- Home

- »

- Biotechnology

- »

-

U.S. Personalized Retail Nutrition And Wellness Market, Industry Report 2030GVR Report cover

![U.S. Personalized Retail Nutrition And Wellness Market Size, Share & Trends Report]()

U.S. Personalized Retail Nutrition And Wellness Market Size, Share & Trends Analysis Report By Type (Fixed Recommendation, Repeat Recommendation, Continuous Recommendation), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-281-6

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

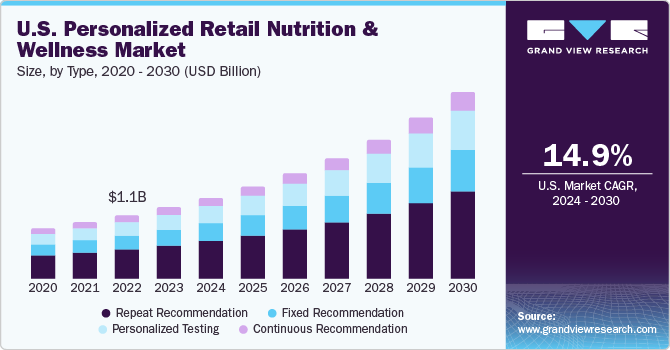

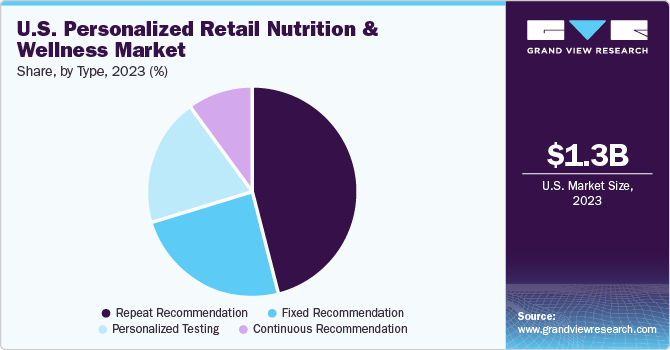

The U.S. personalized retail nutrition and wellness market was valued at USD 1.28 billion in 2023 and is expected to grow at a CAGR of 14.9% from 2024 to 2030. The increasing trend for customization in food sector, focus on healthier eating, self-help solutions, and personalized medicine have primarily fueled the demand for personalized nutrition products.

The incorporation of personalized nutrition approach into the nutrition and food sector is anticipated to significantly improve the consumer health and wellbeing alongside prevention of chronic condition like obesity and cardiovascular diseases. Although, in past years, the nutraceutical and functional food market alone has witnessed significant growth in terms of revenue, implementation of a one-size-fits-all approach to nutrition is not appropriate resulting in the launch of personalized nutrition approach. One of the key factors driving this market is adoption of FDA approved ingredients for development of functional food products by different companies. Conferences and interventions conducted for the advancement of personalized medicine in the country are expected to encourage companies for investments.

In 2023, U.S. personalized retail nutrition and wellness market accounted for a market share of over 38% in the global personalized retail nutrition and wellness market. Habit Food Personalized, LLC; Orig3n, and Vitagene, Inc. are some of the companies that are engaged in catering consumers through their advanced solutions, software, and algorithms for personalized nutrition. Understanding the growing awareness, popularity, and demand for personalized nutrition, new entrants are making investments to capitalize on the avenues present in the market. For instance, in June 2020, ZOE launched an AI-driven test kit and app for devising personalized diet plans based on a person’s individual gut microbes.

Market Characteristics & Concentration

The industry growth stage is high (CAGR >10%) and pace of the growth depicts an accelerating trend. The U.S. personalized retail nutrition and wellness industry is highly fragmented, which is marked by the presence of large number of companies competing for market share.

A wide variety of protocols are used to gather relevant information about the patients for proper designing of an individualized nutrition treatment plan. Wearable devices that deliver crucial assessment of a person’s physical activities and overall health is one of the significant product innovations in the industry. These devices help track heart rate and calorie count along with providing details about stress levels and sleep patterns. In addition, as at-home test kits are considered more comprehensive, there are a substantial number of companies in the space that are engaged in offering home test kits. Such developments are opportunistic for the industry.

The U.S. personalized retail nutrition and wellness industry is characterized by a substantial level of M&A and collaboration activities undertaken by key manufacturers. Numerous companies are collaborating with other relevant companies to strengthen their portfolio and expand their reach. For instance, in February 2021, Nature’s Way announced that it had acquired Baze for the business expansion of its health and wellness portfolio based on personalized and evidence-based nutrition. Companies planned to leverage Baze’s platforms for the development of high-quality personalized nutrition solutions.

Currently, safety considerations, nutritional recommendations, and related regulations of personalized nutrition are based on the fundamental requirements of an average healthy population. Regulatory bodies review and approve certain products considering the dosing range of individual nutrients, as this is considered a key component for effective implementation of the concept of personalization. As the FDA has relaxed the regulations on marketing of consumer genetic health tests, a number of manufacturers are anticipated to increase investments in development direct-to-consumer genetic tests for disease treatment. Such initiatives are projected to boost the potential of personalized nutrition and wellness products.

Type Insights

The repeat recommendations segment accounted for the largest revenue share of 46.3% in 2023. Presence of companies providing personalized food plans as per an individual’s health condition is fueling the segment growth. There are around 750 carotenoids present in human food, of which b-carotene, a-carotene, b-Cryptoxanthin, Lycopene, Lutein, Zeaxanthin, and Astaxanthin play an important role in human health. The carotenoid level helps detect the risk of medical conditions such as cardiovascular diseases, cancer, neurodegenerative diseases, and metabolic diseases. Custom meal recommendations by OneX are based on antioxidant protection and oxidative risk. This device provides suggestions for specific ingredients along with custom recommendations for a longer period to help patients design their optimal meal plan.

Personalized testing is projected to exhibit the fastest CAGR over the forecast period. Factors such as increasing popularity of wearable technology to monitor personalized data, advancements in genomic science, and exponential decline in the cost of genome sequencing are opportunistic for the demand growth. Development of several personalized nutrition programs, which use the information of genetic & metabolic characteristics of an individual, is used to design specific dietary plans that consist of specific foods and supplements.

Key Personalized Retail Nutrition And Wellness Company Insights

Key U.S. personalized retail nutrition and wellness companies include Nature’s Lab, Nature’s Bounty, and Bayer AG among others. The increase in strategic initiatives by companies for delivering comprehensive genetic algorithms for specific foods and nutrients are contributing to the market growth.

Key U.S. Personalized Retail Nutrition And Wellness Companies:

- Nature's Lab

- Cargill, Incorporated

- Nature's Bounty

- Bayer AG

- PlateJoy LLC

- Better Therapeutics Inc.

- Viome Life Sciences, Inc.

- Noom, Inc.

- Savor Health

- Nutrigenomix

- DNAfit (Prenetics Global)

Recent Developments

-

In January 2024, AHARA announced the launch of AHARA for Employers, a B2B preventive healthcare solution. The solution provides personalized nutrition plans for employees to cater to their daily nutrient requirement.

-

In July 2023, Quest Diagnostics announced the launch of its inaugural consumer-initiated genetic test, which will be exclusively accessible through the company's consumer health platform at questhealth.com. The new platform is aimed at helping patients to understand their potential risk for specific hereditary health conditions.

U.S. Personalized Retail Nutrition And Wellness Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 3.39 billion

Growth rate

CAGR of 14.9% from 2024 to 2030

Base year for estimation

2023

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type

Country scope

U.S.

Key companies profiled

Cargill, Incorporated, Nature's Bounty, Bayer AG, PlateJoy LLC, Better Therapeutics, Inc, Viome Life Sciences, Inc., Noom, Inc, Savor Health, Nutrigenomix, DNAfit (Prenetics Global), Nature's Lab

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options U.S. Personalized Retail Nutrition And Wellness Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the U.S. personalized retail nutrition and wellness market based on type:

-

Type Scope Outlook (Revenue, USD Million, 2018 - 2030)

-

Fixed Recommendation

-

Dietary Supplements & Nutraceuticals

-

Vitamins

-

Proteins

-

Minerals

-

Amino Acids

-

Enzymes

-

Others

-

-

Functional Foods

-

Proteins

-

Vitamins

-

Dietary Fibers

-

Fatty Acids

-

Minerals

-

Prebiotics & Probiotics

-

Carotenoids

-

-

Traditional Botanicals

-

-

Repeat Recommendation

-

Dietary Supplements & Nutraceuticals

-

Vitamins

-

Proteins

-

Minerals

-

Amino Acids

-

Enzymes

-

Others

-

-

Functional Foods

-

Proteins

-

Vitamins

-

Dietary Fibers

-

Fatty Acids

-

Minerals

-

Prebiotics & Probiotics

-

Carotenoids

-

-

Traditional Botanicals

-

-

Continuous Recommendation

-

Dietary Supplements & Nutraceuticals

-

Vitamins

-

Proteins

-

Minerals

-

Amino Acids

-

Enzymes

-

Others

-

-

Functional Foods

-

Proteins

-

Vitamins

-

Dietary Fibers

-

Fatty Acids

-

Minerals

-

Prebiotics & Probiotics

-

Carotenoids

-

-

Traditional Botanicals

-

-

Personalized Testing

-

Frequently Asked Questions About This Report

b. The U.S. personalized retail nutrition and wellness market size was estimated at USD 1.28 billion in 2023 and is expected to reach USD 1.45 billion in 2024.

b. The U.S. personalized retail nutrition and wellness market is expected to grow at a compound annual growth rate of 14.9% from 2024 to 2030 to reach USD 3.39 billion by 2030.

b. The repeat recommendations segment accounted for the largest revenue share in 2023. The presence of companies providing personalized food plans as per an individual’s health condition is fueling the segment's growth.

b. The key players in the U.S. personalized retail nutrition and wellness market include Cargill, Incorporated, Nature's Bounty, Bayer AG, PlateJoy LLC, Better Therapeutics, Inc, Viome Life Sciences, Inc., Noom, Inc, Savor Health, Nutrigenomix, DNAfit (Prenetics Global)

b. The increasing trend for customization in food sector, focus on healthier eating, self-help solutions, and personalized medicine have primarily fueled the demand for personalized nutrition products.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."