- Home

- »

- Medical Devices

- »

-

U.S. Over-the-Counter Hearing Aids Market, Report, 2030GVR Report cover

![U.S. Over-the-Counter Hearing Aids Market Size, Share & Trends Report]()

U.S. Over-the-Counter Hearing Aids Market Size, Share & Trends Analysis Report By Product, By Technology, By Distribution Channel, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-348-9

- Number of Report Pages: 140

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

U.S. OTC Hearing Aids Market Size & Trends

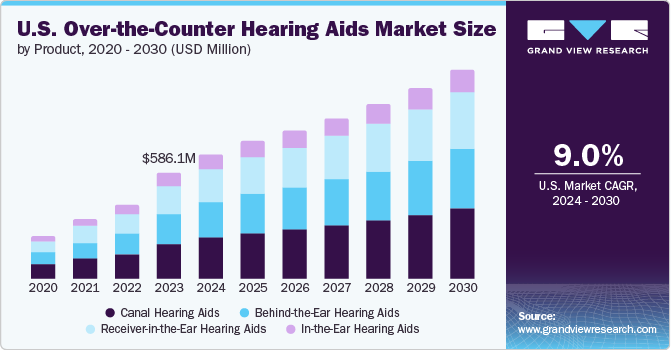

The U.S. Over-the-Counter hearing aids market size was estimated at USD 586.10 million in 2023 and is anticipated to grow at a CAGR of 9.03% from 2024 to 2030. The increasing prevalence of deafness, the rising adoption of hearing aids, and the growing number of new launches of products are some of the major factors expected to facilitate market growth over the forecast period. The key factors driving the accessibility of Over-the-Counter (OTC) hearing aids in the U.S. are cost-effectiveness, a wide distribution channel of OTC hearing aids, and simplified regulation by the U.S. government for OTC hearing aids.

Hearing loss or impairment is a common condition in the U.S. with the presence of industries such as defense and manufacturing, which cause significant noise pollution. As per Deafness and Hearing Loss Statistics in June 2023, over 48 million people across the U.S. live with some level of hearing loss. Furthermore, over 22 million people are exposed to hazardous noise levels in their workplaces. This is mainly due to the rise in noise pollution and increasing life expectancy, which is leading to a high incidence of age-related hearing loss.

OTC hearing aids have lower prices when compared to prescription products and, hence, are more affordable. This is one of the important factors responsible for the growing demand for OTC devices. According to the American Speech Language Hearing Association, the estimated average price of the product is around USD 1,500 per pair compared to that of prescription hearing aids, which range from USD 1,000 to USD 7,000 per pair.

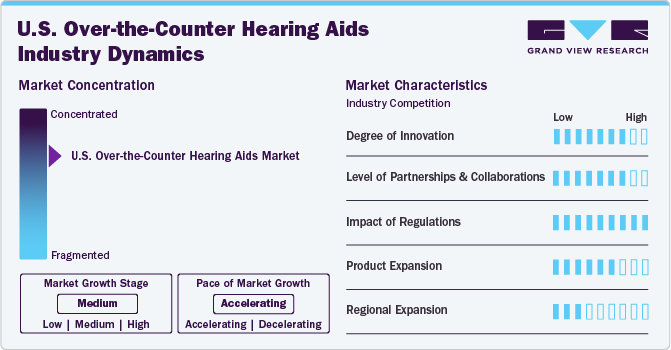

Market Concentration & Characteristics

The chart below illustrates the relationship between market concentration, market characteristics, and market participants. The x-axis represents the level of market concentration, ranging from low to high. The y-axis represents various market characteristics, including industry competition, degree of innovation, level of M&A activities, the impact of regulations, product expansion, and geographic expansion.

For instance, the market is concentrated, with the presence of top players in the market. The degree of innovation is high, and the level of M&A activities is also medium. The impact of regulations on the market is high, and the geographic expansion of the market is low. In addition, the product expansion is at the medium level in the market.

The degree of innovation in the market is significant, with a focus on technological advancements and emerging trends. Technological innovations like preconfigured devices and remote audiology support services are transforming the industry.

The partnership and collaboration in the market are primarily driven by companies focused on product innovation, geographical expansion, and marketing & distribution. For instance, in February 2023, MD Hearing partnered with Medline to distribute OTC hearing aids and to add OTC hearing aids as a part of the OTC supplemental benefit offering for 2023.

The regulation of hearing aids in the U.S. has undergone significant changes in recent years, with the aim of promoting competition, innovation, and consumer choice in the market. The FDA's final rule regarding OTC hearing aids became effective in October 2022, creating a distinct category for OTC devices apart from prescription hearing aids. Manufacturers previously selling products directly to consumers until April 2023, to adhere to FDA regulations for OTC hearing aids. Any products must comply with these regulations before being introduced to the market.

Market players utilize a strategy of product expansion to increase their capabilities and promote the reach of their product offerings. For instance, in June 2023, Sonova Holding AG launched the Sennheiser All-Day Clear in the U.S. It is a self-fitting OTC hearing aid offered with optional support for audiologists.

The industry is growing in the country due to its potential to improve accessibility, cost-effectiveness, and outcomes. This growth is fueled by established industry leaders expanding into emerging markets and indigenous startups experiencing growth. Companies are expanding by launching products in new geographies and merging with or acquiring companies based in different locations. For example, in October 2022, Lexie (hearX IP (Pty) Ltd.) and Walgreens announced that people aged 18 & older with mild-to-moderate hearing loss would be able to purchase Lexie Lumen OTC hearing aids at Walgreens locations across the U.S.

CASE STUDY: EARGO RETAIL EXPANSION STRATEGY

Eargo is undertaking several strategic initiatives to expand its retail presence with existing regulations established by the U.S. FDA. The company is conducting select retail pilots to refine its approach, utilizing physical retail spaces to enhance the Eargo experience and leveraging newly acquired self-administered hearing screeners to enhance its retail presence.

Strategy of Eargo:

-

Select Retail Pilots: The company is refining its retail strategy within the changing regulatory landscape of the U.S. The company gathers valuable insights, tests different approaches, and optimizes its retail model for broader implementation.

-

Leveraging Physical Retail: The company utilizes physical retail spaces to enhance its brand presence and accessibility to consumers.

-

Self-Administered Hearing Screener: The recent acquisition of a self-administered hearing screener represents a significant advancement in Eargo’s retail strategy. This innovative tool allows consumers to assess their hearing health conveniently and independently, serving as a key element in the retail experience.

-

In-Person Customer Engagement: The company is investing in face-to-face interactions, such as community events or healthcare partnerships, to strengthen its relationships with consumers.

Product Insights

The canal hearing aids segment dominated the market, accounting for the largest share of 33.05% in 2023. Technological advancements, new product approvals, and compact design are some of the key factors expected to drive market growth. The canal hearing aids segment includes Invisible-In-the-Canal (IIC), In the canal (ITC), and Completely-In-Canal (CIC) hearing aids. The design facilitates eliminating external noise, which is anticipated to drive the adoption of these devices. For instance, in January 2024, Eargo, Inc. launched Eargo SE. The Eargo SE is a simplified, self-fitting OTC device tailored to Eargo’s hallmark essentials: Open-fit, rechargeable, virtually invisible, lifetime support, and CIC form factor.

According to the National Center for Health Statistics, published in February 2023, about 37.5 million Americans, constituting roughly 15% of adults aged 18 and above in the U.S., have trouble hearing without the assistance of a hearing aid. This positions deafness as the third most prevalent chronic health issue in the U.S. As a result, the adoption of canal hearing aids is expected to surge as they are highly discreet and barely noticeable.

However, the Behind-the-Ear (BTE) hearing aids segment is expected to witness the fastest growth over the forecast period from 2024 to 2030. This can be attributed to its diverse advantages, such as ease of handling and high preference by the young population. These devices fit properly into various ear molds, eliminating the need for device replacement in case of growing children.

Distribution Channel Insights

The retail stores segment dominated the market, with a share of 48.90% in 2023. This can be attributed to higher profit margins in retail stores and an increase in the availability of OTC hearing aids in retail stores. Customers can purchase these devices directly from retail places, either in person, via mail, or online. To sell OTC products, retailers do not require a licensed professional, such as an audiologist.

In addition, retailers such as CVS, Walmart, and Walgreens are implementing expansion strategies to enhance the sales of OTC hearing aids. For instance, in October 2022, Walgreens added OTC hearing aids to its 8,000+ retail locations. Some OTC hearing aids available in retail stores like CVS, Walmart, Walgreen, Hy-Vee, Inc., and Sam’s Club are Lexie B1 Self-fitting, Lucid Hearing Enrich PRO, Go Prime OTC Hearing Aids, and Liberty SIE 128, among others.

However, the online segment is projected to exhibit the fastest growth at a CAGR over the forecast period. This can be attributed to the increasing penetration of e-commerce channels and their higher adoption. Furthermore, technological advancements are another major factor expected to significantly boost the online segment's growth. Online platforms provide a seamless shopping experience with various features, such as product recommendations, virtual shopping, and personalized customer support. These advancements have enhanced the online shopping experience for consumers and have contributed to the popularity of the online distribution channel.

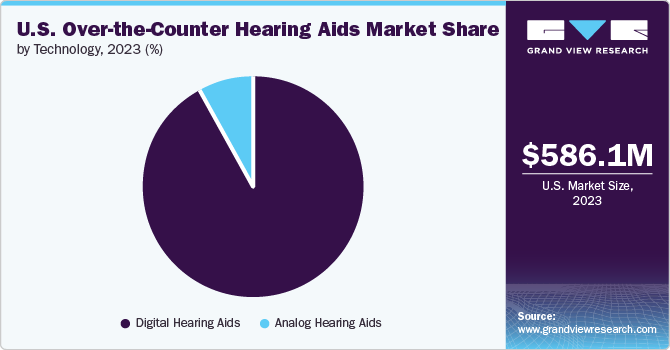

Technology Insights

Based on technology, the digital hearing aids segment dominated the market with a share of 92.20% in 2023 and is expected to retain its position during the forecast period. Digital hearing aids can be programmed according to the external environment to amplify sound and reduce noise. These devices are technologically advanced and eliminate background noise, providing an enhanced hearing experience.

Digital hearing aids have several advantages over traditional analog hearing aids, such as directional microphones, feedback reduction, signal processing, speech enhancement, and noise reduction. In addition, companies are developing a new generation of digital hearing aids along with innovative technology and improved compatibility with smartphones, propelling segment growth. Furthermore, increased awareness about digital devices and their usage is expected to facilitate market growth in the U.S.

The analog segment is expected to witness substantial growth over the forecast period. Analog hearing aids work by raising the intensity of continuous sound waves. All sounds, including noise & speech, are uniformly amplified by these devices. In some analog devices, a microchip embedded in the device allows the user to program different settings to suit diverse listening environments.

Key U.S. Over-the-Counter Hearing Aids Company Insights

The market exhibits considerable competition due to the participation of numerous multinational and local players. These companies are implementing diverse strategies, such as introducing new products and forming partnerships and collaborations to increase their market shares. Some of the emerging players in the market include Novidan, NUHEARA LIMITED, and Audien Hearing.

Key U.S. Over-the-Counter Hearing Aids Companies:

- Eargo Inc.

- GN Store Nord A/S (Jabra)

- Bose Corporation

- MDHearing

- Audicus

- Sony Corporation

- Starkey Laboratories, Inc. (Start Hearing)

- hearX IP (Pty) Ltd. (Lexie)

- Sonova

- WSAudiology

- NUHEARA LIMITED

- Audien Hearing

- Novidan

Recent Developments

-

In March 2024, Audien Hearing launched a new range of OTC hearing aids: Atom 2 and Atom Pro 2, with advanced noise cancellation features and sound quality.

-

In January 2024, Lexie Hearing launched its Lexie B2 Plus Self-fitting OTC Hearing Aids, powered by Bose, with an in-app hearing test and extended battery life.

-

In October 2023, Eargo, Inc.expanded its partnership with Best Buy to display its hearing aid product in over 500 Best Buy retail stores.

-

In February 2023, Nuheara partnered with Target.com to expand its retail distribution of OTC hearing aids across Target.com.

U.S. Over-the-Counter Hearing Aids Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 1.16 billion

Growth rate

CAGR of 9.03% from 2024 to 2030

Actual data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technology, distribution channel

Key companies profiled

Eargo Inc.; GN Store Nord A/S (Jabra); Bose Corporation; MDHearing; Audicus; Sony Corporation; Starkey Laboratories, Inc. (Starkey); hearX IP (Pty) Ltd. (Lexie); Sonova; WSAudiology; NUHEARA LIMITED; Audien Hearing; Novidan.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Over-the-Counter Hearing Aids Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. Over-the-Counter hearing aids market report based on product, technology, and distribution channel:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

In-the-Ear Hearing Aids

-

Receiver-in-the-Ear Hearing Aids

-

Behind-the-Ear Hearing Aids

-

Canal Hearing Aids

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Digital Hearing Aids

-

Analog Hearing Aids

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Retail Stores

-

Audiology Offices

-

Online

-

Frequently Asked Questions About This Report

b. The U.S. Over-the-Counter hearing aids market size was estimated at USD 586.10 million in 2023 and is expected to reach USD 689.81 million in 2024.

b. The U.S. Over-the-Counter hearing aids market is expected to grow at a compound annual growth rate of 9.03% from 2024 to 2030 to reach USD 1.16 million by 2030.

b. Canal hearing aids segment dominated the market, accounting for the largest share of 33.05% in 2023. Technological advancements, new product approvals, and compact design are some of the key factors expected to drive the market. Furthermore, Hearing loss can significantly affect a person’s health and quality of life if left untreated. Studies suggest that untreated deafness can lead to depression, cognitive deterioration, and a higher chance of dementia.

b. Some prominent players in the U.S. OTC hearing aids market includes Eargo Inc.; GN Store Nord A/S (Jabra); Bose Corporation; MDHearing; Audicus; Sony Corporation; Starkey Laboratories, Inc. (Starkey); hearX IP (Pty) Ltd. (Lexie); Sonova; WSAudiology; NUHEARA LIMITED; Audien Hearing; and Novidan.

b. Key factors that are driving the U.S. OTC hearing aids market growth include affordability, accessibility, and technological advancements. OTC hearing aids have gained popularity due to their lower cost compared to prescription hearing aids.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."