- Home

- »

- Animal Health

- »

-

U.S. Pet Daycare Market Size, Share & Growth Report, 2030GVR Report cover

![U.S. Pet Daycare Market Size, Share & Trends Report]()

U.S. Pet Daycare Market (2025 - 2030) Size, Share & Trends Analysis Report By Pet (Dogs, Cats), By Service (Day Boarding, Pet Sitting), By Delivery Channel, And Segment Forecasts

- Report ID: GVR-4-68039-943-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Pet Daycare Market Size & Trends

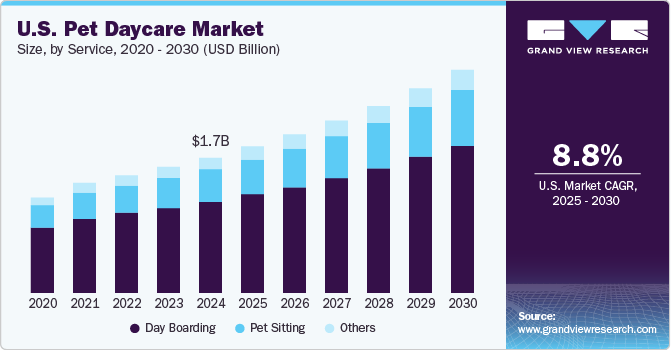

The U.S. pet daycare market size was estimated at USD 1.73 billion in 2024 and is projected to grow at a CAGR of 8.78% from 2025 to 2030. Some of the primary factors driving the market growth are the increasing number of pets, pet humanization, rising spending, rising number of service providers, and initiatives by the key market players. The growing expense of pet ownership reflects a larger societal trend in which pets are now viewed as essential family members rather than simply pets. As people get wealthier and more urbanized, they are more inclined to prioritize spending on their pets' well-being, which includes purchasing premium food, grooming products, accessories, and top-notch medical treatment.

The U.S. Bureau of Labor Statistics, for example, carried out a study in November 2023 that tracked pets spending over a period of eight years, from 2013 to 2021. According to the survey, expenses on pets increased by 77.9% in the United States. This survey also found that expenses increased faster than other entertainment costs, average annual income, and overall spending.

The market in the United States suffered as a result of the COVID-19 outbreak. Lockdowns and mobility restrictions caused daycare centers to either temporarily close or experience a downturn in activity. At the peak of the pandemic, for example, about 85% of Pet Sitters International members reported a business loss of more than 50%. In 2020, Wag Labs, which has its headquarters in the United States, saw a fall in gross bookings of almost 60%.

The market is anticipated to expand due to the rising number of service facilities and pet-related expenses. For instance, according to Pangolia Pte. Ltd., in the United States, there are about 20,000 petcare facilities and 35,000 pet sitters. In 2024, there will be 9,000 boarding kennels in the US. Thus, the increasing number of petcare facilities is a major factor propelling the market in the United States since it makes more options accessible to companion owners looking for dependable, convenient daily or long-term care. As more facilities offer a range of services, from regular daycare to specialized services like grooming and training, this expansion is in line with the growing number of companion owners and increased awareness of animal welfare.

The increased popularity of small and large breed dogs is expected to drive up demand for personalized companion services. The American Kennel Club, Inc. (AKC) stated that the top 10 dog breeds in the United States were small breeds such as French Bulldogs, Poodles, Bulldogs, Beagles, and Dachshunds, and large breeds such as Rottweilers, German Shepherd Dogs, Labrador Retrievers, and Golden Retrievers.

For example, Labrador Retrievers shed their thick, water-repellent double coat. To keep them clean, the AKC advises taking occasional showers and cutting their nails. The AKC advises socialization activities, puppy training programs, and regular exercise to prevent hyperactive and destructive behavior because of the breed's noteworthy physical strength and strong activity level. The demand for daycare services for pets in the United States is expected to increase owing to similar pet care requirements.

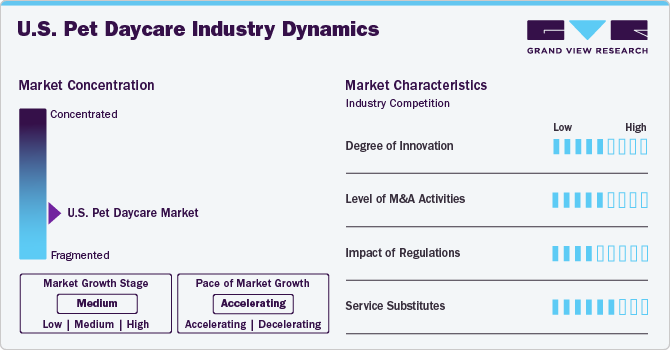

Market Concentration & Characteristics

The market concentration is at a moderate level in the U.S. market for pet daycare. The market growth stage is medium, with an accelerating pace. One major factor propelling the market growth is the increasing adoption of subscription based pet services. Dog or cat owners who use subscription-based services that provide them convenience and simple options can prevent last-minute complications.

For instance, there are three different annual subscription options available from TrustedHousesitters: Basic, Standard, and Premium. The annual cost of each subscription plan is USD 149, USD 229, and USD 299, respectively.

U.S. Pet Daycare Industry Characteristics

The degree of innovation in the market is moderate, driven by partnership and collaboration between market players and supportive initiatives to gain market share. For instance, in May 2023, Husse, a food company for companions, and We Love Pets Ltd. signed a collaboration agreement. The objective of this collaboration was to enhance the availability of products and encourage pets to lead happier, healthier lives.

The market is experiencing a moderate level of merger and acquisition activity, with businesses strategically purchasing or joining partners with others to broaden their service offerings, improve their market visibility, and obtain a competitive edge. For instance, in February 2024, Blackstone successfully acquired Rover Group, Inc. The projected total value of the deal, in cash only, is USD 2.3 billion.

Regulations have a moderate impact on the market. The USDA-administered Animal Welfare Act (AWA) establishes guidelines for animal care in research facilities, which can impact best practices in daycare facilities even though there are no federal laws that directly regulate daycare businesses for companions. Licenses from the appropriate state or local authorities are required for pet daycare services.

It is anticipated that substitution risk will remain moderate. For companion owners looking for alternative care options, alternatives including boarding facilities, in-home sitting, and pet-friendly lodgings offer good choices. Daycare facilities provide the social and physical requirements of pets, while in-home pet sitters provide individualized care. The selection is further expanded by the fact that certain lodging establishments and rental homes allow companions. By providing convenience, flexibility, and maybe lower prices, these alternatives might affect market demand.

Pet Insights

The dogs segment accounted for the largest revenue share of 88.60% in 2024. In the United States, dogs are among the most popular pets. In 2023, 56% of Americans reported having a dog in their home, a significant rise from the previous decade. Furthermore, 86.9 million households (about 66%) in the United States had dogs, according to the American Pet Products Association's National Pet Owners Survey 2023-2024. In the United States, dogs have become more significant and well-liked for decades, and their owners usually regard them as loyal family members. To some extent, one-third of Americans say they love their dogs even more than their partners.

Large breeds typically require ample exercise, socialization, and space to move freely, needs that can be challenging to meet in regular home settings, particularly for dog owners with busy schedules. Pet daycare services often cater to these requirements by offering specialized play areas and activities tailored to larger, more active breeds, which enhances appeal for owners of large dogs. In addition, daycare services often provide options for managing breed-specific behaviors and health needs, further driving demand among large-breed dog owners.

The cat segment is expected to grow at the fastest CAGR over the forecast period. Cats are increasingly contributing to the growth of the U.S. market. Although historically associated majorly with dog care, many daycare facilities are expanding to accommodate the needs of cat owners, offering specialized environments for cats to stay safely and comfortably while their owners are away. This demand is largely due to rising cat ownership, alongside pet humanization trends and an increasing focus on providing stress-free, enriching experiences for pets across the board.

Service Insights

The day boarding segment accounted for the largest revenue share of over 67% in 2024. Day boarding services often include structured activities, socialization opportunities, and professional supervision, making it an appealing option for busy dog or cat owners looking to ensure their pets receive exercise and mental stimulation. In addition, increased pet humanization trends contribute to the demand for day boarding, as more people prioritize pet well-being and seek reliable care services.

The others segment include pet walking, grooming, and other services. Services such as grooming and walking significantly enhance the market by offering comprehensive care options that cater to owners' busy lifestyles. Many daycare centers now integrate grooming services, like baths, nail trimming, and coat maintenance, making these facilities a one-stop shop. This convenience is attractive to owners who prioritize their pets’ appearance and hygiene but have limited time to handle it themselves. Pet walking services complement daycare by helping pets exercise, reducing behavioral issues, and improving their health-another key factor for owners seeking active care solutions while at work or away. These services are making daycare facilities increasingly popular and essential in urban areas.

Delivery Channel Insights

Commercial facilities dominated the market in 2024. The increasing number of pet daycare franchisees, a broad range of services, and the potential to broaden service offerings to cover both indoor and outdoor services are the factors that have contributed to the market growth. Dogtopia, for example, provides pet daycare services at its facilities, which are typically 6,000 to 8,000 square feet. There are facilities with outdoor areas as well. Dogtopia signed the biggest franchise deal in March 2022, planning to open approximately 60 new locations throughout the United States in the upcoming years.

The others segment is anticipated to register the fastest CAGR of over 9% from 2025 to 2030. It includes both in-house and mobile/outdoor delivery methods. Queen City Petsitting Company provides a variety of pet sitting services, including in-home pet care and pet sitting in hotel rooms. Although dogs are the primary target of these services, cats, gerbils, fish, rabbits, ferrets, and other animals are also covered.

Key U.S. Pet Daycare Company Insights

The market is fairly competitive owing to the presence of a large number of small-scale service providers in various countries competing with established service providers. Players in this market are constantly involved in various strategic initiatives, such as regional expansion, mergers & acquisitions, and new service launches, to gain a higher market share. For instance, in February 2024, Dogtopia announced the launch of its Dogtopia Spa product line. The company has included 12 new products catering to several aspects of dog health.

Key U.S. Pet Daycare Companies:

- A Place for Rover, Inc.

- Dogtopia Enterprises

- Paradise 4 Paws, LLC

- Come Sit Stay

- Fetch! Pet Care

- Barkley Ventures, Inc.

- PetSmart LLC

- Housecarers

- Camp Run-A-Mutt Entrepreneurial Resources

- Camp Bow Wow

Recent Developments

-

In January 2024, Dogtopia Enterprises recently disclosed the establishment of 43 new daycares, increasing its present service offering by incorporating sophisticated technologies to help dogs live happier and healthier lives.

-

In November 2023, after more than 500 franchise agreements were signed in the United States, Dogtopia established its 250th dog daycare facility.

-

In June 2023, Dogtopia signed a franchise deal to develop dog care centers in Passaic County, New Jersey, and Rockland County, New York.

U.S. Pet Daycare Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.87 billion

Revenue forecast in 2030

USD 2.85 billion

Growth Rate

CAGR of 8.78% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Report updated

October 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Pet, service, delivery channel

Key companies profiled

A Place for Rover, Inc., Dogtopia Enterprises, Paradise 4 Paws, LLC, Come Sit Stay, Fetch! Pet Care, Barkley Ventures, Inc., PetSmart LLC, Housecarers, Camp Run-A-Mutt Entrepreneurial Resources, Camp Bow Wow

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Pet Daycare Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the U.S. Pet Daycare market report based on pet, service, and delivery channel.

-

Pet Outlook (Revenue, USD Million, 2018 - 2030)

-

Dogs

-

Large Breeds

-

Medium Breeds

-

Small Breeds

-

-

Cats

-

Others

-

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Day Boarding

-

Pet Sitting

-

Others

-

-

Delivery Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Commercial facilities

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. Pet Daycare market size was estimated at USD 1.73 billion in 2024 and is expected to reach USD 1.87 billion in 2025.

b. The U.S. Pet Daycare market is expected to grow at a compound annual growth rate of 8.78% from 2025 to 2030 to reach USD 2.85 billion by 2030.

b. Day Boarding represented over 60% share of the U.S. Pet Daycare market by Service Type in 2024. The key factors contributing to this growth include pet parents returning to office post-COVID, high proportion of pet parents among millennials and genZ, and use of technology to increase awareness and adoption of pet services.

b. Some key players operating in the U.S. Pet Daycare market include A Place for Rover, Inc.; Dogtopia Enterprises; Paradise 4 Paws, LLC; Come Sit Stay; Fetch! Pet Care; Barkley Ventures, Inc.; PetSmart LLC; Housecarers; Camp Run-A-Mutt Entrepreneurial Resources; and Camp Bow Wow.

b. Key factors that are driving the U.S. Pet Daycare market growth include increasing pet population, pet humanization, pet expenditure, number of pet service providers, and initiatives by market players.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.