U.S. Personalized Nutrition & Supplements Market Size, Share & Trends Analysis Report By Ingredients (Proteins & Amino Acid, Vitamins, Minerals, Probiotics, Herbal/Botanic), By Dosage Form, By Age Group, By Distribution Channel, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-324-1

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

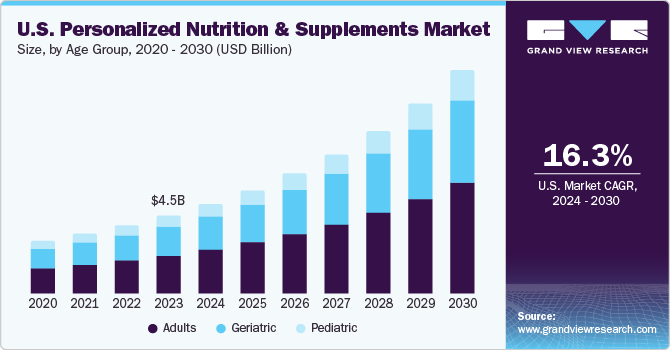

The U.S. personalized nutrition & supplements market size was estimated at USD 4.55 billion in 2023 and is projected to grow at a CAGR of 16.28% from 2024 to 2030. The U.S. personalized nutrition and supplements market is driven by increasing health awareness, technological advancements, and consumer demand for customization. Factors such as the rise of preventive healthcare, chronic disease management, and the affordability of genetic testing play a significant role in driving the market growth.

The U.S. personalized nutrition and supplements market experienced a slight drop during COVID-19 but is anticipated to boost significantly post-pandemic. This recovery is driven by increasing health awareness, technological advancements, and a growing consumer demand for customized health solutions. Additionally, innovative products, advances in nutrigenomics and microbiome research, regulatory support, and trends toward natural, organic, and sustainable products further propel the market.

Moreover, the rising incidence of lifestyle diseases, coupled with growing concerns about scarce nutrition and a significant geriatric population, are key drivers behind the increasing demand for personalized nutrition products in the U.S. As lifestyle-related conditions such as diabetes, obesity, and cardiovascular diseases become more prevalent, there is a heightened awareness among consumers about the importance of maintaining ideal nutrition to prevent these illnesses. This has led to the growing adoption rate of healthier lifestyles, where individuals actively seek out personalized dietary solutions that cater to their unique health needs and preferences.

Furthermore, the increasing prevalence of diet-related diseases, such as obesity, diabetes, and cardiovascular conditions, is a significant driver for the U.S. personalized nutrition and supplements market. As awareness of the link between diet and chronic health issues grows, consumers are seeking tailored nutritional solutions to prevent and manage these conditions. Personalized nutrition offers customized dietary recommendations and supplements based on individual health data, genetic profiles, and lifestyle factors, aiming to optimize health outcomes and mitigate disease risks. This trend is further fueled by advancements in health technology and diagnostics, making personalized approaches more accessible and appealing to health-conscious consumers.

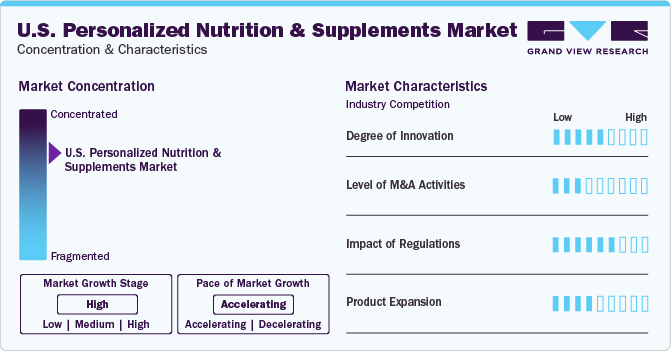

Market Concentration & Characteristics

The degree of innovation in the U.S. personalized nutrition & supplements industry is considered moderate due to several factors. While there have been significant advancements in genetic testing, AI-driven health assessments, and tailored supplement formulations, the widespread application and integration of these technologies remain limited. Many companies still rely on traditional methods and generic supplements. Furthermore, the regulatory challenges also slow down the adoption of nutrition and supplements.

The market is also characterized by the moderate level of merger and acquisition activities undertaken by several industry players. Companies are increasingly recognizing the potential of personalized nutrition and are strategically acquiring or merging with firms that offer innovative technologies, specialized knowledge, or complementary products. In September 2020, Bayer acquired a 70% majority stake in Care/of, a New York-based vitamin and supplement startup, in a deal valued at USD 225 million.

Stringent FDA guidelines on health claims, ingredient safety, and labeling requirements ensure consumer protection but can also slow down the introduction of new products and technologies. Compliance with these regulations often requires substantial investment in research, testing, and documentation, which can be challenging for smaller companies and startups. Thus, the U.S. personalized nutrition & supplements industry is anticipated to have significant impact in the upcoming years.

The market is experiencing moderate growth, driven by increasing consumer awareness of the link between diet and health, along with advancements in health technology and diagnostics. However, the growth rate is tempered by several factors, including high costs associated with personalized products, regulatory hurdles, and the emerging stage of consumer trust and understanding of these offerings.

Ingredient Insights

The vitamins segment held the largest market share of 26.89% in 2023. This is attributed to the widespread recognition of vitamins’ essential role in maintaining overall health and preventing nutrient deficiencies. The accessibility, variety, and well-documented benefits of vitamins make them a foundation in personalized nutrition strategies, further drives their leading position within the U.S. personalized nutrition & supplements market.

The herbal/botanic segment is expected to grow at the highest CAGR of 17.16% over the forecast period. The upsurge is attributed to several factors driving consumer preferences towards natural and plant-based ingredients. Increased awareness about the potential health benefits of herbal and botanical supplements, coupled with a growing interest in holistic approaches to wellness, has spurred demand for products derived from herbs, roots, flowers, and other botanical sources.

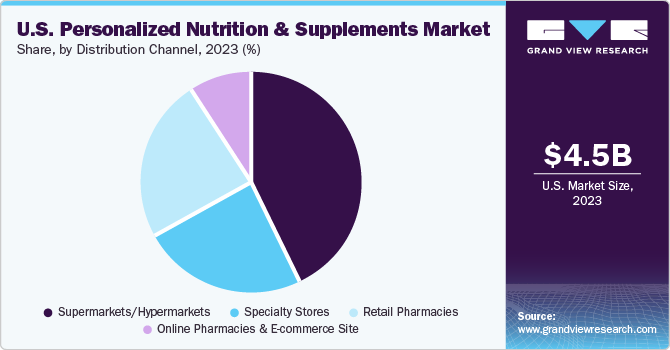

Distribution Channel Insights

The supermarkets/hypermarkets segment held the largest market share of 43.23% in 2023. The key driver of this segment is the frequency of users visiting supermarkets since it is considered to be a one-stop destination for groceries supplies. Several players are initiating collaborations with supermarkets to increase their sales. The increasing traffic at supermarkets is anticipated to support the growth of supplements. In the U.S., around 92% of citizens have at least made one trip to the supermarket between November 2021 and December 2021, which increased from 74% at the same time in 2020. The average frequency of shopping trips increased to 13 times in 2021 from 8.4 times in 2020.

The online pharmacies & e-commerce site segment is expected to witness a fastest CAGR over the forecast period. The segment growth is attributed to various factors such as price discounts, at-home delivery, and convenience in ordering. Furthermore, consumer satisfaction with buying at the best prices is higher in online pharmacies as it allows comparison of the price of the products from different sites. Increasing participation by companies and startups in this field is expected to boost the demand for personalized nutrition & supplements through online pharmacies' portals.

Dosage Form Insights

The tablets/capsules segment dominated the market in terms of revenue in 2023 with a share of 64.38%. They are safe to consume, inexpensive to produce, and effective at delivering nutrients. Tablets & capsules can be produced in various shapes and sizes that can assist in consumption. Furthermore, the manufacturing cost of tablets & capsules are relatively lower, which makes it affordable for consumers. In addition, tablets & capsules tend to be absorbed more quickly and act faster once disintegrate.

The liquid segment is anticipated to grow at the fastest CAGR of 17.53% over the forecast period. The advantage of liquid-form supplements and vitamins lies in their ease of customization, allowing for various dosages of different nutrients to create a personalized mix. This growth is driven by the increasing use of supplements among children and older adults. Liquid supplements are easier for the aging population to consume and offer faster absorption into the system.

Age Group Insights

The adults segment dominated the market in terms of revenue in 2023 with a share of 49.14% and is expected to grow at the fastest CAGR over the forecast period. The market growth is driven owing to growing consumer focus on health, wellness, and preventive care. Adults are progressively pursuing personalized nutrition solutions for specific health concerns such as cardiovascular health, weight management, digestive health, and overall wellness. According to a survey conducted in September 2020, approximately 73% of Americans use supplements and the core purpose for consuming dietary supplements was strengthening the immune system. Moreover, according to the data published by Foursquare, stores witnessed high footfall of middle-aged consumers in 2021.

The geriatric segment is anticipated to grow at a significant CAGR over the forecast period. Advanced technologies, such as DNA analysis and AI-driven dietary recommendations, enable the creation of highly individualized nutrition plans that consider genetic predispositions, lifestyle factors, and existing health conditions, thereby enhancing the overall well-being of the geriatric population. This factor is expected to impel the demand for personalized nutrition & supplements for geriatric population over the foreseeable future.

Key U.S. Personalized Nutrition & Supplements Company Insights

Key players operating in the U.S. personalized nutrition & supplements market are undertaking various initiatives to strengthen their market presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are playing a key role in propelling the market growth.

Key U.S. Personalized Nutrition & Supplements Companies:

- Viome Life Sciences, Inc.

- DSM Nutritional Products AG

- Thorne

- HUM Nutrition, Inc.

- GenoPalate Inc

- Pharmavite

- GNC Holdings, LLC

- The Vitamin Shoppe

- Nestlé Health Science (Nestlé)

- Baze Labs

- InVite Health

Recent Developments

-

In November 2022, IFF announced plans to accelerate its entry into the personalized nutrition sector through a strategic partnership with Salus Optima, a UK-based digital company specializing in personalized nutrition, health, and wellness. The partnership will initially focus on metabolic health, targeting conditions such as obesity, pre-diabetes, high cholesterol, and pre-hypertension.

-

In September 2020, Viome introduced Viome Precision Supplements, a personalized formula based on cellular, mitochondrial, and gut microbiome health data. It was the first to offer at-home retesting 2 to 3 times a year, enabling consumers to monitor health improvements and receive updated formulas based on their body's response.

-

In January 2020, Nestlé Health Science’s Atrium Innovations acquired LivingMatrix, a personalized functional medical platform that uses technology-based data and algorithms to support healthcare providers.

U.S. Personalized Nutrition & Supplements Market Report Scope

|

Report Attribute |

Details |

|

Revenue forecast in 2030 |

USD 12.92 billion |

|

Growth rate |

CAGR of 16.28% from 2024 to 2030 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Ingredient, dosage form, age group, distribution channel |

|

Key companies profiled |

Viome Life Sciences, Inc.; DSM Nutritional Products AG; Thorne; HUM Nutrition, Inc.; GenoPalate Inc; Pharmavite; GNC Holdings, LLC; The Vitamin Shoppe; Nestlé Health Science (Nestlé); Baze Labs; InVite Health |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

U.S. Personalized Nutrition & Supplements Market Report Segmentation

This report forecasts revenue growth at U.S. levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. personalized nutrition & supplements market report based on ingredient, dosage form, age group, and distribution channel.

-

Ingredient Outlook (Revenue, USD Million, 2018 - 2030)

-

Proteins & Amino Acid

-

Vitamins

-

Minerals

-

Probiotics

-

Herbal/Botanic

-

Others

-

-

Dosage Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Tablets/Capsules

-

Liquids

-

Powders

-

Others

-

-

Age Group Outlook (Revenue, USD Million, 2018 - 2030)

-

Pediatric

-

Adults

-

Geriatric

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarkets/Hypermarkets

-

Specialty Stores

-

Retail Pharmacies

-

Online Pharmacies & E-commerce Site

-

Frequently Asked Questions About This Report

b. The U.S. personalized nutrition and supplements market size was estimated at USD 4.55 billion in 2023 and is expected to reach USD 5.23 billion in 2024.

b. The U.S. personalized nutrition and supplements market is expected to grow at a compound annual growth rate of 16.28% from 2024 to 2030, reaching USD 12.92 billion by 2030.

b. The vitamins segment held the largest market share, 26.89%, in 2023. This is attributed to the widespread recognition of vitamins’ essential role in maintaining overall health and preventing nutrient deficiencies.

b. Some key players operating in the U.S. personalized nutrition and supplements market include Viome Life Sciences, Inc., DSM Nutritional Products AG, Thorne, HUM Nutrition, Inc., GenoPalate Inc, Pharmavite, GNC Holdings, LLC, The Vitamin Shoppe, Nestlé Health Science (Nestlé), Baze Labs, and InVite Health

b. The U.S. personalized nutrition and supplements market is driven by increasing health awareness, technological advancements, and consumer demand for customization. Factors such as the rise of preventive healthcare, chronic disease management, and the affordability of genetic testing fuel the growth of the market significantly.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."