R&D) to introduce new natural products that are safe and efficient at the same time. For instance, The Original Poop Bags, a Georgia, U.S.-based company, launched Catfidence, a 100% organic bamboo cat litter. It is manufactured from sustainable pine and bamboo and is certified as compostable.

The demand for sprays and aerosols is expected to grow at a CAGR of 6.4% from 2024 to 2030. Pet odor control sprays and aerosols, such as pet urine odor remover sprays, are commonly used to eliminate or mask unpleasant smells caused by pets, including urine stains and dander. These products work by saturating affected areas, such as carpets, with a spray that neutralizes odor-causing substances, like urine crystals. When sprayed, the product releases both volatile and non-volatile compounds into the air. While volatile substances evaporate and may be inhaled during application, non-volatile compounds can settle on the skin or remain in the treated area until cleaned. These sprays are designed for efficient odor control, particularly in homes with large pets like dogs, which may urinate indoors due to age or health issues, likely driving the market growth.

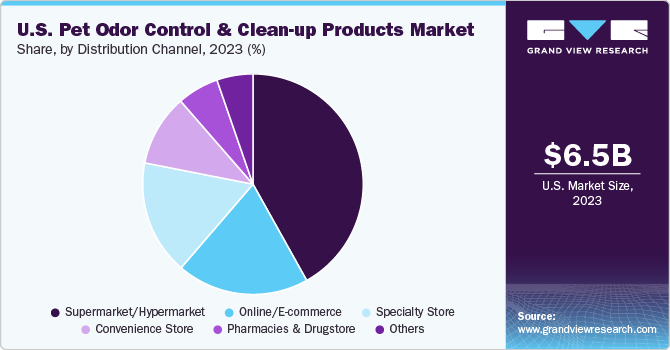

Distribution Channel Insights

Supermarkets/hypermarkets accounted for the largest share of about 42% in 2023. Pet owners are increasingly choosing supermarkets and hypermarkets to purchase pet odor control & clean-up products due to the convenience of one-stop shopping and the broad selection available. These retail environments offer a wide range of products, from deodorizing sprays and powders to innovative solutions like odor-controlling mats and candles, all in a single location. The ability to pick up pet supplies alongside groceries and other household items saves time and adds convenience, making these stores a preferred choice for busy pet owners. Additionally, supermarkets and hypermarkets often feature competitive pricing and regular promotions that attract budget-conscious consumers.

Online/e-commerce sale is projected to grow at a CAGR of 6.4% from 2024 to 2030. E-commerce platforms offer extensive product assortments and attractive pricing, with big brands using aggressive discounts to capture market share. The convenience of online shopping, combined with digital shelf analytics that help brands optimize pricing and product discoverability, makes e-commerce a dominant force. With vast product selections and the ability to target specific consumer needs through the effective use of trending keywords, online channels provide an unparalleled shopping experience for pet care products.

Fast delivery has become a critical aspect of the pet care industry, exemplified by the partnership between Instacart and PetSmart in May 2023. This collaboration, which extends same-day delivery to 1,500 PetSmart stores across the U.S., highlights the growing consumer demand for rapid and convenient service. With 69% of e-commerce shoppers preferring delivery for their recent purchases, the ability to quickly access pet supplies-from food to pet odor control & clean-up products-enhances customer satisfaction and loyalty. This emphasis on swift, reliable delivery aligns with the industry's focus on providing a seamless and efficient shopping experience for pet owners.

Regional Insights

The Southeast region accounted for a market share of around 25% in 2023. Many pet owners are shifting toward eco-friendly and non-toxic cleaning solutions, aligning with broader trends toward sustainable living. The Southeast's warm and humid climate tends to intensify pet odors, especially in carpets and upholstery, making odor control a constant concern. Additionally, the region's growing population of retirees and seniors, who often prioritize home cleanliness for health reasons, contributes to the rising demand. Furthermore, with the Southeast's booming pet services industry, including pet-sitting and boarding facilities, there is an increased need for commercial-grade products to maintain high standards of cleanliness.

The demand for pet odor control & clean-up products in the Northeast region of the U.S. is expected to grow at a CAGR of 5.7% from 2024 to 2030. The region's densely populated cities, such as New York and Boston, are seeing a surge in pet ownership among apartment dwellers who have limited ventilation and smaller spaces, making effective odor control a priority. Furthermore, the Northeast's harsh winters often force pets to remain indoors for extended periods, leading to a greater need for cleaning solutions. Rising awareness of allergens and indoor air quality, driven by health-conscious consumers, is also a key driver. Additionally, many Northeast consumers are increasingly seeking high-quality, eco-friendly products that are safe for pets and humans, aligning with broader sustainability trends in the region. These factors collectively boost the demand for specialized pet odor control solutions.

Key U.S. Pet Odor Control & Clean-up Products Company Insights

The market is highly competitive, with a mix of established brands and emerging players. Key competitors include Nature's Miracle, Arm & Hammer, and Rocco & Roxie, known for their enzymatic cleaners and eco-friendly formulations. The market is driven by innovations in natural, non-toxic, and pet-safe products, with brands focusing on expanding their product lines to include multipurpose solutions, such as sprays, wipes, and litter deodorizers. Online sales through platforms like Amazon and Chewy have also intensified the competition, with reviews and consumer feedback playing a crucial role in brand positioning.

Key U.S. Pet Odor Control & Clean-up Products Companies:

- Spectrum Brands, Inc. (Nature's Miracle)

- Compana Pet Brands (Simple Solution)

- Church & Dwight Co., Inc.

- Procter & Gamble (Febreze)

- Rocco & Roxie Supply Co.

- Angry Orange

- BISSELL Inc.

- Zero Odor

- Fresh Wave

- Bi-O-Kleen Industries, Inc.

Recent Developments

-

In July 2024, Church & Dwight Co., Inc. brand ARM & HAMMER Cat Litter and the American Society for the Prevention of Cruelty to Animals (ASPCA) celebrated Adopt a Shelter Cat Month by unveiling AI-generated "Purrsonality Pics" during a virtual adoption event. These playful and unique cat portraits, created using generative AI, showcased each cat's distinct personality to enhance their appeal to potential adopters. The campaign successfully raised USD 200,000 in just 72 hours for the ASPCA.

-

In April 2023, Angry Orange products were made available at nearly 4,000 Walmart stores across the U.S. and on Walmart's website. Its products, known for their strong citrus scent and effectiveness, were also introduced in Canada, where Walmart stores began carrying its Stain Remover and Enzyme Cleaner. This expansion followed significant success on Amazon, where Angry Orange had accumulated over 100,000 five-star reviews. This launch was a key milestone in making the company’s products popular and more accessible to a broader customer base.

U.S. Pet Odor Control & Clean-up Products Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 6.74 billion

Revenue forecast in 2030

USD 8.87 billion

Growth Rate (Revenue)

CAGR of 4.7% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, and region.

Regional scope

Northeast, Southwest, Midwest, West, Southeast

Country scope

U.S.

Key companies profiled

Spectrum Brands, Inc. (Nature's Miracle), Compana Pet Brands (Simple Solution), Church & Dwight Co., Inc., Procter & Gamble (Febreze), Rocco & Roxie Supply Co., Angry Orange, BISSELL Inc., Zero Odor, Fresh Wave, Bi-O-Kleen Industries, Inc.

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Pet Odor Control & Clean-up Products Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. pet odor control & clean-up products market report on the basis of product, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Litter

-

Sprays and Aerosols

-

Cleaners

-

Gels & Beads

-

Litter Deodorizer

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarket/Hypermarket

-

Specialty Store

-

Pharmacies & Drugstore

-

Convenience Store

-

Online/E-commerce

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

U.S.

-

Northeast

-

Southwest

-

Midwest

-

West

-

Southeast

-

-

Frequently Asked Questions About This Report

b. Key players in the U.S. pet odor control & clean-up products market are Spectrum Brands, Inc. (Nature's Miracle), Compana Pet Brands (Simple Solution), Church & Dwight Co., Inc., Procter & Gamble (Febreze), Rocco & Roxie Supply Co., Angry Orange, BISSELL Inc., Zero Odor, Fresh Wave, Bi-O-Kleen Industries, Inc.

b. Key factors driving the pet odor control & clean-up products market in the U.S. include rising pet ownership, growing awareness of pet hygiene, increased demand for eco-friendly and non-toxic cleaning solutions, and innovations in odor-neutralizing technologies.

b. The U.S. pet odor control & clean-up products market was estimated at USD 6.47 billion in 2023 and is expected to reach USD 6.74 billion in 2024.

b. The U.S. pet odor control & clean-up products market is expected to grow at a compound annual growth rate of 4.7% from 2024 to 2030 to reach USD 8.87 billion by 2030.

b. Southeast dominated the U.S. pet odor control & clean-up products market with a share of around 25% in 2023. The pet odor control & clean-up products market in the Southeast U.S. is driven by the high pet ownership rates, humid climate that exacerbates odor issues, and increasing consumer demand for effective, eco-friendly cleaning solutions.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."