U.S. Paints And Coatings Market Trends

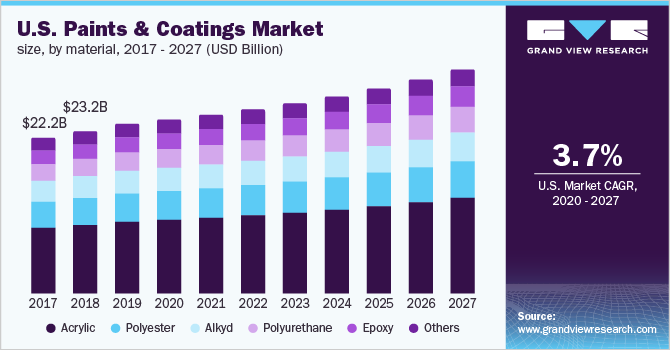

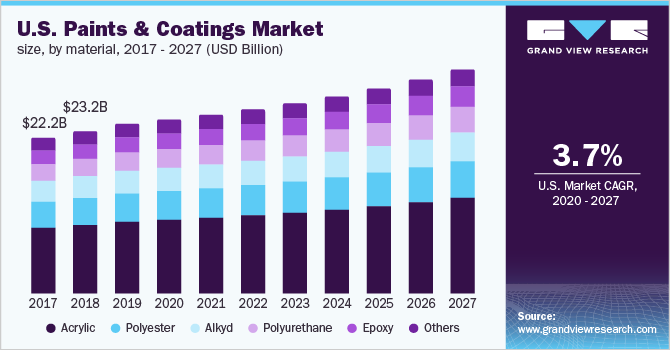

The U.S. paints and coatings market size was valued at USD 31.78 billion in 2024 and is expected to grow at a CAGR of 4.5% from 2025 to 2030. This growth is attributed to the increasing construction activities and urbanization as primary contributors, boosting demand for residential and commercial coatings. In addition, the automotive sector's expansion also plays a significant role, necessitating advanced coatings for durability and aesthetics. Furthermore, a rising consumer preference for eco-friendly products, such as low-VOC and sustainable coatings, aligns with regulatory trends and environmental concerns, driving the market’s growth.

Paints and coatings serve various purposes across different sectors, including residential and commercial buildings, industrial equipment, automobiles, and marine vessels. Their structural properties, such as waterproofing, corrosion resistance, and strong adhesion, are essential for protecting surfaces from rust, erosion, and wear, which drives market growth in the U.S.

In addition, increasing regulatory pressures and heightened awareness about the adverse effects of traditional paints have led to a surge in demand for low-VOC (volatile organic compounds) alternatives. These eco-friendly options are designed to minimize harmful emissions during application and disposal. As manufacturers adapt to stringent regulations by enhancing their processes, the market for low-VOC paints continues to expand.

Furthermore, this shift aligns with environmental standards and reflects consumer preferences for safer, more sustainable products. Consequently, the combination of regulatory compliance and a growing emphasis on health and environmental safety significantly contributes to the evolving landscape of the paints and coatings market.

Product Insights

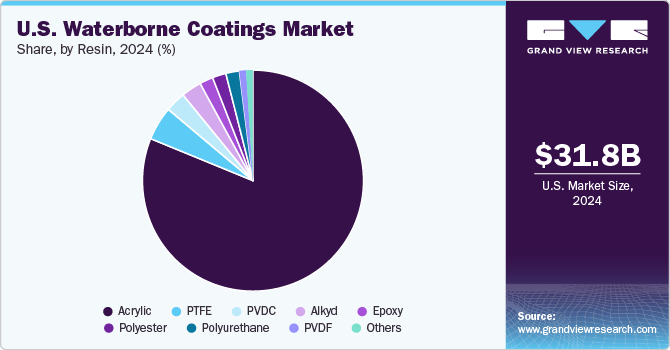

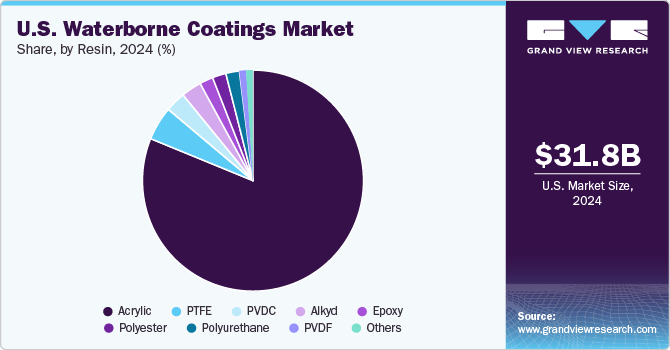

Waterborne coatings dominated the market and accounted for the largest revenue share of 44.4% in 2024. This growth is attributed to their eco-friendliness and compliance with stringent environmental regulations. As consumers and manufacturers increasingly prioritize sustainability, waterborne coatings with lower volatile organic compound (VOC) emissions are gaining popularity. In addition, the construction and automotive industries significantly contribute to this demand by seeking durable and safe coating solutions. Furthermore, formulation technology advancements enhance waterborne coatings' performance characteristics, making them more appealing for a wide range of applications.

The powder coatings segment is expected to grow at a CAGR of 5.8% over the forecast period, owing to its environmental benefits and versatility across multiple industries. With negligible VOC content, powder coatings meet strict regulatory standards, making them an attractive alternative to traditional solvent-based options. In addition, the automotive industry is a major driver as the demand for durable finishes increases alongside the rise of electric vehicles. Furthermore, powder coatings are extensively used in architectural applications for their aesthetic appeal and protective qualities. Continuous innovations in formulation and application techniques further enhance their attractiveness, ensuring sustained market expansion.

Key U.S. Paints And Coatings Company Insights

Some of the major players in the market include the Sherwin-Williams Company, Axalta Coating Systems, LLC, and others. These companies use several strategies, such as strategic partnerships, new product launches, and mergers & acquisitions, to gain a competitive edge in the market.

-

PPG Industries, Inc. provides diverse products, including industrial liquid coatings, automotive finishes, protective and marine coatings, and packaging coatings. The company serves various segments, such as aerospace, automotive, construction, and consumer goods, focusing on innovative solutions that enhance durability and aesthetics across multiple applications.

-

RPM International, Inc. specializes in various products, including sealants, adhesives, and specialty coatings. Headquartered in Medina, Ohio, RPM operates through multiple subsidiaries catering to consumer and industrial markets. The company’s offerings encompass architectural coatings, industrial maintenance products, and roofing systems. RPM focuses on segments such as construction, maintenance, and repair markets, emphasizing high-performance solutions that meet customers' evolving needs while ensuring compliance with environmental standards.

Key U.S. Paints And Coatings Companies:

- The Sherwin-Williams Company

- Axalta Coating Systems, LLC

- PPG Industries, Inc.

- RPM International, Inc.

- BASF SE

- 3M

- Sika AG

Recent Developments

-

In October 2023, Sherwin-Williams announced a strategic agreement with Sinoboom, a leading manufacturer of aerial work platforms. This partnership will see Sherwin-Williams supply high-performance paint and coatings designed for Sinoboom's equipment. The collaboration aims to enhance their products' durability and aesthetic appeal while ensuring compliance with industry standards. By leveraging Sherwin-Williams' expertise in coatings technology, this agreement underscores their commitment to providing innovative solutions that meet the evolving needs of the industrial market.

-

In February 2023, PPG Industries launched the PPG STEELGUARD 951, an innovative fire protection coating tailored for the architectural market. This 100 % solid, flexible epoxy coating offers up to three hours of cellulosic fire protection, expanding into a thick, insulating layer during a fire to maintain the structural integrity of the steel. Furthermore, it provides effective corrosion protection in harsh environments without requiring a top coat, thereby reducing project costs and time. The coating combines aesthetic appeal with durability, meeting stringent fire and corrosion standards in the paints and coatings industry.

U.S. Paints And Coatings Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2025

|

USD 32.94 billion

|

|

Revenue forecast in 2030

|

USD 41.12 billion

|

|

Growth rate

|

CAGR of 4.5% from 2025 to 2030

|

|

Base year for estimation

|

2024

|

|

Historical data

|

2018 - 2023

|

|

Forecast period

|

2025 - 2030

|

|

Quantitative units

|

Volume in Kilotons, Revenue in USD Million, and CAGR from 2025 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Product

|

|

Country scope

|

U.S.

|

|

Key companies profiled

|

The Sherwin-Williams Company; Axalta Coating Systems, LLC; PPG Industries, Inc.; RPM International, Inc.; BASF SE; 3M; Sika AG

|

|

Customization scope

|

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

U.S. Paints And Coatings Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the U.S. paints and coatings market report based on, product.

-

Product Outlook (Volume, Kilotons, Revenue, USD Million, 2018 - 2030)

-

Radiation Cured Coatings

-

Radiation Cured Coatings, By Raw Material

-

Oligomers

-

Monomers

-

Photo initiators

-

Additives

-

Radiation Cured Coatings, By Formulation

-

Ultraviolet Curing

-

Electro Beam Curing

-

Radiation Cured Coatings, Application

-

Wood

-

Industrial

-

Printing Inks

-

Paper & Film

-

Electronic Products

-

Adhesives

-

Glass

-

Others

-

Powder Coatings

-

Powder Coatings, By Resins

-

Epoxy

-

Polyester

-

Epoxy-Polyester (Hybrid)

-

Acrylic

-

Polyurethane

-

Others

-

Powder Coatings, By Application

-

Consumer Goods

-

Architectural

-

Automotive

-

General Industries

-

Furniture

-

Others

-

Waterborne Coatings

-

Waterborne Coatings, By Resins

-

Acrylic

-

Polyurethane

-

Epoxy

-

Alkyd

-

Polyester

-

PTFE

-

PVDC

-

PVDF

-

Others

-

Waterborne Coatings, By Application

-

Architectural

-

General Industrial

-

Automotive OEM

-

Metal Packaging

-

Protective Coatings

-

Automotive Refinish

-

Industrial Wood

-

Marine

-

Coil

-

Others

-

Solvent-borne Coatings

-

Solvent-borne Coatings, By Type

-

One Component

-

Two Component

-

Solvent-borne Coatings, By Application

-

Automotive

-

Industrial

-

Printing Inks

-

Others