U.S. Pet Dental Health Market Size, Share & Trends Analysis Report By Type ( Products, Services), By Animal Type (Dogs, Cats), By Indication, By Distribution Channel, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-282-1

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

U.S. Pet Dental Health Market Size & Trends

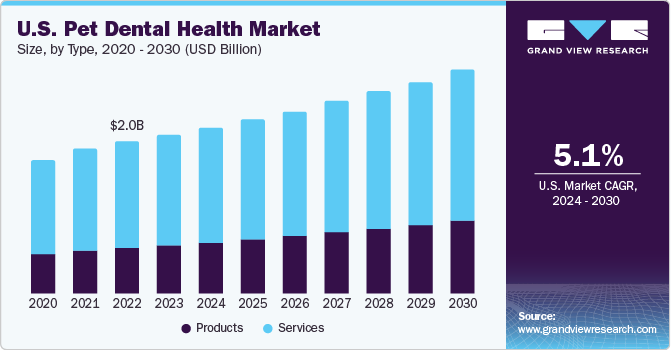

The U.S. pet dental health market size was estimated at USD 2.1 billion in 2023 and is expected to grow at a CAGR of 5.13% from 2024 to 2030. The rise in pet dental diseases, increased awareness among pet owners about preventing painful dental conditions, surge in veterinary dental check-ups & procedures, introduction of innovative pet oral care products by leading companies, and growth in pet ownership rates are key factors contributing to the market’s expansion.

U.S. accounted for over 32.2% in the global pet dental health market share in 2023, owing to the growing awareness of maintaining pet dental health with appropriate oral care products, regular dental cleaning, and other treatments, as these are vital for enhancing the overall health and behavior of animals. These elements are anticipated to present lucrative opportunities for market growth. The American Veterinary Medical Association (AVMA) reports that periodontal diseases are the most prevalent dental conditions in pets aged three years and older. Veterinary centers of America (VCA) Animal Hospitals states that over 80.0% dogs are diagnosed with active dental diseases by the time they reach three years of age.

However, the COVID-19 pandemic led to a downturn in the pet dental health market, particularly in 2020. This negative impact was largely due to lockdown measures implemented in various regions, which led to the closure of and limited access to veterinary services. This situation has posed challenges for pet owners in obtaining primary veterinary dental care due to the cancellations and enforced restriction of veterinary dental appointments. AVMA has noted that providing veterinary services during the pandemic has been a significant challenge for veterinarians. In 2020, the productivity of veterinary practices in the U.S. fell by 25% due to the pandemic. However, as veterinary practices are an essential healthcare business in the country, services began to recover in 2021 as activities gradually resumed.

The U.S. pet dental health market companies have encountered some difficulties in maintaining their supply of veterinary oral care products due to the unpredictability of distribution channels. Nevertheless, government agencies and key market players have implemented several measures to sustain their animal healthcare business throughout the pandemic. For instance, Virbac mentioned in its 2020 annual report that the company did not face supply issues that could have affected their overall sales during the year. However, the production sites were not able to operate at full capacity, leading to delivery issues. The company’s strategies for crisis supply chain management have increased its revenue in the following years.

Market Characteristics & Concentration

Companies in the U.S. pet dental health market are actively participating in activities such as product innovation, mergers and acquisitions, and regional expansion to fortify their position. The surge in pet ownership and heightened awareness of pet dental health have led to a growing market that these companies aim to serve. To differentiate themselves from competitors with distinctive and efficient products, and to boost sales and mitigate risk by attracting new customers across various regions, these companies are continually involved in such activities. These strategies are designed to boost market share, diversify product offerings, and ensure the market’s sustainable growth.

Consistent innovation efforts by manufacturers to introduce novel products that can satisfy the growing demand for dog & cat dental solutions are high in the market. Companies are offering products that are appealing to pets, effective on tartar & plaque, and easy to use for owners. For instance, in May 2022, Oxyfresh introduced the Dental Care Finger Brush. The BPA-free silicone finger brushes are available in packs of six and are designed to gently clean teeth & gums.

Market players adopt strategies initiating mergers and acquisitions to gain resources such as facilities, capabilities, labor, equipment, or product/service portfolios to boost their market position & revenue. These initiatives may be implemented to expand regionally or widen the global network to reach more customers. For instance, Virbac completed the acquisition of iVet LLC, a specialty pet food company in the U.S. With this acquisition, the company will be able to add a new product portfolio and gain expertise in distribution, logistics, & e-commerce.

Legal and regulatory authorities such as FDA approves and regulates the drugs intended for animal use, as per Federal Food, Drug, and Cosmetic Act. Similarly, medical devices or products for animal use have regulatory oversight by FDA, which can take strict action if the product or device is adulterated or misbranded. Governments of many developed and developing countries have initiated animal welfare boards to protect animals from various diseases.

One of the other key factors driving the market includes R&D initiatives in the veterinary dental industry by major companies, and expansion of oral care product offerings. The presence of strong players in U.S., along with continuous development in the country, is further increasing market growth. Companies implement expansion strategies to reach a larger consumer base in the worldwide market. For instance, Greenies Dental Treats, a subsidiary of Mars, Inc., extended its product distribution to supermarkets, drugs, and other mass retailers in 2019.

Major companies are adopting regional expansion strategies to increase their geographical presence, expand their customer base across countries, and build on existing resources & capabilities to meet the high demand. This allows market players to leverage existing expertise, technology, or labor at a wider scale and serve more patients. For instance, in May 2023, Virbac, a global animal health company, has acquired a distributor in the Czech Republic and Slovakia. This acquisition will allow Virbac to expand its presence and strengthen its position in the Central European market.

Type Insights

Products held a significant market share and is expected to grow at the fastest CAGR of over 6.1% during the forecast period, owing to the growing awareness among pet parents regarding animal dental care. A variety of pet oral health products, including enzymatic toothpaste and brushes, oral care solutions, dental care powder, foods, treats, chews, and dental wipes, among others, are available to help maintain the oral health of pets. The veterinary industry’s swift progress has introduced several new products to the market from leading players. Despite the pandemic, some industry participants have experienced substantial growth in the sales of oral care products through online distribution. For instance, Tropiclean witnessed a 15% rise in its pet dental care products in 2020 compared to its sales in 2019.

Services dominated the market with the largest revenue share of 69.3% in 2023. This is due to the extensive array of diagnostic and treatment services for dental care provided by different veterinary practices. Dental health significantly influences the overall health and behaviour of pets, making an annual routine dental check-up essential for them. Prevention is the primary factor in managing dental disorders; therefore, regular teeth cleaning and brushing to remove plaque are vital. The American Animal Hospital Association advises regular oral exams and dental cleanings to eliminate tartar and prevent gum diseases.

Animal Type Insights

Dogs dominated the market and accounted for the largest revenue share of over 59% in 2023, owing to the increasing dog adoption rates and significant dental disease prevalence estimated among them. The escalating rate of dog population in all regions is significantly propelling the market’s growth. As per the American Kennel Club (AKC), there was an increase in dog-owning households in the U.S., from 50% in 2018 to 54% in 2021. Furthermore, the COVID-19 pandemic has prompted many people country-wide to adopt dogs for emotional support.

Cats segment is anticipated to grow at the fastest CAGR of 5.87% during the forecast period. The rise in cases of gingivitis in cats and their awareness is enhances the growth of this segment. For example, the Cornell Feline Health Centre reports that gum diseases like gingivitis and periodontitis are found in 50% to 90% of the cat population. These dental conditions can be triggered by other infectious diseases such as feline leukaemia virus, diabetes mellitus, feline immunodeficiency virus, autoimmune diseases, and kidney diseases. Therefore, regular removal of plaque using oral care methods and routine teeth cleaning is commonly practiced, which has a significant effect on the growth of this segment.

Indication Insights

Gum diseases indication dominated the market and held the largest revenue market share of 37.7% in 2023. The high incidence of gum diseases like periodontitis and gingivitis among pets contributes to this. Periodontal diseases, which are caused by bacteria in the mouth and are generally progressive, can harm the gums, teeth, upper and lower jawbones, and other facial structures. As the disease starts below the gum line, noticeable signs and symptoms only appear once it has advanced. Approximately 80% of dogs and 70% of cats over the age of 3 years suffer from active gum diseases. This accounts for the largest portion of the market segment.

Dental calculus is expected to grow at the fastest CAGR of 6.61% over the forecast period, owing to its prevalence among domestic dogs. Only a professional veterinary dentist can eliminate dental calculus through thorough teeth cleaning and polishing. However, consistent teeth brushing can reduce plaque accumulation in animals’ teeth, preventing the advancement of calculus and subsequent severe gum diseases. Dental chews aid in the removal of dental calculus from the tooth surface. If not curtailed in the early stages through routine brushing and good oral hygiene, this common pet oral issue can result in periodontal diseases.

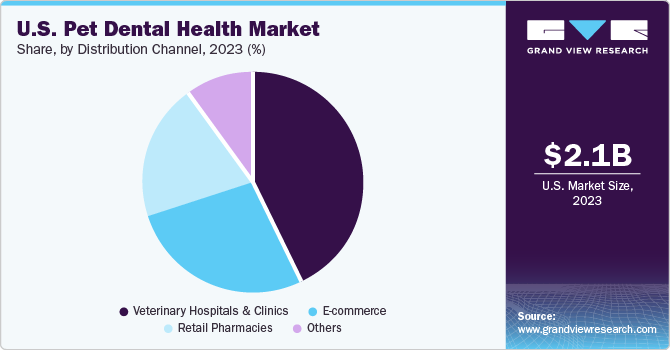

Distribution Channel Insights

Veterinary hospitals & clinics held the largest market share of 42.7% in 2023. The increase in the number of veterinary hospitals and clinics worldwide, equipped with advanced facilities, contributes to this. These veterinary clinics and hospitals play a vital role in pet dental healthcare by offering professional dental treatments through licensed veterinary dentists. The rise in the number of veterinary professionals also propels the market segment’s growth. As per the American Veterinary Medical Association, the count of veterinary professionals in the U.S. reached 121,461 in 2021.

E-commerce is anticipated to grow at the highest CAGR of 5.58% during the forecast period. With an increasing number of families having companion animals, there is a greater demand for easy access to pet oral care supplies. There are numerous brands of dental care diets, toothbrushes, chews, wipes, snacks, rinses, oral care water additives, pastes, and other products available for use in pet dental care. During the COVID-19 pandemic, online sales of these products increased significantly, enabling practical and simple platforms for pet dental care items. A few examples include Chewy, Amazon, Walmart, Target Brands, Inc. etc.

Key U.S. Pet Dental Health Company Insights

The U.S. pet dental health market is highly competitive. Leading players deploy various strategic initiatives that include competitive pricing strategies, partnerships, product and service expansion, sales & marketing initiatives, and mergers & acquisitions. For instance, in August 2022, the Colgate-Palmolive Company decided to purchase 3 dry pet food production facilities from Red Collar Pet Foods for USD 700 million to assist the global expansion of its Hill's Pet Nutrition business. Such initiatives by companies and animal dental health organizations are fueling the opportunity for market growth.

Key U.S. Pet Dental Health Companies:

- Virbac

- Colgate- Palmolive Company

- Dechra Pharmaceuticals plc

- Nestlé Purina Pet Care

- Vetoquinol SA

- Nylabone (Central Garden & Pet Company)

- Barkbox

- imRex Inc.

- Basepaws, Inc.

- Dentalaire, International.

- Pedigree (Mars Incorporate)

- PetIQ, LLC.

- Animal Dental Clinic

- Petzlife UK

Recent Developments

-

In January 2023, Nestlé Purina Pet Care’s Purina Pro Plan Veterinary Diets announced a partnership with the American Veterinary Medical Foundation (AVMF) to support veterinarians. Through this partnership, Purina will donate a portion of its proceeds to the AVMF to fund scholarships, disaster relief grants, and other initiatives that support veterinary professionals.

-

In July 2022, Virbac announced the launch of its new Tenotryl (enrofloxacin) injectable solution in the U.S., which was approved by FDA in March. This will help the company expand the range of its products.

-

In August 2022, Colgate-Palmolive Company decided to purchase the dry pet food production facilities from Red Collar Pet Foods for USD 700 million to assist the global expansion of its Hill's Pet Nutrition business.

U.S. Pet Dental Health Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 2.20 billion |

|

Revenue forecast in 2030 |

USD 2.97 billion |

|

Growth rate |

CAGR of 5.13% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, animal type, indication, distribution channel |

|

Country scope |

U.S. |

|

Key companies profiled |

Virbac; Colgate- Palmolive Company; Dechra Pharmaceuticals plc; Nestlé Purina Pet Care; Vetoquinol SA; Nylabone (Central Garden & Pet Company); Barkbox; imRex Inc.; Basepaws, Inc.; Dentalaire, International.; Pedigree (Mars Incorporate); PetIQ, LLC. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

U.S. Pet Dental Health Market Report Segmentation

This report forecasts revenue growth in the U.S. market and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. pet dental health market based on type, animal type, indication, and distribution channel:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Products

-

Oral Care Products

-

Toothpastes & Brushes

-

Oral Care Solutions

-

Foods & Treats

-

Dental Chews

-

Dental Powder

-

Others

-

-

Medicines

-

Equipment

-

-

Services

-

Diagnosis

-

Treatment

-

Dental Cleaning

-

Surgery

-

Root Canal Therapy

-

Others

-

-

-

-

Animal Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Dogs

-

Cats

-

Others

-

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Gum Disease

-

Endodontic Diseases

-

Dental calculus

-

Oral tumor

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Veterinary Hospitals & Clinics

-

Retail Pharmacies

-

E-commerce

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. pet dental health market size was estimated at USD 2.1 billion in 2023 and is expected to reach USD 2.20 billion in 2024.

b. The U.S. pet dental health market is expected to grow at a compound annual growth rate of 5.13% from 2024 to 2030 to reach USD 2.97 billion by 2030.

b. The services segment dominated the U.S. pet dental health market with a share of 69.3% in 2023. This is due to the extensive array of diagnostic and treatment services for dental care provided by different veterinary practices. Dental health significantly influences the overall health and behaviour of pets, making an annual routine dental check-up essential for them. Prevention is the primary factor in managing dental disorders; therefore, regular teeth cleaning and brushing to remove plaque are vital.

b. Some key players operating in the U.S. pet dental health market include Virbac; Colgate- Palmolive Company; Dechra Pharmaceuticals plc; Nestlé Purina Pet Care; Vetoquinol SA; Nylabone (Central Garden & Pet Company); Barkbox; imRex Inc.; Basepaws, Inc.; Dentalaire, International.; Pedigree (Mars Incorporate); PetIQ, LLC.

b. Key factors that are driving market growth include a rise in pet dental diseases, increased awareness among pet owners about preventing painful dental conditions, a surge in veterinary dental check-ups & procedures, the introduction of innovative pet oral care products by leading companies, and a growth in pet ownership rates.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."