- Home

- »

- Medical Devices

- »

-

U.S. Personal Mobility Devices Market, Industry Report 2030GVR Report cover

![U.S. Personal Mobility Devices Market Size, Share & Trends Report]()

U.S. Personal Mobility Devices Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Walking Aids, Wheelchairs, Scooters), And Segment Forecasts

- Report ID: GVR-4-68040-274-8

- Number of Report Pages: 75

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

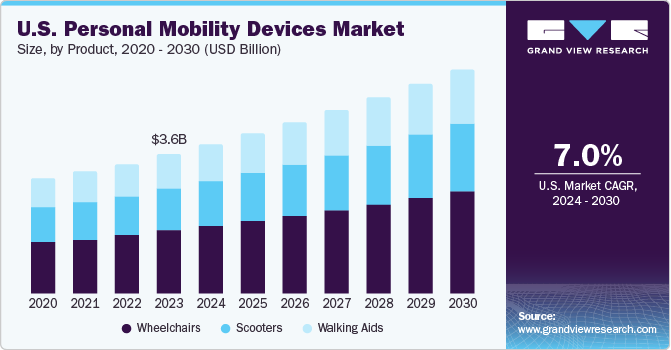

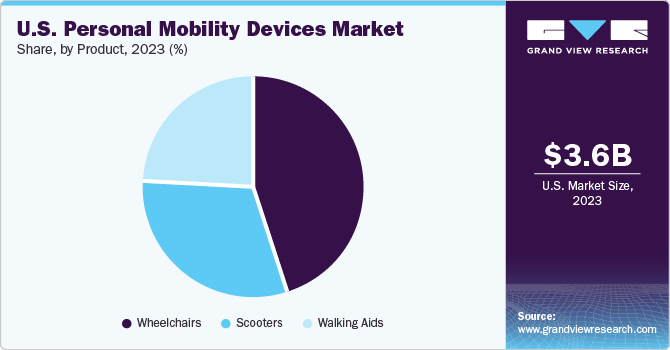

The U.S. personal mobility devices market size was estimated at USD 3.64 billion in 2023 and is projected to grow at a CAGR of 7.0% from 2024 to 2030. The aging population, rising number of accidents causing disabilities, technological advancements, and new product developments are expected to boost the demand for personal mobility devices such as mobility scooters, power wheelchairs, and walkers. The increasing prevalence of disabilities and chronic conditions among adults is the major factor driving the growth of this market in the U.S. According to the Centers for Disease Control and Prevention (CDC), 12.1% of U.S. adults have a mobility disability with serious difficulty in climbing and walking.

The COVID-19 pandemic significantly impacted the market due to the increased need for social distancing, remote work, and a growing demand for personal mobility devices. Also, individuals with mobility issues or disabilities were more hesitant to use public transportation or rely on assistance from others due to concerns about potential exposure to the virus, which led to the growing demand for personal mobility devices. On the other hand, the pandemic also caused disruptions in supply chains, affecting the production and distribution of personal mobility devices. This led to delays in fulfilling orders and increased costs for manufacturers and retailers.

Technological advancements play a pivotal role, with ongoing innovations such as lightweight materials and smart features enhancing the user-friendliness of personal mobility devices. The rising awareness about the benefits and availability of personal mobility devices, propelled by education campaigns, has also played a crucial role in driving adoption. Moreover, consumer preferences for customization and personalization have led manufacturers to offer a diverse range of options, catering to individual needs and preferences. The supportive healthcare infrastructure and policies further encourage using these devices, collectively creating a dynamic and evolving landscape for the U.S. personal mobility devices market.

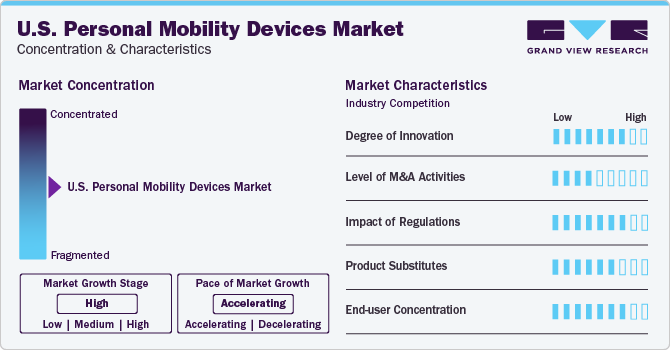

Market Concentration & Characteristics

The market growth stage is high and the pace of the growth is accelerating. Manufacturers are constantly striving to develop advanced technologies and features to enhance the performance, safety, and convenience of personal mobility devices such as wheelchairs, scooters, and power chairs. Innovations in battery technology, lightweight materials, connectivity features, and ergonomic designs have been key drivers of growth in this market. For instance, in November 2023, Honda Robotics introduced a revolutionary hands-free wheelchair called UNI-ONE which can be controlled by the user's body weight and can lift them to a semi-seated position, enabling them to be at the same height as others. This device has a range of approximately five miles and a usage time of two hours. Honda plans to launch the UNI-ONE in 2025, initially in the U.S. and Japan.

The level of merger and acquisition (M&A) activities in the market has been moderate in recent years. While there have been some notable acquisitions and partnerships among key players in the industry. The presence of large multinational corporations and smaller regional manufacturers contributing to the fragmented nature of the market. M&A activities are often driven by the need to expand product portfolios, access new markets, or achieve economies of scale. For instance, in September 2022, Via and May Mobility partnered to launch the first public transit project in rural America, to utilize wheelchair-accessible American Disability Act (ADA) compliant autonomous vehicles. The main objective of this initiative was to demonstrate that AVs can make a significant difference in society when employed for public transportation. The implementation allows everyone to reserve a complimentary on-demand shared ride from an AV.

Regulations play a crucial role in shaping the market. Government agencies such as the Food and Drug Administration (FDA) and the Federal Trade Commission (FTC) have established guidelines and standards to ensure personal mobility device safety, quality, and efficacy. Compliance with regulatory requirements is essential for manufacturers to gain market approval and maintain consumer trust. In addition to federal and state regulations, personal mobility devices are subject to industry standards. These standards are developed by organizations such as ANSI (American National Standards Institute), ASTM (American Society for Testing and Materials), and UL (Underwriters Laboratories).

Various product substitutes cater to individuals with mobility impairments are present in the market. These substitutes include traditional manual wheelchairs, walking aids such as canes and crutches, and alternative transportation options such as ride-sharing services and public transportation. The availability of product substitutes poses a competitive challenge for manufacturers of personal mobility devices, driving them to differentiate their products through innovation and value-added features.

End-user concentration is a significant factor in this market. This market serves a wide range of end-users, including individuals seeking natural and organic products for health and wellness, patients seeking alternative systems of medicine for chronic diseases, and healthcare providers seeking complementary therapies for their patients. The concentration of end-users varies depending on the region and product category. Manufacturers in the market consider the unique requirements and preferences of different end-user segments to develop personalized solutions that address their specific mobility challenges.

Product Insights

The wheelchairs segment dominated the market with a revenue share of more than 45.0% in 2023 and is expected to grow with the fastest CAGR of 7.2% during the forecast period. This growth is attributed to the growing aging population and the increasing prevalence of disabilities and chronic conditions among the population. As the aging population grows and the incidence of conditions such as arthritis, multiple sclerosis, and spinal cord injuries rises, the demand for mobility devices such as wheelchairs has significantly increased. In May 2023, the World Health Organization (WHO) introduced fresh guidelines for providing wheelchairs in partnership with the International Society of Wheelchair Providers and the International Society for Prosthetics and Orthotics. The purpose of these guidelines is to tackle the worldwide issue of providing wheelchairs to approximately 80 million people who require them, ensuring that they have equitable and timely access to wheelchairs that are tailored to their individual needs.

Moreover, advancements in technology have played a crucial role in driving the growth of the wheelchair segment within the personal mobility devices market. Innovations such as lightweight materials, improved battery life, enhanced maneuverability, and smart features have made wheelchairs more user-friendly and appealing to a wider range of users. These technological advancements have improved the overall user experience and increased the adoption of wheelchairs among individuals with mobility impairments. For instance, in February of 2023, Rollz introduced the Rollz Motion Electric. This innovative wheelchair combo combines the strength of a standard rollator with the convenience of an electric wheelchair, making it an ideal solution for individuals in need of mobility support. It is a practical and sturdy option that can accommodate a wide range of mobility conditions, from periodic assistance to full-time wheelchair use. The growing awareness about the importance of independent living and mobility assistance for individuals with disabilities has also fueled the demand for wheelchairs in the market.

Key U.S. Personal Mobility Devices Company Insights

Some key players operating in the market include GF Health Products, Inc.; Invacare Corporation; Carex

-

GF Health Products, Inc., an Atlanta-based company specializing in designing, manufacturing, and distributing a wide range of medical equipment and devices, such as wheelchairs, patient lifts, and patient handling solutions, including mobility devices and related accessories.

-

Invacare Corporation is a manufacturer and distributor of medical devices with a focus on mobility solutions in the U.S. and internationally. The company’s product portfolio includes a wide range of personal mobility devices, such as power wheelchairs, manual wheelchairs, and scooters, designed to meet the diverse needs of individuals with disabilities and mobility challenges.

Key U.S. Personal Mobility Devices Companies:

- GF Health Products, Inc.

- Invacare Corporation

- Carex

- Kaye Products, INC

- Briggs Healthcare

- Medline Industries, LP.

- NOVA

- Performance Health

Recent Developments

-

In January 2024, Robooter unveiled its latest power wheelchair, the X40. This model is designed with adjustable speed, integrated omnidirectional wheels, and a remote control. With a long-lasting battery and user-friendly interface, the X40 offers a hassle-free navigation experience. For added convenience, it also has an optional compact 10Ah battery, which makes it easy to transport on different types of public transportation.

-

In March 2023, Golden Technologies, an exhibitor at Medtrade, launched two new lightweight foldable power wheelchairs, further expanding their existing mobility product line. The all-new Stride aluminum folding wheelchair GP301 and the Cricket folding power wheelchair GP302 are super-portable, lightweight, and stylish.

-

In January 2023, Wheelfreedom, a mobility solutions provider announced the launch of Ki Mobility's Rogue 2, a lightweight rigid wheelchair that provides support and comfort for people with limited mobility. The Rogue 2 is a replacement for the original Rogue and has become a top-selling product at Wheelfreedom.

U.S. Personal Mobility Devices Market Report Scope

Report Attribute

Details

Market Size Value in 2024

USD 3.9 billion

Revenue forecast in 2030

USD 5.9 billion

Growth rate

CAGR of 7.0% from 2024 to 2030

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in K units, revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product

Country scope

U.S.

Key companies profiled

GF Health Products, Inc.; Invacare Corporation; Carex; Kaye Products, Inc.; Briggs Healthcare; Medline Industries, LP.; NOVA; Performance Health.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Personal Mobility Devices Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. personal mobility devices market report based on product.

-

Product Outlook (Volume, K Units; Revenue, USD Million, 2018 - 2030)

-

Walking Aids

-

Rollators

-

Premium Rollators

-

Low-Cost Rollators

-

-

Others (Canes, Crutches, and Walkers)

-

-

Wheelchairs

-

Manual wheelchairs

-

Powered Wheelchairs

-

-

Scooters

-

Frequently Asked Questions About This Report

b. The U.S. personal mobility devices market size was estimated at USD 3.64 billion in 2023 and is expected to reach USD 3.9 billion in 2024.

b. The U.S. personal mobility devices market is expected to grow at a compound annual growth rate (CAGR) of 7.0% from 2024 to 2030 to reach USD 5.9 billion by 2030.

b. In terms of market share, wheelchairs dominated the market by more than 45.0 % in 2023. This is attributed to the growing aging population and increasing prevalence of disabilities and chronic conditions among the population.

b. Some key players operating in the U.S. personal mobility market include GF Health Products, Inc.; Invacare Corporation; Carex Health Brands, Inc.; Kaye Products, Inc.; Briggs Healthcare; Medline Industries, Inc.; NOVA Medical Products; Performance Health

b. Key factors driving the market growth include the aging population, rising accidents causing disabilities, technological advancements, and new product developments. The increasing prevalence of disabilities and chronic conditions among adults is the major factor driving the U.S. personal mobility market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.