- Home

- »

- Advanced Interior Materials

- »

-

U.S. Passive Fire Protection Market, Industry Report, 2030GVR Report cover

![U.S. Passive Fire Protection Market Size, Share & Trends Report]()

U.S. Passive Fire Protection Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Cementitious Materials, Intumescent Coatings, Fireproofing Cladding), By Application (Oil & Gas, Construction, Industrial Plants), And Segment Forecasts

- Report ID: GVR-4-68040-307-0

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Passive Fire Protection Market Trends

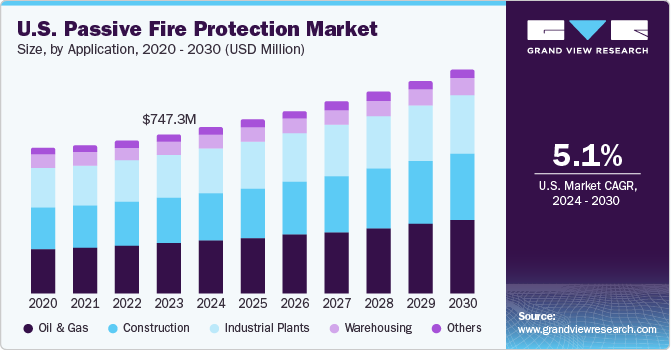

The U.S. passive fire protection market size was estimated at USD 747.3 million in 2023 and is projected to grow at a CAGR of 5.1% from 2024 to 2030. Stringent fire safety measures are driving the U.S. market. In response to the increasing threat of wildfires, California has been updating its building codes to incorporate more stringent fire safety measures. These regulation changes include the requirement of fire-proof materials, enhanced fire-rated assemblies, and improved ventilation systems to avoid the spread of smoke and fire flames. This initiative has increased demand for fire protection solutions across the state’s construction industry.

Furthermore, the growing construction activity and infrastructure development in the U.S. contribute to the demand for passive fire protection products and systems. As the population grows, urbanization accelerates, and new infrastructure projects emerge, there is a continuous need to construct residential, commercial, industrial, and institutional buildings. With each new construction project comes the opportunity to integrate passive fire protection measures into the building design and construction process. Architects, engineers, and contractors increasingly specify and install passive fire protection solutions to meet regulatory requirements, enhance building resilience, and mitigate fire-related risks.

Additionally, the increasing focus on sustainable building practices and green construction drives innovation and adoption in the U.S. passive fire protection market. Green building certifications, such as LEED (Leadership in Energy and Environmental Design), emphasize energy efficiency, indoor air quality, and environmental sustainability. Passive fire protection solutions that contribute to objectives, such as low-VOC (Volatile Organic Compound) coatings and environment friendly fire-resistant materials, to gain traction in the market. Building owners and developers recognize the benefits of integrating sustainable fire protection solutions that align with their broader sustainability goals while ensuring compliance with fire safety regulations.

Market Concentration & Characteristics

The U.S. passive fire protection industry is moderately concentrated, owing to the presence of major companies such as 3M, Hempel, and Jotun in this space. However, numerous smaller companies offer specialized products and services. Innovation in passive fire protection primarily revolves around developing more efficient and effective fire-resistant materials and systems. Materials science and engineering advancements contribute to developing new products with enhanced fire-resistance properties, such as intumescent coatings, fire-resistant glass, and fire-resistant textiles.

Regulations compliance and building codes play a significant role in driving demand for passive fire protection products and services. Similarly, strict building codes and fire safety regulations mandate, and the use of fire-resistant materials and systems in commercial and residential construction projects are driving the market growth.

Although some alternatives to passive fire protection exist, such as active fire protection systems like fire sprinklers and alarms, yet passive fire protection remains an essential component of overall fire safety measures. Passive fire protection systems provide passive fire resistance without the need for active human intervention, making them critical for ensuring the safety of buildings and infrastructure.

The end-user base for passive fire protection products and services is diverse, encompassing various industries such as construction, oil and gas, manufacturing, healthcare, and transportation. While there may be a concentration within specific sectors, the broad applicability of passive fire protection ensures a diverse customer base.

Application Insights

The oil and gas sector held the highest market share in 2023 and is the fastest-growing application segment during the forecast period. The industry's highly flammable materials necessitate robust passive fire protection measures to mitigate the risk of catastrophic fires. Intumescent coatings play a vital role by providing fireproof coatings, fire-resistant barriers, and structural fireproofing to safeguard equipment, structures, and personnel from fire hazards. The critical importance of passive fire protection in this sector is underscored by the high-value assets at stake and stringent safety regulations that mandate effective fire protection solutions. The increasing exploration and production activities globally in the oil and gas sector are creating opportunities for the application of intumescent coatings. The expansion of oil refineries, petrochemical projects, and other related activities further drives the demand for intumescent coatings in this sector.

The construction segment is expected to witness significant growth over the forecast period. The increasing complexity and scale of construction projects in the U.S. contribute to the demand for passive fire protection solutions. Construction companies recognize the importance of incorporating passive fire protection systems early in the design and planning stages of projects to mitigate fire risks and enhance building resilience. This proactive approach to fire safety drives the adoption of passive fire protection solutions across various construction segments, including residential, commercial, industrial, and institutional buildings.

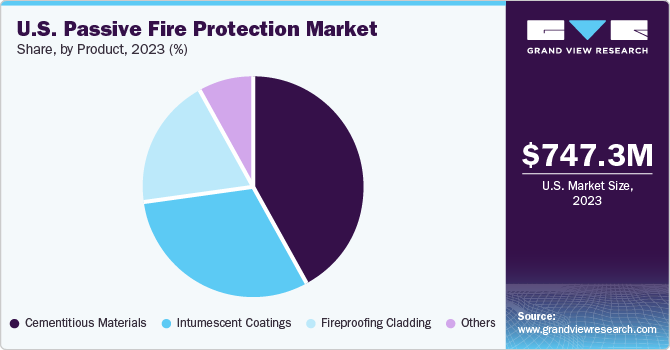

Product Insights

The cementitious materials in product segment held the highest market share of 41.3% in 2023. Cementitious materials are used in construction to contain fires and restrict the fire spread. These substances are sprayed or coated onto structural components like walls, columns, and steel beams. When subjected to high temperatures, they create a thick, insulating coating that shields the underlying structure from fire damage. Cementitious materials play a significant role, especially in applications where high-temperature resistance and durability are crucial. They are commonly used in both new construction and retrofit projects.

Intumescent coatings of the product segment is expected to grow at the fastest CAGR during the forecast period. Intumescent coatings are a rapidly expanding sector within fire-resistant materials due to their exceptional performance and advantages over other options. These coatings respond to heat by swelling to form a heat-insulating char that hinders the rise in steel temperature, thus safeguarding the substrate surface for a specific duration. Compared to cementitious coatings, intumescent coatings are thinner, offer superior fire protection properties, and notably reduce the weight of structures and substrates. The building & construction industry is a primary application area for intumescent coatings, holding the largest share of the fire-resistant coatings market.

Key U.S. Passive Fire Protection Company Insights

Some of the key companies operating in the U.S. passive fire protection market are Nullfire, TENMAT Inc.

-

Nullifire manufactures passive fire protection products, specializing in intumescent coatings and fire-stopping solutions. Nullifire's range includes intumescent coatings for steel structures and fire-stopping products that provide exceptional protection for service penetrations, movement joints, and linear gaps. Nullifire offers training programs to ensure the professional application of its products and access to new technologies, further solidifying its commitment to providing effective passive fire protection solutions.

-

TENMAT, a manufacturer of advanced passive fire protection products and materials, offers a wide array of flexible, lightweight, and readily deployable solutions for demanding fire-stopping applications. With innovation, TENMAT consistently develops new fire protection products to align with global standards and applications, ensuring thorough testing by independent third-party labs such as UL and Intertek. Their product range includes intumescent coatings and fire-stopping solutions that have undergone rigorous testing to validate their effectiveness and reliability across various construction applications.

Key U.S. Passive Fire Protection Companies:

- 3M

- Hilti Corporation

- Isolatek International

- Nullifire

- Roxul Inc.

- Sherwin-Williams

- STI Firestop

- TENMAT Inc.

- Tremco Incorporated

- USG Corporation

Recent Developments

-

In October 2022, Hilti Corporation launched a Modular Sleeve System. This system provides modularity, i.e., components can be separated and recombined with flexibility. Firestop sleeves have adapted to the continuously changing advancement in technology, which helps to prevent the spread of fire, smoke, and infection.

-

In October 2021, Hilti Corporation launched a firestop submittal generator that helps to develop project submittals with firestop listing and product data sheets, certificates, and technical documentation. It allows productivity planning, installation, and management of firestop solutions. After selection with the Hilti Firestop Selector, the firestop submittal generator creates a cover page and can include documents such as safety data sheets, product data sheets, and engineering judgments.

U.S. Passive Fire Protection Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 780.1 million

Revenue forecast in 2030

USD 1,052.2 million

Growth rate

CAGR of 5.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application

Key companies profiled

3M; Hilti Corporation; Isolatek International; Nullifir; Roxul Inc.; Sherwin-Williams; STI Firestop; Tenmat Inc.; Tremco Incorporated; USG Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Passive Fire Protection Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. passive fire protection market report based on product, and application:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Cementitious Materials

-

Intumescent Coatings

-

Fireproofing Cladding

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Oil & Gas

-

Construction

-

Industrial Plants

-

Warehousing

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. passive fire protection market size was estimated at USD 747.3 million in 2023 and is expected to reach USD 780.1 million in 2024

b. The U.S. passive fire protection market is expected to grow at a compound annual growth rate of 5.1% from 2024 to 2030 to reach USD 1,050.2 million by 2030

b. The cementitious materials segment led the market with a revenue share of 41.3% in 2023. The increasing trend toward digital transformation and the widespread adoption of remote work practices are playing a pivotal role in driving the demand for software solutions in the passive fire protection market.

b. Some key players operating in the U.S. passive fire protection market include 3M, Hilti Corporation, Isolatek International, Nullifir, Roxul Inc., Sherwin-Williams, STI Firestop, Tenmat Inc., Tremco Incorporated, USG Corporation

b. Factors such as stringent regulatory requirements and adoption of passive fire protection measures in the construction segment driving the U.S. passive fire protection market growth

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.