- Home

- »

- Medical Devices

- »

-

U.S. Oral Care Market Size, Share & Growth Report, 2030GVR Report cover

![U.S. Oral Care Market Size, Share & Trends Report]()

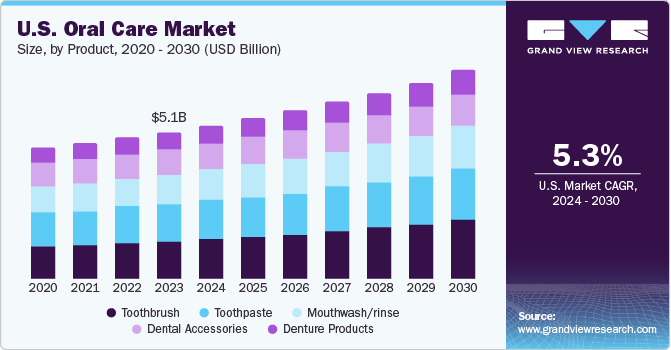

U.S. Oral Care Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Toothbrush, Toothpaste, Mouthwash/rinse, Denture Products, Dental Accessories), By Distribution Channels (Convenience Stores, Online Retail Stores), And Segment Forecasts

- Report ID: GVR-4-68040-198-9

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

The U.S. oral care market size was valued at USD 5.08 billion in 2023 and is anticipated to register a compound annual growth rate (CAGR) of 5.32% from 2024 to 2030. This growth is attributed to the rising awareness of dental hygiene, increase in disposable income, and increasing preference for cosmetic dentistry.

The growing incidences for oral conditions play a vital role in influencing market growth. According to the National Institute of Dental and Craniofacial Research, 91.0% U.S. population aged between 20-64 years had dental caries. Among these, 27% population have untreated dental caries. Accordingly, high prevalence of dental ailments and diseases-such as tooth enamel, periodontal disease, dental caries, and dental erosion-remains a significant global health challenge, positively impacting the U.S. oral care market.

The post-pandemic impact on the market presented challenges globally. For instance, the 2020 Q2 numbers released by Johnson & Johnson reported a favorability for oral care products, specifically Listerine mouthwash, with sales rising by approximately 10.8%. The impact of sedentary lifestyles and higher consumption of sweets during the COVID-19 pandemic act as indirect drivers for the market. Moreover, the technological boom resulting from the pandemic has aided the oral care market with the advent of teledentistry platforms such as Denteractive and Aspen Dental.

According to the World Dental Federation, globally, nearly 30.0% of individuals aged 65 to 74 have no natural teeth, which is driving the need for innovation in dentures and dental accessories further. In September 2021, the Sunstar Global Oral Health Survey stated that the U.S. ranks second worldwide in the best brushing habits. Moreover, consumers are shifting their choices more towards innovative technology-based oral care products. This has further created opportunities for market growth.

Market Concentration & Characteristics

The market is highly influenced by technological innovation and new oral care products. This is due to the increasing preference of consumers for innovative products and the rising importance of oral care. Moreover, awareness of oral care, along with the increased per capita disposable income, have driven the demand for creative oral care products using smart technology and teledentistry platforms. For instance, in February 2023, Colgate launched a whitening pen and a whitening kit targeted towards maintaining enamel safety and oral hygiene

The U.S. oral care market is characterized by a high level of merger and acquisition activity. Key players in the market are expanding their product portfolio and emphasizing the significance of oral care products and innovation. For instance, in December 2023, Bruush Oral Care Inc., a U.S.-based oral care company, announced their plans of a merger with ArriveTechnology Inc. to utilize their Mailbox-as-a-service platform as a smart, secure exchange point

The regulatory scrutiny in the oral care market is influenced by multiple regulatory bodies, such as the Food and Drug Administration (FDA), Centre for Diseases Control and Prevention (CDC), Health Resources and Services Administration (HRSA), and National Institute of Dental and Craniofacial Research (NIDCR). The FDA regulates various oral care products, including toothpaste, mouthwash, and dental devices, to ensure their safety and effectiveness

Furthermore, several key players are expanding their product portfolio using technological advancements to further their reach. For instance, in October 2023, BURST Oral Care launched their novel flagship sonic toothbrush and curve sonic toothbrush with an LED screen and a smart responsive software

Many market participants have expanded their regional reach in the U.S. to cater to the increased demand for oral care, specifically cosmetic dentistry. For instance, Swish Dental expanded their Texan operations with two state-of-the-art dental studios in December 2023.

Product Insights

Toothbrushes dominated the products segment with nearly 26.0% of the market share in 2023, owing to their customized attributes and higher efficiency. Moreover, the segment is also expected to grow at the fastest rate owing to the advanced features being developed, such as rapid and automatic bristle motions. For instance, In January 2024, Laifen Tech launched Laifen Wave Electric Toothbrushes that work on its proprietary technology, Laifen Wave, which provides 3x higher-brushing efficiency.

The mouthwash/rinse segment is anticipated to grow significantly over the forecast period. Moreover, key manufacturers in the oral care market are focusing on innovative and high efficiency products to improve the oral health and overall experience of consumers of all age-groups. For instance, in March 2023, Thera Breath launched a mouthwash for kids specializing in strengthening teeth and enamel. The product consists of the high amount of hypochlorous in turn provides higher purity, efficacy and safety.

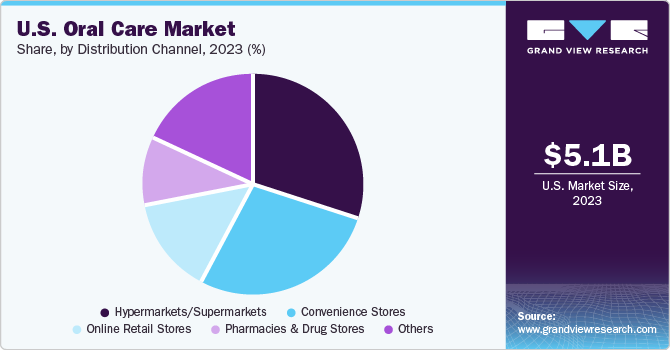

Distribution Channels Insights

Based on the distribution channels, supermarkets/hypermarkets dominated the market share in 2023 owing to the availability of widely spread supermarkets and hypermarkets in the region. Moreover, robust discounts of stores reduce the cost burden of retailers and consumers, in turn leading to market growth.

The online retail segment is projected to witness the fastest CAGR over the forecast years. This growth is driven by the provision of oral care services at home, online selling of oral care products, and discounts on home delivery services. Key players in the region are running marketing campaigns to highlight their eco-friendly and vegan oral care products. Major market participants as Amazon, Flipkart, and Walmart often offer large discounts on oral care products, driving market growth further. In addition, small-scale retailers often depend on online sales and discounts and augment their growth.

Key U.S. Oral Care Company Insights

The market is fragmented, with prominent players accounting for a large percentage of the market. Some of the prominent players operating in the oral care market include Colgate-Palmolive Company; Procter & Gamble; Unilever plc; and Sunstar Suisse S.A.

Market players have resorted to varied strategic initiatives for sustained growth, such as mergers, collaborations, product development, and expansion among the U.S. For instance, global players in the market are collaborating with local, private Dental Service Organizations (DSOs) and Supermarket chains to provide better oral care and cater to a larger audience.

Key U.S. Oral Care Companies:

The following are the leading companies in the U.S. oral care market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these U.S. oral care companies are analyzed to map the supply network.

- Colgate-Palmolive Company

- GlaxoSmithKline plc

- Procter & Gamble

- Johnson & Johnson Services, Inc

- Unilever plc

- Henkel AG & Co. KGaA

- Sunstar Suisse S.A.

- KYOCERA Medical Corp.

- Church & Dwight Co., Inc.

Recent Developments

-

In January 2024, Lidl, a German supermarket chain, announced their expansion to another store in Queens, New York, marking their 174th store in the U.S.

-

In May 2021, Unilever announced plans to convert toothpaste tubes of its oral care brands, such as Closeup, Pepsodent, and Signal, into recyclable ones by 2025.

-

In April 2020, Perrigo Company plc acquired the the oral care assets of High Ridge Brands Co, including Firefly and Dr. Fresh brands.

-

In August 2020, Colgate-Palmolive Company launched a smart electric toothbrush, hum by Colgate.

U.S. Oral Care Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 5.31 billion

Revenue Forecast in 2030

USD 7.24 billion

Growth rate

CAGR of 5.32% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion/million and CAGR from 2024 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments Covered

Product, distribution channels

Country scope

U.S.

Key companies profiled

Colgate-Palmolive Company; GlaxoSmithKline plc; Procter & Gamble; Johnson & Johnson Services, Inc; Unilever plc; Henkel AG & Co. KGaA; Sunstar Suisse S.A.; KYOCERA Medical Corp.; Church & Dwight Co., Inc.

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Oral Care Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. oral care market report based on product, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Toothbrush

-

Manual

-

Electric (Rechargeable)

-

Battery-powered (Non-rechargeable)

-

Others

-

-

Toothpaste

-

Gel

-

Polish

-

Paste

-

Powder

-

-

Mouthwash/rinse

-

Medicated

-

Non-medicated

-

-

Denture Products

-

Cleaners

-

Fixatives

-

Floss

-

Others

-

-

Dental Accessories

-

Cosmetic Whitening Products

-

Fresh Breath Dental Chewing Gum

-

Tongue Scrapers

-

Fresh Breath Strips

-

-

Others

-

Oral Irrigators

-

Countertop

-

Cordless

-

-

Mouth Freshener Sprays

-

-

-

Distribution Channels Outlook (Revenue, USD Million, 2018 - 2030)

-

Hypermarkets/Supermarkets

-

Pharmacies and drug stores

-

Convenience Stores

-

Online retail stores

-

Other

-

Frequently Asked Questions About This Report

b. The U.S. oral care market size was estimated at USD 5.08 billion in 2023 and is expected to reach USD 5.31 billion in 2024.

b. The U.S. oral care market is expected to grow at a compound annual growth rate of 5.3% from 2024 to 2030 to reach USD 7.24 billion by 2030.

b. Toothbrushes dominated the products segment with nearly 26.0% of the market share in 2023, owing to their customized attributes and higher efficiency.

b. Some of the prominent players operating in the oral care market include Colgate-Palmolive Company; Procter & Gamble; Unilever plc; and Sunstar Suisse S.A.

b. This growth is attributed to the rising awareness of dental hygiene, increase in disposable income, and increasing preference for cosmetic dentistry.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.