- Home

- »

- Medical Devices

- »

-

U.S. Pediatric Home Healthcare Market, Industry Report, 2030GVR Report cover

![U.S. Pediatric Home Healthcare Market Size, Share & Trends Report]()

U.S. Pediatric Home Healthcare Market Size, Share & Trends Analysis Report By Service (Rehabilitation Therapy Services, Skilled Nursing Services), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-283-2

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

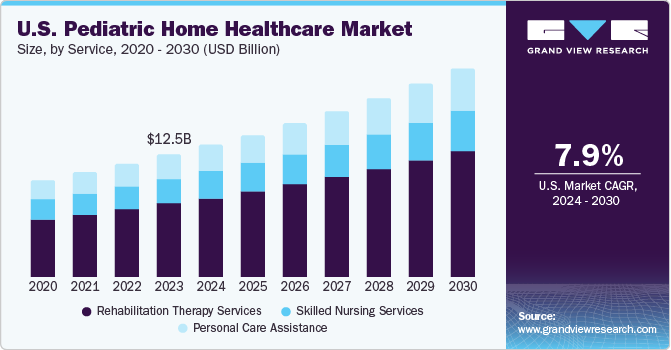

The U.S. pediatric home healthcare market size was estimated at USD 12.53 billion in 2023 and is projected to grow at a CAGR of 7.85% from 2024 to 2030. The rising prevalence of chronic diseases in children and technological advancements to provide medical assistance and continuous care at home for children with medical complexities (CMC) are likely to enhance market growth. In addition, children with chronic illnesses are more likely to experience emotional, behavioral, and psychiatric symptoms compared to healthy children.

The increasing prevalence of chronic diseases in the child population of the U.S. is a growing concern. The number of children suffering from chronic illnesses like asthma, diabetes, and obesity has been rising steadily. This has led to an increased demand for home healthcare services that can manage and monitor these conditions effectively. According to the Healthy Children Organization, ten to twenty million American children and adolescents are affected by chronic illnesses or disabilities.

Sickle cell disease is the most frequently inherited blood disorder in the U.S. Sickle cell disease, the most prevalent type of inherited blood disorder, affects an estimated 70,000 to 100,000 individuals in the U.S., leading to the production of abnormal hemoglobin from birth. Children who have sickle cell disease suffer from episodes of severe pain and face ongoing medical challenges. However, receiving early and consistent medical care and treatment can help minimize complications and allow children with the condition to lead full and active lives. Moreover, chronic illnesses can have a significant impact on a child's physical, cognitive, social, and emotional development. This can lead to a higher risk of mental illness compared to healthy peers and can also affect the child's family.

The COVID-19 pandemic resulted in an increased demand for home healthcare services, which proved useful during times of restricted movement and social distancing measures. In addition, the increasing number of children and youth with special healthcare needs (CYSHCN) demands pediatric home healthcare services, which leverage a child's quality of life and significantly decrease medical expenses.

Prolonged hospital stays can be expensive, but pediatric home-based services offer a cost-effective solution that improves patient care efficiency. As a result, many U.S. providers offer a range of services to meet the growing demand for pediatric home healthcare. Increasing coverage for children and youth with special healthcare needs further supports the market growth. According to the National Center for Biotechnology Information, regarding underinsurance among children with special healthcare needs, it was observed that those with complex physical and behavioral health requirements experienced a higher prevalence of underinsurance compared to children without such needs. The study, conducted between 2016 and 2021 with a total sample size of 218,621 U.S. children, revealed that underinsurance was most common among families with incomes ranging from 200% to 399% of the federal poverty level.

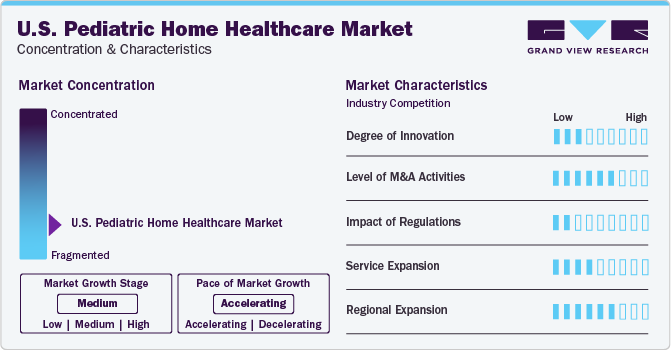

Market Concentration & Characteristics

Technological advancements have led to the development of more sophisticated medical equipment and devices used in home healthcare settings. These devices enable healthcare professionals to provide better care and monitor children with complex medical needs. Medical technology has made a difference in home healthcare for children in the areas of remote monitoring and telemedicine, wearable health devices, personalized medicine, mobile health apps, and assistive technologies.

Merger and acquisition activities in the U.S. market have seen a consistent uptrend, reflecting a strategic drive among companies to consolidate and expand their service portfolios. This surge is fueled by rising demand for pediatric home healthcare services and the pursuit of operational efficiencies. For instance, in November 2023, Pediatric Home Respiratory Services, LLC (PHS), headquartered in Minnesota and across multiple states, acquired Apple Homecare Medical Supply, Inc., a significant supplier of pediatric respiratory and enteral supplies in Texas. PHS offers enteral nutrition, pediatric respiratory equipment, home care/private duty nursing, infusion nursing & pharmacy, and more.

Favorable insurance policies are expected to drive market growth. The American Academy of Pediatrics confirms that Medicaid covers essential services such as primary care, hospice care, personal care assistance, and nursing care for children.

Medicaid is primarily designed to cover medical expenses for children, while private insurance is intended to cover the remaining costs. A majority of Medicaid beneficiaries in Texas are enrolled in the STAR managed care program. In addition, the U.S. Government’s Children's Health Insurance Program (CHIP) provides health coverage for uninsured children in families who earn too much for Medicaid but not enough for private coverage.

The market is highly fragmented due to the high presence of healthcare service-providing companies. Moreover, the level of mergers and acquisitions between home healthcare services providing companies is significantly high in the country, along with companies’ geographical expansion. For instance, in September 2022, Pediatric Home Service, a Minnesota-based company, announced the expansion of its service offerings to the state of Iowa.

Several organizations play a vital role in advocating for and providing pediatric home healthcare services for children with chronic illnesses and mental health needs. These organizations focus on enhancing access to quality care, promoting research, and raising awareness about the unique challenges faced by this vulnerable population. The American Academy of Pediatrics, the National Association for Home Care & Hospice, and Children’s Home Healthcare are a few of the notable organizations dedicated to improving the health and well-being of children.

Service Insights

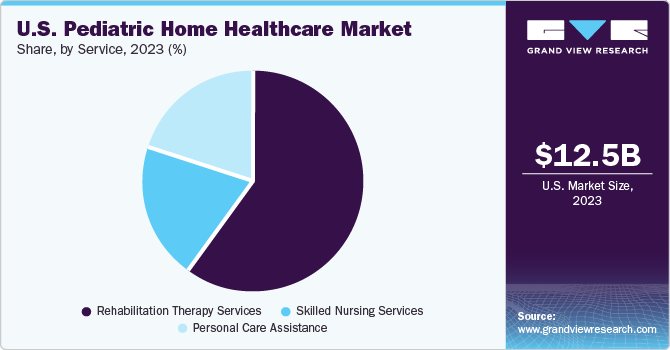

Based on service, the market is segmented into rehabilitation therapy services, skilled nursing services, and personal care assistance. The rehabilitation therapy services segment led the market with the largest revenue share of 60.27% in 2023 and is also expected to grow at the fastest CAGR over the forecast period. This growth is attributed to the increased demand for rehabilitation therapy services due to neurological and muscular challenges faced by premature infants. Various service providers offer different types of rehabilitation therapies, such as speech, physical, and occupational therapies, to help children with conditions like cerebral palsy, autism, muscular atrophy, and ADD/ADHD. For instance, in October 2023, U.S. Physical Therapy, Inc., a provider of industrial injury prevention services and outpatient physical therapy clinics, announced the acquisition of two physical therapy practices through separate transactions. These acquisitions marked its entry into the Colorado market with its first clinics and expanded the company's presence in Alaska.

The skilled nursing services segment plays a crucial role in pediatric care for various reasons. For instance, according to the Centers for Disease Control and Prevention (CDC), one in every thirty-three babies is born with defects in the U.S. Children, especially those with complex medical conditions or special needs, often require specialized care that goes beyond what can be provided by parents or caregivers alone. These services have been effective in reducing inpatient expenses for children with medical complexities.

The personal care assistance segment is anticipated to grow at a significant CAGR during the forecast period. This growth is attributable to government policies and initiatives aiding mothers to return to work. For instance, the American Rescue Plan (ARP) of March 2021 provided USD 24 billion under the Child Care Stabilization Program to child care industry. This significant investment played a crucial role in stabilizing the provision of child care during the pandemic, while also addressing pre-existing challenges in the market. Child care providers utilized these resources to retain their staff, pay rent, and cover their expenses during uncertain times.

Key U.S. Pediatric Home Healthcare Company Insights

Some of the key players operating in the market include Aveanna Healthcare, LLC; Care Options for Kids; Pediatric Home Service; Pediatric Home Healthcare; Continuum Pediatric Nursing.

-

Pediatric Home Service provides vast range of home healthcare services including respiratory therapy and equipment, infusion nursing and pharmacy, private duty nursing, enteral nutrition, clinical online and on-site education, and skilled nursing visits

-

Aveanna Healthcare, LLC offers a complete range of pediatric home healthcare services including skilled nursing, physical therapy, occupational therapy, speech therapy, aide services, and fall prevention

At Home Healthcare; Entrusted Pediatric Home Care; Children’s Home Care; Interim HealthCare Inc are some of the other market participants in the U.S. market.

Key U.S. Pediatric Home Healthcare Companies:

- Aveanna Healthcare, LLC

- Care Options for Kids

- Pediatric Home Service

- Pediatric Home Healthcare

- At Home Healthcare

- Entrusted Pediatric Home Care

- Children’s Home Care

- Interim HealthCare Inc

- Continuum Pediatric Nursing

Recent Developments

-

In November 2023, Pediatric Home Service, a Minnesota-based company, announced that it entered the Florida market by acquiring All About Pediatrics, a Jacksonville, Florida-based company

-

In December 2022, Comprehensive Health Homes for Integrated Care (CHIC) Kids Pilot Program was initiated by the Texas Health & Human Services Commission, aiming to enhance care coordination for children with complex medical conditions by establishing or enhancing a health home model

-

In April 2022, Pediatric Home Healthcare, LLC completed the acquisition of Villa Children Therapy, one of the esteemed providers offering specialized pediatric physical, speech, and occupational therapy services

U.S. Pediatric Home Healthcare Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 13.50 billion

Revenue forecast in 2030

USD 21.24 billion

Growth rate

CAGR of 7.85% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, region

Country scope

U.S.

Key companies profiled

Aveanna Healthcare, LLC; Care Options for Kids; Pediatric Home Service; Pediatric Home Healthcare; At Home Healthcare; Entrusted Pediatric Home Care; Children’s Home Care; Interim HealthCare Inc; Continuum Pediatric Nursing

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options.

U.S. Pediatric Home Healthcare Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. pediatric home healthcare market report based on services and region:

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Skilled Nursing Services

-

Personal Care Assistance

-

Rehabilitation Therapy Services

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

West

-

Midwest

-

Northeast

-

Southwest

-

Southeast

-

Frequently Asked Questions About This Report

b. The U.S. pediatric home healthcare market size was estimated at USD 12.53 billion in 2023 and is expected to reach USD 13.50 billion in 2024.

b. The U.S. pediatric home healthcare market is expected to grow at a compound annual growth rate (CAGR) of 7.85% from 2024 to 2030 to reach USD 21.24 billion by 2030.

b. In terms of service, rehabilitation therapy services dominated the market with the largest market share of 60.3% in 2023. This high share is attributed to the rising prevalence of chronic and metabolic diseases in children.

b. Some key players operating in the U.S. pediatric home healthcare market include Aveanna Healthcare, LLC, Care Options for Kids, Pediatric Home Service, Pediatric Home Healthcare, At Home Healthcare, Entrusted Pediatric Home Care, Children’s Home Care, Interim HealthCare Inc, and Continuum Pediatric Nursing

b. Key factors driving the market growth are the rising prevalence of chronic diseases in children and technological advancements to provide medical assistance and continuous care at home for children with medical complexities (CMC).

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."