- Home

- »

- Beauty & Personal Care

- »

-

U.S. Personal Care Products Market, Industry Report, 2030GVR Report cover

![U.S. Personal Care Products Market Size, Share & Trends Report]()

U.S. Personal Care Products Market (2024 - 2030) Size, Share & Trends Analysis Report By Product, By Gender (Men, Women), By Age Group, By Distribution Channel, And Segment Forecasts

- Report ID: GVR-2-68038-301-0

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Personal Care Products Market Trends

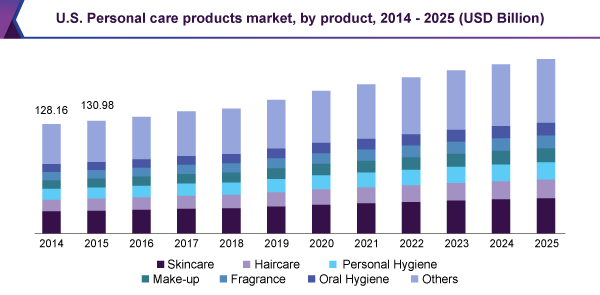

The U.S. personal care products market size was valued at USD 73.17 billion in 2023 and is projected to grow at a CAGR of 6.1% from 2024 to 2030.The rising aging population of the U.S. is the major factor in the growth of the personal care products market. As per the United States Census Bureau, Americans aged 65 and older have grown from 49.2 million in 2016 to 57.8 million in 2022. They represented 17.3% of the total population in 2022. These people are mainly interested in healthcare products that help maintain their youthful appearance.

The growing prevalence of skin conditions such as acne and eczema is becoming common. Rising personal care influencers on social media, beauty specialist retailers, and dermatologists are introducing people to new products for skin conditions, which is a major factor driving demand for personal care products. Consumers are becoming more aware of the potential health risks of cosmetics, shifting more towards organic and chemical-free products, and demanding products made with natural ingredients.

Social media's influence is increasing, creating demand for such products. In addition, the number of people spending on personal care products has increased mainly in the last few years, raising the market for such products. Additionally, celebrities worldwide are launching personal care brands, attracting followers to buy more personal care products.

The U.S. has some of the major companies providing personal care products across the globe. The increasing adoption of e-commerce has significantly helped the market growth as these companies sell personal care products worldwide through these platforms. The U.S. is technologically advanced and more interested in research and development of new and organic ingredients, which helps the personal care segment grow as companies provide more natural products free from harsh chemicals. The market is anticipating an upward trend in terms of profit and growth owing to reasons such as companies focusing on eco-friendly packaging and ethical sourcing practices, practicing sustainability, and prioritizing transparency with customers.

Product Insights

The skin care segment dominated the market in 2023. The focus on wellness, grooming, and self-care has increased significantly after the pandemic. People are prioritizing self-care routines and investing in skincare products. There is a growing demand for multifunctional products such as moisturizers with SPF to protect against UV rays or creams, and cosmetics products are built with the benefits of moisturizer and makeup finish. It aligns well with the busy lifestyle of the users. The evolving demographics and aging population are other major factors as people use more of such products to maintain a youthful appearance. Additionally, the rise in men’s skincare routines opened a new range in the skin care segment, continuing the market growth. The growth in the prestige beauty sector and influential marketing are the reasons for market growth, as their focus is on using high-performance and innovative ingredients, which is expected to drive market growth.

The hair care segment is expected to grow at the fastest CAGR of 7.4% over the forecast period. The increased experimentation with hairstyles and additional hair coloring leads to a demand for a wider variety of hair care products. As people understand the importance of scalp health for overall hair well-being, hair care products addressing problems such as dandruff, itchy scalp, and hair loss are gaining more attention. Consumers are seeking more natural and eco-friendly products to deal with issues such as premature aging of hair or grey hair. The rise in direct-to-customer brands that provide personalized hair care solutions to customers depending on their hair type and concerns allows the segment to grow. Additionally, hair care companies are constantly innovating; technological advancements such as new formulas, ingredients, and product delivery systems are driving the market.

Gender Insights

Women’s personal care products accounted for the largest revenue share in 2023. The social norms and beauty standards have emphasized women’s appearance, driving the demand for personal care products such as makeup, haircare, skincare, body care, and more among women. The personal care market primarily caters to women’s needs. Companies provide a wide range of products across different categories for women. Beauty marketing and advertising often target women and influence their purchase decisions. Personal care products are often associated with beauty and confidence. It offers women a way to express themselves. Makeup allows women to experiment with their looks and color, while the skincare routine can be a form of self-care, and women are highly investing in well-being.

Men’s personal care products are expected to grow at the fastest CAGR over the forecast period. There is a huge shift in social norms regarding men’s personal care. Men’s interest in personal care and appearance is more accepted. Men increasingly recognize the importance of personal care and invest in products that promote healthy skin, hygiene, and sharp appearance. Brands are increasingly making products to cater to male shaving, trimming, skincare, haircare, and body care needs. More options encourage men to experiment and establish personal care routines. The rise of male influencers openly discussing self-care routines and promoting personal care products and makeup routines is normalizing self-care for men. The rising influencer marketing helps break stigmas around male personal care and encourages more men to explore personal care. Due to this increasing trend, this segment is expected to grow in the coming years.

Age Group Insights

The adults age group dominated the market with a significant revenue share in 2023. Adults between the age group of 31-50 years have more disposable income. Adults mostly experiment with different beauty and personal care products. The anti-aging, anti-wrinkle creams, moisturizers, and hair coloring products are mainly popular among adults. The personal care product market offers a variety of solutions to address the concerns of aging and wrinkles, and this age group is more likely to be interested in such products.

The young adults (20-30) age group is expected to register the fastest CAGR of 7.1% during the forecast period. Young adults are more experimental with their looks and well-being and are most likely to purchase new personal care products to discover what works best. Influencer marketing primarily targets young adults, and they play a significant role in promoting various beauty routines and new products. Adults are more likely to follow the beauty trends their favorite influencers encourage and are willing to spend on the latest products.

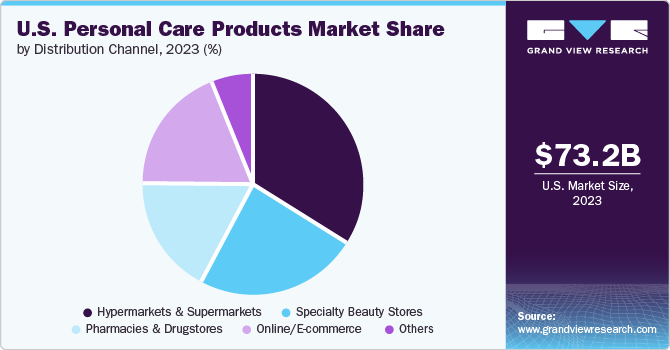

Distribution Channel Insights

The hypermarkets & supermarkets segment dominated the market in 2023. Hypermarkets & supermarkets provide a wide variety of products under one roof; therefore, it is convenient and time-saving for people to purchase products from such places. It goes well with the busy lifestyle of people as customers get all the products in one place. Hypermarkets & Supermarkets give customers the advantage of competitive pricing as such stores provide discounts to customers as they can leverage their bulk buying power to negotiate lower prices with suppliers.

The online/e-commerce sector is projected to grow at the fastest CAGR over the forecast period. Online and e-commerce platforms allow customers to buy from the comfort of their homes without stepping outside. To lure customers, these platforms offer benefits like one-day delivery and easy returns. Online retailers also offer huge discounts to customers compared to physical stores. Additionally, the rise of smartphones and tablets makes it easier for people to shop online anytime, anywhere.

Key U.S. Personal Care Products Company Insights

Some of the key companies in the U.S. personal care products market include Coty Inc.; L’Oréal Group; Estee Lauder Companies, Inc.; Revlon Consumer Products LLC, and others. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Coty Inc. is a beauty company with well-known brands in skincare, fragrance, sun care, cosmetics, and hygiene. It supplies its products through various distribution channels, such as specialty retailers, department stores, mass-market retailers, and duty-free shops in airports globally.

-

Estee Lauder Companies is a well-known beauty brand that manufactures and sells high-quality skin care, makeup, fragrance, and hair care products. It is known for its creativity and innovation. It has more than 20+ luxury brands in the personal care sector, and customers love its products across the globe.

Key U.S. Personal Care Products Companies:

- Revlon Consumer Products LLC

- L’Oréal Group

- Avon Products, Inc.

- Coty Inc.

- Estee Lauder Companies, Inc.

- Unilever plc

- Beiersdorf AG

- Procter & Gamble (P&G) Company

- Henkel AG & Co KGaA

- Kao Corporation

Recent Developments

-

In March 2024, L'Oréal launched a new ingredient called Melasyl, designed to address localized pigmentation issues like age spots and post-acne marks across all skin tones. Melasyl was developed over 18 years of research and clinical testing and will be incorporated into products from L'Oréal's brands like La Roche Posay, L'Oréal Paris, and Vichy to provide more accessible solutions for people dealing with uneven skin tone and pigmentation.

-

In February 2024, Coty Inc. and Marni, the Italian luxury fashion brand announced a new long-term licensing agreement to produce, develop, and distribute beauty and fragrances products under the Marni brand until at least 2040. The partnership aims to translate Marni's creative and fashion-forward identity into the beauty sector, delivering premium offerings that strengthen Marni's luxury positioning and expand its brand.

U.S. Personal Care Products Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 77.21 billion

Revenue forecast in 2030

USD 110.11 billion

Growth Rate

CAGR of 6.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, gender, age group, distribution channel.

Key companies profiled

Coty Inc.; L’Oréal Group; Estee Lauder Companies, Inc.; Revlon Consumer Products LLC; Avon Products, Inc.; Unilever plc; Procter & Gamble (P&G) Company; Beiersdorf AG; Henkel AG & Co KGaA; Kao Corporation

Customization scope

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Personal Care Products Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. personal care products market report based on product, gender, age group, and distribution channel:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Skincare

-

Hair Care

-

Shower and Bath

-

Perfume/Fragrances

-

Color Cosmetics

-

-

Gender Outlook (Revenue, USD Million, 2018 - 2030)

-

Men

-

Women

-

-

Age Group Outlook (Revenue, USD Million, 2018 - 2030)

-

Teenagers (Ages 13-19)

-

Young Adults (Ages 20-30)

-

Adults (Ages 31-50)

-

Mature Adults (Age 51 & Above)

-

-

Distribution Chanel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hypermarkets & Supermarkets

-

Specialty Beauty Stores

-

Pharmacies & Drugstores

-

Online/E-commerce

-

Others

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.