U.S. Personal Sound Amplification Products Market Size, Share & Trends Analysis Report By Product (Behind-the-Ear, In-the-Ear), By Sales Channel (Online, Offline), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-475-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

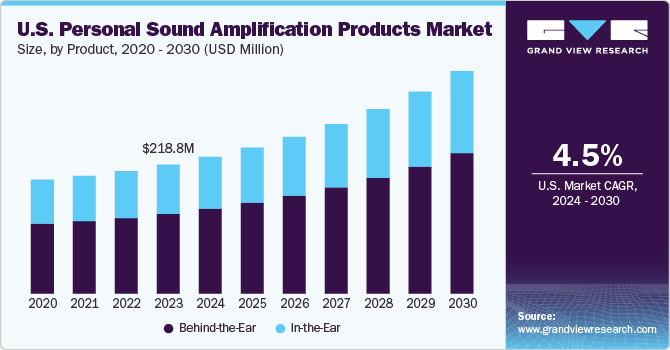

The U.S. personal sound amplification products market size was estimated at USD 218.84 million in 2023 and is expected to grow at a CAGR of 4.5% from 2024 to 2030. The market is primarily driven by the increasing incidence of mild hearing loss among young and adult populations. In addition, industry players' growing research and development efforts to create innovative products are expected to drive market expansion further during the forecast period. A notable surge in demand for personal sound amplification products (PSAPs) among older adults has become a significant growth factor.

According to the National Institute on Deafness and Other Communication Disorders (NIDCD), hearing impairment is prevalent among older adults. In the U.S., it is estimated that one in three individuals aged 65 to 74 experiences some degree of hearing loss. Furthermore, approximately half of those aged 75 and older are affected by this condition. These statistics present a substantial opportunity for the market as the demand for hearing assistance devices continues to rise among this demographic.

The prevalence of mild deafness in the young and adult population of the country is a crucial driver expected to improve the demand for PSAPs. The National Institute on Deafness and Other Communication Disorders estimates 2 to 3 out of every 1,000 newborns show hearing impairment in one or both ears. Notably, over 90% of children with hearing loss are born to parents who have normal hearing. This gradual increase in ability to hear impairment across age groups is expected to propel the need for nonprescription solutions, such as PSAPs, designed to assist individuals with mild-to-moderate hearing loss.

One significant advancement propelling the demand is integrating Bluetooth technology, enabling PSAPs to connect with smartphones, televisions, and other audio devices. This feature has enhanced the functionality of PSAPs by allowing users to stream audio directly to their devices and expanded their appeal to tech-savvy consumers seeking multifunctional devices. For instance, in March 2022, Alango Technologies, a DSP voice and audio enhancement solutions provider for the communications sector, launched an upgraded iteration of its BeHear ACCESS hearing amplifier. This new version introduces a provision for straightforward sound customization without an application, offers tailored tinnitus masking therapy, delivers increased amplification devoid of feedback, and facilitates enhanced pairing through Bluetooth 5.0 technology.

Market Concentration & Characteristics

The chart below illustrates the relationship between market concentration, characteristics, and participants. The x-axis represents the level of market concentration, ranging from low to high. The y-axis represents various characteristics, including the degree of innovation, the level of partnerships & collaborations, the impact of regulations, and regional expansion. For instance, the U.S. PSAP market is fragmented, with many small players entering the market and launching new innovative products. The degree of innovation is high, the level of partnerships & collaboration activities is medium, the impact of regulations is medium, and the regional expansion is low.

Degree of innovation in the U.S. PSAP market is high, driven by technological advancements and changing consumer preferences. Companies continuously enhance their products with Bluetooth connectivity, noise reduction, and smart adaptive sound settings. For instance, in July 2021, Alango Technologies introduced an upgraded version of its BeHear. ACCESS hearing amplification headset. This launch enabled the company to expand its product range and attract a larger customer base.

Level of partnerships and collaborations in the PSAP market is medium, as manufacturers increasingly align with healthcare professionals, audiologists, and technology companies to enhance product offerings and improve reach. For instance, in January 2022, Williams AV, LLC collaborated with MIPRO Germany as a distribution partner to distribute its complete commercial AV product line in Germany. Such partnerships help bridge the gap between technology and healthcare, fostering a holistic approach to hearing health and enhancing customer service, ultimately contributing to expansion.

Impact of regulations on the PSAP market is medium, particularly as the FDA has been working to establish clearer guidelines for PSAPs and over-the-counter hearing aids. These regulations aim to ensure safety and efficacy while promoting consumer access to affordable hearing solutions. The passage of legislation allowing direct sales of hearing devices is expected to enhance market growth by removing barriers for consumers. However, navigating regulatory frameworks still challenges manufacturers, particularly in ensuring compliance with varying state laws and federal guidelines, which affect product development timelines.

Regional expansion in the U.S. PSAP market is low, primarily due to the concentrated nature of the consumer base and existing disparities in access to hearing health services across different areas. In addition, traditional marketing strategies have not effectively penetrated these underserved markets, resulting in slower adoption rates. Although e-commerce opened new avenues for reaching a broader audience, the need for tailored outreach and educational efforts in certain regions hinders more widespread acceptance and growth of PSAPs. As a result, companies must focus on increasing awareness and accessibility in these areas to foster greater regional expansion.

Product Insights

The behind-the-ear (BTE) segment held the largest revenue share of 61.92% in 2023, due to its widespread appeal and functionality. BTE devices are favored for their comfort, ease of use, and superior sound quality, making them particularly suitable for a diverse range of consumers, including those with varying degrees of hearing loss. According to the U.S. FDA, BTE hearing aids are typically the largest type. This style is suitable for individuals of all ages and is often preferred for young children due to its ability to be adjusted as they grow. Features such as Bluetooth connectivity and smartphone integration, allowing for seamless audio streaming and personalized sound adjustments, combined with BTE devices' reliable performance, contribute to their dominance in the market and increase their attractiveness to new and existing users seeking effective hearing solutions.

The in-the-ear (ITE) segment represented significant growth in 2023, driven by consumer demand for discreet and comfortable hearing solutions. ITE devices are designed to fit snugly within the ear canal, making them less visible than traditional options, which appeals particularly to younger users and those concerned about aesthetics. Key drivers of this segment's growth include advancements in miniaturization technology that enable more powerful sound amplification in smaller devices and increased customization options to cater to individual ear shapes and preferences. The combination of comfort, style, and advanced functionality positions the ITE segment as a dynamic and rapidly evolving part of the PSAP.

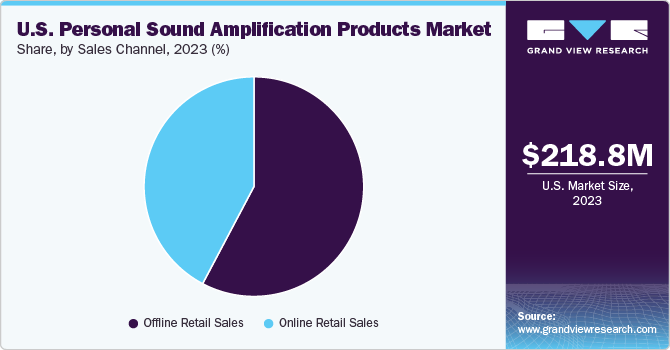

Sales Channel Insights

The offline retail sales segment held the largest revenue share of 57.74% in 2023. The segment is primarily driven by the traditional shopping preferences of consumers seeking personalized assistance and immediate product availability. Many customers value the opportunity to physically test devices and receive expert guidance from sales staff, which helps build trust and confidence in their purchasing decisions. In addition, offline retail channels often include partnerships with audiology clinics and hearing aid centers, providing a professional environment where consumers can explore options tailored to their needs. For instance, in October 2023, Eargo, Inc. expanded its partnership with Best Buy, increasing its in-store presence to more than 500 locations.

The online retail sales segment is expected to grow at the fastest CAGR of 5.2% over the forecast period. This segment is driven by the increasing preference for e-commerce and the convenience it offers consumers. With a growing number of consumers seeking to browse a wide range of products from the comfort of their homes, online channels are capitalizing on this trend by providing detailed product information, customer reviews, and easy comparison features. Expanding direct-to-consumer brands also played a significant role, as these companies leverage digital marketing strategies to reach targeted audiences more effectively. The shift towards online retail not only enhances accessibility but also fosters greater consumer awareness and acceptance of PSAPs as practical solutions for hearing needs.

Key U.S. Personal Sound Amplification Products Company Insights

Major companies in this segment focus on innovation and developing advanced features to meet the growing consumer demand for effective hearing solutions. The market is witnessing a trend towards integrating technology, such as Bluetooth connectivity and smartphone compatibility, which enhances user experience and accessibility. For instance, in September 2024, Apple introduced the AirPods Pro 2, which offers a comprehensive hearing health solution featuring noise cancellation, a scientifically validated hearing assessment, and functionality comparable to clinical hearing aids.

Key U.S. Personal Sound Amplification Products Companies:

- LUCID HEARING HOLDING COMPANY, LLC

- Britzgo.com

- Sound World Solutions

- MEDca Hearing

- Tweak Hearing (Ear Technology Corporation)

- Williams AV, LLC

- vivtonehearing

- LifeEar (Precise Hearing)

- Apple Inc.

- Google LLC.

Recent Developments

-

In January 2024, Amplifon acquires a significant Miracle-Ear franchisee, enhancing its position in the U.S.

-

In June 2024, Williams AV introduced three new products: the Digi-Loop 104, a compact hearing loop amplifier designed for small rooms; the SoundPlus T3, an infrared transmitter tailored for assistive listening; and the Digi-Wave ACM, a production intercom system.

-

In January 2023, Eargo, Inc. introduced the Eargo 7, which includes enhanced sound adjustment capabilities for noisy settings, water-resistant features, and the ability to recharge.

U.S. Personal Sound Amplification Products Market Report Scope

|

Report Attribute |

Details |

|

Revenue forecast in 2030 |

USD 377.98 million |

|

Growth rate |

CAGR of 4.53% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast data |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, sales channel |

|

Country scope |

U.S. |

|

Key companies profiled |

LUCID HEARING HOLDING COMPANY, LLC; Britzgo.com; Sound World Solutions; MEDca Hearing; Tweak Hearing (Ear Technology Corporation); Williams AV, LLC; Vivtonehearing, LifeEar (Precise Hearing); Apple Inc.; Google LLC. |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

U.S. Personal Sound Amplification Products Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. personal sound amplification products market report based on product and sales channel.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Behind-the-Ear

-

In-the-Ear

-

-

Sales Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online Retail Sales

-

Offline Retail Sales

-

Frequently Asked Questions About This Report

b. The U.S. personal sound amplification products market size was estimated at USD 218.84 million in 2023.

b. The U.S. personal sound amplification products market is expected to grow at a compound annual growth rate of 4.53% from 2024 to 2030 to reach USD 377.98 million by 2030.

b. Behind-the-Ear dominated the market with a share of 61.92% in 2023. This is attributable to its widespread appeal and functionality. BTE devices are favored for their comfort, ease of use, and superior sound quality, making them particularly suitable for a diverse range of consumers, including those with varying degrees of hearing loss.

b. Some key players operating in the U.S. personal sound amplification products (PSAP) market include LUCID HEARING HOLDING COMPANY, LLC, Britzgo.com, Sound World Solutions, MEDca Hearing, Tweak Hearing (Ear Technology Corporation), Williams AV, LLC, Vivtonehearing, LifeEar (Precise Hearing), Apple Inc., Google LLC.

b. Key factors that are driving the market growth include technological advancements in PSAPS, prevalence of mild deafness in the young and adult population.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."