- Home

- »

- Nutraceuticals & Functional Foods

- »

-

U.S. Pea Protein Market Size, Share & Growth Report, 2030GVR Report cover

![U.S. Pea Protein Market Size, Share & Trends Report]()

U.S. Pea Protein Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Isolates, Concentrates), By Form (Dry, Wet), By Source, By Application (Food & Beverages, Animal Feed), And Segment Forecasts

- Report ID: GVR-4-68040-324-6

- Number of Report Pages: 70

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Pea Protein Market Size & Trends

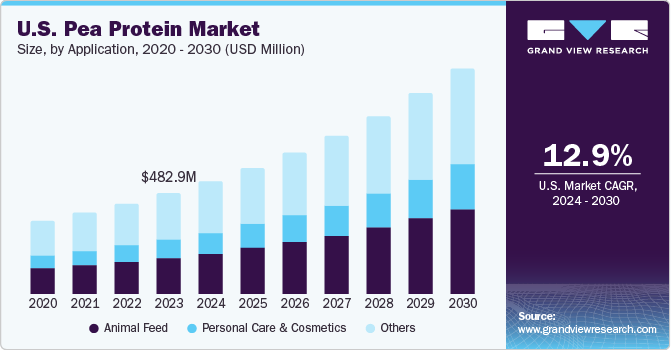

The U.S. pea protein market size was estimated at USD 482.9 million in 2023 and is expected to grow at a CAGR of 12.9% from 2024 to 2030. The rising importance of a flexitarian diet among the people of the U.S. on account of the growing concerns over the cardiological impacts associated with red meat consumption is expected to boost the importance of plant proteins in the country. Furthermore, growing awareness of adverse effects associated with foods comprising gluten and fiber is expected to drive market growth over the forecast period.

The U.S. pea protein market accounted for a share of 22.8% of the global pea protein market in 2023. The presence of manufacturing facilities of meat producers including Tyson, JBF, Cargill, and National Foods in the U.S. is expected to increase the use of pea protein as a texturizing agent in meat production. Moreover, increasing consumption of grains including soy and canola for bio-based chemical production is anticipated to reduce their availability as protein ingredients. As a result, pea protein is expected to emerge as an important ingredient among food & beverage manufacturers on account of its proximity with the yellow pea-producing country Canada.

Increasing consumer awareness regarding an active and healthy lifestyle, which can be attained by exercising regularly and maintaining a balanced diet comprising all essential nutrients and amino acids, is expected to drive the demand for the pea proteins market in the U.S.

Product Insights

The isolates segment accounted for a revenue share of 49.7% in 2023. Rising concerns over gluten-related disorders in the U.S. owing to increasing expenditure on research pertaining to human health are expected to promote the importance of gluten-free pea protein isolates in the food & beverage industry.

The pea protein concentrates segment is expected to grow at a CAGR of 12.6% over the forecast period. The rising prevalence of gastrointestinal disorders has emphasized the importance of calorie-free and weight-reduction diets. This trend, coupled with the low cost of pea protein concentrates than isolates, is expected to promote the incorporation of pea protein concentrates in beverages, baked foods, and meat products over the forecast years.

Source Insights

The yellow split peas segment dominated the market with a revenue share of 75.8% in 2023. Yellow peas are the commonly grown varieties in the U.S. and account for roughly two-thirds of pea production in the U.S. In regions including North America, yellow peas predominantly find applications in the compound feed industry and are used as whole seeds, which are ground and blended with ground cereal seeds during the process of producing feed.

Other sources include lentils, green peas, chickpeas, and fava beans. This segment is expected to grow at a CAGR of 10.1% over the forecast period. These sources offer various micronutrient profiles and amino acid compositions, giving consumers more options to meet their dietary needs.

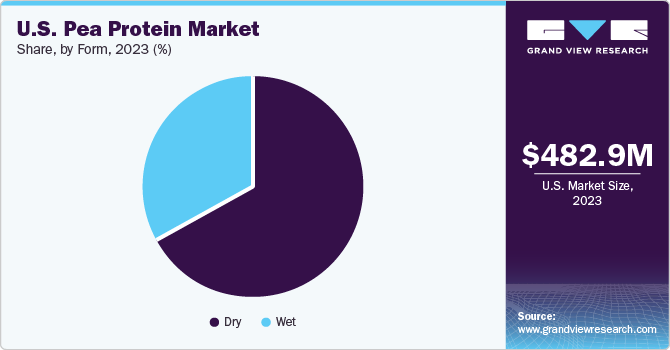

Form Insights

The dry pea protein segment accounted for a revenue share of 67.4% in 2023. Through the process of manufacturing pea protein using dry milling combined with air classification, the native functionality of the protein ingredients can be retained. This approach also leads to savings in water and power usage. In this process, yellow or red peas are ground using an impact-driven method and jet milling process at various levels of classifier wheel speeds to create pea flours with different particle distribution, protein content, and damaged starch levels. Moreover, the dehulling process results in the removal of 97-98% of the fiber content.

The wet pea protein segment is expected to grow at a CAGR of 11.9% over the forecast period. Wet fractionation of peas to manufacture protein ingredients is done using equipment such as a dehuller, hammer mill, soaking tanks, decanter, spray, and drum driers. Solubilization of pea protein, lipids, and sugar uses a NaOH solution with a pH count of 10.5 to 11.0. This procedure removes starch content by using a decanter or ultra-filtration process. The wet pea proteins are then dried using a spray drier or fluidized bed drier. However, high manufacturing costs may hinder the segment growth.

Application Insights

The food & beverages segment dominated the market with a revenue share of 39.0% in 2023. There is high adoption of pea proteins by sports nutrition manufacturers for formulating muscle-building protein supplements, which contributed to the high share of dietary supplements in 2020. However, growing demand for meat alternatives wherein pea protein is utilized as a texturing agent and functional ingredient is expected to fuel the demand for pea proteins in the coming years.

The personal care & cosmetics segment is expected to grow at a CAGR of 13.4% from 2024 to 2030 owing to the strong purchasing power of consumers in the developed countries, which supported the personal care & cosmetics sector in the U.S. Rising expenditure on premium products, such as moisturizers and anti-aging products, is expected to fuel the demand for pea protein in personal care & cosmetics applications.

Key U.S. Pea Protein Company Insights

Some of the key players operating in the market includeAxiom Foods, Inc., Ingredion, and The Scoular Company

-

Axiom Foods, Inc., headquartered in California, was established in 2005. The company manufactures and distributes protein ingredients, dairy alternatives, sugar, and syrups. Its product portfolio includes brown rice protein, organic pea protein, sacha inchi protein, whole grain rice milk, whole grain oat milk, brown rice sugar solid, and organic coconut palm sugar

-

Ingredion manufactures and markets sweeteners, starches, nutrition ingredients, and biomaterials for end-use industries, including food & beverage, paper, and pharmaceutical

Key U.S. Pea Protein Companies:

- Axiom Foods, Inc.

- Ingredion

- The Scoular Company

- DuPont

- PURIS

- A&B Ingredients

- Burcon NutraScience Corporation

- Emsland Group

- Roquette Frères

- Sotexpro

Recent Developments

-

In December 2020, Axiom Foods, Inc. launched new versions of VegOtein TX texturized pea protein for vegan and processed meats. The company launched over five versions of VegOtein TX texturized pea protein, which reduces the need for gums and stabilizers, such as soy and wheat gluten, while manufacturing plant-based meat products

-

In January 2020, Roquette Frères announced a multi-year supply agreement with Beyond Meat, a plant-based meat manufacturer in the U.S. This supply agreement significantly strengthened the clientele base of Roquette Frères

U.S. Pea Protein Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 662.6 million

Revenue forecast in 2030

USD 1,127.5 million

Growth rate

CAGR of 12.9% from 2024 to 2030

Historical period

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, form, source, application

Regional scope

U.S.

Key companies profiled

Axiom Foods, Inc.; Ingredion; The Scoular Company; DuPont; PURIS; A&B Ingredients; Burcon; NutraScience Corporation; Emsland Group; Roquette Frères; Sotexpro

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Pea Protein Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. pea protein market report based on product, form, source, and application:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Isolates

-

Concentrates

-

Textured

-

Hydrolysates

-

-

Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Dry

-

Wet

-

-

Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Yellow Split Peas

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Food & Beverages

-

Meat substitutes

-

Bakery goods

-

Dietary supplements

-

Beverages

-

Others

-

-

Personal Care & Cosmetics

-

Animal Feed

-

Others

-

Frequently Asked Questions About This Report

b. The global U.S. pea protein market size was estimated at USD 482.9 million in 2023 and is expected to reach USD 662.6 million in 2024.

b. The U.S. pea protein market is expected to grow at a compound annual growth rate of 12.9% from 2024 to 2030 to reach USD 1,127.5 million by 2030.

b. Yellow split peas dominated the market with a revenue share of over 75.8% in 2023. Yellow split peas have a high protein content, making them ideal for pea protein extraction. Additionally, they are widely available, ensuring a consistent supply. They also possess favorable functional properties and a neutral flavor, making them versatile for various food applications. Consumer familiarity and acceptance of yellow split peas contribute to their prominence in the market.

b. Some of the key market players in the U.S. pea protein market are Burcon Nutrascience; Roquette Freres; The Scoular Company; DuPont; Cosucra Groupe Warcoing SA; Nutri-Pea; Shandong Jianyuan Group; Sotexpro SA; Ingredion, Inc.; Axiom Foods, Inc.; Fenchem, Inc.; Martin & Pleasance; The Green Labs LLC, among others.

b. The growth factors such as increasing demand for plant-based protein, health and fitness trends, and the growing vegan and vegetarian population are being projected to augment demand over the forecast period. Furthermore, the versatility of pea protein and its ability to provide functional properties like emulsification, texture enhancement, and foaming have widened its market potential

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.